Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

The Complete Guide to SaaS Sales Forecasting

By Quiet Light

Effective SaaS forecasting practices are an essential part of running a software business. When used wisely, SaaS forecasting can provide you with invaluable insight and clarity as you grow your business.

Unfortunately, for many owners, forecasting isn’t always a simple and straightforward process. In many cases, sloppy financial records and disorganized documentation practices leave SaaS founders confused and frustrated. However, it doesn’t need to be that way…

To provide you with a clear roadmap for SaaS forecasting, we sat down with industry expert and CFO extraordinaire, Ben Murray. This article provides a comprehensive overview and guide to help you master SaaS forecasting in your own business.

Thinking of Selling Your Business?

Get a free, individually-tailored valuation and business-readiness assessment. Sell when you're ready. Not a minute before.

The Making Of A CFO

Ben Murray went into a field of work that intimidates many: finance and accounting. Ben’s love of numbers made him a perfect fit for the industry, where he ended up spending over twenty years of his career.

Ben focused primarily on the airline and software industries. There, he gained substantial experience with financial forecasting and complex Excel models. The skills he gained provided him with a solid foundation to educate others.

When he looked around, Ben saw that plenty of people were writing about SaaS financials, but few of them were willing to cough up their processes and templates. That meant SaaS founders knew what they needed to do, but didn’t have the knowledge to actually make things happen. Ben figured, “Why not help these folks?” and started his own blog, TheSaaSCFO.com.

Today, Ben writes about the intersection of SaaS marketing and SaaS metrics. His content focuses on the pain points that he experienced himself as a CFO. In addition to providing educational content, he also offers free templates and resources to any SaaS founder seeking uncomplicated answers.

Whether they were trying to value a business or improve the sustainability of their businesses, owners found what they were looking for on Ben’s blog.

Why is SaaS Forecasting Important?

Although you might be able to get your business off the ground without effective SaaS forecasting, that doesn’t mean it isn’t essential. As you start to scale, your forecasting practices will largely determine your ongoing success.

“As you start to scale, your forecasting practices will largely determine your ongoing success.”

There are a few core reasons why SaaS forecasting is an absolute must:

- Making hiring decisions

- Identifying weaknesses

- Understanding the present and future state of your business

Forecasting helps SaaS businesses understand their financials on a deeper level. If you want to scale your business but aren’t sure about its long-term investment requirements, you need forecasting.

Hiring Decisions

Personnel costs are the largest expense for most SaaS businesses. In fact, in many cases, they account for 70% of total costs.

“Instead of guessing when to hire, you can instead use forecast data to make better decisions. This allows you to scale sustainably, rather than impulsively.”

Despite the significant costs associated with hiring, few founders know when it’s the right time to bring on new talent. Not surprisingly, this often leads to inefficient and costly hiring decisions.

Instead of guessing when to hire, you can instead use forecast data to make better decisions. This allows you to scale sustainably, rather than impulsively.

Identifying Weaknesses

Nobody likes talking about their shortcomings, but that’s the only way your SaaS business will improve.

SaaS forecasts provide you with clarity about the strengths and weaknesses of your business. As Ben points out, forecasting helps you identify problematic patterns with:

- New customer bookings

- SaaS churn

- Downgrades

Without forecasting, you can easily overlook negative trends in each of these areas. Of course, when you’re in the dark, it’s hard to take action. Forecasting turns on the lights by providing invaluable data so you can correct or avoid such issues in your SaaS business.

Using SaaS Forecasting to Understand Your Business

Feel free to guess all you want at pub trivia night, but don’t guess when it comes to your SaaS business. Can you answer these questions off the top of your head?

- What’s your monthly recurring SaaS revenue (MRR)?

- How many current SaaS customers do you have?

- What’s your customer acquisition cost (CAC)?

“Forecasting clarifies your business operating expenses so you can identify meaningful SaaS metrics.”

As Ben points out, “If you don’t understand your current financial state, it’s going to be really hard to forecast.” And, without understanding your current finances, it’s likely that you’ll have difficulty scaling.

Forecasting clarifies your business operating expenses so you can identify meaningful SaaS metrics. These are essential if you plan to sell your business one day (more on that later).

SaaS Forecasting Without a CFO On Staff

Having an experienced CFO on staff is highly recommended. However, if you’re in the early stages and don’t yet have the budget, you can still track some of the essentials yourself.

Ben says the best place to start is in a simple Excel or Google sheet. It’s not fancy, but you can begin tracking your cash invoicing there. This will help you forecast your cash balance and how long that balance will last.

A few important items to track include

- Invoices/income

- Headcount

- Major expenses

Tracking these will help you get a high-level idea of what’s happening within your business. Examine the sheet and see if you can find any patterns. What cash comes in, and when? What expenses do you regularly incur (i.e. employee salaries and rent)? By looking for patterns, you’ll be able to do rudimentary forecasting without a CFO. At the very least, you’ll be able to create a rough sales forecast.

Buy a Profitable Online Business

Outsmart the startup game and check out our listings. You can request a summary on any business without any further obligation.

Challenges of SaaS Forecasting (and How to Overcome Them)

While Google sheets may be a reasonable place to start, the forecasting method mentioned above will only get you so far. That’s because SaaS businesses are notorious for being difficult to forecast. That doesn’t mean it’s impossible, but it does mean you’ll likely need some support.

Follow Ben’s three forecasting tips to effectively forecast for your SaaS business.

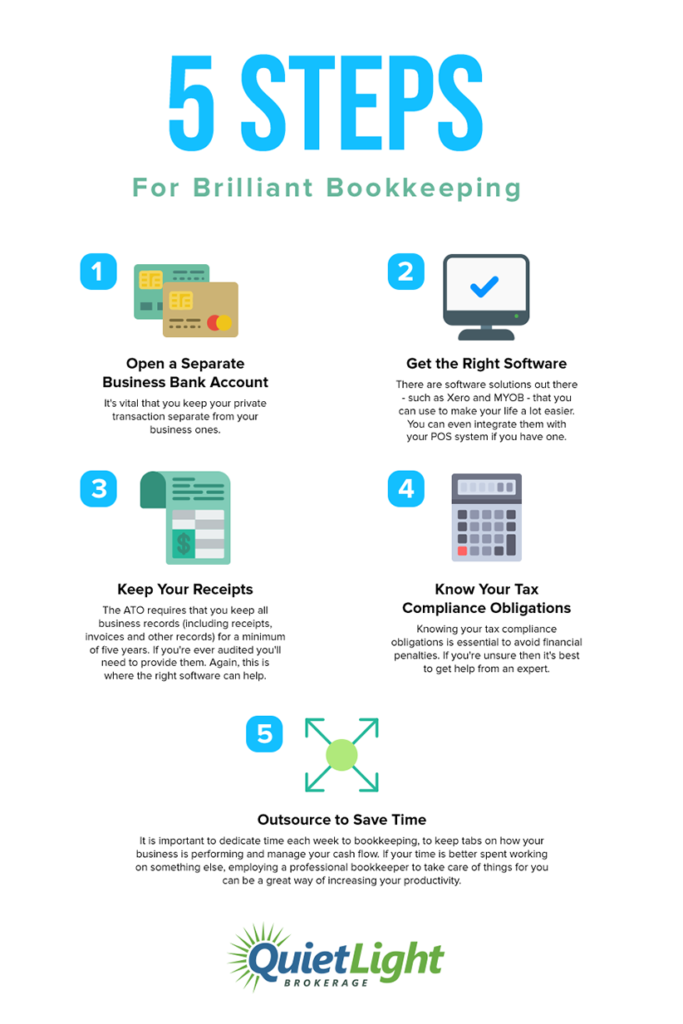

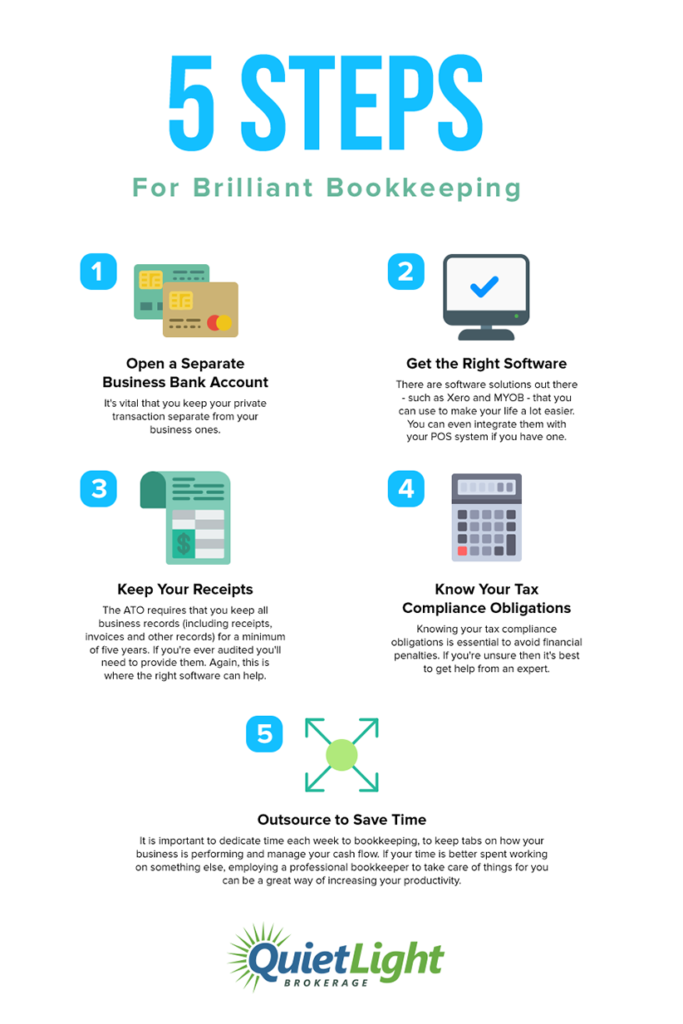

1. Get Organized

Forecasting is like traveling. You can’t get to where you want to go unless you know where you are.

You need historical financial data in order to do effective forecasting. That’s why forecasting is one of those SaaS essentials that you need to understand. If you have healthy margins, positive earnings trends, and you’re under $1 million in SaaS revenue, Quickbooks can help you get organized.

“Finalize your books every month to get clear on these expenses. This will provide you with a clean, crisp profit and loss statement (P&L).”

If you started off in Excel sheets, now’s the time to get on QuickBooks. It’s ubiquitous, cheap, and easy to use.

When you set up QuickBooks, make sure that everything is organized correctly. Not only does being organized make things easier, but it’s going to be essential as you scale. One of the first steps to getting organized is learning how to categorize expenses.

“One thing I see with SaaS firms is they’re coding all of their expenses into one big bucket,” Ben explains.

If you dump all of your expenses into one category (or in too many categories), your numbers are going to be all over the place. You’ll have no clue how much you spend on various aspects of your business.

If you’re new to forecasting, try to keep things simple. Classify expenses by the following categories:

- Employee salaries

- Travel expenses

- Commissions/affiliate payments

- Rent

- Marketing/advertising

Finalize your books every month to get clear on these expenses. This will provide you with a clean, crisp profit and loss statement (P&L). Having accurate P&L’s is essential when speaking with investors or buyers. After all, valuable companies always need to be on top of their financial documentation practices.

2. Choose How To Do Your Accounting

Don’t dump numbers into QuickBooks willy-nilly. You need a documented, structured plan for how you run calculations. These numbers have a significant impact on your metrics, so don’t gloss over this section!

If your SaaS business sends invoices monthly and only looks at monthly recurring revenue (MRR), this isn’t as big a deal. However, if you offer subscribers a discount if they pay annually (a metric called annual recurring revenue, or ARR), you might have a messy situation on your hands. According to Ben, “with annual contracts, you see a lot of SaaS companies posting that revenue right to their P&L.”

If you get a lump sum of money in an annual payment, it’s tempting to say, “I earned $12,000 in November on this one account.” However, this would be false. That $12,000 should be separated into twelve monthly payments of $1,000.

This is a similar process to that of building an optimized supply chain for an e-commerce business. If this process feels intimating, you might want to consider hiring a SaaS bookkeeper to manage it for you.

3. Understand Your Balance Sheet

When was the last time you looked at your balance sheet? If it’s collecting dust, it’s time to brush it off and bring it to the forefront of your SaaS dashboard.

Unfortunately, SaaS balance sheets are different from those of many other businesses. There are two main reasons for this:

- Deferred revenue

- New rules

Deferred revenue is revenue that has been paid for goods or services that have yet to be delivered. For example, deferred revenue becomes relevant when you parse out a $12,000 ARR into $1,000 monthly increments. Deferred revenue is considered a liability because you “owe” the SaaS customer for 12 months.

There are new rules about commissions, which you can now count as an asset on your SaaS balance sheet. Software development also counts as an asset. It’s best to speak with a trained professional to understand more about how this affects your particular business.

You need to have a basic understanding of your balance sheet to run a successful business.

What SaaS Metrics Matter the Most?

Forecasting is only as accurate as the metrics it’s based on. Therefore, it’s critical that you use effective accounting practices in order to establish correct metrics.

To generate useful forecasts, you need to have measurable data. Without it, it’s impossible to see how your company is truly doing.

While every business is different, Ben says SaaS founders should be concerned with 3 types of SaaS metrics.

- Sales and marketing efficiency metrics

- Employee SaaS metrics

- Customer lifetime value

1. Sales and Marketing Efficiency

The first place Ben likes to look for metrics is in sales and marketing. “Once you’re past cash flow, it comes down to go-to-market sales and marketing efficiency,” he says. Whether you’re an inbound or outbound kind of marketer, these metrics have big implications for your MRR and ARR. Together, they help you with sales forecasting.

The key here is to compare the money you bring in (MRR/ARR) minus the money you’re spending on sales and marketing activities. This data tells you how much it costs to acquire every dollar of MRR/ARR. Obviously, you want to have a financial model that allows you to bring in more MRR/ARR than you spend on SaaS marketing.

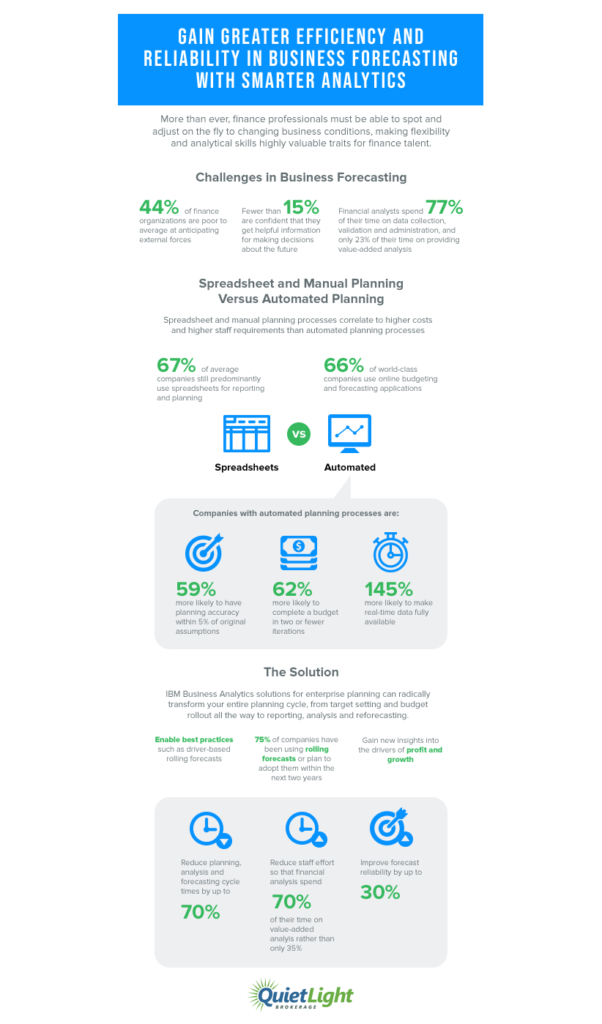

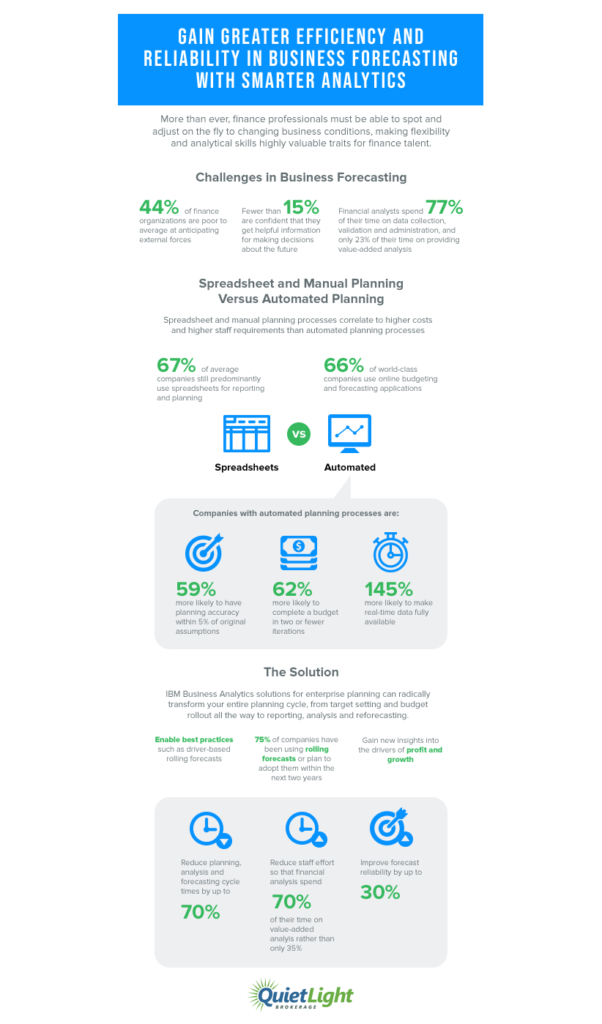

The desirable ratio depends on your business. You can check out Key Bank’s SaaS report to see what other businesses are spending. Here’s their report from 2018.

2. Employee SaaS Metrics

Headcount is generally the biggest recurring cost for SaaS brands. You might try to keep these low at first, but if you want to support more clients, you’re going to need more people.

To evaluate this metric, look at how efficient you are at bringing on new bookings compared to your wage costs. Like with sales and marketing, you want to be in the black, having more earnings than expenses.

It’s important to note that this metric isn’t about driving bottom-line savings. You have to remember that your employees are building your company and designing your products. As Ben says, “you need to invest in employees because they’re creating your company and your product.” In other words, high-quality employees are what drive all successful SaaS companies.

3. Customer Lifetime Value

SaaS customer lifetime value (LTV) is a critical metric to track. However, the nature of SaaS businesses often skews it. For example, you might have one amazing customer who raises your average LTV. However, such outliers don’t reflect your true LTV.

This brings up an important question: how can Saas company owners see their true costs and value?

“Not only are SaaS metrics important for running your business, but they’re an essential part of the valuation process as well.”

Ben says it comes down to your denominator. To understand someone’s LTV, you have to see how the numbers break down. Why did you choose the numbers you chose? Are you aggregating numbers or conveniently cherry-picking them?

SaaS brands have more leeway in LTV calculations because the definition of a “customer” will vary. Is someone a customer when they’re brand-new? Or are they a new customer when they resubscribe six months after canceling? Every SaaS brand has a different definition that’s going to influence the LTV metric.

Because it’s easy to make mistakes when defining LTV, Ben recommends looking at all of your SaaS metrics together, including churn rate. Never look at a SaaS metric in a vacuum, because it needs big-picture context to truly be important. “Lifetime value can be all over the place. You have to understand what inputs they’re using to get that number,” he explains.

Not only are SaaS metrics important for running your business, but they’re an essential part of the valuation process as well.

5 Things that SaaS Buyers and Investors Look For

You probably aren’t going to run your SaaS on your own forever. Likely, you’ll want to bring on investors or exit the business in the future. That may sound like a far-off dream at the present moment, but the decisions you make right now will affect the opportunities available to you later on.

Don’t scare off future investors by building a messy business. Instead, focus on these five areas in order to build a desirable company.

1. Clean Books

Remember how we talked about importing your financials into QuickBooks? That’s not just for your own benefit.

“Keeping your financials clean from the start will make it easier to sell your SaaS business in the future.”

Investors and buyers care deeply about clean books. In Ben’s words, “it comes back to having a good, clean P&L.”

If you have weak books and are trying to sell, it’s a good idea to clean them up before going to market. To get organized, you’ll need to look carefully at the following areas:

- Invoicing data

- SaaS churn and other costs

- Revenue streams

Based on these three areas, you can work backward to figure out your numbers.

While this process can be completed retroactively, it’s much better to stay current with your booking. Keeping your financials clean from the start will make it easier to sell your SaaS business in the future.

2. Recurring Revenue

Recurring revenue powers SaaS businesses. Investors and buyers want to know that subscribers are going to stick around for the long haul.

This number can significantly affect your valuation as a company. As Ben points out, “you must understand the value of your recurring revenue.”

A few important metrics relating to recurring revenue growth include:

- Bookings data

- Gross dollar retention

- Net revenue retention

- Downgrades and SaaS churn

Don’t just pay attention to these numbers for your best-selling products. Instead, separate subscription revenue figures by product line in order to gain a clear understanding of your sales revenue breakdown. This can help you create an invaluable revenue forecast. Understanding SaaS metrics such as these will provide you with greater clarity in your business.

3. Business Model

Can you explain your SaaS business model and SaaS financial model?

Even if you have an amazing product or service, that doesn’t mean your business is going to succeed. Do you have customer support or tech support to ensure that customers have their needs met? Do you have a process for reviewing and integrating feedback?

It’s important to have the infrastructure in place to keep your customers happy and satisfied. This is true for both B2C and B2B SaaS companies.

4. Customer Acquisition Strategy

How do you get new customers? Investors and buyers want to know not only how you get these customers, but how much they cost you.

This is where LTV and CAC come into play. In order to have a sustainable business, you need to have a predictable SaaS sales process. Make sure that you continually refine your acquisition strategy in order to maximize your LTV and minimize your CAC. By doing so, you’ll be able to make accurate financial projections for your SaaS company.

5. Potential Deal Breakers

This is a broad category, but buyers and investors lookout for red flags when evaluating businesses. Make sure your SaaS business doesn’t have any of these warning signs that might deter investors:

- Long payback period

- Insufficient cash flow

- Lack of product-market fit

“Investors look closely to make sure that you’re offering a product that has a strong demand.”

Your payback period is the amount of time it takes for you to recoup the cost of acquiring a new customer. If it takes 13 months or longer to recover costs, some buyers might be leery.

Cash flow is pretty straightforward. Is your business generating sufficient cash flow, or are you relying on lines of credit and incurring debt? Buyers want to know that your business has healthy cash flow forecasting practices in place.

Product-market fit is essential at all stages. Investors look closely to make sure that you’re offering a product that has a strong demand. If you’re not able to acquire and retain customers over time, investors are going to be concerned.

Conclusion: SaaS Forecasting is Essential

Forecasting may not be a perfect science, but it’s certainly far more effective than wishful thinking or ignorance. By using clear data, accurate forecasting and financial modeling allow you to make metrics-driven decisions that help you succeed.

If you get organized, choose an effective accounting method, and familiarize yourself with a balance sheet, you’ll gain new insights that would otherwise be missed. Additionally, if you ever decide to sell your business, SaaS forecasting will allow you to provide important information to potential buyers.

Whether you’re running a SaaS startup or seeking to scale, do yourself the favor of utilizing SaaS forecasting to fuel your success.

If your business isn’t perfect right now, join the club. Most SaaS businesses have something they could improve. But instead of burying your head in the sand, do something about your deficiencies. Action will move the needle and make your business more profitable.

Thinking of Selling Your Business?

Get a free, individually-tailored valuation and business-readiness assessment. Sell when you're ready. Not a minute before.