Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Anatomy of an Exit

By Quiet Light

If you are thinking of selling your business, there are a number of important things to consider – and they all come down to preparation. In this post we share the story of one incredible exit and the important lessons you can learn about separating your businesses, growing them, and preparing them for a smooth exit when the time comes.

Preparing to sell, and failing to prepare

Listing the business and one false start

Meeting with potential buyers and presenting the deal

This seller was tired.

If you chase two rabbits, he’d often advised others, they’ll both get away.

Then one day he woke up and realized he hadn’t taken his own advice all that well.

He was tired of chasing too many rabbits.

Tired of dreaming that Amazon had shut down his account and then waking up mornings to check and see if the dream was actually real.

Tired of playing by someone else’s rules and having all his cash tied up in inventory, while sinking deeper into Amazon debt.

A high-seven-figure seller on Amazon with four brands and a podcast, he and his partner were no stranger to risk or the ups and downs of the ecommerce game.

But as he increasingly found himself with more to lose and less solid ground underfoot, the stakes suddenly seemed awfully high.

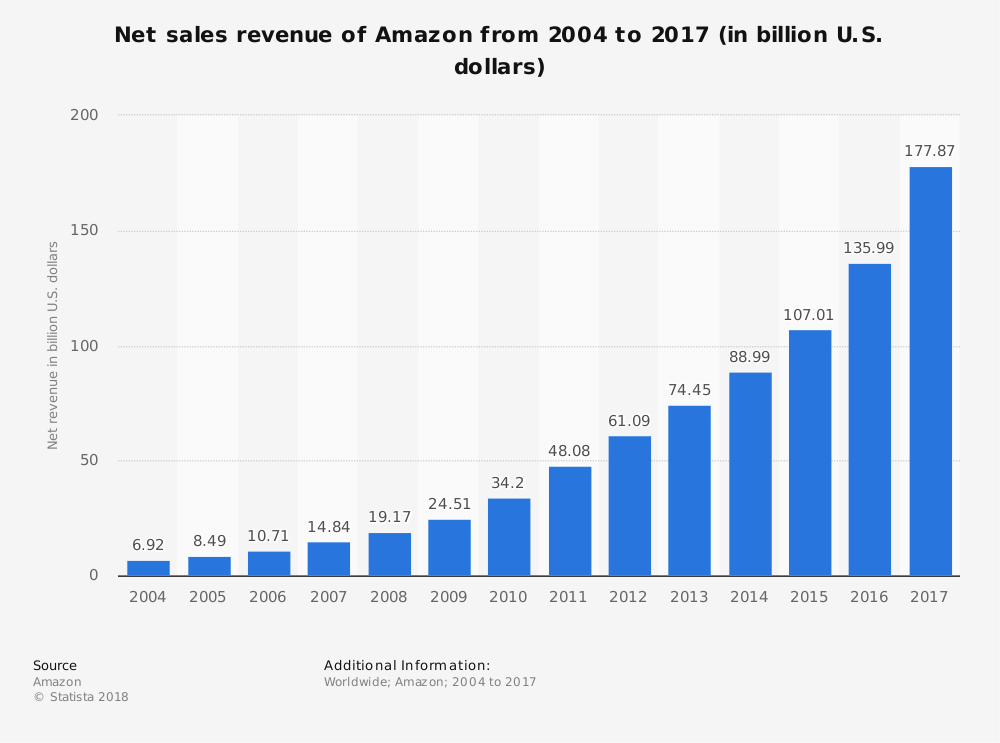

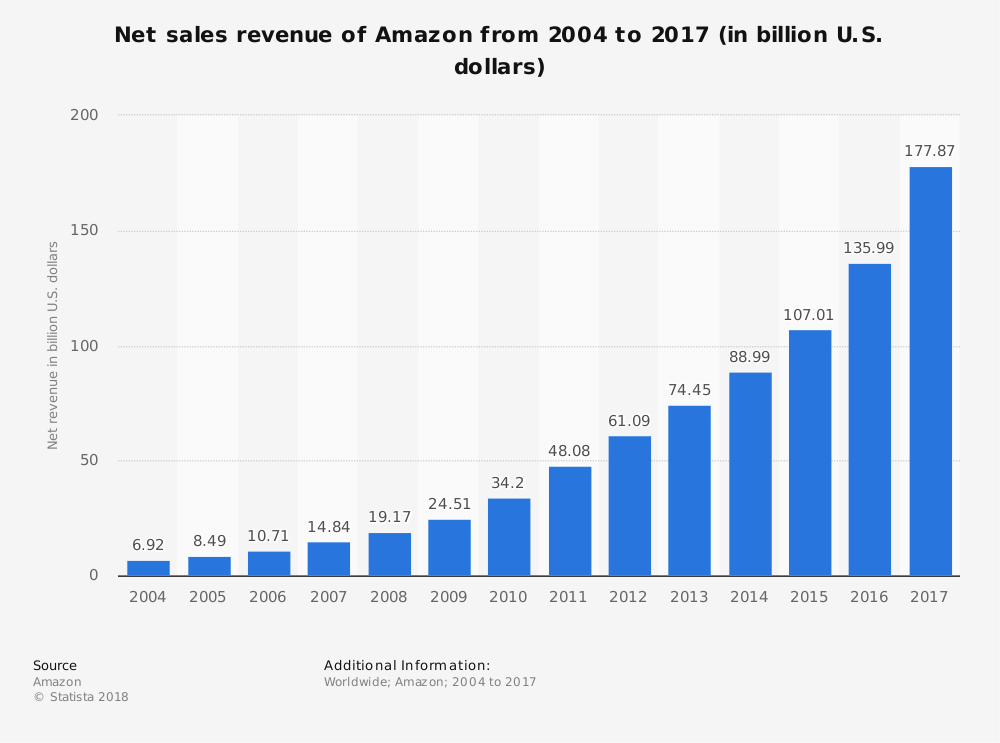

Amazon keeps changing, there’s no question.

And it’s getting more and more crowded. According to Marketplace Pulse, in fact:

- 1,029,528 new sellers have joined Amazon this year.

- That’s the equivalent of 2,975 new sellers every day.

As it all continues to snowball, when does a smart business owner decide to cash out?

Selling your business is all about timing.

Legend has it that for Joe Kennedy (father of JFK) back in 1929, the event that saved his fortune and got him out of the market just in time came when a shoeshine kid gave him a stock tip.

It’s an old-fashioned story that seems to come up a lot in 2019. I for one like living in a time when that storied “shoeshine kid” could hop online, take some courses, and build his own fortune. But the point holds.

And here’s more from Marketplace Pulse:

- There are over 5 million sellers across all Amazon marketplaces.

- 1,761,784 sellers have products listed for sale.

- A growing number of sellers on Amazon are based in China or Hong Kong.

- China’s share of the Amazon marketplace now sits at around 25%.

Combine that last fact with the uncertainties of the trade war, and sourcing products from China, long considered the smart FBA model, becomes more interesting.

On the Quiet Light podcast, you’ll here talk about the many levers of risk and reward that shift and change as your business grows. And as you grow in business.

I realize that business is more math than magic, but I still can’t help thinking of the exacting, timing-critical acts of some of the world-famous magicians.

Consider the vast number of levers involved in one show – lighting, timing, training – and the exact balance that must be struck at all times to pull off each stunt. It reminds me of the long list of risk levers that exist in ecommerce – inventory, tariffs, debt, liquidity, taxes, etc. – all with their own tipping point.

Siegfried and Roy’s legendary show at the Mirage in Vegas, which of course included the controversial use of dozens of wild animals plus massive mechanical props and a cast of 60 people, cost $28MM to stage and earned the duo a $57.5MM a year contract.

They performed that show 5,749 times before the fateful night when it came to a crashing and tragic end.

Entrepreneurs aren’t magicians, but we take on risk and embrace change like few others. That ability is integral to who we are, and stagnation, standing still, would be a fate worse than death to most of us.

Still, as the old country song says, you gotta know when to hold em and know when to fold em.

Last week, to kick off the Incredible Exits series on the Quiet Light podcast, one seller talked about taking some but not all his chips off the table, embracing change, and the tumultuous journey of listing an ecommerce brand for sale.

If you’re thinking about selling your business in the future, there’s much to learn from his experience.

Below I’ll trace the seller’s journey from decision-to-sell to LOI, zeroing in on a few actions he’s glad he took and a few he’d do differently going forward.

Preparing to sell, and failing to prepare

At the time he decided to sell, the business was growing revenues at 100% per year.

They had four brands under one LLC and $1.3MM tied up in inventory company-wide.

The tax returns showed high six-figure profits, but as a rapidly-growing business, the cash to pay those taxes was forever hard to come by. Why?

Because growth requires inventory, and inventory eats up cash.

The owner had been running at top speed for four years, and it was taking a toll.One thing he did right?

Through fantastic relationship building, he lucked into a sourcing agent who negotiated prices down on one SKU well in advance of the sale.

The owner points out that the move wasn’t so much part of his plans to sell, as much as just good business.

Either way, it meant a $43k increase to SDE (from one SKU, mind you), a 16% saving on COGS, and a substantial difference to the eventual listing price of this site.

Before selling your business, plan to negotiate with manufacturers or find a sourcing agent as far ahead of time as possible.

Planning to sell, sort of

When this seller and his partner set up the company, he knew one thing…when it was time to get out of ecommerce, he’d get out. Meaning sell the whole conglomerate.

Of course, hindsight is 20/20.

“The thought of having six or seven different tax returns and credit cards for each business and trying to figure out how we’re going to separate employees,” he says, “…having to have them all segmented out just was not appealing to me in any way, shape, or form, and I was more concerned about today than tomorrow.”

When that time actually came to get out, it was a bit trickier than he’d once planned for.

Two of the brands were highly profitable, but the other two were in startup mode, which meant more money pouring into the brands than coming out of them.

So the better, more lucrative way to take chips off the table?

Sell one of the brands as a single entity.

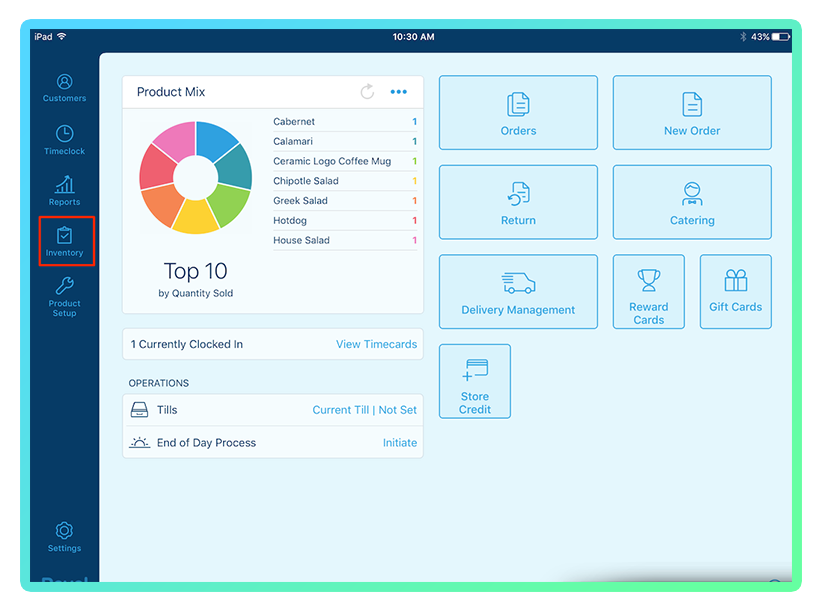

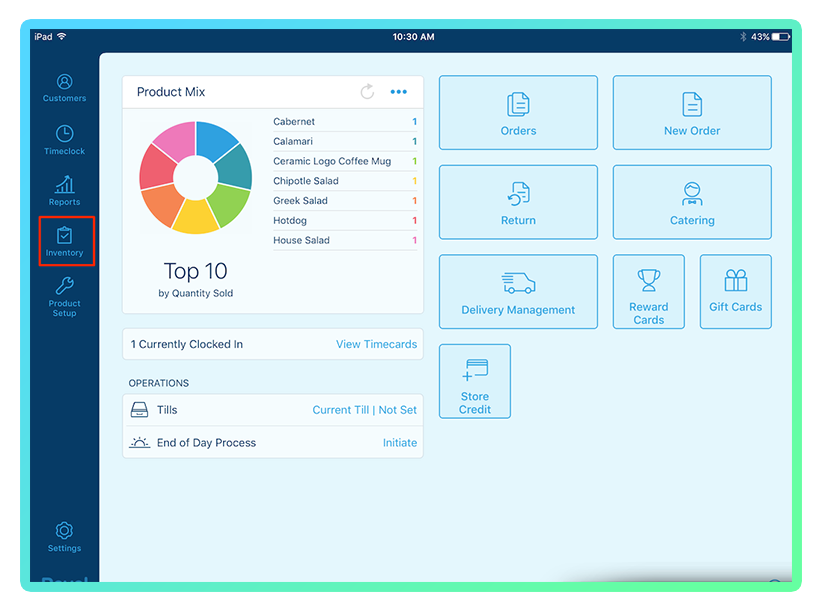

Listing the business and one false start

Trying to sell one brand, when the LLC consisted of four, however, posed some challenges.

Potential buyers had questions…how did shared resources and shared employees across brands affect the true bottom line of a single brand? And how would the allocation of resources work going forward?

Did they want a brand which had been ripped off its stable foundation?

And then there was the single Amazon account.

When you’re selling your business, look at it from the buyer’s perspective. Focus on making their lives easier, not yours.

“If there was anything I could go back and do differently,” the owner notes now, “it would be having multiple Amazon accounts at an earlier stage.”

Selling just one brand alone meant getting three other brands out of the original account and into a new one.

And setting up multiple Amazon accounts is no simple task.

The owner quickly realized he needed to seamlessly transfer those brands into a new account, but he calls that task “impossible.”

It involves recalling truckloads of inventory, relabeling it, and placing it under the new account.

A process he’s undertaken now.

“It’s not going to be cheap,” he says.

More challenges ahead

Even with the single LLC problem solved, there were vendor issues.

One reason for selling the brand in question rather than the second established brand in the LLC, was that he ran into a snag.

Some of his vendors refused to transfer their relationships “as is” to a new owner.

That made lumping the two brands together at the moment difficult to impossible.

It’s something you might not think about before selling your business, so planning ahead can make all the difference.

Once the decision was made to separate a single brand out, the listing went out in early December at a relatively high multiple.

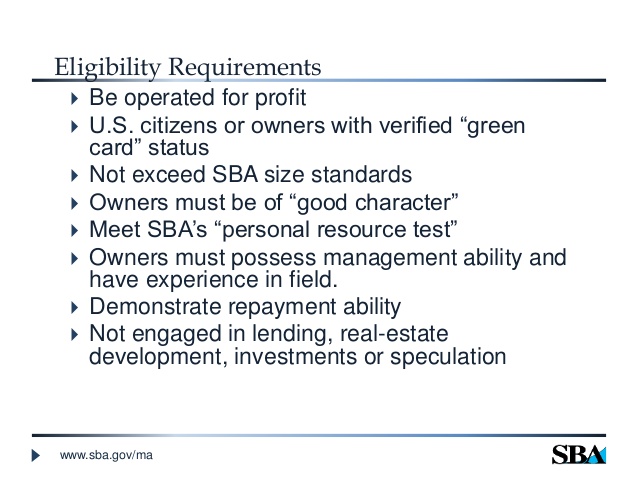

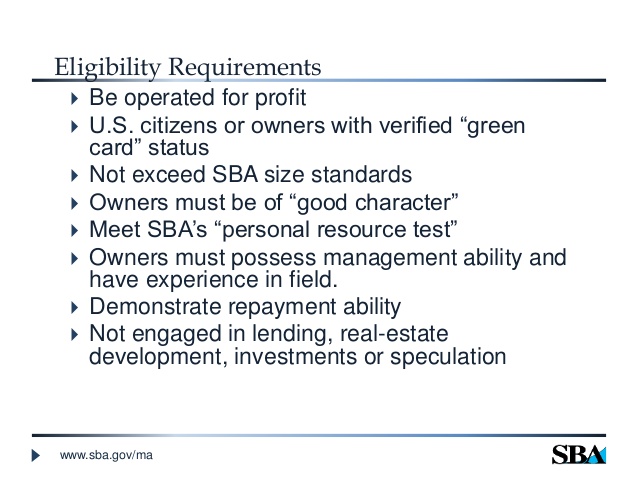

As the seller felt like time was of the essence, he opted not to seek SBA eligibility.

Doing so would have added time to the process but expanded the pool of potential buyers.

The first time out, they listed at a multiple of 4x with assurances to potential buyers that, once December numbers were in, that multiple would look a lot lower.

But buyers, it turned out, opted to wait and see.

Ultimately, though December numbers were indeed up 80% year-over-year, they re-launched the listing in January at a multiple of 3.2 – a $75k reduction from the first time out.

And quickly had two offers.

Meeting with potential buyers and presenting the deal

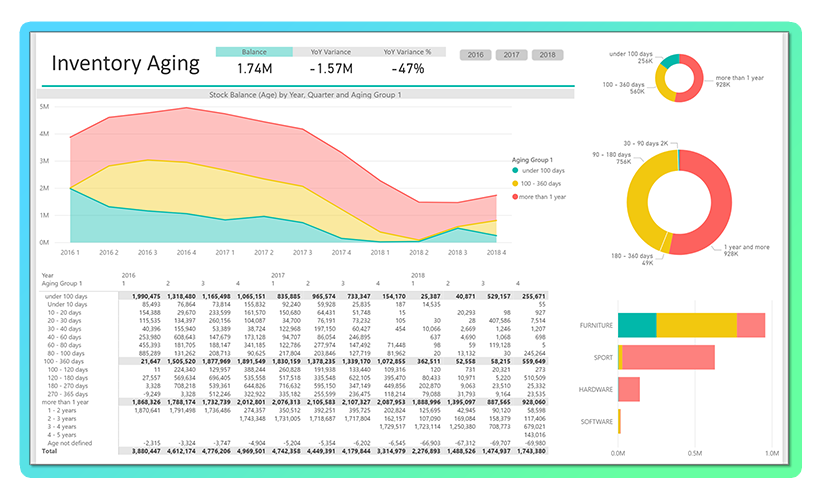

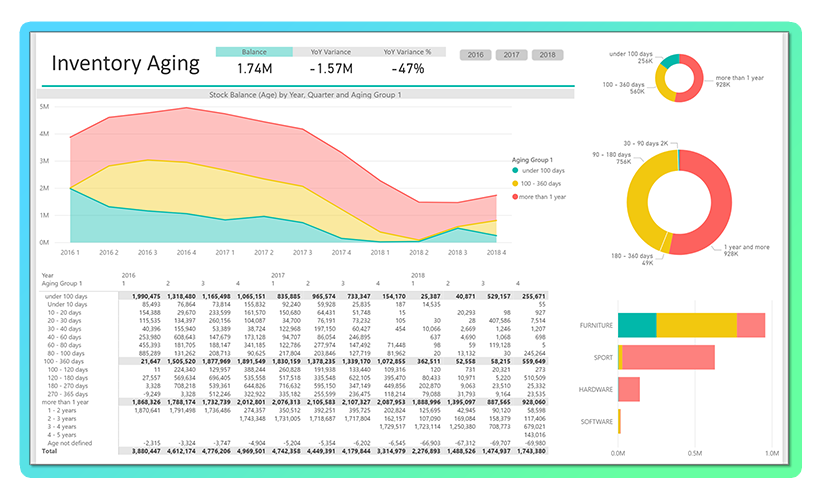

In terms of presenting the site’s package to buyers this time around, this owner’s biggest challenge would now be inventory.

Less inventory means more cash, so excess inventory is a problem when you’re selling your business and even when you’re not.

“For every dollar you have in excess inventory,” the owner explains, “that’s a dollar that you don’t have in some new product launch or some other thing that can make you more money.”

But he also points out that no business will plan inventory perfectly all the time. It’s a constant balancing act with risk on both sides.

You either err on the side of too much inventory, he says, and soak up too much of your cash flow.

Or you err on the side of too little, and risk missing sales, falling too low in Amazon search results, or losing the buy box.

In the seller’s case, he opted for the former strategy.

Transparency is everything

While across the company, they aimed to turnover inventory 3-4 times per year, that wasn’t the case with the single brand.

One of its products, in fact, required ordering a year’s worth at a time. Of the $400k of total inventory, the owner knew that $100k would take longer than 12 months to sell.

So he had some explaining to do to buyers. And some tough decisions to make.

What did he do?

The right thing.

Not comfortable sticking a buyer with inventory that would be slow moving, he took the initiative and made some adjustments.

The owner’s MO was this…he would put the buyer’s interests top of mind and wouldn’t create a situation that may hinder the buyer’s chances of success.

He was wise enough to know that for a deal to go through to closing, he’d need a buyer who trusted him.

What would that look like exactly?

- He completely wrote off $40k worth of inventory that he knew wasn’t valuable.

- He sold slower moving inventory (more than 12 months) at a 50% discount.

- He agreed to 12 months financing at 5% interest.

Inventory problem solved. Buyer impressed.

And as Joe pointed out, sophisticated buyers will ask for inventory aging reports, so you can count on any sticky issues coming out in due diligence regardless.

The owner’s approach of getting out ahead of a potential problem and valuing transparency probably helped the chances of a successful deal tremendously.

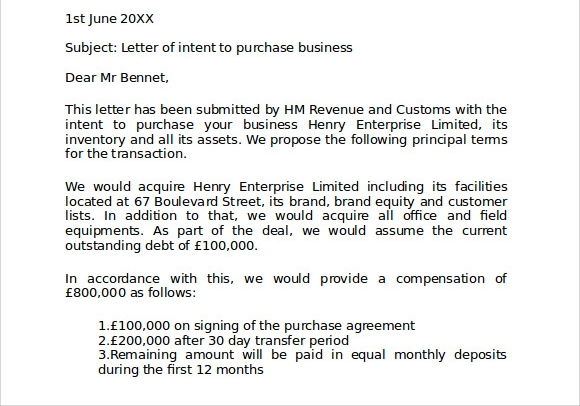

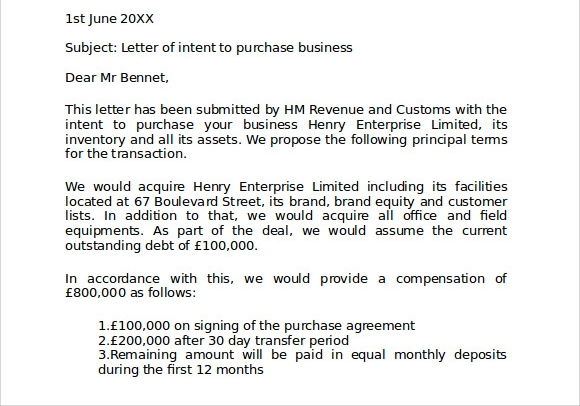

Life after LOI

The year-over-year growth of this business in just a few years is stellar and came in at 74% in January.

With the 3.2x multiple and inventory financing, the final offer of 96% of list price made for a great deal.

But Joe points out that the factor that will most likely make the biggest difference in getting this deal done is the character shown by this seller. As we often say, when you’re selling your business, you’re selling yourself first.

Once the business was under LOI, it wasn’t visions of tropical vacations dancing through his head right off the bat.

The seller’s attention turned to the buyer, and he took the time to write an email that showed who he really is…a fellow entrepreneur who cares about more than the check and wants to see the buyer succeed with this business that he built from the ground up.

He’d nurtured this business for years, often sharing the journey along the way on his podcast. In the email he calls it his “love child.”

With the impending sale of the brand, this owner’s taken some chips off the table and probably quieted some of those “What ifs” that must have been running through his head.What if Amazon freezes the account with $1.3MM in inventory?

What if the trade war ramps up again?

It’s less of a problem now. He’s making plans to travel more and get offline and out in nature.

He’ll focus more on other business interests and less on following the rules over at Amazon.

Of course, he’s still got three more brands to build.

But one less rabbit to chase.