Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

What to Expect In a Non-Compete Agreement When Selling Or Buying An Online Business

By Quiet Light

When buying an online business, there are a lot of things that you’ll need to negotiate. How much you’ll pay might be the most obvious, but some secondary terms are just as important as price.

One secondary key element of any acquisition of an online business is the non-compete agreement.

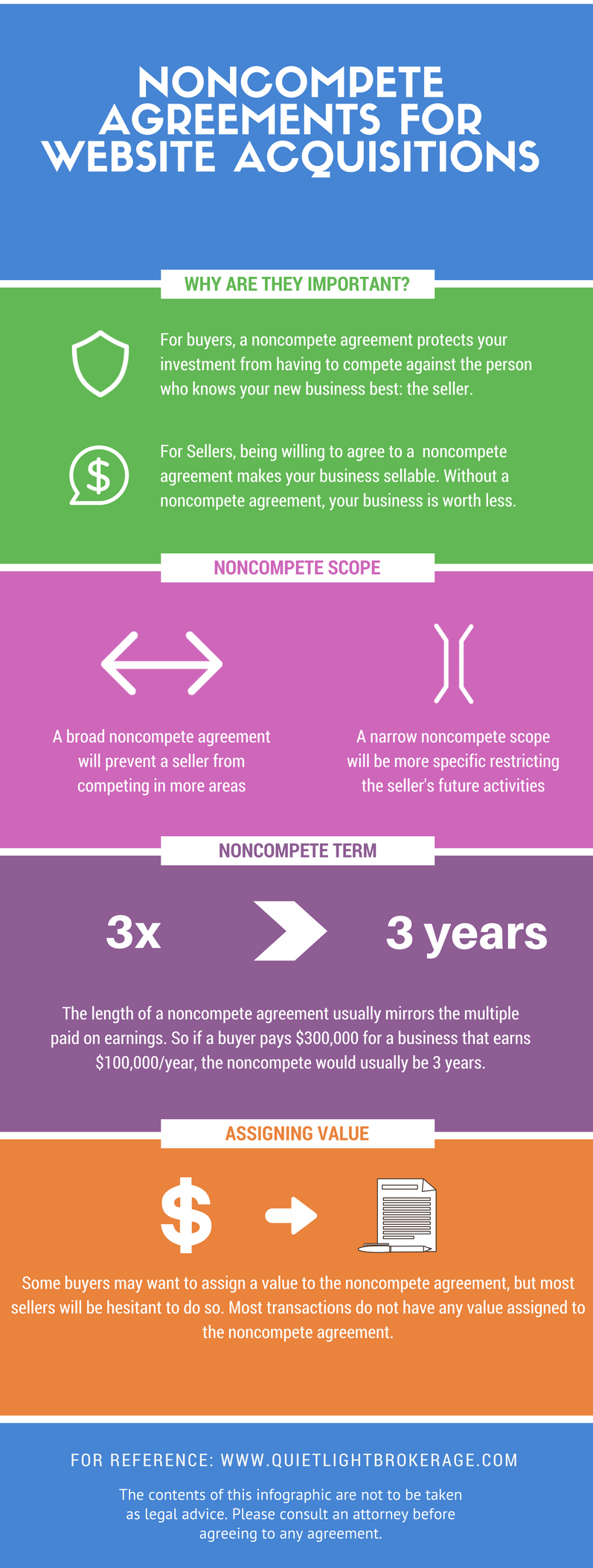

A non-compete agreement is an agreement between a buyer and a seller where the seller agrees not to compete directly or indirectly with the buyer’s newly acquired business. Essentially, the non-compete agreement protects a buyer from having to compete against the person (aka the seller) who knows the business in question the best.

In this blog post, we’ll cover:

- Why non-competes are essential for both buyers and sellers

- What 3 aspects are included in every non-compete agreement

- Why assigning value to a non-compete agreement might backfire

- How to not allow the non-compete agreement to derail your deal

The Importance of a Non-Compete Agreement For The Buyer

For buyers, having a non-compete agreement in place is usually a non-negotiable tenet of any deal.

Since the seller is the person with the most knowledge about the business being transferred, buyers may feel intimidated or concerned with the seller’s know-how and feel that they are a potential threat to their newly acquired business. Therefore, in most cases, a buyer would like to include a non-compete agreement in the contract to have confidence in their acquisition.

A reasonable non-compete agreement gives a buyer the necessary time to make back their original investment, time to establish themselves as the new owner of the business, and enough runway to distance themselves from one of the top potential threats to their business.

The Importance Of a Non-Compete Agreement For The Seller

For a seller, a non-compete agreement might not seem to be as important. After all, why would you want to restrict what you can do in the future?

But agreeing upfront to a non-compete agreement is something that will add significant value to your business. A few clients in the past have indicated that they would not be comfortable signing a non-compete agreement. Buyers pretty much deemed these listings as untouchable.

Offering a non-compete agreement upfront to a buyer gives them reassurance that you are offering your business for sale in good faith and that your intentions are to leave the industry for some time. This upfront assurance brings a positive pressure on your asking price (as we explain in our Ultimate Guide to Website Value).

What Could A Seller Do To Hurt a Buyer?

I’ve spoken to several sellers who tried to convince me that it would be almost impossible for them to actually compete with the business they are selling. After all, what they are selling usually took years to build and involved a lot of sweat equity.

But this offers only a little comfort to potential buyers. After all, a seller has:

- Expert know-how

- Client lists

- Vendor relationships

- Code knowledge

- Organizational and efficiency know-how

In the vast majority of cases, sellers are ready to be done with their industry and business, so agreeing to a non-compete is a no-brainer

What Are The Terms of a Non-Compete Agreement?

We know why a buyer and seller would agree to a non-compete agreement. What does an agreement like this entail?

Most non-compete agreements will consist of three main parts: the parties involves, the scope of the agreement, and the term of the agreement. There may be additional elements involved, but these three parts make up the bulk of most non-competes.

Understanding The Scope Of a Non-Compete Agreement

The scope of a non-compete agreement determines what the seller can and cannot do after they sell their business. The focus here is defining what ‘competing’ actually means.

In most non-compete agreements, a seller will be barred from selling the same types of products or services – or they will be barred from trying to appeal to the same type of customer.

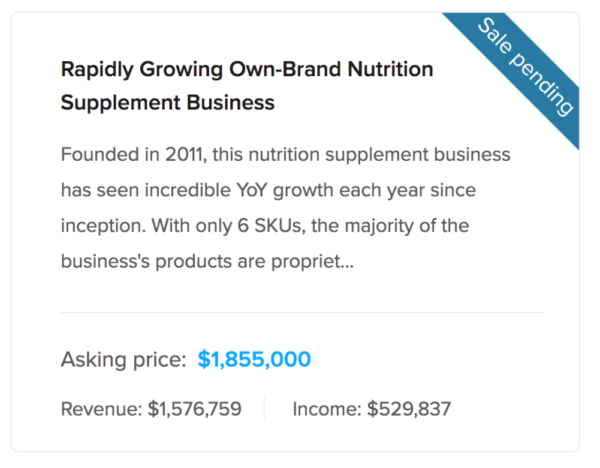

Consider the following example of a recent e-commerce business for sale:

What should the seller in this case expect?

The scope of an agreement can range from narrow to broad.

In an agreement with a narrow scope, the seller won’t have too many restrictions. They may be restricted from selling the exact same supplements, or they may be restricted from marketing to the same consumers.

In an agreement with a broad scope, the seller may be restricted from the entire health and wellness niche, even if it is different from nutrition supplements.

Most agreements fall somewhere in the middle. In this case, a normal scope would restrict the seller from operating a business in the nutritional supplement business of a same or similar nature to what they were doing before.

[note color=”blue” width=”100″ title=”Making Exceptions to a Non-Compete”]

A seller may also request a carve out to the scope of a non-compete.

For example, Quiet Light Brokerage recently sold a website in the dating niche. The seller wanted to continue to operate a dating website, but solely in Central America.

The non-compete agreement prevented the seller from opening or working with a dating website in the US, but allowed for them to operate a Spanish speaking website targeted towards Central America.[/note]

Defining The Terms of a Non-Compete Agreement

The other major part of any non-compete agreement is it’s term. The term will define how long the seller will avoid operating in a business that is considered to be in competition with the business being sold.

In most cases, the term should mirror the multiple paid for the business to be considered reasonable.

For example, if the nutrition supplement business has $100,000 in discretionary earnings and sells for $300,000, it has a multiple of 3. Therefore a non-compete on this business would normally be three years.

Some buyers go into a transaction with the expectation that they will keep the person selling their business out of the industry for years to come. But enforceability of non-compete agreements are an issue. Courts generally look for non-compete agreements to be reasonable in their nature.

Attorney Jamal Jackson lists unreasonably long terms as the top reason a non-compete agreement would be unenforceable.

Do I Have To Assign a Value To a Non-Compete Agreement?

First of all, what does it mean to assign a value to a non-compete agreement?

When a transaction is closed and the final purchase agreement is signed, the buyer and seller need to determine what is being purchased and how much each asset is worth. This is called the asset allocation agreement.

For example, a business that is acquired for $1,000,000 might have the following allocation:

- Inventory: $150,000

- Customer lists: $150,000

- Goodwill: $700,000

In some cases, a buyer might want to assign value to the non-compete agreement so they can demonstrate the value of the damage caused if the seller were to violate that agreement. With an assigned value, the purchaser will have a specified amount to claim for damages.

However, there have been examples of when this backfires for the buyer.

First, a seller is going to strongly resist allocating any amount of money to the non-compete agreement for tax reasons (**see below). Due to this, the amount allocated will typically be much less than the actual damages that would be potentially caused from the seller competing. Assigning a value to a non-compete agreement effectively places a ceiling on the damages you could collect if a seller acts in bad faith.

Secondly, over the years we have had hundreds of lawyers review deals that did not assign value to a noncompete agreement without any issues.

Why Sellers Resist Allocating Money To a Non-Compete Agreement

The reason a seller wouldn’t want any value assigned to a non-compete agreement is for income tax purposes.

According to Tax Advisor, the amount that the seller receives for the non-compete agreement is treated as ordinary income for tax purposes, “whether the transaction is structured as a stock or asset sale.”

However, if the non-compete agreement is created to enforce the transfer of goodwill, then it’s not necessarily taxed at ordinary income rates. Instead, the non-compete agreement may be considered a part of the purchase of the business and taxed as capital gains.

Of course, how this impacts your tax situation might be different given your location and the type of deal that you are structuring, so be sure to consult your accountant and not just this blog post.

How To Avoid Derailing Your Deal With The Non-Compete Agreement

Agreeing to the terms of a non-compete agreement can be a surprising sticking point in the process of buying or selling an online business.

Despite the fact that a seller is usually ready to move on and out of their industry, there can still be back and forth negotiations on the specifics of the non-compete.

This is usually due to the natural competition that arises during the process of a larger negotiation (everyone wants to win). But it can also be scary to leave a business that you know you are good at and to close the door of every returning by agreeing to a non-compete agreement.

If you find the non-compete agreement to be a sudden sticking point in your negotiations, remember these points:

- If you are the buyer…remember that the person selling their business is selling for a reason: they are done with their business. In most cases it would take a lot of work to rebuild what they created. Because of this, organize your non-compete requirements in a way that will protect your interests in a reasonable way.

- If you are the seller…see point 1 above. You are selling for a reason. The person buying your business should have a period of time where they don’t have you as a potential threat.

Conclusion

There are a lot of terms that you’ll negotiate when buying or selling an online business, and the non-compete agreement is just one of those terms.

As with any element of negotiation, make sure that you keep the bigger picture in mind. If you are selling your business, do you want to continue to operating in your industry or niche? And if not, could this be an area where you give your buyer some peace of mind by offering stronger non-compete terms?

And if you are buying an online business, what threat does the seller actually pose to you? Make sure that what you ask of a seller actually protects you rather than just asking for terms for the sake of it.