Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Buying an Online Business: Should You Go Big Or Go Small?

By Quiet Light

When buying an online business, which is the better investment – buying one big online business, or buying multiple smaller internet businesses?

Some people would argue that multiple, smaller acquisitions is less risky. As the saying goes, don’t put all your eggs in the one basket.

If you buy multiple websites, you take a ‘portfolio’ approach. One bad acquisition won’t sink you and the other businesses can also help keep you afloat if one of the acquisitions is having a cashflow problem.

On the other hand, a single, larger acquisition allows you to focus on just one venture. To use another saying, “too many cooks spoil the broth”.

The downside of this strategy is that your investment depends on the success or failure of just one acquisition. If you lose the business, you lose the lot.

So which is better?

There are good arguments to be made for both theories. To learn more, I dug into some statistics to see what the data might say.

Are Larger Websites More Work? Not Necessarily

A lot of buyers target smaller websites because they do not have the time for the work that comes with a larger acquisition.

The buyer might be a professional who only wants a ‘side income’ and isn’t ready yet to leave their corporate 9-5 job. Or they might be a stay-at-home parent who misses their career, but can’t dedicate 30+ hours per week to an acquisition. Being a parent is enough work as it is! I can attest to this from experience!

Whatever the reason, the common perception is that a smaller website should be less responsibility.

It turns out this isn’t actually the case.

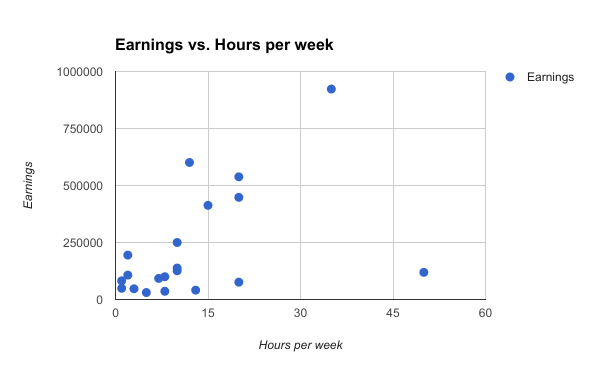

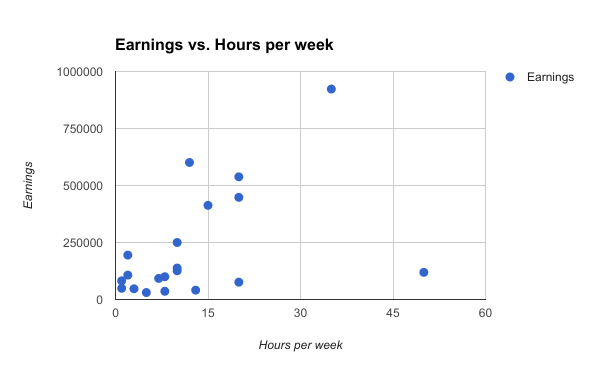

I looked at the last 20 websites for sale that we worked with at Quiet Light Brokerage to see just how much time their owners were investing, and how this related to how much those websites earned.

I then asked Google Sheets if there was any correlation between earnings per year and hours worked. In other words, if a business earns more money, does that mean you should expect to spend more time each week running the business?

Google gave me a correlation coefficient of 0.45.

If you are struggling to recall your senior year math course (like I was), a correlation coefficient of 0.45 means that there is not much of a connection between the two.

[note width=’45’ align=’right’ color=’yellow’ title=’What inthe World is a Correlation Coeffecient?’]

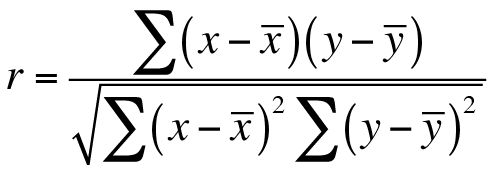

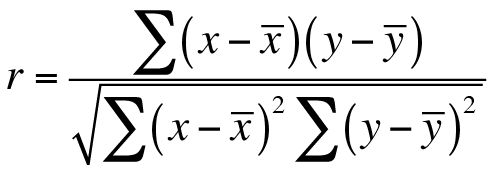

If you are like me, this number probably didn’t mean much to you since you are probably not a professional statistician. A correlation coefficient (called the “r” value) shows how closely correlated (connected) two numbers are to each other. A” r” value can be anywhere between -1 and +1.

- An r value of +1 is a perfect correlation. As one set of data increases, the other will increase.

- An r value of -1 is a perfect negative correlation. As one set of data increases, the other will decrease.

- An r value of 0 means there is no correlation whatsoever.

[/note]

Are Larger Websites More Work? A Bit – But Not Much…

The chart above is really helpful in understanding how much extra work you might expect if you are buying a larger website. Here are a few key points to notice and remember:

- There Are Larger Earning Websites That Don’t Take Much Time To Run

It may look as if the truly “big earners” all require at least 10 hours per week to run. But if you consider that this graph shows bottom line earnings, it is surprising at just how little time owners are spending per week to pull in mid to high six-figure earnings. For example, a lot of processes can be automated and many staff can run the business on their own with minimal interaction from the boss. - Small Websites Are Not Necessarily Less Work

The website that takes the most amount of time to run (50 hours) is also on the lower-end of earnings ($119,000). (I wrote an article about selective outsourcing that might be helpful for this owner). - The Highest Earners Tend To Take More Time, But Only Marginally So

Every business that has earnings over $250,000 is also located further to the right in time commitment. However, if you are earning twice as much (or more), are you going to complain about working 15 hours vs. 10 hours per week? Probably not.

Smaller Websites Are Less Complex, Thus Easier To Run

Even though a larger website might take the same amount of time to run as a smaller website, that doesn’t mean it is necessarily easier to run. There are time commitments that are harder than others.

For example, I have no problem spending an hour replying to emails. However, spending an hour writing an article like this is much more difficult and takes more energy.

So are larger businesses more complex and thus more difficult to run?

Online Businesses Get More Complex As They Grow (& That’s Not Surprising)

Any buyer who has worked with Quiet Light Brokerage will know we ask our clients a lot of questions. A seller may have to endure a handful of phone calls and 100+ written questions before we are ready to list their business for sale.

Naturally, if the business isn’t all that complex, we’ll have fewer questions to ask.

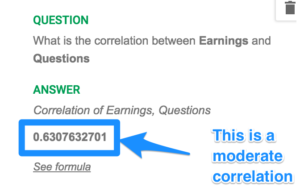

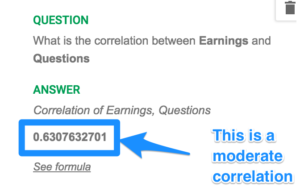

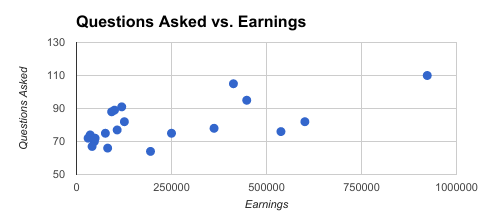

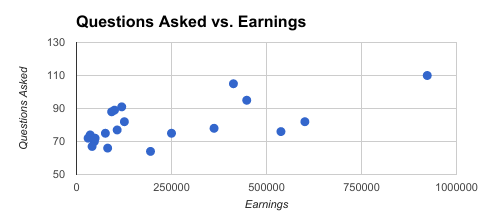

So I looked to see if there was any correlation between the number of questions we had to ask and the amount of money a website earned.

Turns out, there is a moderately positive correlation:

Graphed out, we can see this a little better.

This Really Shouldn’t Surprise Us

Of course, this result shouldn’t surprise us that much. In order to generate more revenue and more earnings, an online business is usually involved in more activities.

For example, a small, highly passive business might rely on organic rankings and a passive revenue stream such as Adsense. There’s not much to manage in that business.

But that same business might turn into a larger business if the owner engages in email marketing, social media, and content partnerships while adding a paid content channel and direct advertisers.

Higher revenue businesses typically do more with the same core assets.

This Is a Case For Buying Smaller Websites

Although smaller websites are not necessarily less work than larger websites, they are less complex to run and manage. This is likely due to owners of larger websites outsourcing key activities or hiring contractors to manage parts of their business.

If you are trying to determine between buying a large site versus buying lots of smaller sites, buying lots of smaller websites should be easier to manage.

Of course, this assumes that you can combine tasks across multiple smaller businesses.

If you are a Statistician…

…please close your eyes and cover your ears. Trying to correlate the complexity of a business to its earnings by looking at the number of questions is obviously fraught with error. With a larger sample size, we might get a more reliable approach, but even then, the broker who is asking the questions will influence this result heavily.

Fortunately, the data matches up with our experience at Quiet Light. Most higher revenue businesses are more ‘sophisticated’ in that there are more pieces to puzzle.

Are Larger Businesses More Or Less Risky Than Smaller Businesses?

When we weigh the options of buying one large website vs. buying multiple smaller websites, one of the key questions you must ask yourself is this: do you want to place all of your money with one acquisition?

But this question doesn’t tell the whole story. This question assumes that a large website is just as risky as a smaller website.

That doesn’t seem to be true when we look at the data.

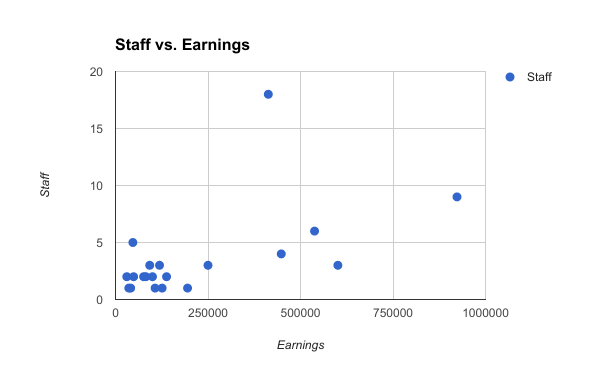

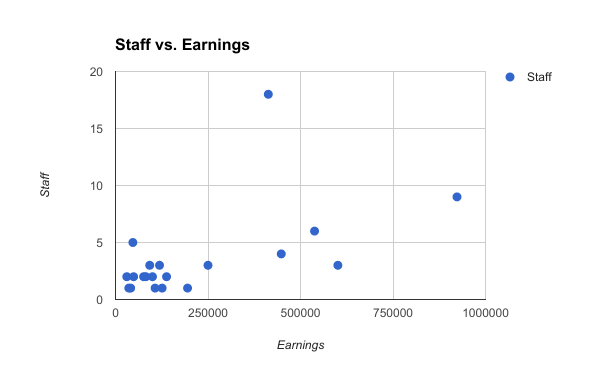

Larger Businesses Are Less Dependent On Their Owners

We already know larger businesses are not necessarily more or less work than smaller businesses, but we do know they are likely more complex than a smaller business.

The reason this complexity doesn’t become more work is because larger businesses are able to outsource various roles.

I went through the same 20 businesses I used throughout this blog post and analyzed the number of staff or contractors on each one. I then averaged the earnings of those businesses based on the number of employees working there.

| Number of People Working on Business | Solo Owner | One Staff | Two Staff | Three or More |

|---|---|---|---|---|

| Annual Website Earnings | $100,956 | $116,592 | $265,625 | $473,800 |

As a business grows in revenue and earnings, it also tends to grow in the number of people working on the business in a full-time capacity.

This might be a good argument for why you should invest more money into specialists within your company.

Outsourcing parts of can bring relief to dependencies on the owner (often called a “key man risk”). Key man risk is one of the most common factors that destroys value in an Internet-based business.

As a buyer, if you know that a business comes with several established staff members, you do not have to question whether you can replace the seller as the owner of the business: they’ve already begun to replace themselves.

Larger Businesses Have More Room For Error

While the data above is interesting and insightful, there are few arguments that are more convincing than this: large businesses can have more bad things happen to them without killing the business.

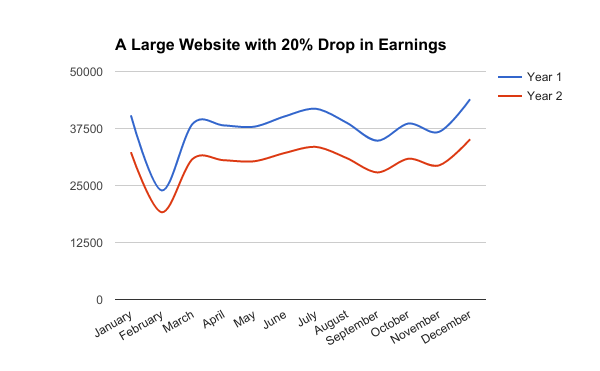

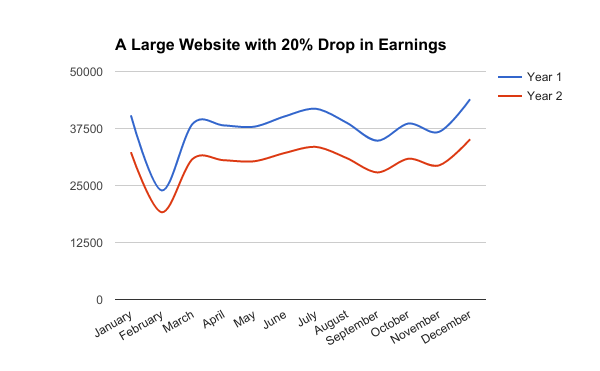

As a simple example, take a look at the chart below which shows a fictional company that suffers a 20% decline in earnings.

| Total Earnings | |

|---|---|

| Year 1 | $453,794 |

| Year 2 | $363,035 |

Losing 20% of earnings is not something you want to happen. For this business, the difference in annual earnings is almost $90,000. That would be a tough decline to swallow.

But if your earnings are high enough, you can absorb that decline while still having plenty of money left to invest in the business and bring it back to growth.

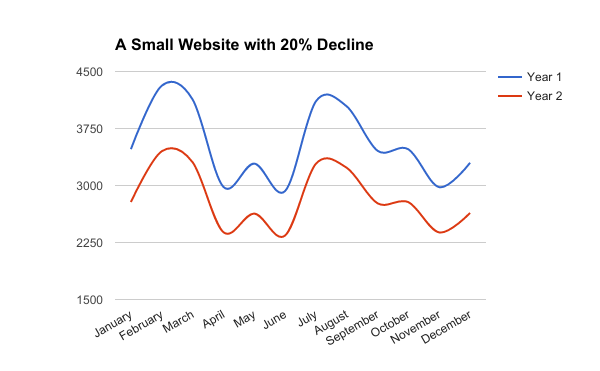

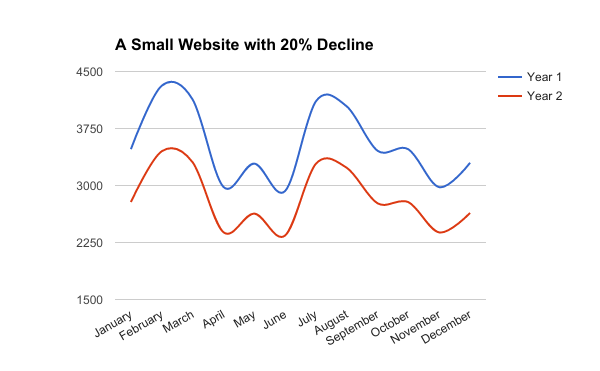

That’s not the case with a smaller website.

For a smaller website, a 20% decline in earnings could be the death of the business since there is so little money to invest in re-growing the business.

In this example, while the total amount of money lost from one year to the next isn’t nearly as much (~$8,500), there is not a lot of money left to invest in the business without taking away from your personal profits.

| Total Earnings | |

|---|---|

| Year 1 | $42,480 |

| Year 2 | $33,984 |

In this sense, larger businesses are far less risky than smaller businesses.

So Larger Websites Are a Better Acquisition, Right? Not So Fast…

You might read this and think larger websites are a better acquisition, but I’m not ready to say that yet.

It’s true that larger websites are less risky since they have more room for error, and they tend to be more transferable. It’s also true that, while they are more complex, they don’t necessarily take more time to run.

But they are still “all or nothing” investments. You simply can’t turn a blind eye towards the risk that comes with investing in just one large property.

If risk was not a factor, then buying a large online business would easily be the better choice for any buyer. But

So which strategy is better? For an experienced buyer who knows how to guage the riskiness of an online acquisition, they would probably be better off buying a large website. But for a relatively new buyer, or someone who may not feel as comfortable assessing risk, keeping the approach to small acquisitions may be a better option.

What are your thoughts? Is it better to buy big or to buy small?

Comments are closed.

Love this content you guys are putting out! I wrestle with these exact questions. Keep up the good work, QLB.

Thanks! Let me know if you have other questions like this – it makes it a lot easier to come up with blog posts (as you know).

Thank you for your great posts! My husband and I are big fans of your podcast (and anxiously waiting to come across a business that meets our criteria for buying)! I would personally love to see a post on the podcast topic the other day about the risks involved in transferring an account to a new seller and how to get around it (I was a little overwhelmed by the idea of having a separate laptop and no overlap in wireless network usage)!