Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Getting real about eCommerce: 2019 State of the Merchant Report

By Quiet Light

eCommerce is the hottest thing to happen in product sales since POS systems and credit cards. Wonder where the future of eCommerce is actually going? Buckle up and come along for the ride, courtesy of eCommerceFuel’s Andrew Youderian. Learn about the five big takeaways from his eCommerce report and what it means for your business.

eCommerceFuel—an exclusive community for eCommerce high rollers

The State of the Merchant Report, courtesy of eCommerceFuel

Drop-shipping versus manufacturing

It’s no joke when we say eCommerce is a big, big deal. In fact, a quarter of the world’s population, or 1.91 billion people, bought something online in 2019.

Considering that we’re halfway through the year, we expect the numbers to surge even more during the holiday season.

This year, eCommerce will account for nearly 14% of all retail sales made worldwide.

eCommerce is a burgeoning industry with a lot of potential for webby entrepreneurs and digital nomads alike.

And everybody wants to peek into the crystal ball to predict the future of eCommerce.

Where are people selling online? Will eCommerce continue being profitable? Is Amazon still listening to my conversations so they can sell me more crap?

Whether you want to sell your business online or start an eCommerce brand, we’ve got the inside scoop.

QuietLight Brokerage sat down with Andrew Youderian, founder of eCommerceFuel, to chat about the future of eCommerce.

eCommerceFuel—an exclusive community for eCommerce high rollers

Andrew is no stranger to eCommerce success. He started his career in investment banking, but had enough of the bland environment.

Andrew quit his job at the bank and struck out on his own.

If you want to sell your business online, look no further than Andrew’s story. He started and sold several eCommerce stores, generating $7 million in sales in his time as a store owner.

But rolling in dough wasn’t enough for Andrew.

He realized it was lonely at the top. It’s hard to find community and advice as a seven-figure store owner, after all.

That’s why he founded eCommerceFuel.

eCommerceFuel is a private membership community for seven-figure eCommerce store owners.

Andrew even conducts eCommerceFuel Live, a three-day eCommerce extravaganza where members let their hair down and learn how to scale their business.

(QuietLight Brokerage had the chance to attend and it was lit, if you’re curious.)

eCommerceFuel’s membership averages $2.6 million in eCommerce sales every year.

Because of that, Andrew has his finger on the pulse of eCommerce. That’s why he created the eCommerceFuel State of the Merchant Report.

Andrew interviews his 1,000+ member community for their thoughts on eCommerce, sharing these insights in a free annual report that speaks to the future of eCommerce.

eCommerce state of affairs

Whether you run a store, want to sell your business online, or are interested in buying an eCommerce store, it’s important to get your head out of the sand.

Know where eCommerce is going so you can shift to market conditions.

It could be the difference between enjoying a seven-figure business of your own and a sad warehouse full of unshipped goods.

Our hot take is that eCommerce is still on fire, especially in our current economy.

The bull market has caused eCommerce spending to surge in recent years. That means eCommerce business owners are seeing crazy year over year growth.

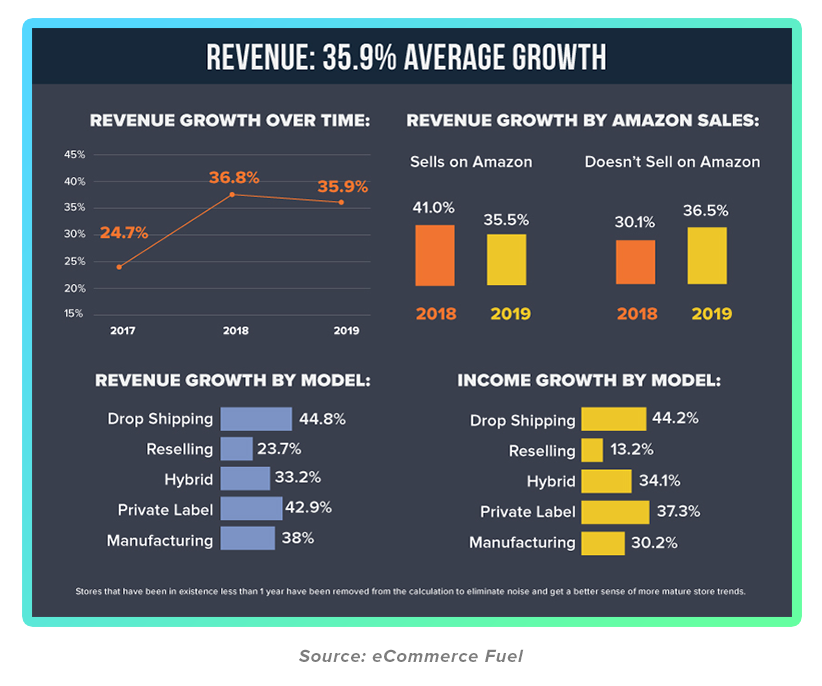

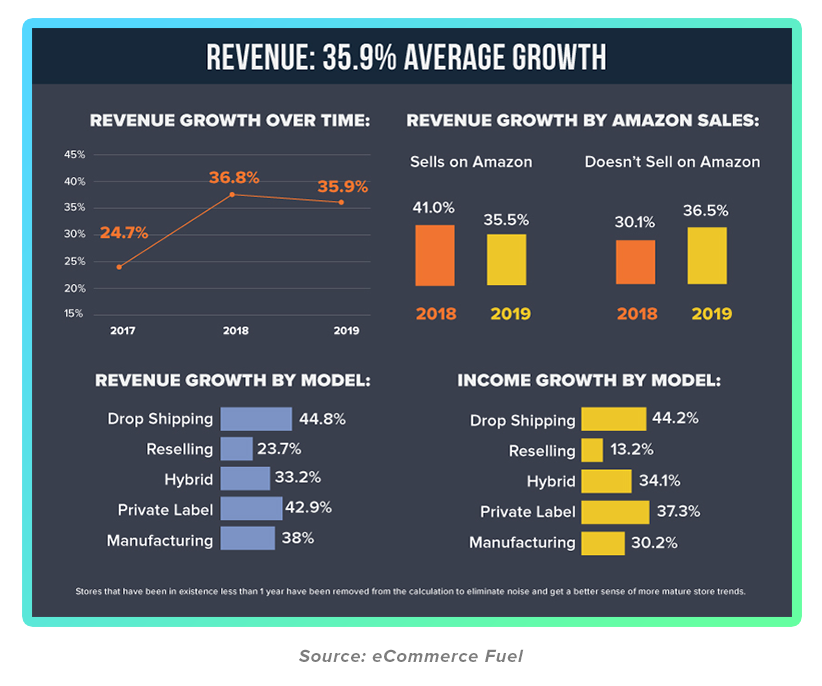

According to the eCommerceFuel report, eCommerce businesses saw 25% growth in 2017 but are projected to grow by 36% in 2019.

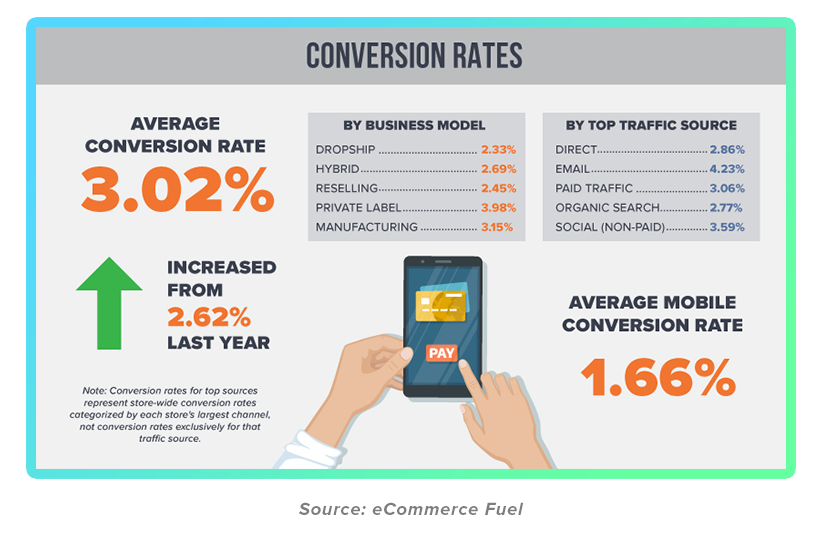

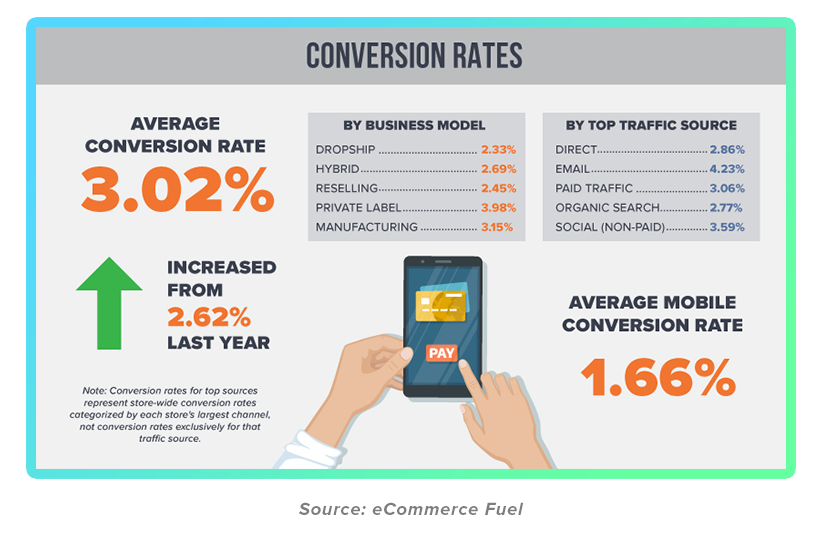

Conversion rates are even higher this year at 3%, up from 2.6% in 2018.

This kind of growth is crazy.

eCommerce is booming, robust, and healthy, which makes it a perfect avenue to explore if you’re looking to sell your business online.

Obviously, the eCommerce of 2018 looks different from the eCommerce of 2019 and beyond.

We chatted with Andrew to get the Cliff’s Notes version of the latest eCommerceFuel report to see where eCommerce is going.

Use these insights to keep your eCommerce business on the straight and narrow.

The State of the Merchant Report, courtesy of eCommerceFuel

There’s something about trends that entrepreneurs just can’t resist. Not unlike eager middle school kids, we want to know what’s hot and what’s not.

Unlike boy bands and spiked hair, these trends have a real impact on your business.When you’re trying to buy an eCommerce business, you have to see these trends.

Not only that, but you have to know how meaningful these trends actually are.

For example, is your eCommerce strategy the equivalent of a Shakeweight—interesting for three months before it fizzles out—or Uggs, an unexpected but successful creation that works for the long haul?

There’s only one way to know, and that’s to consult with experts like Andrew Youderian.

His eCommerceFuel report is your crystal ball for understanding where opportunities are in eCommerce.

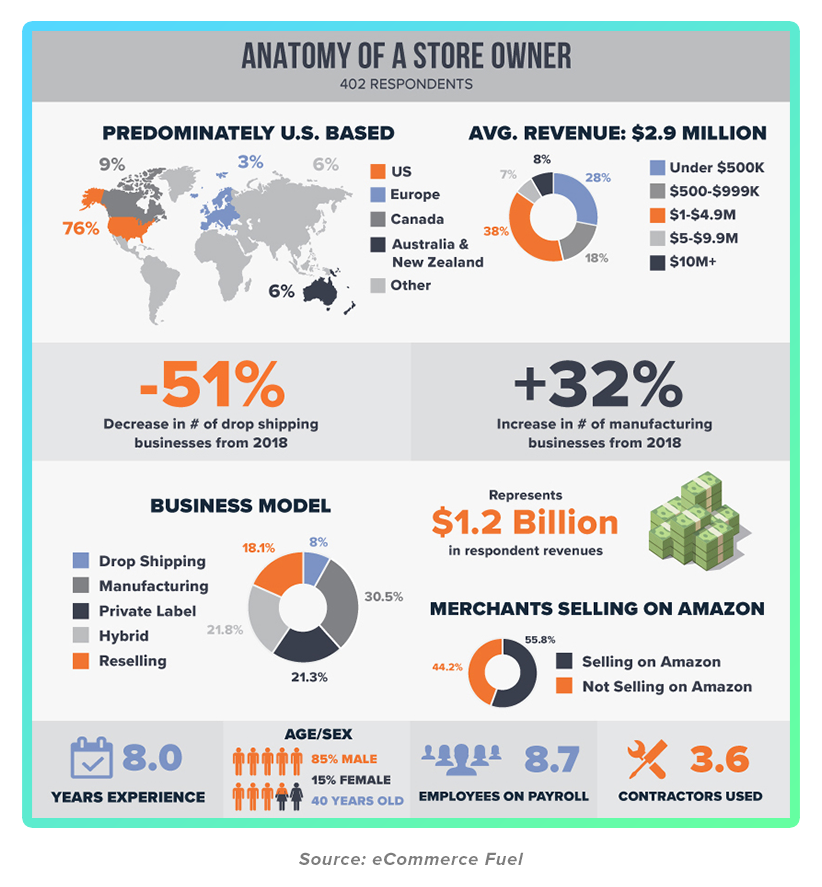

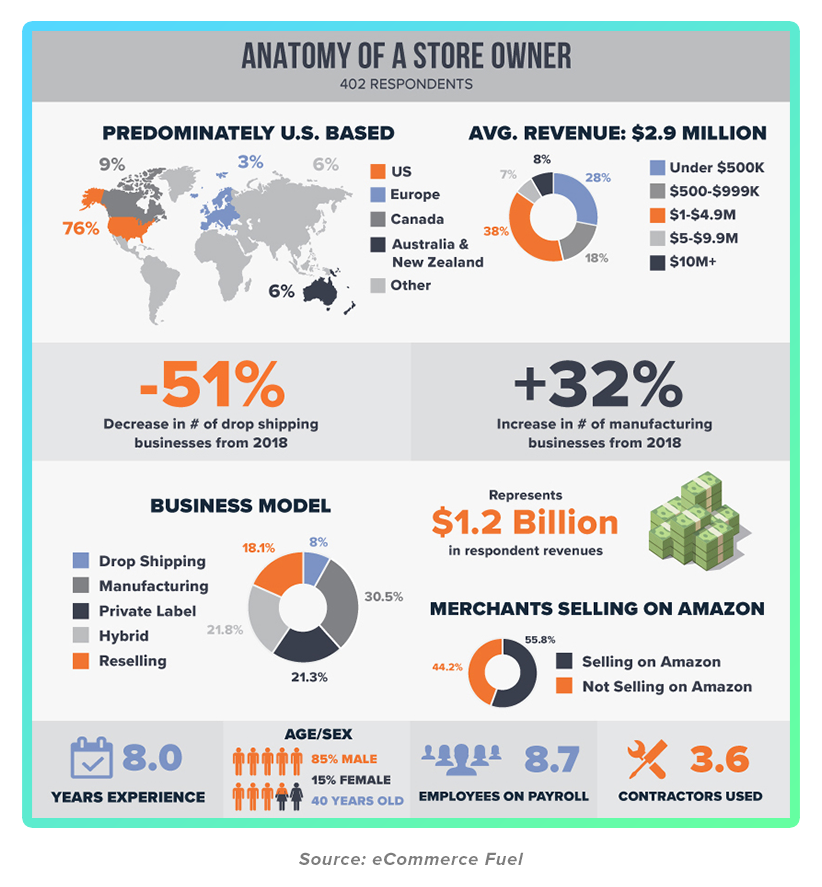

The State of the Merchant report comes directly from eCommerceFuel’s Membership. The data is collected from real entrepreneurs who are in the trenches of running a profitable eCommerce product business.

We’ve identified five important takeaways from the State of the Merchant Report that will affect how you do eCommerce moving forward.

ROI for merchants

Entrepreneurs are used to a lot of acronyms, like ROI, ROAS, and LTV. Ask any entrepreneur and they’ll rattle off their favorite metric like it’s their sports team.

ROI is a tried and true favorite that’s a perfect indicator for eCommerce success.

Andrew’s report homed in on ROI, or return on investment, a metric that determines how many sales a campaign brought in for your eCommerce store.

The State of the Merchant Report looked at how eCommerce stores promote their business with marketing, trying to find the most effective platforms for eCommerce.

But entrepreneurs are humans and sometimes they make strange decisions. Andrew’s report clarified the difference between which promotional platforms were most popular versus those that actually delivered hard returns.

Because the most popular options aren’t always the most effective.

The report found that the most popular channels (in order) were:

- Facebook Ads

- Google Ads

- SEO

But when we take a look at the cold, hard results, it’s a different story. The most effective platforms (in order) were:

- Amazon Ads

- SEO

- Google Ads

- Facebook Ads

It’s clear that there’s a distinction between what actually works for business and what we think works. You’ll never know until you look at the data, and that’s exactly what the State of the Merchant Report reveals.

Use the ROI to see where your money is best spent. These figures make it easier to sell your business online by demonstrating the business’s value.

Facebook Ads

This report reveals a big, fat problem: entrepreneurs think Facebook Ads are incredibly effective, but in reality, they aren’t working out.

According to Andrew’s report, Facebook had the lowest return on ad spend (3.4) compared to Amazon (4.6) and Google (5).

It’s even worse when you look at the costs to advertise on Facebook.

Facebook Ads has the fastest-growing costs, with a 20% increase in cost year over year. That’s compared to a 16% increase with Amazon and a 10% increase with Google.

With that said, why in the hell are people investing so much money in Facebook Ads?

If the data says it isn’t working, why are entrepreneurs devoting precious cash flow to a platform that doesn’t yield results?

The answer is actually quite complicated.

Facebook FOMO

Facebook Ads has a lemming effect.

Lemmings are rodents that live in herds. If they get worked up, they function with a pack mentality. It’s so strong that, if one lemming jumps off a cliff, the rest will follow.

The same is true for Facebook. Entrepreneurs pump money into Facebook because everyone else is doing it. As a result, they spend more money on a platform that might not be right for their business.

That’s because Facebook is a tough nut to crack.

Although Facebook is the fifth most effective sales medium according to Andrew’s report, we still hear so many stories about Facebook Ads jettisoning an eCommerce brand into success.

And that’s true. QuietLight Brokerage clients have been able to get as much as five times their investment on Facebook.

The problem?

Those entrepreneurs spent months and thousands of dollars to get to that point. It’s through experimentation and perseverance that eCommerce entrepreneurs see Facebook success.

When should I use Facebook, then?

Good question. We aren’t saying that Facebook is bad for eCommerce sales at all.

What we’re saying is that Facebook doesn’t have the same search intent as Amazon. Users aren’t on Facebook to buy shoes, so that’s why they aren’t buying shoes from your Facebook Ads.

Facebook Ads isn’t meant to sell product because that’s not what its audience wants. It should be used for awareness first and foremost.

For example, let’s say you’ve created an ice cream scoop that never gets stuck. It’s a new product and nobody knows it exists, so people aren’t searching for it on platforms like Amazon or Google.

Facebook Ads can help you build brand awareness and enter the market. It’s great for education and for providing proof of concept.

If you want to succeed on Facebook Ads, adopt a different mentality. Get specific with your targeting and understand that the platform is for awareness, not for sales.

Email marketing

Email is the grandfather of digital marketing, so it might come as a surprise that it’s the second most effective channel for merchants.

But email is anything but retired. This channel still delivers insane ROI, with as much as a $44 return for every $1 spent.

If you’re looking to sell your business online, there’s no better way to demonstrate ROI than a devoted email list with killer templates.

Email is incredibly valuable, but it’s getting harder to do email well.

The reason? Advertising fatigue.

With Facebook, Amazon, and Google controlling so much of the advertising space, it’s overwhelming your audience.

People see as many as 5,000 ads and branded messages every day. As consumers, we’re so bombarded with ads for clothes, pills, tech, and so much other crap that we have to be selective with our attention.

Consumers are pros at tuning out promotional messages. If we weren’t, we would all probably go insane from information overload.

This is why you can show an ad to someone 15 times and they won’t remember you.

That’s why eCommerce merchants have to be more cunning to make email work.

People’s inboxes are crammed full; how are you going to stand out from everyone else?

The tonic for advertising fatigue

According to Andrew, the solution is personalization.

Consumers use spam filters and ignore their Promotions folder like the plague.

It’s very hard to do it well, but personalization is the only way merchants will survive the crucible of the crowded inbox.

For example, Andrew interviewed an antiques dealer on the eCommerceFuel podcast. Although the merchant specialized in antiques, he had mastered the art of effective, modern email marketing.

He had a crazy 25% open rate on his emails and Andrew asked him for the secret.

Like most things in marketing, the secret was that there was no secret. The merchant just spent hours putting together a valuable, personalized newsletter he knew his audience would love.

eCommerce merchants have to do the same if they expect to stay relevant in consumers’ inboxes.

Drop-shipping versus manufacturing

eCommerceFuel’s State of the Merchant Report also looked at the makeup of eCommerce store owners.

Namely, which were drop shipping and which were manufacturers.

Although drop shopping was once the Promised Land, today things aren’t so clear. Last year 16% of eCommerceFuel owners did drop shipping. That figure halved this year, coming in at just 8%.

What’s going on?

Two years ago drop shipping was a no-brainer eCommerce strategy. Now it seems that entrepreneurs are abandoning the practice.

This isn’t to say that drop shipping is bad. Andrew found that drop shippers were actually in the lead as far as revenue growth.

With no inventory, no upfront cash, and no cash flow problems, drop shipping can be an amazing way to run a business. And you can do it from a beach in Panama if you want, which is an enticing perk.

The reason drop shipping is declining is because Darwinism is at play in the market. After thinning the herd, we’re now left only with the drop shippers who know how to make their business work.

Manufacturing as a spectrum

Drop shipping is rife with global competition. It’s so hard to make it as a drop shipper than many merchants have embraced manufacturing.

But merchants aren’t choosing between just drop shipping or manufacturing; manufacturing happens on a scale.

On one end, you have drop shipping, where you see the products. Then you get into reselling, where you sell products that aren’t yours. And then we get into creating unique, manufactured goods.

Manufacturing is the future of eCommerce. The data doesn’t lie: the number of manufacturing merchants went up by a third for 2019.

The numbers hint that this was a good move, too: gross margins for manufacturers are up to 53% in 2019 from 48% in 2018.

Tariffs, politics, and China—oh my

The U.S.-China trade war isn’t going well. In an epic “nananana boo boo” to each other, both the U.S. and China have been increasing tariffs.

Politics aside, this has big implications for manufacturers sourcing product or manufacturing in China.

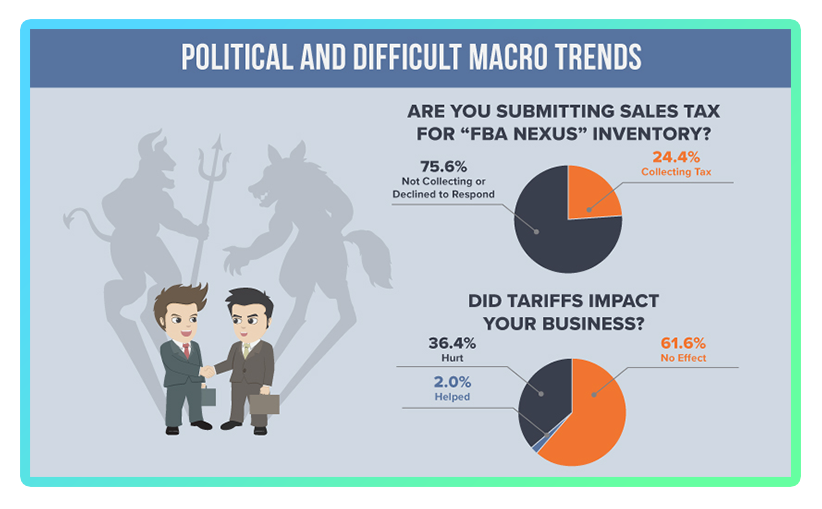

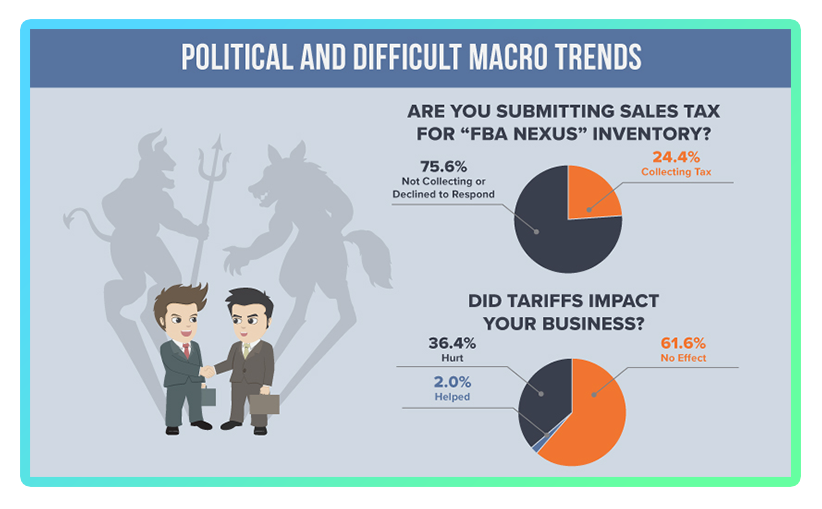

36% of merchants in the State of the Merchant Report said tariffs hurt their business this year.

At least for now, no other countries are a go-to alternative to China for manufacturing, either.

While Taiwan, Canada, and Mexico are popular choices, for most entrepreneurs, it’s China or bust.

Keep your eyes peeled for more news stories about the U.S.-China feud; it’s gonna get ugly.

But don’t let that scare you away from manufacturing.

Sure, manufacturing is more stressful, but more merchants are going this way because of the cost savings and control you get from manufacturing. Entrepreneurs always find a way around sticky situations, and this is no different.

Not only does manufacturing give you more control, but it also allows you to become a key player on monster marketplaces like Amazon.

Amazon

And speaking of the eCommerce behemoth, Andrew has a lot to say about Amazon.

Amazon did over $232 billion in sales in 2018. While it’s clear that consumers love Amazon retail therapy, Andrew has some interesting news for Amazon-focused merchants.

2019 was the first year that eCommerceFuel noted non-Amazon eCommerce stores outpaced Amazon eCommerce brands.

Although it seems like everyone and their mother sells on Amazon, the truth is that you could see better growth off the platform.

This is precisely why QuietLight Brokerage has always preached the gospel of diversifying your revenue streams. If you only focus on Amazon sales, you’ll miss out on other growth opportunities. That’s happening to many Amazon-only merchants.

From zero to sixty

It may come as a surprise to hear that Amazon merchants didn’t perform as well in 2019. After all, it’s one of the biggest marketplaces in the world, and a natural fit for many eCommerce products.

Amazon hasn’t always been in the lead.

When QuietLight Brokerage went to the first eCommerceFuel Live event, few merchants were selling on Amazon. But over the next two years, you couldn’t talk to a group of merchants without mentioning Amazon—everyone was on Amazon.

Today it looks like Amazon is plateauing. It’s not necessarily on a decline, but it’s significant to see that merchants aren’t growing more on the platform.

While the results are surprising, it’s clear that Amazon isn’t going anywhere, at least for now. Merchants aren’t leaving the platform in droves, but fewer are selling exclusively with Amazon.

Many merchants are leaving Amazon because:

- The platform has huge counterfeit problems.

- Amazon is increasing seller fees.

- Amazon puts a strangle-hold on merchants with restrictive contracts.

Because of these issues, Andrew predicts that 2020 will be the first year that the number of stores selling on Amazon will actually decrease.

Amazon ain’t the cure-all

The decrease in Amazon growth could also come from buyer behavior.

It seems like you can buy everything on Amazon, including a car, but there are still some places where specialty wins over generalization.

If you need really specialized gear or extremely high-quality goods, you’re going to buy them through the manufacturer, not through Amazon.

Andrew predicts that Amazon will become the Walmart of eCommerce. You’ll go there to inexpensive, everyday items. But when it’s time to buy a niche, premium product, you’ll go straight to the manufacturer.

And that’s why entrepreneurs have to get back in the manufacturing game—so you can capitalize on shifts in buying trends.

By all means, please continue selling on Amazon. But never sacrifice your specialized knowledge or product quality; that will make you stand out if the going gets rough on the platform.

And then there’s the tax problem

If you do Amazon FBA (aka Fulfillment By Amazon), taxes can be a tricky thing. FBA tax, state policy, and the absence of a federal policy mean that nobody’s sure where, how, or if they need to file sales taxes.

According to Andrew’s report, for most merchants, ignorance is bliss. Only a quarter of all FBA merchants submit sales tax, which means 75% aren’t paying sales taxes.

And no, FBA merchants aren’t trying to dodge their taxes. The “why” is more complicated than that.

People aren’t pay taxes because taxes are confusing as hell.

There’s no clear precedent on where you should pay taxes; it’s a state by state issue that varies for every merchant.

FBA taxes are a big gray area, so merchants are willing to take the risk. To them, the risks of paying the taxes actually outweigh not collecting tax at all.

That’s because:

- It’s not about the money; it’s about the time. Sales tax requires a gigantic workload that merchants can’t deal with. In fact, some merchants don’t want to touch taxes at all. In this case, it makes more sense to sell your business online to avoid the headaches.

- Collecting taxes may open the merchant up for an audit. It puts you on a sales tax agency’s radar, which nobody wants.

At the end of the day, you’ve got to do you. But remember, if you plan to sell your business online, all taxes need to be current to make the sales process go smoothly.

Andrew is pretty sure things will come to a head and require federal intervention. Until that point, merchants have to decide whether to pay FBA sales taxes

Cutting through the B.S.

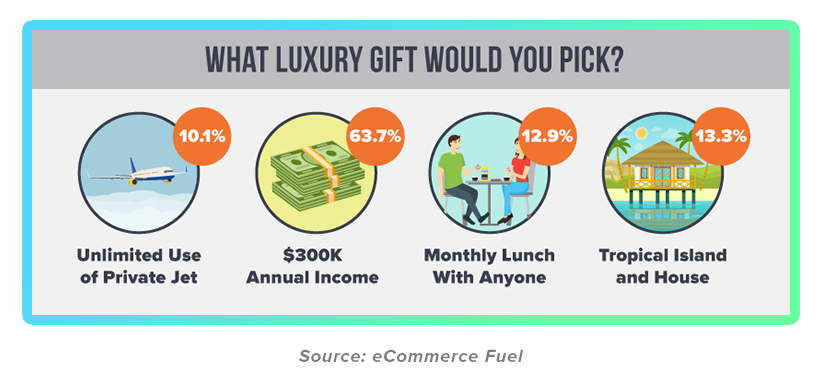

Would you rather have unlimited use of a private jet, a $300k annual income, a monthly lunch with anyone, or a house on a tropical island?

That’s the last question on the eCommerceFuel report, and it’s no surprise that two-thirds of all merchants said they’d take $300k in guaranteed income.

Entrepreneurs are known for taking risks, but guaranteed cash is hard to pass by, much like these upcoming opportunities in the eCommerce marketplace.

Andrew’s State of the Merchant Report shows that, while it’s getting harder to do business online, it’s an exciting market full of possibility.

Trends come and go, but it’s the merchants who adapt that survive. After all, the “good ol’ days” dry up pretty quickly. The people who survive are the ones to embrace challenge and build a sustainable eCommerce business.

How about you? Are you adding fuel to your own eCommerce flame?