Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Should You Use Escrow When Buying an Online Business?

By Quiet Light

Here’s a short answer to that question: yes, in most cases you should use an escrow service if you are buying an online business.

While there are many things to consider if you are intending to buy an online business or if you are intending to sell an online business, one that shouldn’t be overlooked is whether you use an escrow service.

You may be very familiar with how escrow works on a basic level, but how it applies to online businesses is worth a closer look.

What are the advantages and disadvantages of escrow in an acquisition? Who does it actually protect (and what does it protect them from)? Do the advantages make the cost worthwhile?

The Multiple Benefits of Escrow When Buying an Online Business

Most buyers and sellers know that escrow is supposed to help add security to your transaction. But it actually does this in multiple ways:

- It places whatever cash is being delivered at closing in the hands of a neutral 3rd party. This puts the buyer and the seller on even grounds.

- It forces both buyer and seller to plan the transfer in more detail as the conditions of an escrow release of funds needs to be understood in advance.

- It can provide extra security for a seller who is holding a seller note as ownership of a key asset can often be placed into escrow.

- It helps to resolve disputes before they arise as it forces both the buyer and seller of an online business to discuss more thoroughly the details of the planned exchange.

Escrow Provides Equal Protection for both the Buyer and Seller

Buying an online business is unlike most other large purchases. For most large purchases, whether it be a house or acquiring a physical business, most buyers and sellers have the opportunity to meet in person.

With an online business acquisition, however, this often isn’t the case. In fact, relatively few transactions involve a face-to-face meeting of a buyer and seller.

Obviously this can make trust an issue (which is why we encourage face to face meetings).

Even if you do meet face to face, this does not always alleviate issues of trust. The fact is, buying an online business is an exchange of highly valuable assets. The buyer is obviously exchanging cash (or the promise of cash) for the business and all that comes with it. Any time something of value is exchanged, trust can be a serious consideration.

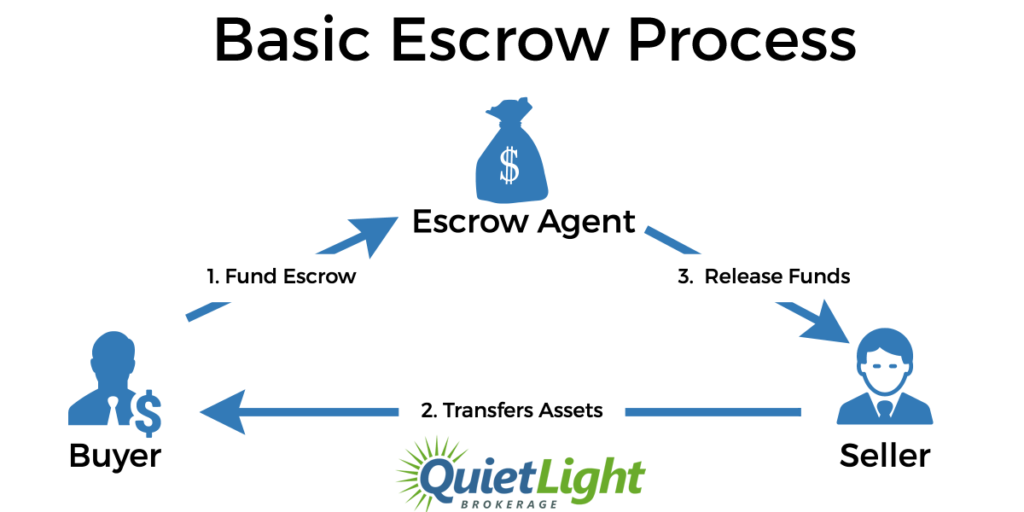

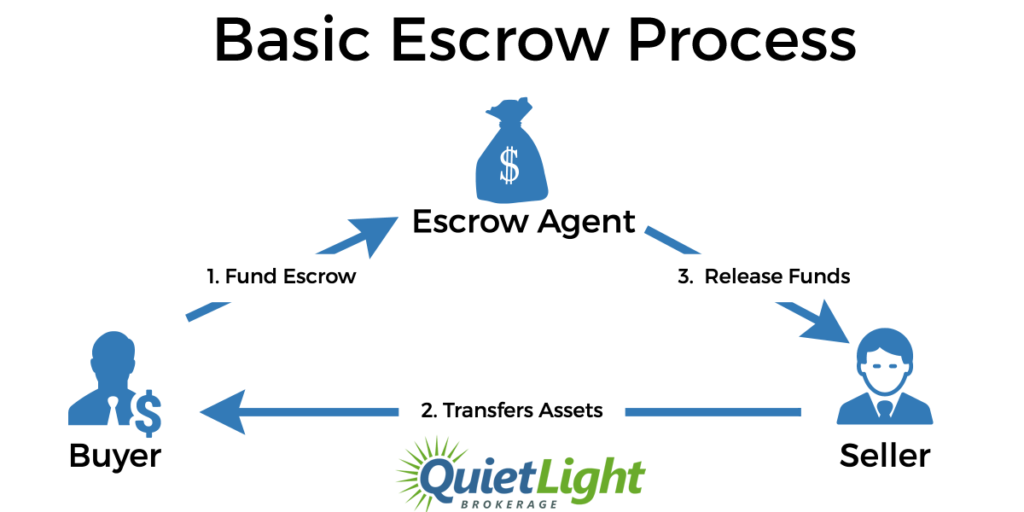

Fortunately, the basic escrow process helps eliminate many of these issues of trust as the escrow agent (the person or entity holding the funds) will be bound by strict rules – rules that the buyer and seller agree to in advance.

When you open an escrow account, neither the buyer or the seller control the funds. For the seller, there is the assurance that the buyer no longer has their funds. Likewise, the buyer has the assurance that the seller won’t receive their funds until the transfer is completed and confirmed.

Placing the money with a neutral 3rd party allows you and your counterpart to focus on transferring the assets in their entirety.

But this, of course, requires that you and your counterpart take the time to plan the transfer of the business in detail.

An Escrow Agreement Plans the Transfer in Detail

An escrow agent is not supposed to act as a mediator. Rather, the agent is more like a referee who simply follows and enforces the rules that are laid out in an escrow agreement.

The goal of an escrow agreement is to help plan the transfer, set the rules and definitions of what will be transferred (which is defined by the buyer and seller), what will trigger the release of funds, and how to resolve any potential dispute between a buyer and seller.

[note color=”yellow” width=”100″]An escrow agreement must fully detail the conditions of the escrow arrangement between the parties. It normally includes such information as the identity of the appointed escrow agent, definitions for any expressions pertinent to the agreement, the escrow funds and detailed conditions for the release of these funds, the acceptable use of funds by the escrow agent, the duties and liabilities of the escrow agent, the escrow agent’s fees and expenses, and the jurisdiction and venue in the event of a legal action.

Source: Investopedia[/note]

But an escrow agreement forces you and your counterpart to do more than just set up rules, it forces you to plan your transfer in detail.

How will your closing day look? What do you need to transfer? Are there any spots that might be difficult to transfer?

A well thought out escrow agreement will help make the transfer as smooth as possible.

In addition, your escrow agreement will also lay out ways that certain disputes can be resolved easily and amicably. It is much easier to resolve a dispute before it happens rather than trying to resolve a dispute when you are in the middle of it.

When All Else Fails, Interpleader Action Saves the Escrow Process

Surprises happen and sometimes the best of plans fails to account for all of the potential variables. As a result, a very, very small percentage of deals using escrow may fall into a dispute. So what happens next?

Your escrow agent is essentially caught in the middle. Fortunately, the escrow instructions will account for disputes.

The first course of action is always to have the buyer and seller attempt to mediate their own dispute. Naturally, this is the most desirable outcome. However, if the buyer and seller reach an impass, they may look to the escrow officer for assistance. Even worse, they may demand that the funds be released or returned under the argument that the escrow instructions have been met.

Rather than face potential lawsuits, in the case where a buyer and seller are not able to reach an agreement, the escrow officer may file interpleader action

“An interpleader action requires the intermediary to place the money into the court’s custody. The intermediary or escrow agent is then dismissed as a party to the interpleader action and the defending parties must litigate and argue for their rights to the money among themselves” (Law Offices of Oates & Oates)

Obviously, this is not an ideal result, but it also shows how well escrow actually works. Once those funds are held with a neutral third party, there is very little chance that the funds will be released without your permission.

Escrow Can Secure a Seller Note Through a Domain Holding Agreement

If a seller is asked to finance the sale of their business, they are usually doing so without any real security. The purchaser might sign a personal guarantee, and there is always the possibility to sue the purchaser to get the business back, but actually acting on both of these options involves a significant commitment of time, money, and emotional energy by the seller.

So if the buyer decides to stop paying the note, a seller might decide that it isn’t worth the hassle of trying to collect on those funds.

A better and more efficient alternative is to hold the business domain name in escrow for the duration of the seller’s note. (note: not all escrow services will offer a domain holding agreement)

Having the domain in escrow means that if the buyer fails to make their payments without filing a formal dispute, the domain name will revert ownership to the original seller. And owning that domain name gives them quite a bit of leverage.

This process involved is much faster and easier than going to court. This makes it a powerful weapon to have and can be faster than filing a lawsuit.

Finally, Escrow Can Settle Miscellaneous, Post-Closing Costs

When closing the sale of an online business, there is often a period of time that elapses between funding escrow and closing. During this time, some expenses might be incurred or inventory spent. Pre-closing estimates of costs may turn out to be incorrect. In general, there may be a need for minor post-closing adjustments.

These small adjustments are easy to take care of using money from escrow.

In some cases, a seller might anticipate bills from vendors to come in a few weeks after the closing. Using a holdback – a small percentage of funds that are held in escrow for up to 30 days after closing – can be an effective and easy way to manage these bills.

In fact, in some states (such as California), state laws require that funds be held in escrow until all bulk sale tax notifications are met and local tax authorities are notified. Any outstanding tax liabilities are then paid for directly from escrow.

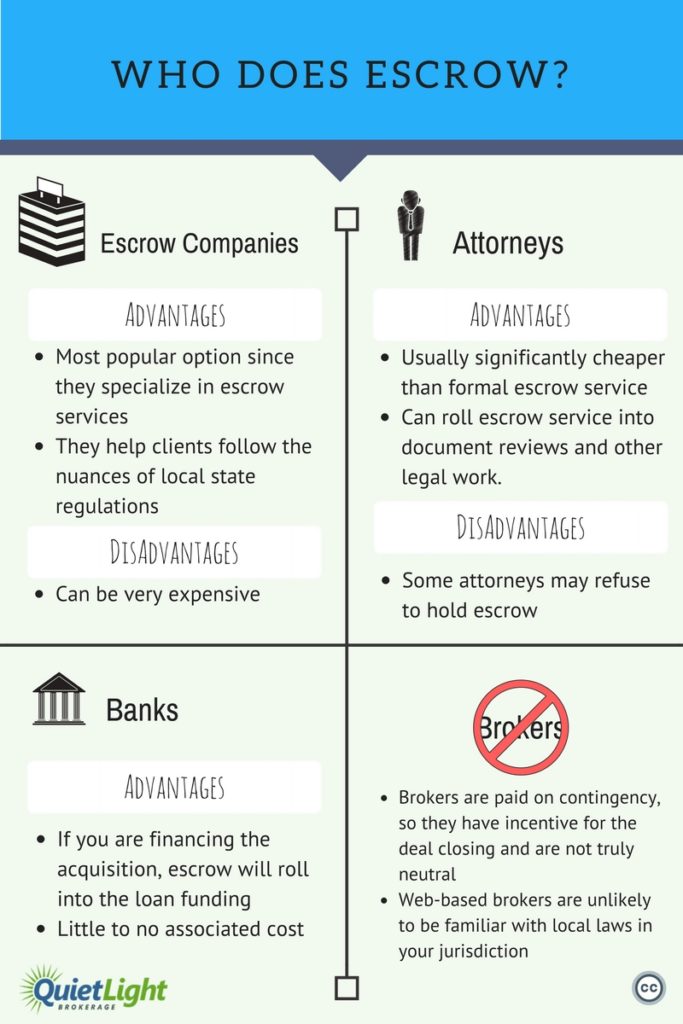

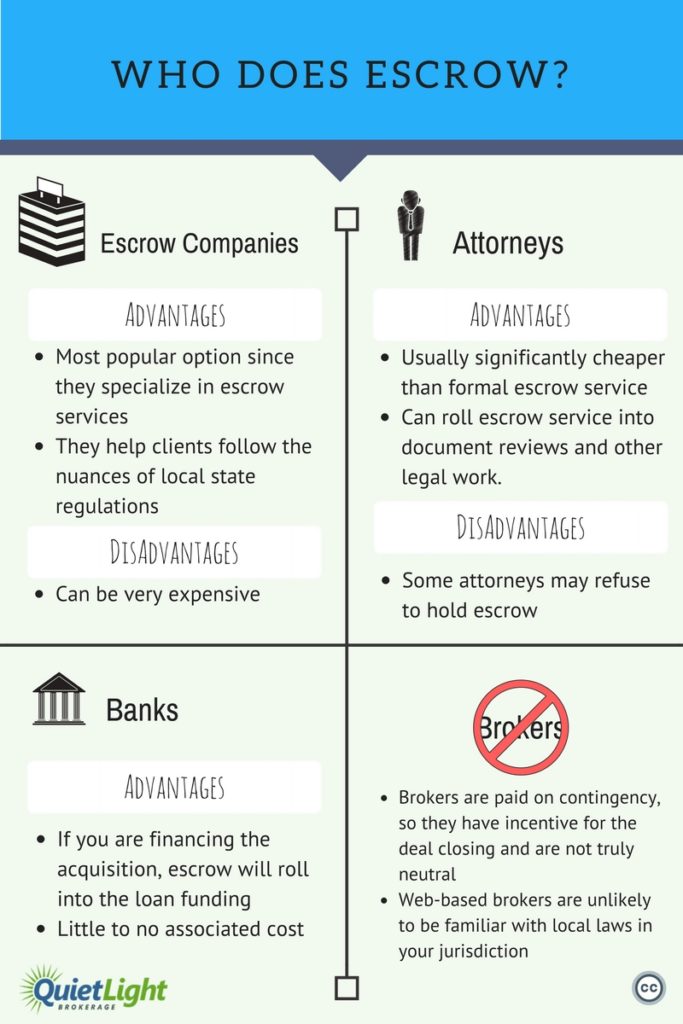

Who Can Handle Escrow? Escrow Companies, Attorneys, Banks, but Not Brokers or Advisors

You have more than one option when deciding who can deal with the escrow process during a negotiation to buy an online business.

Escrow Companies Are The Most Popular, But Most Expensive Option

Most buyers and sellers opt to use an escrow company to close their sale, and there are plenty of options.

The company that has been around the longest for online transactions is escrow.com, which has been around since the toddler days of the Internet. There are other companies available as well, some that specialize in online transactions, and others that may specialize in local laws.

Using an escrow service has a few couple of advantages. First, they are a specialized service, so you can be sure they know their business. Their agreements will likely be solid, neutral, and well-thought-out. Disputes are usually easier to resolve given the long history these companies have in managing transactions.

Second, any local regulations and government notification requirements will be handled cleanly. There are a number of compliance laws that often get overlooked, even by competent attorneys. Escrow services help make sure your deal is fully compliant with local laws.

Finally, if you decide to set up a domain holding agreement for a seller’s note, you would typically do this with an escrow company.

Many Attorneys Provide Escrow Services

Many people are not aware that attorneys are also licensed to hold escrow funds. If you are already using an attorney to help you with your closing documents (and you probably should), it can be much more cost-effective to ask your attorney to hold the funds for closing rather than paying the fees from an escrow service.

However, even though an attorney is licensed to hold the funds for your transaction, not all will. Some attorneys are not allowed to hold funds for transactions on which they are advising. In addition, some attorneys just don’t want to take on the potential liability of holding funds due to the potential conflict of interest that may arise.

You may also feel uneasy if the other person’s attorney is the one holding the funds. But given that the penalty for abusing escrow is significant for an attorney, this generally shouldn’t be an issue so long as the escrow is set down in a well-written agreement.

If You Are Financing Through a Bank, They May Agree To Escrow

The last option are banks. If you are applying for a business loan through your bank, they would likely offer to take care of escrow for you (unless you told them otherwise that you had an alternative arrangement set up).

Just speak to the bank officer in charge of your loan application to see what the bank offers its customers. Along with attorneys, banks may also prove to be one of the cheaper options, compared to an escrow company.

You Should Not Trust a Broker or Intermediary to Hold Funds

Some web brokerage companies may offer to act as escrow for your transaction. Having a broker offer escrow services is a bad idea for a few reasons:

Your Broker is Not a Neutral 3rd Party

An effective escrow agent needs to be third-party and neutral. Your broker is neither.

Not only is an internet business broker directly involved in the transaction, in most cases a broker’s compensation is tied directly to whether the transaction happens or not. In other words, if the transaction fails, they do not get paid.

This immediately makes a broker a heavily biased party in the transaction.

Local Law Compliance

Certain states have local laws regarding the sale of any business, including online businesses, such as notifying local tax authorities of the sale. It is unlikely that your broker is familiar with all of the laws in your jurisdiction.

The key difference between using an attorney and a broker for escrow is that the attorney is not being paid based on the success or failure of the transaction. In addition, the consequences of mishandling escrow funds are significant for an attorney.

If you are working on a transaction with a broker who offers escrow services, it is entirely up to you if you choose to use them. During the time that Quiet Light offered escrow, we never had any significant issues. For the most part, it actually helped the transactions.

But the concerns in using your broker for escrow should not be taken lightly.

The Biggest Downside to Using Escrow? Cost

Cost only really becomes an issue if you choose to use an escrow agent or some attorneys. But as we have discussed earlier in the article, sometimes you may need to use an escrow agent.

Formal escrow firms are not cheap. On a one million dollar sale price, escrow fees can run around $8,000. Not only is this a pretty steep cost, but there is always the question of who should be responsible for the escrow cost (which should be discussed and agreed to as early as possible).

Looking at those fees, using an attorney seems like a sensible alternative, assuming your attorney is willing and allowed to act as escrow.

However, at the end of the day, paying $8,000 to protect a million-dollar investment either on the buy-side or sell-side of a transaction is a very small price to pay.

With good planning, adding escrow into a transaction adds an additional layer of security for both the buyer and seller which is never actually needed. But that doesn’t mean you shouldn’t use escrow.

Drafting an escrow agreement helps you plan the transfer and closing. In addition, even with the best planning, surprises can arise. If they do, you’ll be very happy to have that extra layer of security.

With all of the moving parts involved in transferring the ownership of a business, bringing in a 3rd party to act as custodian of the funds can reduce the number of items you need to focus on, especially if they help with local law compliance.

While the fees can run high, the benefit is extra insurance. As with any insurance, the fee is always worth it, if you need it.

Comments are closed.

If the buyer receives the domain, but says they haven’t received it (and they have changed the WHOIS details to an unrelated entity) – how can that be resolved?

If the buyer was utterly dishonest (as I think you are implying), then the money would go into a dispute. While the money is being disputed, the escrow agent would hold onto the funds – it wouldn’t go to either the buyer or the seller. If the buyer and seller do not resolve the issue between themselves, then the escrow agent would eventually file interpleader action which causes the issue to be litigated in court.

The buyer in this case would be at a significant disadvantage since the court could request records of the domain transfer being initiated (assuming the seller does not have some confirmation of this already).

Thanks Mark, I’ve sold hundreds of domains via escrow and that possibility had always bothered me.