Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

How Seller Financing Works & What Happens If a Buyer Doesn’t Pay

By Quiet Light

Many buyers require seller financing in order to proceed with an acquisition. Not only does seller financing provide them with leverage, these buyers often feel as if sellers who are willing to offer financing believe more strongly in the future of the business they are selling.

But what happens if you buy a business, have a seller note, but can no longer make the payments sometime in the future? What are the consequences for the seller when defaulting on a seller note?

When I hear this question, I am fortunate to hear it from a seller who is asking it as a hypothetical question. The seller is usually evaluating whether or not they want to accept an offer that includes seller financing.

But it is a much different experience if you are a seller who is asking this question because the person who now owns your business missed the past few payments.

What options does a seller have in this situation? And, as the buyer, what risks do you take on by asking a seller to finance a portion of an acquisition?

Related Article: A Practical Guide to Buying a Business

In this blog post, I’ll cover:

- Why buyers love owner financing. There are very tangible benefits buyers see in owner financed deals.

- Why sellers refuse owner financing. There are real and perceived risks that make most sellers slow to accept owner financed deals.

- A case study of a buyer who defaulted on an owner financed deal. An owner of Brain Host sold his shares on an owner financed agreement. I’ll cover what he did when the buyers defaulted on his payments.

- How sellers have a lot of leverage in owner financed deals. Despite the risks to a seller, buyers actually risk more in an owner financed deal.

- How to craft an owner financed deal that is safe. Seller financing can be beneficial to both the buyer and the seller. I’ll close with some tips on crafting an owner financed deal that is safe and beneficial for everyone.

Seller Financing Makes a Lot Of Sense For a Buyer

While it is no secret that most buyers like deals that have an element of seller financing, why buyers love seller financing is also not a secret.

First (and most obviously), a seller willing to extend a note on a deal requires you bring less cash to the closing table. Since you are buying a business that is (presumably) bringing in income, the business can literally pay off a portion of its own acquisition price. This gives you, the buyer, leverage to buy a larger business with less money down.

Second, most buyers who require seller financing do so to keep the seller involved and invested in the future success of the business. While you may be able to plan a smooth transition, it is nice to have a seller invested in issues that might crop up in the future.

Finally, many buyers see sellers who are willing to offer financing as someone confident in the future success of their businesses. Whether or not a willing seller is truly a bellwether of a business’s stability is a debatable point.

But Sellers Hate Offering Seller Financing

As much as buyers love finding ecommerce businesses for sale where they can get owner financing, by contrast, sellers hate offers that contain seller financing.

Andrew Youderain, the founder of E-commerce Fuel, recently wrote an exhaustive blog post on selling an e-commerce business where he touched on seller financing:

I’m not going to mince words here: I hate owner financing.

For me, selling my businesses in the past partially came down to avoiding risk. I’m choosing to sell a cash flow at a 3x(ish) multiple to lock in those gains and avoid the chance the business tanks over time. So why in the world would I finance a purchase for the buyer and assume MORE risk? As a seller, you’re assuming all downside risk (apart from any interest) without any of the upside of ownership.

No, thank you.

Andrew’s thoughts on owner financing echo those of most sellers.

There are three typical objections from sellers.

How Can a Seller Enforce Seller Financing?

The first thought most owners have when they see an offer that includes a seller note is “how am I going to enforce the payments on this note?” As one owner told me, “I’m not a bank, and I don’t want to pretend to be one.”

Collecting on a defaulted buyer is pretty much a guaranteed headache (as we’ll get into later) which would be time-consuming, stressful, and potentially expensive. A seller who accepts financing on their business must ultimately trust they won’t have to fight that battle or be willing to fight it if needed.

Can I Trust My Seller Financing to a Buyer Who Has Control of My Business?

Once a seller considers this first question, their thoughts naturally move to you, the buyer.

- Are you really competent to run this business?

- Are you going to do something really stupid that destroys the earnings?

- Can I trust you to not wriggle out of future payments?

These thoughts are not a personal attack – they are the same risk assessment that a buyer will make of them.

What Collateral Can I Get to Secure My Seller Financing?

Depending on how they answer this second question, their thoughts often move to how they will collateralize their payments. In a real estate loan, you can obviously collateralize the loan with the property itself. So it makes sense that you can do the same with an online business, right?

Well, not really.

First, if an owner is selling their business, they are typically ready to move on to different pastures. They no longer want to wake up every day to the tasks and responsibilities of running their business. So the idea of taking the business back isn’t exactly an appealing thought for most sellers.

Second, if you begin to miss payments, the chances are this is due to the business suffering in some way. Since online businesses are valued so heavily on their cash flow, the seller might have their loan secured with an asset that is quickly losing its value as the business continues to suffer.

Is This Financially Beneficial For Me?

If a seller gets through all of these thoughts, they’ll eventually think about the money question. Does it even make sense to exchange their business for monthly payments?

As the owners of their business, they are presumably already seeing regular monthly payments. Granted, there is some work associated with these monthly payments, but the monthly payments should continue in perpetuity.

With owner financing, they get monthly payments that have a guaranteed end date.

Owner financing is just not a very appealing thought for most sellers.

What Corey Hammond Of Brain Host Did When His Buyer Stopped Paying

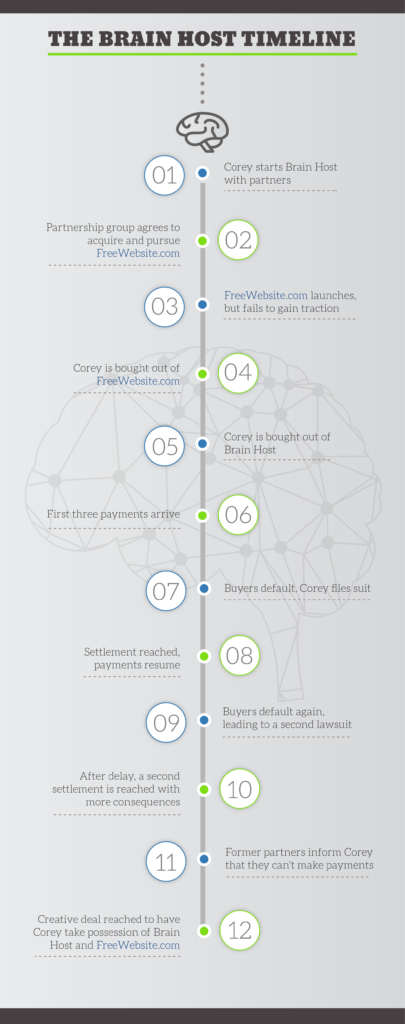

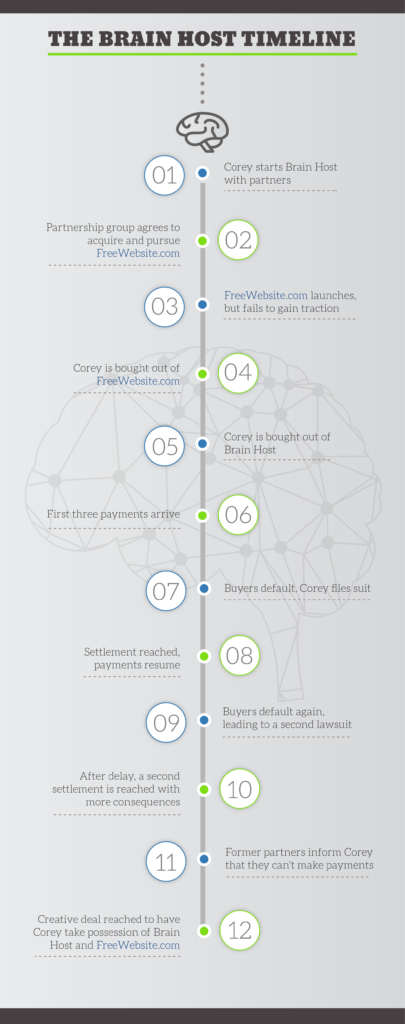

Corey started Brain Host with several partners in 2010. After a few years of exponential growth ($0 to eight figures in just a couple of years!), the partnership acquired FreeWebsite.com. Encouraged by the growth of Brain Host, they saw huge opportunities to develop Free Website into a profitable freemium website builder business that leveraged the hosting infrastructured they developed.

Corey disagreed, not that they idea wasn’t great, but in the timing and manner his partners wanted to execute the new venture. He wanted to continue to push resources into Brain Host which was continually proving itself.

As it turned out, Corey was right. Freewebsite.com launched and fell flat of their original expectations.

“Free Website was supposed to launch in the spring, but it didn’t technically launch until the summer.” Corey explained, “It failed to sustain itself and we tried to pick up the pieces throughout June and July, but it was too late. It wasn’t going to do or produce what we had hoped it was going to produce.”

A Partnership Sours & Corey Is Bought Out On a Heavily Financed Deal

Rather than recognize FreeWebsite.com as a failed project, the partners fell victim to their sunk-cost bias (a topic which I wrote about on Forbes). But Free Website didn’t have enough capital to dig itself out of its hole.

So the partners continued to take more funds from Brain Host to support Free Website.

As the CEO of Brain Host, Corey was no longer willing to tolerate the situation. Free Website “essentially took my Brain Host team and cut it in half. My development team went from 5 people to 2. Half of those resources went to building Free Website, and half stayed on to run Brain Host.”

As a result, he became a more vocal point of dissent.

Due to the disagreement, his partners bought out Corey’s shares in both Free Website and Brain Host.

What Corey got was an offer he felt was undervalued and which disproportionately relied on seller financing.

So What Happens If a Buyer Defaults On Payments? Here’s What Happened In Corey’s Situation

Sellers hate owner financing because they don’t want to go through the process of collecting if a buyer defaults on their payments.

For Corey, this fear became a reality just four months after he sold his shares. While the first three payments came in on time, the fourth payment never arrived. Three months later, Corey filed a lawsuit to collect his payments.

This was enough to bring the partners to a quick settlement, back payments, and a promise to resume payments as scheduled. But unfortunately, this wasn’t the end for Corey.

Thinking of Selling Your Business?

Get a free, individually-tailored valuation and business-readiness assessment. Sell when you're ready. Not a minute before.

Shortly after they resumed payments, they let Corey know they were having trouble meeting his payments. He agreed to give them some time to make the next few payments, but those never materialized.

It wasn’t long before Corey was forced to file a second lawsuit – one which would be much uglier and difficult than the first. Corey’s first lawsuit only succeeded in getting back payments, but no consequences for future defaults. Since he was quickly in the same position as before, he knew this lawsuit needed more than just back payments.

His former partners also dug their heels in for the next six months as lawyer fees ratcheted up and legal strategies were spun.

After six months, Corey and his former partners reached another settlement which included automatic judgments if they should default again.

The End Of The Road: Final Payments

After their second settlement, the partners made good on Corey’s note. Corey watched the business from a distance and saw it was struggling.

One day, the call came in from his former partners:

“They came to me in May 2016. They called and asked to meet. At that meeting, they told me ‘The course has run out. There’s no more money to pay you, you can sue us again and we’ll just go into bankruptcy or we figure some elegant solution out.

“That elegant solution was me acquiring back, not only Brain Host, but the main asset, FreeWebsite.com”

After 3+ years of lawsuits and settlements, Corey had his original business back, though bruised and neglected.

It Turns Out Sellers DO Have Options If a Buyer Defaults

If a seller’s main concern about accepting owner financing is whether they have options to collect on a defaulted loan, Corey’s story shows a seller really does have powerful options.

While sellers are often concerned about their options if a buyer defaults, the fact is, a buyer has a lot more they can potentially lose in a default. For the partners in Brain Host, they lost the money they invested in paying for Corey’s shares, they lost countless hours fighting a lawsuit they could never win, and they finally lost the asset they bought.

But this was only because Corey was willing to enforce the agreement. For Corey, the impact of the lawsuits were severe. It impacted his personal life, his friendships, his career, and every aspect of his life.

But despite all that, he doesn’t regret what happened to him:

“The first lawsuit or the second lawsuit, yes, I would be very negative towards the whole thing. But I’m a big believer in things that happen, maybe not for a reason per se, but the sum of who I am is built on my experiences. I got a PhD in Business, Finance, and Law all wrapped up in a two-year, three-year period of time. Sure, it cost me more than a college education probably would have, but I wouldn’t trade the experience for anything.”

Need a Good Contract Attorney?

Visit Our Partner Page to View a List of Experienced eCommerce Contract Attorneys We’ve Worked with Over the Years.

Making a Seller Financing Offer That Makes Sense

We know why seller financing can be a great deal for buyers, and we know why sellers tend to hate owner financing. We also know that a default on owner financing leads to a giant mess for both the seller and the buyer.

So how can we make a seller financing offer that makes sense? Here are four tips to keep owner financing in check:

Find The Sweet Spot Of Owner Financing

In Corey’s sale, the deal was structured way too heavily towards owner financing. This increased the risk for both the partners and Corey exponentially. You need to find the sweet spot for owner financing that balances risk mitigation against the benefits of financing. In most cases, this is going to be between 20% and 30% of the final price, but this, of course, will vary for each deal.

Hold The Domain In Escrow, & Have Planned Resolutions

Lawsuits are expensive, slow, inefficient, and stressful. Rather than have a lawsuit be the default option, agree to hold the domain in escrow or agree to forced arbitration or mediation. These options give both the buyer and the seller a greater chance at reaching a faster resolution.

Pay Attention To Payback Ratios

Banks won’t extend a loan if the debt to earnings ratio is too high. Forecast your planned expenses – including your own payments – and leave some wiggle room to make sure you can service your seller’s note.

Keep It Short

The longer the note, the higher the chances there will be a default. Not only do we not know where a business will be in four or five years, but if the business begins to struggle early on and there is a long-term debt, it can be tempting to default to free up short-term cash flow.

Wrapping Up: Final Thoughts

Buyers will always like anything which involves less up-front money, and sellers will always be naturally suspicious of such deals from people they don’t know. It’s only normal to want all of the price up-front – it’s less risk on their part.

Buy a Profitable Online Business

Outsmart the startup game and check out our listings. You can request a summary on any business without any further obligation.

But with the right terms, the right agreements, and some trust, being open to seller financing can open up offers that you might not otherwise be able to entertain. Many buyers will pay more if they are able to finance a portion through owner financing.

Overall, being open to owner financing will bring in far more interested buyers. As you have more potential buyers interested in your business, your negotiation leverage increases which only helps you get a better price.

Seller financing can, indeed, be a great win / win option for both a buyer and a seller.

Comments are closed.

Great article. As both a buyer and seller I feel both points. I generally purchase smaller assets under $30K so I don’t really need the seller to have skin in the game but if I was making a larger purchase I would want skin in the game from the owner just like the owner would want from me and the bank lender would require as well.

Thanks for the great insights.

The seller should be just fine with 20 or 30 percent note for the same or less than the multiple. If not, they are selling a faulty product(the business) or have grave concerns the buyer can’t run the site. Brokers get paid by the seller so they are near 100 percent blind on the issue.

Jerre,

Thanks for your comment. While a broker does technically get paid from the proceeds that the seller receives, our payment really comes out of the transaction. There is no payment without a deal being reached.

I would disagree that a seller who refuses to carry a note must be selling a faulty product or have grave concerns about the buyer. For most sellers, it simply doesn’t make financial sense to carry a note. Their businesses usually don’t take a lot of time to run in the first place. Exchanging monthly income with no end date (if they were to hold the business) for a lower monthly income with a definite end date simply isn’t that appealing…