Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

How To Use 401K Retirement Funds To Buy An Online Business

By Quiet Light

You have a lot of financing options at your disposal to buy an online business. Most buyers tap into cash reserves, SBA loans, or home equity lines of credit to fund an acquisition. But have you ever considered using your 401K retirement account?

Most buyers never consider using their retirement accounts since withdrawing money early from a retirement account results in significant taxes plus a 10% penalty for withdrawing retirement funds early. The IRS considers any withdrawal before 59.5 years old to be an early withdrawal.

But you don’t have to withdraw your retirement funds early to use them for an acquisition. If you set up the right corporate structure and harness the power of a self-directed IRA, you can invest your retirement funds in your acquisition while keeping your retirement in a tax-deferred account.

| Pros and Cons of Different Funding Options | ||

|---|---|---|

| Funding Option | Pros | Cons |

| Cash Reserves, Stocks, Bonds | Easily accessible. Guaranteed availability. | Converts liquid asset into non-liquid asset. |

| SBA Loan | Allows you to leverage your buying power. | Long process No guaranteed funding Risk of being burdened with loan if business fails |

| Investment Partner | Lower risk to your finances. Outside opinions and advice. | Lacks autonomy Partners need to agree on vision |

| Home Equity Loan | Relatively easy access to capital Loans not contingent on business you buy | You risk losing your home in event of default. |

Introducing Rollover For Business Startups

To use your retirement account to invest in your acquisition, you’ll need to do a rollover for business startup (commonly referred to as ROBS). Despite its name, this mechanism isn’t just for new startups. In fact, 33% of all ROBS are done for acquisitions.

ROBS is a financial mechanism that exists thanks to the ability to rollover your retirement account into a self-directed IRA. I talked to a specialist of self-directed IRA’s, Jay Goldblatt of Broad Financial, about self-directed IRA’s. He explains:

“Basically, the 401(k) and the IRA have been well-established in U.S. governments. They’ve established these retirement plans. The classic use of them has been for traditional investments like buying stocks, bonds, and mutual funds and whatnot. That mode has been going on of course for years. That totally was challenged 20 years ago.

There was the challenge by a man named Swanson. He wanted to do something different. He wanted to do something that was not the typical investment. He had his investment, he checked it out. He figured according to the law if there is no problem with what he’s doing alternatively and the IRS didn’t exactly agree. They weren’t sure that this was a valid investment. They sued him, but Mr. Swanson prevailed. He won and the IRS has to pay all his court fees and attorney fees. That really paved the way.”

Jay Goldblatt – Broad Financial

Setting up a self-directed IRA isn’t terribly complex, and companies like Broad Financial make the process fairly easy.

But the IRS has strict rules about how you invest self-directed IRA funds. While you could use a self-directed IRA to acquire a business, there are strict rules about ‘self-dealing’. If you just use a self-directed IRA, you’ll run into the following restrictions:

- You cannot take a salary or distributions from your company.

- You cannot manage the day to day operations of your business.

- Even ‘arms-length’ management is suspect

- You’ll incur an ‘unrelated business income tax.’

Due to these restrictions, financial experts developed the rollover for business startups which effectively removes these restrictions.

How Rollovers For Business Startups Work

A rollover for a business startup still uses the power of a self-directed IRA, but it adds a few additional steps to maneuver around the self-dealing restrictions that a traditional self-directed IRA experiences.

- Setup a new corporation which will be the entity that makes your acquisitions

- Your new corporation then establishes it’s own retirement plan that allows for employees to invest in company stock

- You rollover your retirement plan and direct the IRA to invest in the company stock

- With your retirement funds invested in company stock, the company can now make investments as it sees fit, including acquisitions of profitable websites

When I first heard about ROBS, I wasn’t sure whether it was a legitimate financial tool. I talked to Eric Schetterman of Benetrends, the oldest firm providing ROBS, to grill him about the legitimacy of ROBS.

“To just answer the quick question, ‘Is it legal?’, yes, 100% absolutely…the best way to explain it is, if I worked for company A and I decided to then go work for company B and I have retirement funds at company A and company B also offered a retirement plan, I can roll those funds from one plan to another without any taxes or penalties. It’s just moving plans from one employer’s plan to another…So if I worked at Apple or Microsoft and my retirement plan had that option and I purchased Apple or Microsoft stock while I was employed there, the way it works is my retirement plan buys however many shares of stock it can offer, and then the company has the proceeds from that stock sale to operate their business.

That’s exactly how it works in rollovers for business startups. The client gets a new corporation set up for the business that they’re either acquiring or starting. We then create, design, and customize retirement plan for that business. That retirement plan is designed to allow investments in stocks, bonds, mutual funds, as well as company-owned stock, so then the retirement plan purchases the stock of the corporation. Then through the proceeds of that stock sale, the corporation had the proceeds to fund their business expenses from salaries, furniture, fixtures, the cost of acquiring the business, training employees, any legitimate business purpose. “

Eric Schetterman – Benetrends

What Are The Requirements For a ROBS?

Once you get past the concept of ROBS, the requirements are rather straightforward and common-sense.

1. You Must Set Up a C-Corporation

The initial corporate structure for a ROBS must be a c-corporation. In order for the roll-over to be within IRS guidelines, your new corporation must establish its own retirement plan, and a c-corporation is the only legal entity that can have a retirement plan.

It is possible to transition out of the c-corporation structure at a later date, but that would require buying back the stock purchased by the retirement plan.

2. You Cannot Rollover a Roth IRA

You can use just about any retirement account with a ROBS, but since a Roth IRA has a different tax structure, it is not eligible for ROBS.

3. 401(k) Funds With An Existing Employer

If you have a 401(k) with an existing employer, you typically cannot access those funds if you are still with that employer.

4. Your Corporation Will Have a Retirement Plan To Manage

Adding a retirement plan to your corporation requires additional paperwork, so plan on annual filings (of course, companies like Benetrends manage this paperwork for you).

Is a C-Corporation Really Necessary?

One apparent drawback of a rollover for business startup is the requirement to form your company as a c-corporation and manage a formal retirement account with that c-corporation. Since most investors who buy online companies setup closely held corporations, a c-corp setup feels like overkill.

Not only is it a more robust setup than most buyers need and want, but it also comes with the double taxation of a c-corporation and the disadvantage that selling the company will be taxed at normal income tax rates as opposed to capital gains tax rates.

But even though a c-corporation is the required setup initially, you can direct the retirement plan to sell back the stock to the corporation (and allow you to direct your retirement funds elsewhere), then convert the corporation to an S-Corp or whatever structure is more tax friendly.

What Costs Are Associated With ROBS?

Managing a ROBS should only be done with an expert who knows the regulatory process. If you make a mistake or misapply ROBS funds you’ll find yourself on the wrong end of a lawsuit by the IRS.

Fortunately, typical costs of ROBS is quite manageable. Most firms charge an upfront less than $5,000 and ongoing maintenance fees of $1,200 – $1,500/year. The maintenance fee ensures that your company’s retirement account meets all regulatory standards.

| Rollover Costs of Three Leading Advisory Firms | |||

|---|---|---|---|

| Firm | Initial Setup | Monthly Fee | Year Founded |

| Guidant Financial | $4,995 | $119/month | 2003 |

| Franfund | $4,795 | $95/month | 2006 |

| Benetrends | $4,995 | $120/month | 1983 |

What Is The Effect On The Transaction?

Fortunately, doing a roll-over for a business startup has little to no effect on the actual transaction of acquiring an online business. In fact, if your only alternative to ROBS is an SBA loan, you may actually gain an advantage by being a cash-rich buyer.

Eric Schetterman explains:

“I believe on our side, from my experience, it doesn’t change any aspect of what the seller of the business has to go through. He’s still selling his business and it doesn’t change the structure that he has to sell it as. If anything, a lot of sellers like when clients are using the rollover process, because most likely those buyers are then coming to them cash rich and there might not be the need for maybe seller financing or waiting to have to get an SBA loan or any type of loan… If you structure the proper way, a buyer can typically access these funds in as little as 15 to 18 business days. So you might be able to open up your business to finding more cash rich buyers and maybe have somebody buy the business outright and avoid the need for maybe doing seller financing.”

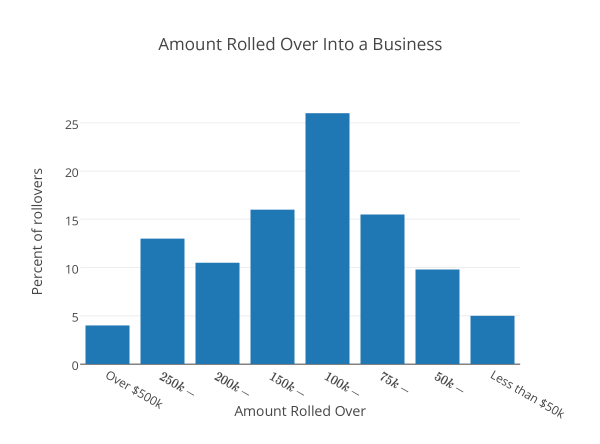

How Common Are ROBS?

While detailed statistics on ROBS don’t seem to be available, the Bureau of National Affairs estimates that there were more than 10,000 rollovers between 2005 and 2011. But that number seems to be light, especially since Eric from Benetrends noted that Benetrends completed over 11,000 roll-overs.

| 2013 Rollover for Business Startups by Company | |

|---|---|

| Guidant Financial | 1,400 |

| Benetrends | over 1,000 |

| Catchfire Funding | over 1,000 |

| FranFund | 450 |

While this article primarily focused on using ROBS to fund an acquisition, ROBS is commonly used to access funds for startups (which is where it get’s its name). There are a number of great success stories of entrepreneurs who risked their retirement to start and grow a thriving business.

What Risks Are Associated With ROBS?

The most noteworthy risk of a rollover for a business startup is the loss of capital. If you invest cash reserves, or if you were to cash out stock and invest in an acquisition, you risk losing those cash reserves if the business you acquire fails.

Well, the same risk applies to a ROBS. But since the funds used in a ROBS are typically reserved for retirement, the risk becomes slightly amplified. If you lose your retirement funds, it’s not as easy to build them back up with the tax protections retirement accounts afford.

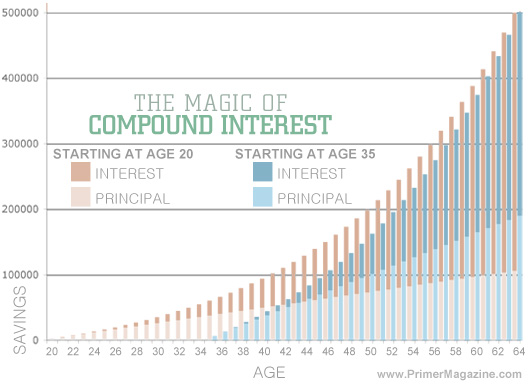

Opportunity Cost

There is also an opportunity cost in using a rollover for business startup. During the time that your retirement funds are invested in the acquisition, those funds are not invested in more traditional retirement investments. And this may be time lost to grow your retirement investment.

Of course, if you grow the value of your business your retirement account’s value will increase as well, and if your retirement plan sells the stock back to your corporation, this should be reflected in that sale.

Regulatory Risks

Beyond the risk of losing capital, you also run the risk of regulatory violations which can accrue massive penalties. Fortunately, violations are rare when you work with an experienced advisor. Companies like Benetrends boast a perfect success rate over thousands of transactions.

Conclusion

All funding options come with an element of risk. Home equity loans risk your property. Cash acquisitions risks liquid capital. Loans typically help a person leverage their purchasing power, and if the business fails, they’ll be responsible for paying back the leverage that you gained in the loan.

Consider all options carefully before investing.

For more information on Self-Directed IRA’s, here are some great resources:

– Jay Goldblatt of Broad Financial. 800-395-5200 x313 (ideal for self-directed IRA’s)

– Eric Schechterman of Benetrends, 866.423.6387 x155 (for ROBS)

Other Resources

Comments are closed.

This is an excellent article, outlining a possibility that I had not yet encountered in over 20 years of reading financial options of various kinds, including self-directed “checkbook control” retirement accounts. I have two questions:

1. Can several family members use “checkbook control” retirement accounts to purchase stock in the same closely-held C-corp? Because that became a forbidden transaction a few years ago under certain other constructs.

2. Are we allowed to purchase shares in a foreign C-corp? Because Curacao has a corporate tax rate of just 2% for C-corps which are doing internet businesses.

Thanks!

Great questions – I’ll see if I can track down the answers. Regarding the 1st question, I do not believe that would work as it would fall outside of how ROBS is typically setup.

The C-corp has to have the ability to setup a qualified retirement plan for it’s employees which they can buy into in order for ROBS to work. I do not know how that works in Curacao.

Again, I’ll see if I can get Eric to chime in.

1. Hi Coach – great questions!

for Question #1 – With a self-directed IRA or 401k from Broad Financial, you can invest in that entity as long as no more than 49% ownership of the c-corp is made up of ‘disqualified’ persons.

The disqualified persons list is the IRA holder, their spouse, child, parent, grandparent or grandchild…

for Question #2 – With a self-directed IRA or 401k from Broad Financial, you can invest in any foreign investment you want, again provided the same rules above – that you don’t own more than that 49% among prohibited family members .

We have helped many clients get this plan to make foreign investments. Feel free to give me a call to discuss. 800-395-5200

Great post Mark. Do you know if the setup cost includes the formation of the C corp?

Yes, for most companies that help you navigate the process, the C-corp formation costs are included in the setup fees. Of course, this may vary from one company to the next, but the one’s I’ve looked at include those formation costs in setup fees.

Hi Ryan,

While I’m here, thought I’d ask – what business would you be starting?

There is a possibility I could help you, depending on the cost of business and # of full time employees. Let me know – will see if I can help.

Great discussion here of an avenue of funding a purchase that I’d not heard of before. I do wonder about the conversion of a business entity from a C-corp to an S-corp. Would that incur the penalty at that time? Looking forward to digging into this some more

No, that wouldn’t incur a penalty if it is done correctly. The corporation would simply buy back the stock which keeps everything within your retirement account. You can then direct your retirement account towards other investments.

Of course, you want to have a pro help you with this to make sure it is done correctly.