Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Guide to Using an SBA Loan to Buy an Online Business

By Ian Drogin

SBA lending has come a long way since the depths of the Great Recession in 2009. In the wake of economic collapse and chaos nearly eleven years ago, the entire lending industry re-evaluated how loans were written, making it extremely difficult to obtain an SBA-backed loan to finance a new business acquisition.

Back then, our view of SBA loans was that they were slow and uncertain. They seemed to be the choice of buyers who really had no other option. However, a lot has changed since then. Today, SBA loans are a GREAT choice for both buyers and sellers of internet-based businesses.

Whether you’re interested in buying an Ecommerce brand, SaaS company, or content site, this article will explain how to go about buying an online business using an SBA loan.

Why SBA Loans Benefit Both the Buyer and Seller

When a business is purchased using an SBA loan, there are typically a few core benefits:

- The buyer can usually make a quicker return on investment, and therefore, offer a better deal.

- The seller can usually be paid in full at closing.

When financing a deal using an SBA loan, a buyer needs to only put down 10% of the purchase price at closing. This means a buyer can acquire an online business, recoup their initial investment in just a few months, and then have the business literally pay for itself over the next few years.

Additionally, buyers who use SBA loans are often able to offer better deals (and improve their chances of winning those deals) because their immediate return on investment is significantly stronger. Obviously, this greatly benefits the seller as well.

For a seller in an SBA deal, they get to receive all or most of their funds at closing. What seller doesn’t want that?

So given the benefits to buyer and seller, this probably raises a number of questions:

- What is involved when applying for an SBA loan?

- How do you qualify?

- What does the process look like?

In order to provide the most helpful information possible, we reached out to one of our recommended lenders at a major bank to ask every question we could think of about SBA loans, as well as took lessons from our extensive experience at Quiet Light Brokerage.

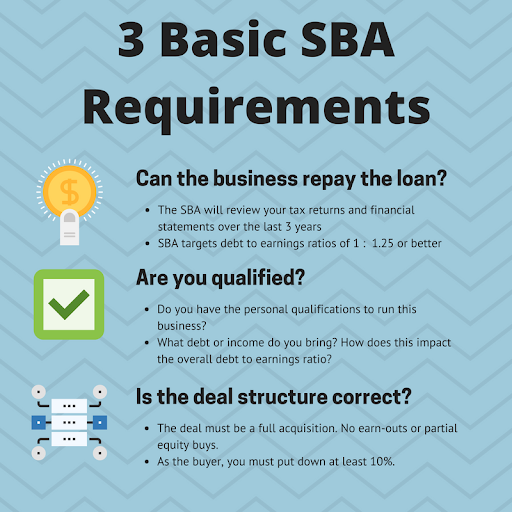

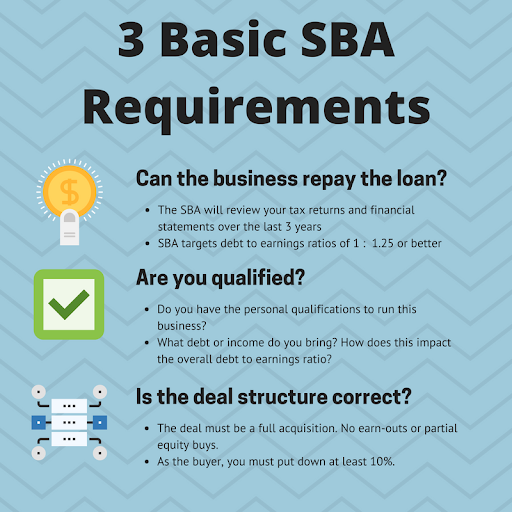

The Three Basic Requirements For an SBA Loan

There are a lot of boxes that your bank and the SBA will require you to check off before getting an SBA loan. However, at the broadest level, an SBA loan has just three basic requirements. Here’s an overview of the conditions you’ll need to meet.

Let’s examine each of these three categories in greater detail.

How the SBA Determines You Can Repay the Loan

First, your bank and the SBA will want to know if the business you’re acquiring will be able to sufficiently service the loan. In other words, will your new business be generating enough revenue to pay back the SBA?

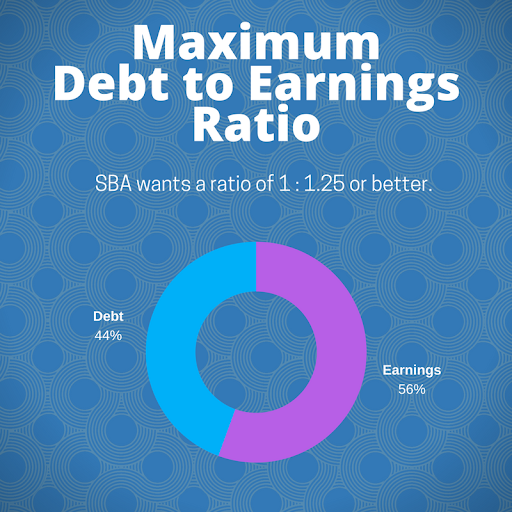

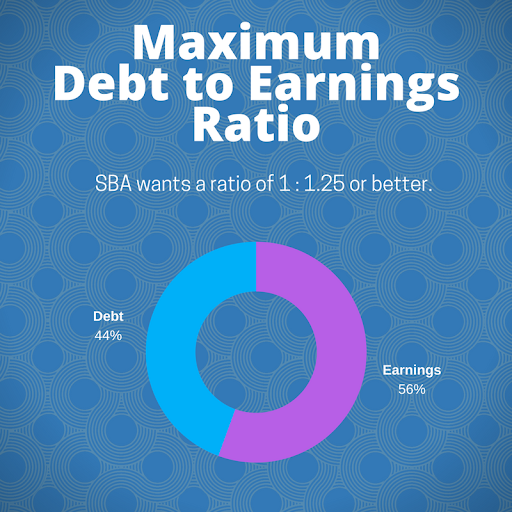

For the online business being acquired, the most important metric the SBA looks at is the business’s current earnings. The SBA wants to make sure you will be able to comfortably pay the loan with the business’s current earnings. Like many loans, this is determined by analyzing a debt-to-earnings ratio.

Minimum Debt to Earnings Ratio

Currently, the SBA wants to see a debt to earnings ratio of 1.25:1 or better. In other words, for each dollar in loan payments, the business needs to make $1.25 in earnings. The required ratio does change from time to time (it was 1.35:1 in 2015).

Calculating the actual earnings of a business is, of course, crucial to getting to the right ratio. This process looks similar to what brokers use when we add back various expenses for the purpose of reducing the tax burden or accounting.

Keep in mind, the SBA will want to make sure you are getting paid and can support your financial needs. Therefore, count on calculating your salary as a part of the debt to earnings ratio. If you have other sources of income (such as a secondary business), this can be included in the debt to earnings ratio. Obviously, doing so will boost your buying power.

Tax Return Requirements

It’s helpful to have three years of tax returns, but you might qualify with fewer.

When you first explore an SBA loan for an acquisition, your banker will ask you for the last 3 years of your US-based tax returns. At Quiet Light Brokerage, all of our clients have provided at least 3 years of tax returns.

That said, the main concern of the SBA is whether the business can service the loan debt. If you can demonstrate your financial qualifications with fewer years of tax returns, you should still be able to get approved.

Of course, this means the business being acquired has to be based in the U.S and have filed tax returns. Tax returns from other countries do not qualify.

How is the Loan Amount Determined?

The SBA will use an independent valuation of your company to determine the loan amount.

During the loan process, your SBA bank will hire an independent valuation company to value the business you want to acquire. While there are different ways to value a business, most independent valuation companies will use an earnings multiplier approach similar to what most brokerage firms use.

If your business valuation comes in lower than what you offered for the business, your bank will make their loan based on the independent valuation.

For example, if you offered $1,000,000 for a business, but the professional valuation comes in at just $900,000, the SBA will extend a note for $675,000 (75% of the $900,000).

You may notice that if the buyer puts down 10% and the SBA provides 75%, that leaves 15% for the seller to finance on their own. We’ll explain the deal structure later in this post (and why you, as a buyer, might want to put down more than 10% at close).

You Must Be a Qualified Buyer

Second, the bank will consider your own personal financial situation and qualifications. Even if the business’s current performance is sufficient for serving the loan, you’ll still need to satisfy personal qualifications, including a debt-to-income ratio that meets their requirements.

While the business being acquired needs to satisfy certain debt-to-earnings ratios, you, as the buyer, have an impact on that ratio. Depending on your financial picture, that ratio may be easier or more difficult to hit.

Your lending bank will examine a few key variables before agreeing to offer a loan:

- Your Finances – what is your financial picture? Is your debt-to-income ratio outside of what the SBA requires? What would your debt-to-income ratio look like if you acquired the business?

- Your Income – do you have enough money to support yourself and your family? If you acquired the business, would you need to pay your salary? If so, how would the debt-to-income ratios change?

- Your Credit Rating – Of course, they will look at your credit rating. The higher the score, the better. A score below 640 will be an issue.

- Your Equity Injection – We’ll look more at down-payment requirements later, but you’ll need to have at least 10% of the purchase price. Be sure these funds are sitting in an account (any account – IRA, stock, savings, etc) at least 2 months prior to the closing date.

- Recent Debt – even if you qualify financially for an SBA loan, the bank may still turn down your loan application if you recently took on a lot of other debt.

- Your Real Estate Assets – while many SBA loans are extended without a real estate security, some banks may still require it. SBA rules limit banks to only securing the loan against real estate, so your other assets are safe.

- Your Resume – if you are highly qualified and well suited to run the business you’re acquiring, this will help you to secure a loan.

While all of this might sound intimidating, you can always talk to a lender to find out if your personal financial situation will be an issue (much more on this later).

Need an SBA Loan to Buy an Online Business?

Visit Our Partner Page to Learn About Acquisition Lending Options Available to Quiet Light Clients

SBA Requirements for Deal Structure

Since the SBA is guaranteeing the loan for you to buy a business, they have some requirements for both the buyer and the seller when it comes to the structure of your deal. Most of these requirements are highly favorable for both the buyer as well as the seller. Here’s a brief overview of the deal structures that are allowed and disallowed.

In addition to the criteria listed above, there are a few other key requirements concerning the allocation of financing as well as a seller standby period.

How Much of the Purchase Price Will the SBA Lend?

For deals less than $500,000, the SBA will guarantee up to 80% of the purchase price of the acquisition. For deals more than $500,000, the SBA will guarantee up to 75% of the purchase price. The following table shows the financing allocation for deals at various price points.

The remainder of the purchase price is the responsibility of the buyer and seller. This is often made up of a combination of seller financing and cash from the buyer.

How Much Do You Have to Put Down?

For the part of the loan that the bank will not cover, the buyer and seller may negotiate how that part of the purchase price is accounted for.

The SBA requires the buyer to commit to paying a minimum of 10% of the purchase price. For example, for an acquisition in which the purchase price is $500,000, the SBA only requires the buyer to pay $50,000 as a down-payment.

However, a buyer does not have to limit their down-payment to 10%. As a buyer, you may decide to put down 20%, 25%, or as much as you can afford.

Any amount not covered by the SBA or by your down-payment has to be covered by seller financing. Lenders tend to prefer deals with seller financing as it incentivizes a more orderly transition since both parties have a financial stake in the future performance of the company.

That said, many sellers are reluctant to agree to seller financing.

Seller Financing Provisions

With an SBA deal, any seller financing is put on a minimum 2-year standby. This means the seller does not receive any payments on their portion of the loan for the first twenty-four months after the acquisition.

Of course, most sellers are extremely resistant to these terms.

Therefore, for the part of the purchase not covered by the SBA loan, most buyers try to pay as much of the purchase price as possible. Since this usually amounts to no more than 20-25%, as a buyer, you should still recoup your down-payment within one year of the acquisition.

Four Prohibited Deal Structures

As shown in the diagram above, there are four prohibited deal structures when an acquisition involves SBA financing:

- Earn-Outs

- Employment Contracts

- Consulting Agreements

- Partial Buyouts

SBA deal structures tend to be pretty simple to understand as they are made up of just three parts: the bank loan, the buyer injection, and seller financing.

Some buyers and sellers may want to delve into more complex deal structures, but this should be done cautiously.

In an SBA deal, the seller is not allowed to be an owner, officer, or employee of the company after selling it. This rules out employment contracts or partial buy-outs.

In addition, while the SBA expects there to be a consulting agreement to help with transition services, consulting agreements with heavy minimum payouts or performance bonuses can have a negative impact on first-year cash flows. As a result, these are also generally not allowed. Earn-outs are also not allowed for the same reason.

Securing The Loan – What Will The Bank Require?

Although many banks will offer SBA loans based on the “goodwill” assets of the business, here are a few additional assets that may be helpful or even necessary in some cases:

- Personal real estate in which you have at least 25% ownership

- Business real estate

- Key Person Life insurance policy

For the bank, SBA loans are obviously guaranteed by the U.S. Government. For an online business acquisition, this is a very good thing as online businesses are usually “hard-asset poor” and difficult to collateralize for banks.

The SBA gives banks the needed security to extend loans on “goodwill,” but even with this security, banks will not extend loans haphazardly. This article goes into more detail about collateralizing SBA loans. If a bank has a high default rate, it can affect their ability to extend new SBA loans.

The SBA Will Take a First Lien Position On All Business Assets

In an SBA loan, the bank and the SBA will take a first lien position on all the business’s assets. This means if the business were to go into receivership, the SBA would have the right to liquidate and collect payments first from any assets being sold.

After business assets, the SBA may move onto personal real estate assets in which you have at least 25% equity, then any business real estate. Many banks, however, will extend SBA loans without real estate security.

Finally, expect your lender to require Key Person Life Insurance. This policy protects the bank and the SBA in the event of your death. When applying for an SBA loan, get your life insurance screening done early as this can take a few weeks to process.

One piece of good news is that “other personal assets” outside of real estate are no longer allowed to be considered by the SBA for debt repayment purposes.

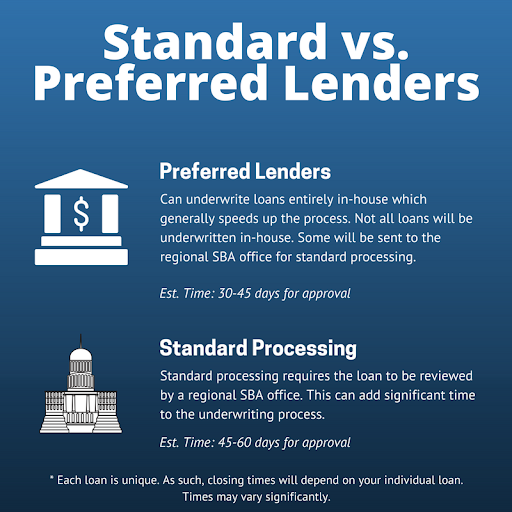

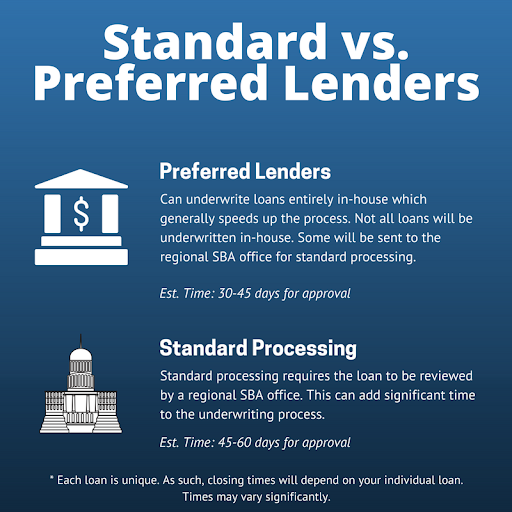

Working With a Preferred Lender vs. Standard Processing Lender

There are two types of lenders that participate in SBA lending — preferred lenders and standard processing lenders. The primary difference between the two is found in the underwriting process:

- When you work with a preferred lender, the bank can manage the underwriting process without submitting your paperwork to a regional SBA office for review.

- For a standard processing lender, your loan request needs to be reviewed by a regional SBA office.

Working with a preferred lender is usually significantly faster. That said, even if your bank is a preferred lender, they may choose to send your loan through standard processing if there is any uncertainty about the loan.

Therefore, even if you work with a preferred lender, you may still find yourself waiting for the loan to be reviewed by a regional SBA office.

Most SBA Loans Are Completed In 45-120 Days

SBA lenders will often tell you they can complete your loan in 30 days or less. While this may be possible at times, our experience has been that it often takes significantly longer.

The SBA process involves a number of people who need to look at and review different parts of your application. Due to this, delays are almost always unavoidable.

Documents To Speed Up Your Loan Application

The main complaint about SBA loans is the amount of time they take to process.

As referenced above, the SBA lending process involves a number of people who look at different parts of your loan application. Therefore, each person will require different documents from you.

You can speed up your loan process by having your documentation prepared and ready to submit. The main documents you’ll want to have prepared are:

- Personal Financial Statement – all SBA lenders require a fully completed personal financial statement.

- 3 Years of Personal Tax Returns – these will be used to validate your financial records.

- 4506-T Form – this is used to validate the accuracy and the filing of your provided tax returns.

- Loan Application Form – this will be bank-specific, but since the loan comes from the bank (the SBA only guarantees it), they will likely have a loan application form for you to complete.

- Borrower Information Form – this is for SBA purposes and helps them track who is borrowing and how much. This is for statistical purposes.

- Pro-Forma Financial Reports – the bank will want to see your projections for the company you are acquiring.

Here are some additional documents they may require:

- A business Plan – this seems to be a very common request among banks as it helps them know you have thought through your acquisition (and if you haven’t, it will force you to).

- Your Resume – this helps the bank get an overall picture of your personal qualifications for the business.

- Profit & Loss Statements For Your Businesses – if you have other businesses that are funding your acquisition in any way, you’ll need to provide P&L statements for those businesses.

- Balance Sheets – this only applies if you are using an existing business to fund your portion of the acquisition, or if you are using a business to demonstrate stronger debt to equity ratios. If you are, you’ll need to provide your balance sheets.

- Miscellaneous Forms – your bank may have additional forms for you to sign either due to their internal practices, or because of your specific type of deal.

Buy a Profitable Online Business

Outsmart the startup game and check out our listings. You can request a summary on any business without any further obligation.

The seller also needs to be organized throughout the process to keep things moving along quickly. Here are some items your seller should be ready to create and submit:

- 3 Years of US-Based Tax Returns – if your seller has not yet filed for the current tax year, be sure this is done before you go through the process as it can take some time to validate a return which has been filed.

- 4506-T Form – the bank will need to see more than just the tax return. They’ll want confirmation from the IRS that the return was filed, paid, and is in good standing.

- 3 Years Of P&L Statements – these should be accurate and kept up to date. The bank may request new P&L statements from time to time. Make sure your seller is aware that these need to be completed monthly in a timely manner. If your seller runs more than one business through the same parent company, you’ll need to send P&L statements for all the businesses they run. The bank will need to verify that the numbers match the tax returns exactly.

- A Balance Sheet – this should be current at the time of submitting the loan.

Is Using an SBA Loan Worth it?

Buyers who have been through the SBA process often have similar feedback: it is hard work, takes a bit longer than they expected, but is completely worth the headaches. Not only do SBA loans allow you to leverage your purchase price by putting less money upfront, but they also allow the seller to provide a more solid and competitive offer.

What has your experience with SBA loans been? Would you recommend the process to a buyer who is considering an acquisition?

Leave your thoughts or questions in the comments below.