Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

How To Plan The Transition Stage Of Buying Or Selling a Website

By Quiet Light

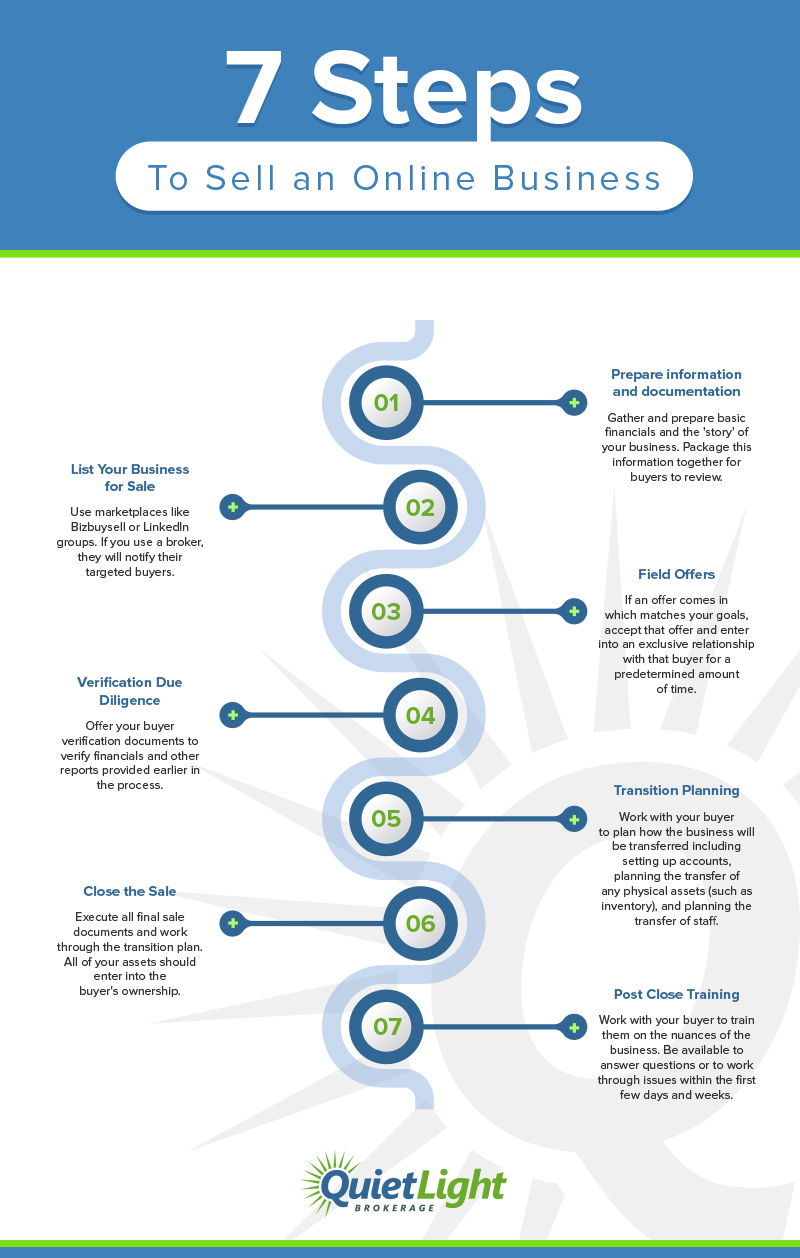

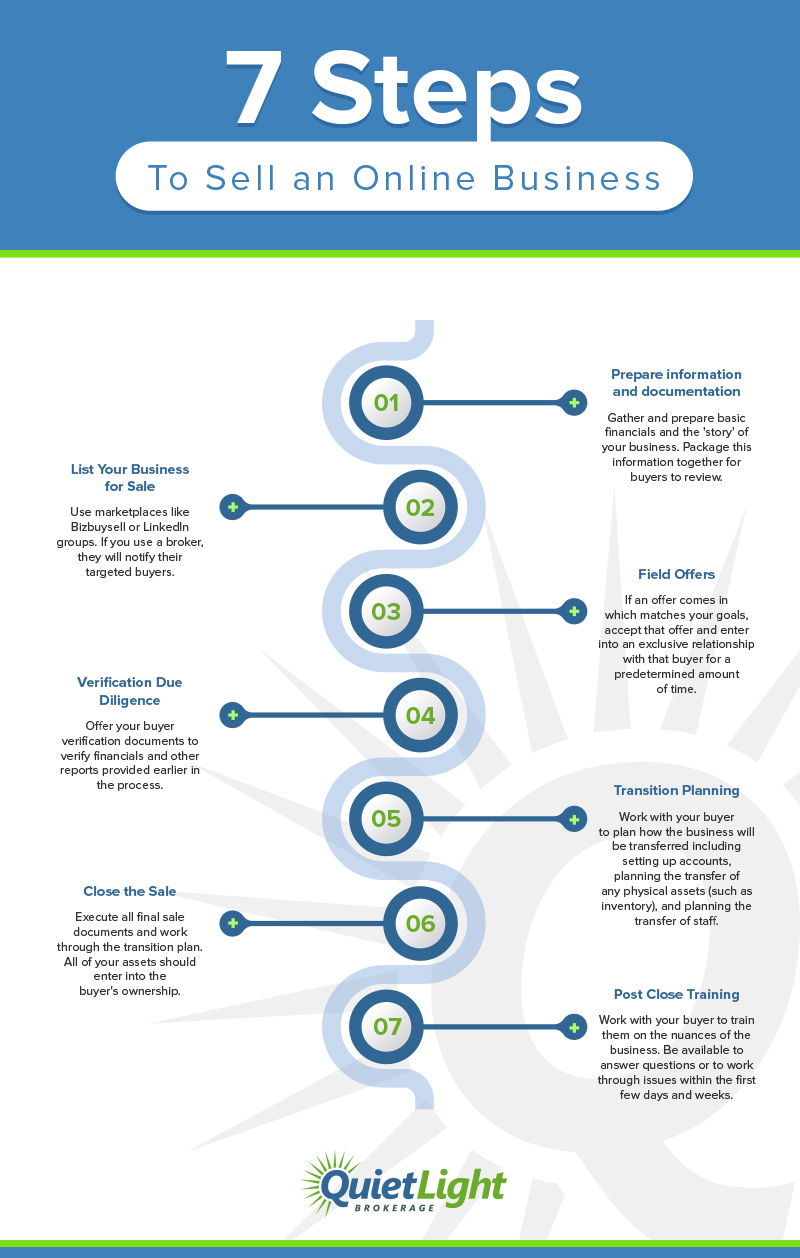

I always tell clients that there are two steps in the process of selling your business that will be more difficult than anything else in the process. First, preparing your information before you sell your business and secondly, preparing your information to get through due diligence.

https://www.youtube.com/watch?v=IZ2oxJIMt-c

These two tedious steps occur at the beginning and middle stages of selling your business.

Because these steps are so difficult, it can be tempting to celebrate and relax once they are done. However, there is still very important work to be done before you can cross the finish line and close the deal.

After the due diligence stage of selling your website, comes transition planning.

Transition planning is the stage of the selling process that comes after a buyer has completed their due diligence work, but before the business officially closes. In this stage, the buyer and the seller work together to plan the transition of the business to the buyer so that change can move along as smoothly and as quickly as possible.

Transition planning is usually composed of two parts:

- The organization of closing documents and the negotiation of any final elements that have not yet been settled.

- When the buyer and the seller work together to plan the details of the transition.

In this article, I’ll break down both parts and prepare the buyer and the seller for the transition planning stage of the selling process.

[note width=”100″ color=”green”] Click to see the breakdown of each stage in the selling process. [/note]

Organizing Final Agreements & Negotiating Final Details

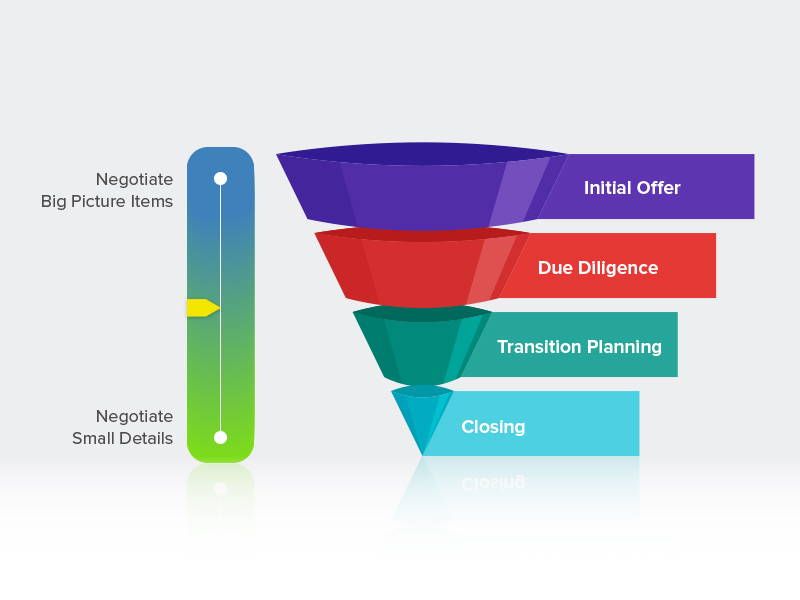

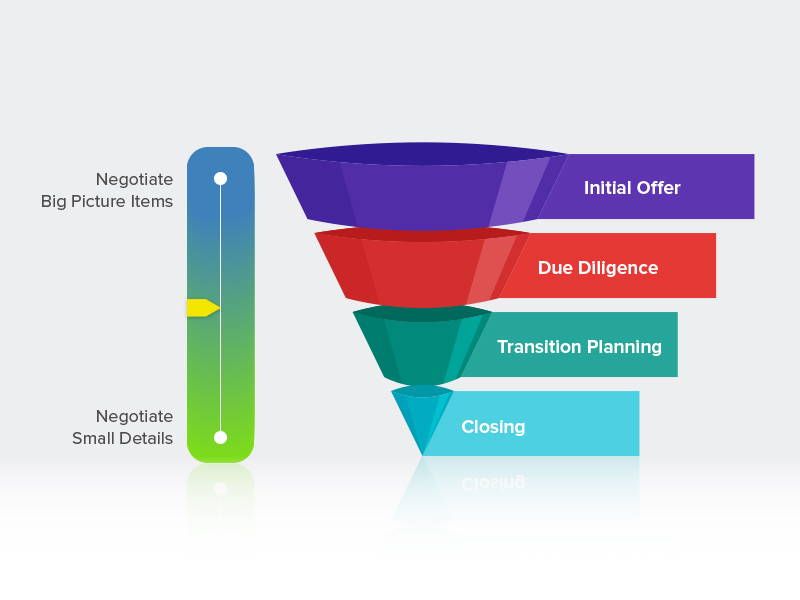

Throughout the process of buying and selling an online business, there are dozens of items that need to be negotiated. Usually, these items are negotiated throughout the process of the deal with the most significant and important terms being negotiated early on, and the smaller, less significant terms being negotiated closer to the closing process.

For example, a buyer and seller will want to agree on the purchase price and any financing needed upfront at the LOI stage of the agreement. These terms fall into the “big picture” of the deal.

But other terms and agreements can be ironed out during due diligence and in this final negotiation stage.

For example, details such as:

- What defines “competing” in a non-compete agreement.

- How many hours per week will the owner need to provide help during the transition services, and do they need to be available by phone, or just email?

- What will be the process for handling returns or chargebacks after the sale?

- If there is a disagreement after the closing, what are the steps to resolve that disagreement?

- Etc.

So once you reach the transition planning stage, any small remaining items should be negotiated and agreed upon. These items will generally bubble up naturally as the buyer and seller work to put the final touches on a purchase agreement.

Keep in mind that every deal is different, so there will be unique elements to discuss with each deal.

Organization of Final Documents

The most important document of any acquisition is the purchase agreement. The purchase agreement manages all the key terms and conditions of the acquisition.

But the purchase agreement doesn’t live alone. The buyer and the seller need to organize and finalize other agreements that are needed at the closing.

During the transition planning stage, you’ll need to work on these documents so everything is ready at the closing.

Some of the most common documents you’ll need at this stage are:

- Bill of Sale: The “bill of sale” is basically a very formal receipt. This document is considered legal evidence that the buyer paid the seller, and that the seller transferred the “good or services” to the buyer.

- External non-compete agreements. Usually, the noncompete terms are contained in the purchase agreement, but if your noncompete agreement is more involved, you may have an external noncompete agreement.

- Promissory note. If there is seller financing involved in the transaction, there will be a need for a promissory note to help govern the financing terms extended to the buyer.

- Corporate authorizations. Although these tend to be fairly rare, depending on the structure of the buying company, or the structure of the selling company, or the attorneys advising on the acquisition, you may need to have formal corporate authorizations to both buy and sell the business.

- Contractor agreements. If the seller is going to provide consulting services to the buyer, they may put in place an individual contractor agreement.

- Asset allocation agreement. Because both parties need to report their acquisition to the IRS, the asset allocation agreement is evidence of how the acquisition will be taxed. The IRS will require that both parties agree to the same taxable terms.

Pro Tip: Click to learn how to successfully transition staff when buying a new business.

[note width=”100″ color=”green”] Click to find out why and how better deals can be made using kindness and professionalism. [/note]

Transition Planning

The second phase of the transition planning process is the planning of the seller’s exit and the buyer’s entrance.

What’s Involved During Transition Planning:

- Planning transition with any vendors

- Setting up merchant accounts and bank accounts

- Arranging for the delivery of inventory (if applicable)

- Development of an asset list

Pro Tip: Schedule in-person transition sessions as both the buyer and the seller can settle details more efficiently.

Plan Transitions With Any Vendors

When a buyer acquires a business, they’ll likely expect to receive the same terms and conditions as the seller received from vendors. After all, they bought the business based on the way it’s run by the seller. If the buyer receives different terms and conditions, their perceived value of the business could change dramatically.

Therefore, the seller should work to ensure the buyer is able to receive a warm hand off with the vendors.

It is up to the seller to determine when they want to notify their vendors that their business is being sold. Some sellers want to wait until the very last minute, in the event that the deal doesn’t close, while others want to prepare their vendors early on for the transition.

Pro Tip: It is always good to have backup vendors or redundancy plan in case a vendor refuses to transfer to a new owner.

Setup Basic Business Accounts

When a buyer takes over a business, they want it to remain as unchanged as possible, so they’ll want to have the same business accounts as the seller. However, many accounts cannot be transferred and the buyer will have to set up their own accounts.

For example, merchant accounts and bank accounts cannot be transferred over as they are tied to a seller’s tax id and corporate identity.

The buyer and the seller, therefore, need to plan the transition of every account that can be transferred. For accounts that are not transferable (such as a merchant account), the buyer will need to set up new accounts.

Pro Tip: These stages of the selling process are particularly time sensitive. For example, it could take one to two days for the seller to call their vendors and set up vendor accounts.

Examples of accounts that may need to be transferred:

- Email accounts

- Social media accounts

- Hosting

- Domain names

- Phone systems

- Shopify account (if Shopify is being used)

- Individual sales channel accounts

- PPC Advertising accounts

- Inventory and order management system

[note width=”100″ color=”green”] Click to learn about how our client transferred her transferrable accounts with the click of a button.[/note]

Arranging for the Delivery of Inventory (If Applicable)

This step in the transition planning process is only applicable to businesses with physical inventory.

Transferring inventory can be complicated and slow moving, making it an important step for the buyer and the seller to plan together.

The buyer and the seller will discuss and plan when and where the physical inventory will be delivered, the method of delivery, who will be paying for the transfer, how to fulfill inventory during the transfer, etc.

Develop an Asset List

The asset purchase agreement or APA is where the buyer and the seller finalize the terms and conditions of the Letter of Intent. The APA should include a list of assets that will be transferred at the sale’s closing.

Pro Tip: The buyer and the seller should work together to create a list of assets as it can be difficult for the seller to remember and keep track of all of their assets.

An asset list is usually composed of the following elements:

- All website domains and URLs

- All 3rd party Seller Accounts

- All hosting accounts

- All domain name accounts

- All e-commerce platform accounts

- All website content and files

- All customer lists

- All marketing materials

- All vendor contacts

- All social media accounts

- All policy and procedure documents/files

- All toll-free numbers associated with websites

- All email addresses associated with website

- All registered or unregistered trademarks

- All contracts (written or verbal) with customers and suppliers

- All inventory on hand or on order at the time of closing

Pro Tip: The secure transferring of your assets can be done using an escrow. Escrow is a system designed to ensure that everyone keeps to their contractual obligations during a business deal.

[note width=”100″ color=”green”] Click to see how one of our clients at Quiet Light Brokerage transitioned her domain in 60 minutes.[/note]

Conclusion

The purpose of this article is to show buyers and sellers that being prepared is the key to the successful transition planning phase of buying or selling a website.

Preparing for the transition stage of the selling process will not only make the transition move along quickly and efficiently, but it can also help avoid a botched transition which can have months or even years of consequences.

When the buyer and the seller plan the transition ahead of time, the actual process of transitioning should only take one to two days. However, without taking the time to plan, unexpected events can pop up and the process may be stretched into days or even weeks.

Take the time for transition planning and watch how easy it can be to transfer a business!

What concerns do you have about the transition planning stage of buying or selling a website? Maybe we can help! Let us know in the comment below.