Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

How to Sell Your SaaS Business: A Step-by-Step Guide

About the Author: David Newell is a Senior Advisor at Quiet Light Brokerage and an industry expert in the valuation and sale of SaaS businesses. David is a former investment banker at Citi (2009-2012). From 2013-2016, he worked as the Head of Brokerage at FE International, where he advised on more than 75 transactions, including 20 SaaS exits, totaling $30M+ in value. David has advised on the sale of several well-known bootstrapped B2B apps, including the sale of Drip to LeadPages in 2016, as well as the exits of Less Accounting, Sifter, CodeTree, and HitTail. In other words, he’s the perfect person to answer the question, “what’s the best way to sell my SaaS business?”

The Market for Software as a Service Companies (SaaS)

As we enter the third decade of the 21st century, it’s remarkable to look back at how the technology and software landscape has changed over the last 20 years. In 2000, for example, smartphones did not exist. Uber, Spotify, Instagram, and Google Maps had yet to be created. In fact, Ruby-on-Rails, React, Swift, and a whole host of programming languages had not yet been invented.

But the biggest change over the last 20 years has been the rise (and near domination) of the Software as a Service (SaaS) business model. In 2000, SalesForce, the first true breakthrough player in the space, was just nine months old with hardly $1 in revenue. But it surpassed $14 billion in 2019. Indeed, global SaaS revenues now exceed $100 billion annually and the market continues to grow at about 30% per annum. The average employee uses at least eight apps in the course of doing their job. The average company spends $2,884 in SaaS subscriptions to keep their workers productive. SaaS growth shows no signs of stopping, with Gartner projecting it to reach $143.7 billion by 2022 alone.

In the last 10 years, SaaS companies created in apartment living rooms and garages have become commonplace. These are brands like Stripe, AirBnb, and BaseCamp, just to name a few. SaaS unicorns aside, what has been the most inspiring is the rise of a global, bootstrapped SaaS community. This community is championed by groups like MicroConf and fueled on by success stories like Rob Walling’s Drip and Nathan Barry’s ConvertKit.

Twenty years ago, the number of “homemade” B2B SaaS apps was minute. Nowadays, it’s one of the most burgeoning aspects of the startup scene. This growth has fueled a corresponding expansion in the secondary market for SaaS apps, as owners eventually look to exit. As such, at Quiet Light, we’re regularly speaking with SaaS founders about:

- What buyers are looking for in a SaaS business

- How to value SaaS

- How to increase value before a sale

- What to expect when you go to market

At Quiet Light, we’ve advised on the sale of over 750 businesses since 2007. We speak with hundreds of founders each year, and they often have similar questions about the market, valuation, buyers, and preparing for an exit. Our philosophy is to provide as much market insight and transparency as possible to allow each owner to make an informed decision about their exit. The impetus for this guide is to share our knowledge, experience, and data with SaaS founders to do just that.

We’ve created the most comprehensive guide to building, valuing, and selling SaaS businesses based on our 10+ years of experience in business brokerage. We’ve tried to include absolutely everything we can, from timeless principles of exit planning to the most recent market data on SaaS multiples and valuation methodology.

This guide is structured into four distinct sections:

First, it explores the SaaS market landscape. This will help you understand who buys bootstrapped SaaS businesses and why. Know the types of investors and their motivations to understand the different approaches required for valuation, multiples, execution, and closing.

Second, we will explore how investors value SaaS businesses and the different valuation methodologies that exist. We will explore why there are different methods when they apply, and what it means for you as you scale your SaaS business.

Third, we will look at the most effective methods for increasing the value of your SaaS business before going to market—with tactical suggestions for doing so.

And finally, we will close with advice on going to market. This will cover the key things you need to know to increase your prospects and the probability of a successful sale.

To navigate to any section, please click on any of the links on the “Table of Contents” menu to the left. As you will see, there’s plenty to get through in this guide. The first step to a successful SaaS exit is understanding the secondary market that exists for these apps, as well as potential buyers and acquisition partners.

Want to Sell Your SaaS Business? Here’s Who Buys Them

As a founder considering a future exit, the question that commonly comes to mind is, “How much is my SaaS business worth?”

It’s, of course, the ultimate question. The answer often informs whether or not to greenlight a sale at all. It is, however, not the best question to start with.

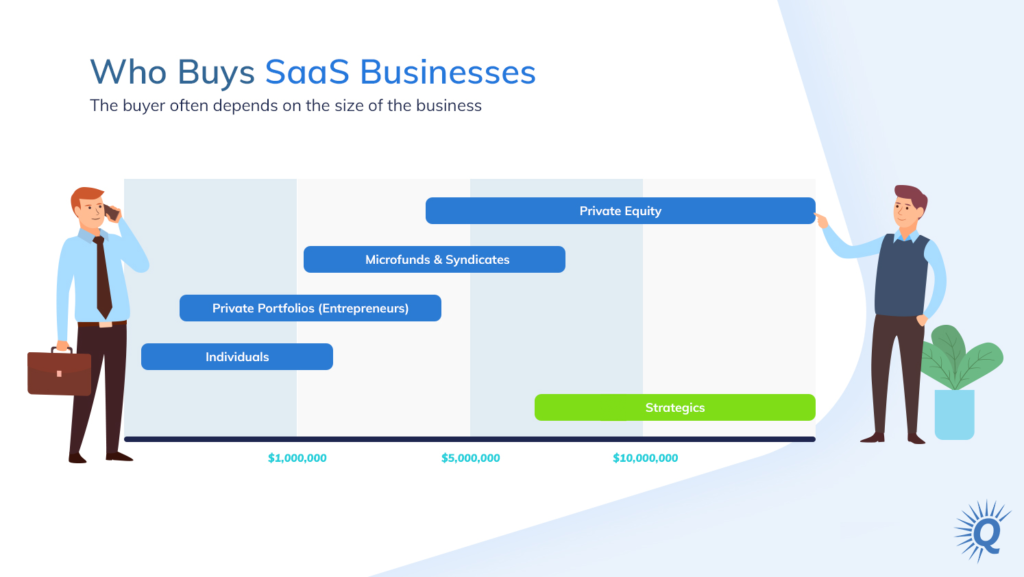

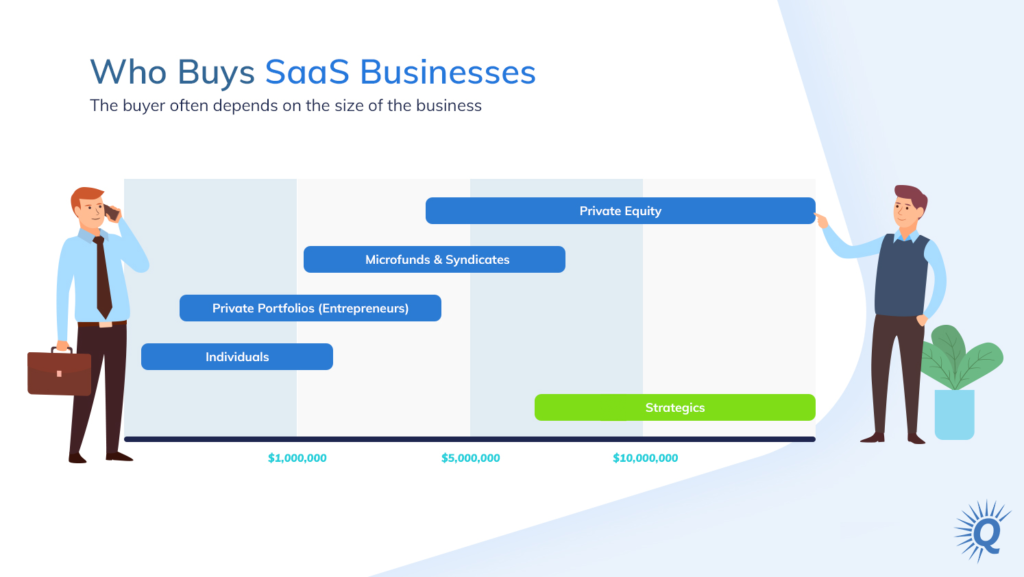

Your business’s worth is based on who is out there to buy it in the first place. In the SaaS buying landscape, there are at least five different types of buyers. They each operate at different value ranges (“cap scales”), have different investment motivations, and have different investment styles. That means the answer to, “How much is my SaaS business worth?” is best answered as, “It depends on who you sell it to.”

The easiest way to think about the players in the SaaS buying landscape is in terms of deal value, and then by investment approach.

What Types of Buyers Acquire SaaS Businesses?

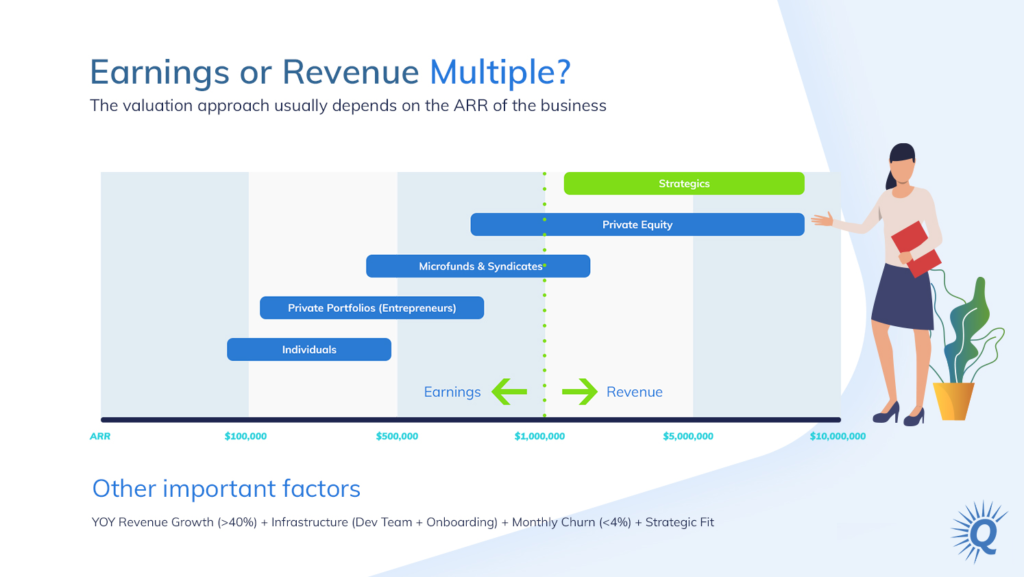

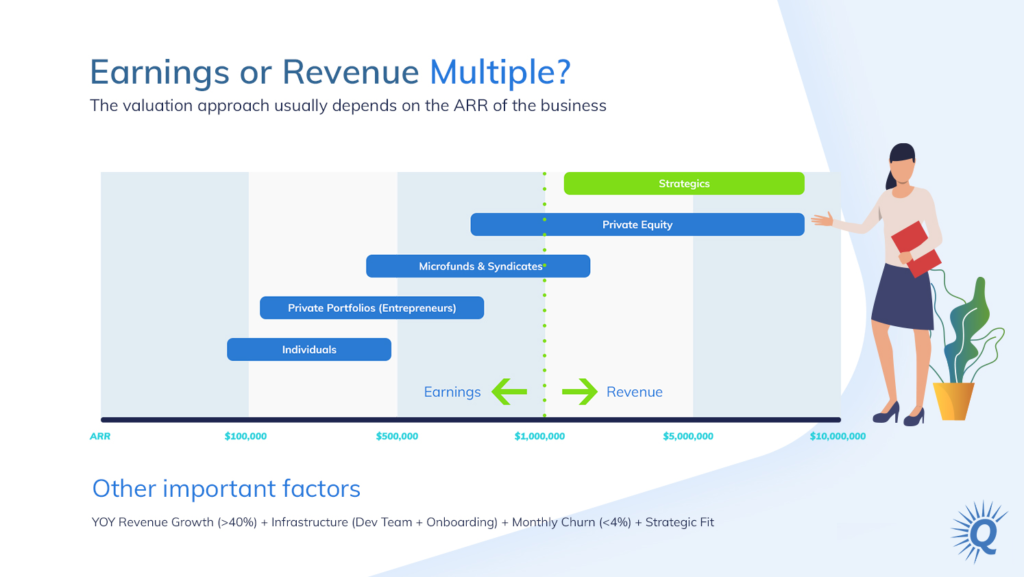

In the $100K to $15M deal range, you typically see five types of investors:

Individuals: These are typically self-financed, individual investors. They have varying degrees of experience and may have prior SaaS ownership. They are driven by ROI, primarily earnings-multiple led, close quickly, and require some degree of post-sale support.

Private Portfolios: These are self-financed individuals managing a portfolio of SaaS apps. They often have significant experience with buying, selling, and managing SaaS businesses. Often they have their own internal infrastructure for development, marketing (SEO/PPC), and customer support. They are driven by ROI, primarily earnings-multiple led, close quickly, and require minimal post-sale support.

Microfunds/Syndicates: These are groups of successful SaaS/internet entrepreneurs that come together to leverage funding economies of scale, as well as share operational resources and expertise. They have their own internal infrastructure for development, marketing (SEO/PPC), and customer support. They are driven by ROI, primarily earnings-multiple led, close quickly, and require minimal post-sale support. They differ from private equity in that they do not have institutional financing and acquire 100% of the company at closing.

Private Equity: These are well-capitalized, institutionally financed investors with varying degrees of expertise in running SaaS businesses. They are ROI-driven and primarily revenue-multiple led, typically with a minimum ARR threshold of $1 to 2M. They typically look to acquire 60% to 80% of the company at closing. Private equity investors aim to incentivize the owner to stay on for at least 18 to 24 months post-sale to work towards pre-agreed revenue and/or development targets.

Strategics: These are companies with similar or complementary business interests that have obvious operational or “strategic” synergies from an acquisition. They are top-line driven and revenue-multiple led, typically with a minimum ARR threshold of $1 to 2M, but this often can be higher ($5M). There is no “standard” acquisition model for strategics as it’s case-by-case, depending on the quality of the fit. Sometimes they might acquire 50% of the company at closing and roll over the rest. This may involve the owner working for the company (commonly considered an “acquihire”), or they can acquire more with less owner involvement, moving towards a more traditional exit. Generally speaking, the more strategics pay out at closing, the lower the multiple (i.e., founders can get more if they commit to staying on). Strategics pay the highest multiples, but with the lowest likelihood, given that the right buyer and seller need to meet at the right time, with the resources, the appetite, and the experience to integrate.

In the diagram, you can see that in the $100K to $3M exit landscape, the vast majority of exits (by volume and value) are made to individual, portfolio, or syndicated buyer types. Private equity and strategic parties tend to become more prominent at the $5M+ value. The reason for this is that they typically want to see at least $1M+ in ARR to conclude there is sufficient, proven product-market-fit (PMF) with the app. Second, they also want to ensure the economics make sense, given the time and resources they will assign to due diligence and closing.

So already you can see that, when there’s <$3M in deal value, there is a focus towards ROI and earnings-multiple driven buyers that close quickly with relatively few post-sale obligations for the founder. Above the $3M threshold, the landscape shifts towards PE and strategic buyers. They focus on revenue-multiple and are willing to pay more, but often want the owner as part of the deal, working for 18 to 24 months post-sale.

It’s important to note that, even in this higher bracket, the vast majority of exits are still to “investment buyers,” and not strategics. Private equity makes up the lion’s share of acquisitions from $5M and up by volume and by value. This is simply because there is a high number of well-funded PE firms set up to acquire SaaS businesses. There is a comparatively smaller number of strategics for each potential investment opportunity.

Second, for a strategic deal to take place, it needs to be the right time and with the right strategy. Capital must also be available, and both parties need the appetite and expertise to integrate the acquisition. A lot of stars have to align, meaning the probability of a successful close is lower with strategics than with a private equity buyer.

With that said, many of the PE or “investment” buyers at this level have pre-existing investments and strategic footholds in the spaces they are looking to acquire. The line between purely investment and purely strategic blurs quite a lot as you move up the cap scale of deal size.

The multiple landscape varies a lot between buyers. As we will explore later on, private equity might pay 5X to 8X for a business, while a strategic could instead pay 10X.

So, how much is your business worth? 5X or 10X, depending on whether it sells to a PE or strategic, in this example. The question, though, is whether there are any strategics out there that have a case for acquiring you—and that they have the capacity to do so right now.

Beyond the Multiple

The other nuance to this question is that the multiple isn’t everything. In fact, only half of your consideration should be on the headline valuation.

Another consideration is deal structure. Do you want a structure that’s all-cash? Earnout? Seller note? Each of these has an impact on valuation and the deal’s risk structure.

Another major factor for cap deals involving PE and strategics is the life you want post-exit. Do you want to continue working for the new owner? Are you prepared to move locations? For how long? If so, what kind of buyer do you want to sell to and work with? If there is a substantial performance component to the deal, then there should be an emphasis on the skill and experience of the acquirer to ensure they can achieve those goals and future payments.

The five types of SaaS buyers bring different approaches to the deal. As a founder, you have to consider each investor type and decide who you want to sell to, and on what terms.

Now that we’ve identified the main players in the SaaS buying market, we can turn to valuation. Let’s see how buyers drive the consensus around the two main valuation methods: revenue vs. earnings multiple.

How to Determine Value When Selling My SaaS Business

Business owners have tried many approaches to correctly value their businesses. Approaches like discounted-cash flow analysis (DCF) were once the norm, which worked well for slow-growing, profitable businesses like utility companies. But as the business landscape evolved, investors looked to actively compare businesses based on their growth rates, profit margins, and forward-looking prospects. All of this aimed to solve two questions: How much cash flow will the business return to the owner? After what time period will the buyer break even after the acquisition?

Today, the most common valuation method is the multiple-method. This involves multiplying the annual earnings by a chosen factor to arrive at the value of the business. This creates two obvious questions for business valuation: 1) what constitutes the earnings? and 2) what is the right multiple?

The first question can create a lot of confusion within the SaaS community, in particular, because what constitutes “earnings” for a SaaS business changes from operating profit to top-line revenue, based on the size, growth profile, and other operating characteristics of the business. So the question for any SaaS founder often becomes, “Am I valued on a revenue or an earnings multiple?”

Before we answer that, we need to cover terminology that commonly applies to SaaS business transactions.

What are SaaS business earnings?

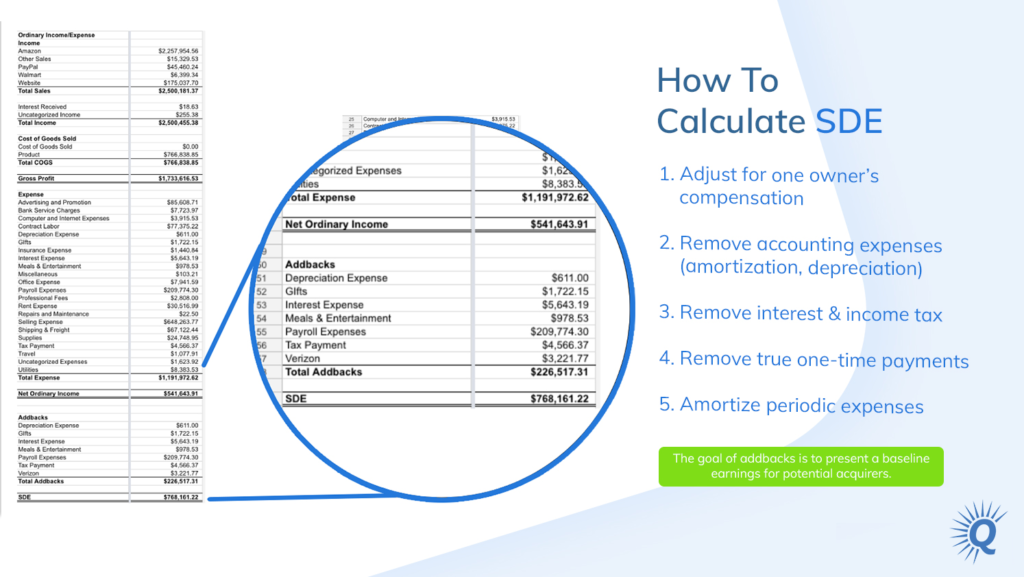

Most businesses are valued by either their operating profit (EBITDA) or their Seller Discretionary Earnings (SDE).

SDE is very similar to EBITDA, but adds back owner compensation and exceptional, one-off items or personal expenses that the new buyer would not readily incur. SDE is the metric of choice for a small business valuation (<$15M) because the owner’s time involvement and compensation varies widely. This creates issues when trying to standardize valuations across different investment opportunities. Small businesses often have personal expenses mixed in too, which are not valid to include in the business valuation; so SDE cleans the accounts and allows for standardization.

As the business grows, it should grow into a dedicated company entity with no personal expenses, and with a standardized owner input (salary + bonus). At this point, EBITDA is the profit metric that makes the most sense. If you look at the market, most business brokers/advisors with listings at <$15M use SDE, but most mid-market advisors with companies at >$15M use EBITDA. Both are right because they are trying to show the business’s true, underlying earnings.

So, how does SaaS fit into this, and where does revenue come in?

Like other small businesses, SaaS valuation starts out with SDE but then changes to Revenue after a certain threshold. This causes a lot of confusion in the SaaS valuation marketplace. Founders often think their business is worth a lot more (or a lot less) than it’s actually worth. Let’s look at why this happens, and whether SDE or Revenue applies to your business.

When I sell my SaaS business, is it valued on a multiple of earnings or revenue?

Bootstrapped SaaS businesses are valued like every other small business, using a multiple of seller’s discretionary earnings (SDE). This reflects the relatively small size of the business, the codependency between the owner at this stage, and the yet-to-be proven scalability of the business.

Early SaaS businesses experience relatively high customer churn (>4% per month) and instability in core metrics like LTV, ARPU, CAC. This happens as they try to find product-market-fit, maturity, and scalability. All of this is to be expected. But what it means is that the best proxy for business earnings is its actual current earnings. That means a multiple of the SDE is the most appropriate valuation in this situation.

Once the business establishes strong product-market-fit, it will scale to the point where more staff are required to replace the owner. Having more customers means more demands and more complexity. This means hiring is needed to help with:

- Customer onboarding to reduce churn

- Removing the owner and installing developers

- Creating a marketing department to grow the business.

This transformation takes the business from a lite-SaaS to a company-SaaS. This propels the business into a different valuation landscape.

Adding more overhead to the business naturally reduces its profitability, sometimes quite substantially. In this situation, a multiple based on profit no longer makes sense. Instead, the revenue line becomes the basis for valuing the business. That’s because revenue is now the best proxy for the future cash flow of the business, assuming it continues to grow.

So why does this only happen with SaaS and not other models?

This is because a growing SaaS business expects future income to take a long time to materialize. That can happen even with robust underlying unit economies. Sales and marketing expenses are recognized upfront, while revenue persists over many years.

This lag makes new customers unprofitable in the short term, even though they clearly will be profitable over their lifetime. If a SaaS business is growing quickly, there are a lot of new, temporarily unprofitable customers making your net income negative. This is true, even if the business stops growing.

This is why revenue is a better indicator of long-term cash flow for a SaaS business compared to net income, or EBITDA. However, a big caveat to this is the importance of revenue growth. This is a hugely important metric for SaaS businesses, more so than any other business model.

In looking at SaaS businesses, buyers must filter between “lite-SaaS” and “company-SaaS” using a few qualitative and quantitative factors. Buyers put your business through “The Four Tests” to evaluate your size, growth, PMF, and team.

Businesses that are considered “company-SaaS” receive a revenue multiple that passes most or all of The Four Tests:

- Annualized Recurring Revenue (ARR): $1M+ (The Size test)

- Revenue Growth (YoY): 40%+ (The Growth test)

- Monthly Churn: <4% (The Product-Market-Fit test)

- Team: Dedicated Customer Success & Development Teams/Employees (The Key-Man test)

These are not hard-and-fast rules. They can change depending on each situation, but it’s important to remember that The Four Tests are general guidelines that many buyers use to evaluate your business. If your SaaS business is a little below $1M ARR, it could well qualify for a revenue multiple, particularly if there is a strong strategic fit for an acquirer (who will value their synergies based on revenue). The best thing to do is speak to an advisor in the space to establish what makes sense in your situation.

There are other exceptions. For example, slower revenue growth can be offset with higher-than-average profit margins, but these are useful guidelines for establishing a baseline. Most businesses in this category are expected to have between 0% to 20% profit margins that are offset by strong revenue growth.

The interplay between profitability and revenue growth is very important to investors. If you have slow revenue growth and low-profit margins, buyers may find your business unattractive, or you might be suited better for an earnings-based valuation. Of course, if you have high revenue growth and high profitability, you’re in the “star” category for most buyers.

Now that we’ve drawn the distinction between revenue versus earnings (SDE) valuations, we can see how these approaches work in practice.

Click to go straight to SaaS Valuation – The Revenue Multiple Method

SaaS Business Valuation – The SDE Multiple Method

The SDE Multiple Method requires three steps to correctly value your business:

- Calculating your SDE

- Benchmark your SaaS to find the multiple

- Applying the multiple to the right SDE

Calculating SDE for Your SaaS Business

To use the SDE method, you will need your monthly P&L from at least the last 24 months. This is because most buyers will not acquire a SaaS business that is less than two years old. Any earlier than that and buyers will consider the business too young and too risky to place a multiple. There are exceptions here, but in general, the two-year rule is a market standard.

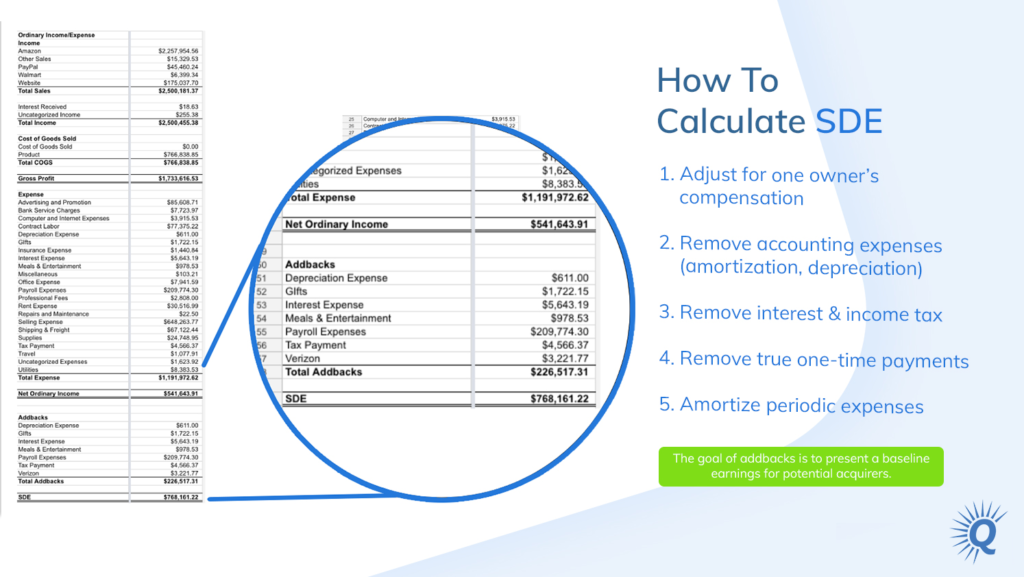

With your monthly P&L current to the most recent month, you can start to make “addbacks” to your trailing twelve-month’s net profit. Be sure to include your personal (owner) compensation, any one-off exception items, and expenses that a new owner would not readily incur. You can read the full step-by-step guide on how to do this here. Check out the Quiet Light webinar on add-backs as well

At a high level, the process looks like this:

Generally speaking, it’s best to work with an advisor on this exercise. They have the expertise to help you determine what qualifies as an addback. Advisors are useful in grey-area situations or where there may be a partial, but not full, addback. Buyers examine addbacks very carefully during due diligence, so an expert opinion at this point is important to avoid a change in your valuation down the road.

This process can have a major impact on your business valuation. Say your net profit is $100K and you deduce that there are $20K in addbacks (or an SDE of $120K). But your advisor points out another $30K that you missed (now an SDE of $150K). At that point, your business value at a 3X multiple just went from $360K to $450K—which is a lot of money. Even small addbacks of $5K to $10K add up quickly with a multiple.

Once you finalize your last twelve-month’s SDE, you can move on to benchmarking your SaaS for a valuation multiple.

Benchmarking Your SaaS Business To Find The Right Multiple

The multiple approach is still the dominant valuation methodology because of its standardized approach. You can compare key characteristics of a business quickly and easily with this method. As a result, a multiple takes growth, size, risk profile, and owner involvement into account. The multiple that your business merits is a test of its comparative strength on each of these measures versus other businesses in the marketplace.

At Quiet Light, we look at business valuation through the lens of the Four Pillars of Value™. This encompasses Risk, Growth, Transferability, and Documentation. Your multiple looks at these four pillars and compares your performance to other businesses.

Naturally, there are many, many variables within any business. So many factors go into creating a multiple. But you can get a reasonable idea of the SaaS multiple by accounting for:

- Age (a measure of risk)

- Revenue and earnings growth (a measure of growth)

- Revenue churn (a measure of risk and growth)

- Owner involvement (a measure of transferability)

To get a sense of your SaaS multiple, pull together:

- Your business’ age

- YoY revenue and SDE growth

- Monthly revenue churn (%)

- Average number of hours you work each week

With these, you can benchmark your multiple using the valuation landscape below. This places SaaS businesses in a range between 3.0X and 5.0X SDE, which is typical in the marketplace.

A word of warning: the above, highly simplified landscape is helpful, but it’s not 100% accurate. Your multiple is a blend of all the vital characteristics of your business. In practice, it’s impossible to look at any of these factors in isolation because they all affect each other.

For example, your customer churn affects your revenue growth. That, in turn, likely affects how much time you spend improving the business. Likewise, it doesn’t make sense to discount a young, fast-growing SaaS just because of its age.

As you can see, valuation is a complicated picture. It’s both an art and a science to derive a multiple, weighing different factors against each other. This is where advisors add a lot of value. They understand the overall picture and help you weigh each factor like a buyer would.

Let’s demonstrate how this works with a couple of examples.

Business A is a mature B2B marketing analytics app that has a current month MRR of $40K and a trailing-twelve-month ARR of $420K. It’s grown 30% in the last year and brought in SDE of $250K, a consistent profit margin as the year before. The business is five years old with a medium workload (20 to 25 hours per week) and has consistent customer acquisition metrics with a steady churn rate of 3% per month.

In valuing Business A, we would consider its growth profile (medium), work involvement (fairly average for a business of the size), and churn rate (low). We’d also take into account its track record (five years is a good length of time), its relative size, free cash flow and margin history. At $250K of SDE, it’s yielding a lot of cash flow that even an owner/operator could consider putting time into personally. Without going substantially deeper into the business, I would be placing this in the realm of 3.7 to 4.0X, possibly using the L6M as the basis for the valuation depending on the growth rate.

Business B is a young, high growth Shopify app that is currently earning $19K in MRR with a trailing-twelve-month ARR of $170K. It’s seen 16% MoM revenue growth but also experiences 10% monthly churn from users on the Shopify platform, bringing net revenue growth to 6% per month (and 70% over the TTM). It’s just turned two years old and requires about 7 to 10 hours a week. It generated $70K in SDE in the TTM, $45K of that was within the L6M.

In valuing Business B, we would consider its strong growth but counterbalance that with the very high churn rate that is often structural to marketplace-based apps like Shopify where customers come and go quickly. While the growth is impressive, we have to be wary that if it slows, the business will quickly start churning backwards. The low workload makes this hands-off and the smaller SDE puts it in a category where buyers are used to taking higher risks. In sum, this would be a SaaS valuation around the 3.1 to 3.3X level but likely using the L3M or L6M to account for the big difference between where the app was 12 months ago and what the buyer will be inheriting on day one.

The simple examples above use a handful of major metrics like churn, growth, and size, but what else is important when it comes to SDE SaaS valuation?

A proper valuation acknowledges anywhere from 50 to 100 factors. But some other major metrics, for SaaS in particular, include the monthly to annual plan ratio, customer metrics, acquisition channel mix, and competitive positioning.

- Monthly to Annual Plan Ratio: As a rule of thumb, monthly recurring revenue is more valuable than annual recurring revenue (i.e., monthly plans vs. annual plans) because MRR is more predictable. Each month, your customers have the opportunity to churn. The churn data you have on a monthly basis is a more accurate prediction of what will happen the following month. The more predictable your revenue is, the more valuable it is to buyers. Conversely, annual plan revenue creates an “overhang” risk for buyers. It’s difficult to say what a customer will do in nine months. When they see a big annual rebill, they have a higher likelihood of churning away. This creates a forecasting risk for buyers, which they tend to discount in their valuation. The optimal monthly to annual plan ratio is 4:1. The optimal pricing discount between the two is less than 25%. Note: This is a phenomenon that’s unique to SaaS businesses in the B2C or B2-SMB space. It doesn’t affect B2-E, which typically has an annual contract model and low churn.

- Customer Metrics: Churn is obviously important to buyers, but so are all of your other key customer metrics. This includes Trial-to-Paid Conversion Ratio (if applicable), LTV, ARPU, and CAC. How these are assessed varies according to your business (e.g., what’s good for your industry, your competitors, etc.) and also based on your customer segment (e.g., higher LTV is expected for enterprise-facing SaaS). As a guiding principle, investors want steady and improving metrics in all key areas. Declining ARPU or LTV or a rising CAC point towards structural issues that may call for a valuation discount.

- Acquisition Channel Mix: Most bootstrapped SaaS businesses gain traction from organic customer acquisition sources like SEO, podcasting, and product-hunt launches. Eventually, though, this growth model begins to slow. Growth needs to come from elsewhere through paid-marketing, affiliate partnerships, and tactical integrations. When the business relies solely on one customer acquisition source, like Google search, it has too much key-channel risk. If you lose Google rankings, you lose traffic, trials, and customers. Conversely, if 50% of your business comes from PPC traffic, then a drop in the organic SERPs doesn’t hurt as much. You need to have a good mix of customer acquisition channels to diversify your risk. Remember, any diversification of risk increases the value of your business in the eyes of an investor, per our core valuation pillar, Risk.

- Competitive Positioning: Buyers want to see how you fare against the competition. If you’re in an industry with 10 other rivals, how are you positioned? Are you a leader or a follower? What is your feature set and pricing versus the other players? Who owns the competition? Are they VC-backed with millions to spend? These factors determine how the business will perform, which affects the multiple buyers who are willing to attach to your SaaS business.

How to Apply the Multiple To The Right SDE

Now you have a sense for which drivers affect SaaS valuation, as well as how they’re interconnected. Now it’s time to apply your SaaS multiple to the SDE.

In step 1, we calculated the SDE for the trailing-twelve-month (TTM or LTM) period, This is the typical earnings number to use for most SaaS valuations. However, in some cases, it makes more sense to use either the last six months (L6M), the last three months (L3M), or even the last month (L1M) and annualize that number instead. If you’re in a scenario where your SaaS is growing very quickly, it’s not appropriate to use the last 12 months. This will show a deflated earnings level versus what the buyer will actually acquire.

You might ask, “Why is this allowed for SaaS and other business models?” Because SaaS has recurring revenue, even the L3M or L1M period is a good proxy for the business’s current and future profit. With stable customer metrics, you can say with greater certainty that the L3M or L1M is a better predictor for the next 12 months compared to the last 12 months (which would be a lower number).

Here’s an example.

Imagine your SaaS business has grown 7.5% consistently month-over-month for two years. It posts 60% year-over-year growth and a most recent MRR of $27.5K versus $16.2K twelve months ago. The business has consistently kept a monthly churn rate of 3.5%, a stable LTV, and profit margins of 40%.

For argument’s sake, let’s say the appropriate multiple is 4X. If we use the LTM SDE of $105K, it would value the business at $420K.

In reality, though, the new owner is not acquiring an earnings stream of $105K per annum. In just the last three months, the business generated $31.6K of SDE, or an annualized equivalent of $126K. With stable customer metrics and growth, it’s fair to say the business’s accurate baseline is $126K and not $105K.

It isn’t accurate to the business or fair to the owner to value the business this way. That means it makes more sense to take the L3M average, annualize it, and then apply the 4X multiple, coming to a valuation of $504K instead.

There are two caveats to this. A SaaS will only qualify for an L1M, L3M, or L6M SDE if:

- Growth over the last 12 months justifies the re-rating.

- Customer metrics (like churn and LTV) are stable or improving.

These two factors have to be in place for this valuation to be a credible indication of the business’s current and future performance.

If the business went through a large jump in revenue over the year, but at the cost of a material reduction to LTV or ARPU, then that is factored into any re-rating decision. For example, cutting prices may pop the revenue and earnings growth as more customers come in short term. But if long-term, it means the business has lower LTV and reduced profitability. Then it’s not something buyers will pay a premium for.

As a rule of thumb, if the business grew 50% or more over the last 12 months, it makes sense to use an L3M SDE figure. If it grew 25% or more, then an L6M SDE figure makes sense. If there was less than 20% growth, LTM is most appropriate. If you’re seeing 75%+, then L1M is appropriate. All of this assumes stabilized or improving churn, LTV, and ARPU.

Once you’ve discerned L1M, L3M, L6M, or LTM SDE, you can then apply your multiple. This will give you a valuation for your SaaS business. Naturally, there are a lot of factors involved in the multiple (and adjustments to the SDE), so for the most accurate valuation analysis, it makes sense to speak with an experienced advisor. Partner with someone with many transactions under their belt so they can help you arrive at the right SDE and the right multiple.

Now that we’ve discussed the SDE-multiple approach, it’s time to look at the revenue multiple approach. You’ll notice that the principles between the two methods are consistent (benchmarking operating metrics), but the weightings applied are very different. In the revenue multiple method, there are no earnings adjustments, and forecasting becomes much more relevant to the overall picture.

SaaS Business Valuation – The Revenue Multiple Method

For SaaS businesses that meet the key criteria and qualify for a revenue multiple (see “The Four Tests”), the formula for valuation is very easy:

Annualized Revenue x Multiple = Company Valuation

In a similar vein to the SDE approach, buyers need to understand the probability and predictability of future cash flow to assign a revenue multiple. Anything that affects the projected size, timing, and predictability of future cash flow affects the multiple. These factors include 1) company-specific drivers such as growth rate, gross margins, retention, etc. 2) industry factors such as size, growth, competition, etc. and 3) macroeconomic confidence.

The revenue multiple method is a two-step process:

- Calculate annualized revenue

- Benchmark to get to a revenue multiple

Let’s see how you can do it.

Calculating Annualized Revenue for Your SaaS Business

There are three ways to arrive at an annualized revenue number for a SaaS business. The route you take depends on the situation:

- Annualizing Current MRR (“Run-Rate”): This is the most common method. It involves annualizing the most recent month’s revenue. This is most appropriate for SaaS businesses with majority monthly-payment-plans where there is a smooth upward MRR profile. If you bill annually and receive a large amount in one month, annualizing with g that month is not an accurate reflection of the total revenue of the business.

- Trailing 12 Month Revenue: This is suitable for SaaS businesses with a lumpy revenue profile, often because of large quarterly or annual billings. It involves taking the revenue for the previous 12 months as a benchmark.

- Forward-Looking 12 Month Revenue: This is your forecast revenue for the next 12 months. Since this is based on forecasts that haven’t happened yet, this method means buyers will closely scrutinize your numbers. They typically do this by looking at the last two to three years of forecasts and comparing them against your actual historical results. If you have a record of consistently beating and upgrading forecasts, this number could be appropriate.

Remember that not all SaaS revenue sources are considered equal. Many larger SaaS businesses have a blend of recurring license revenues, one-time service fees (e.g., onboarding, implementation), and recurring service fees (e.g., maintenance). Recurring software license revenues are valued the highest because of their future profitability. One-time is valued the lowest because they don’t include a subscription. Recurring services are somewhere in between. The average mix is around 80/20 license-fees to service fees, and the multiples reflected in the next section will assume the same. If your business has a higher mix of service fees, this will be a discounting factor to the valuation. If it has higher license fees, it will add to your valuation. These adjustments can be done to the company-wide multiple, but are more accurately done as adjustments to individual revenue streams.

Now that you’ve established a revenue number for your business, it’s time to calculate the multiple.

Calculating The Revenue Multiple For Your SaaS Business

Revenue multiples require a multi-step process. It accounts for company-specific, industry-specific, and overall market/macroeconomic sentiment.

This requires establishing a baseline valuation for SaaS. It uses the current median public revenue multiple for SaaS businesses and then adjusts it based on the company’s characteristics in addition to industry-specific factors.

Similar to the SDE approach, there are anywhere between 50-100 variables involved in a full valuation process. But for a ballpark estimate, the process can be simplified into seven steps:

- Retrieve The Median Public-Market SaaS Revenue Multiple

- Discount For The Private Company Factor (-25 to -30%)

- Adjust for Revenue Growth (Size-Relative)

- Adjust for Market Size

- Adjust for Churn

- Adjust for Revenue Mix + Gross Margi

- Adjust for Profitability

1. The Public-Market SaaS Business Revenue Multiple

Buyers and sellers start with public valuation data to do a valuation analysis. The multiples for publicly traded SaaS companies have high data integrity because they are larger (and less likely to fail), audited by professionals, and are compelled to communicate with the market often about their financial performance. So, at any point in time, the median multiple for SaaS companies is a useful proxy to start the process.

To access public valuation data, you can start with popular online sources. SaaS Capital has created the SaaS Capital Index, which focuses purely on B2B SaaS. It also carves out B2C apps and legacy conglomerate businesses like Microsoft. Another useful source is Bessemer Venture Partners, which has a similar Index.

When choosing a base public multiple, the most important thing is to ensure that the revenue periods are consistent. You want to ensure the revenue period for the base public multiple relates to the same as the one you are using for your company, whether it’s forward-looking, run-rate, or trailing revenue. You’ll receive very different multiples for each, so it must be standardized at this point. SaaS Capital adopts run-rate while Bessemer has forward-looking.

The median public SaaS revenue multiple can vary a lot over the course of a year, so it’s important to keep checking. Right now, the multiple is 9.0X, which we will use in the rest of the examples for this section.

2. Discount For Private Company (-25% to -30%)

While public and private SaaS companies have the same valuation factors, the multiples between the two types of business are quite different. Private SaaS valuations tend to be lower because these companies are smaller and riskier. This is also because the shareholders do not have the same liquidity for exiting.

This “discount factor” is hard to establish because private company transaction multiples are not public record. Only the advisors involved in a number of private SaaS deals can actually provide insight on this. SaaS Capital recently quoted 28%, other sources say 25%, and at Quiet Light we see around 30%. That is because smaller cap businesses ($5M to $20M) have more perceived risk than mid-market businesses ($20M to $100M).

Before we adjust the multiple based on company and industry-specific criteria, we discount the public multiple to get to an average private SaaS multiple. Right now, this places the average private SaaS multiple at 6.3X.

With the benchmark set, we can now make five core adjustments to get to an overall estimate for your SaaS business.

3. Adjust for Revenue Growth (Size-Relative)

Since revenue is the main benchmark for valuation, it makes sense that buyers care about top-line revenue growth.

SaaS businesses are allowed to run less profitability than other business models—provided they post faster revenue growth and earn profits in the future. Because of this, a SaaS business’s year-over-year revenue growth rates are of huge importance to the overall valuation. In fact, a SaaS company’s historical growth rate is the single biggest driver of the valuation multiple. This is because high revenue growth is predictive of greater cashflow coming to the business on a faster time horizon, both of which investors will pay a premium for.

As with all valuation factors, the question becomes, “What’s a good number for my business?”

To answer this, we have to look at revenue growth in context of your business size. It’s much easier for a business with $1M ARR to grow at 50% YoY than it is for one with $500M ARR.

Because of that, we need to benchmark the revenue growth rate relative to company size. Generally speaking, the smaller the business, the faster it is expected to grow.

SaaS Capital has a very useful benchmark for businesses at different size levels. At $1M to $3M ARR, a 50% growth rate is considered average. At $3M to $10M, it’s 40%, and at $10M to $20M, 30% is average. It’s worth noting that this is only a small group of companies benchmarked (private company SaaS data is notoriously hard to find), but these are a good benchmark.

With a size-level benchmark, you can then adjust the multiple based on your comparative YoY revenue growth. If you’re above the median growth for your size, then you merit a premium; if you’re below the median, it warrants a discount.

It’s important to note that the discount factor for falling below the average sets in quickly and steeply. But the premium for being above average is slower and then more exponential.

For example, if the average for your group is 50% and yours is at 30%, you can probably expect a 2X discount. If it’s 70%, it might be a 1 to 1.5X premium. However, if it’s 100%+ (i.e., unicorn territory), then you could be looking at a 3X to 4X premium, depending on how your competitors are faring.

Revenue growth rate is always analyzed in the context of its quality, of course. LTV, Plan ARPUs, and churn all need to be stabilized or improving. Nonetheless, this is an important factor in the valuation. It’s also helpful for strategically timing when to go to market.

4. Adjust for Market Size

Next, adjust for the total value of the addressable market (TAM). When valuing a SaaS business, buyers want to get a sense of how big the market is. This helps them see how much room there is to grow and how big the business could become over time.

Analyze this market size in the context of your competition and your company’s role in the space. A $3 billion-dollar blue-ocean market with a small number of players is worth more than a $10 billion-dollar one with dozens of competitors.

As a rule of thumb, a TAM of $1 billion or more is considered ideal, with a premium for businesses that have clear leadership in the space.

5. Adjust for Churn

The next factor to adjust for is revenue churn. This is, of course, one of the most crucial metrics when it comes to evaluating any SaaS business.

Churn affects all the key factors that influence SaaS cash flow. Lower churn increases revenue growth rate, improves unit economics, and increases profitability. Most importantly, it improves revenue predictability, reducing perceived risk in the eyes of a buyer. Crucially, churn is also cumulative, so small changes in churn have a significant impact over time. A 2% change in monthly churn compounds to a 14% change on an annual basis. The impact on valuation can be just as large over a long enough time period.

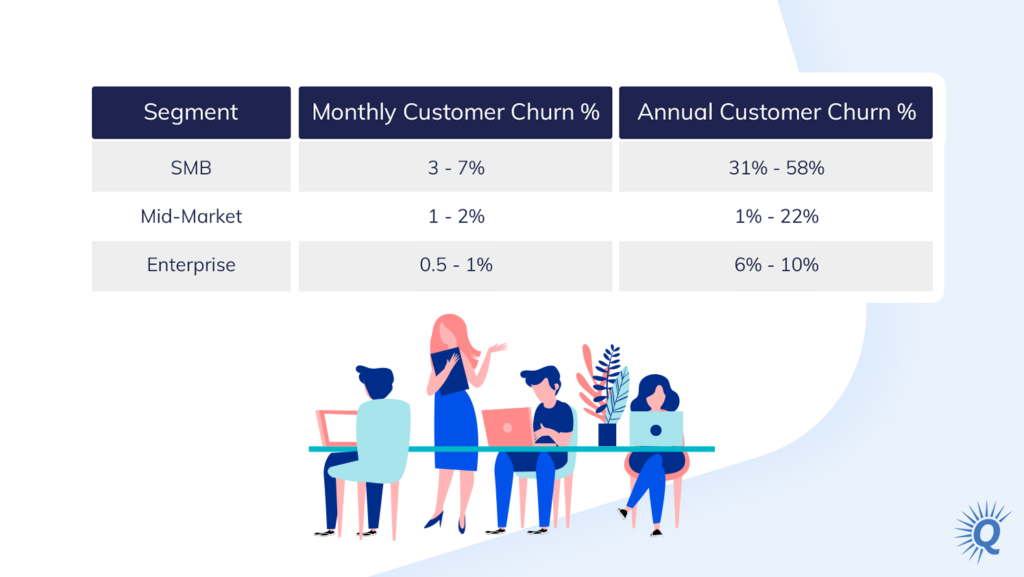

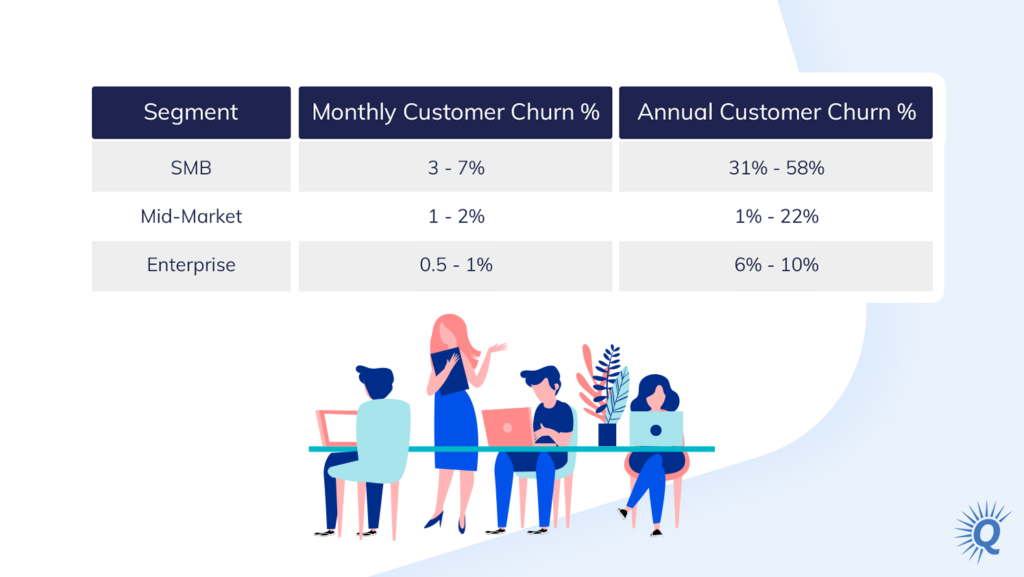

Like revenue growth, churn is assessed in a relative context, but not to the size of the company. Instead, we look at churn against the customer segment (Consumer, SMB, Enterprise) and its average contract value.

Enterprise SaaS businesses experience markedly lower churn rates than SMB because enterprise clients make purchasing decisions much less frequently, signing multi-year service-agreements. The downside is that their tendering process can take months or years, which requires significant sales resources for the SaaS business.

SMB SaaS businesses see higher monthly churn because their end users go out of business at a higher rate. That means they are switching/purchase decisions faster, and therefore can churn more quickly. The smaller the business, the more acute this becomes. For example, SaaS apps for Shopify or Amazon FBA Sellers have relatively high churn versus project management tools for small businesses.

Tom Tunguz, an expert on SaaS churn, observes the below standards for SaaS businesses depending on their customer segment:

Source: SaaS Innovator’s Dilemma

Churn is sensitive to revenue and cash flow. That means its adjustment factor to the valuation is similar to revenue growth. A relatively high churn will affect the multiple quickly, a lower one will see a modest increase, and a very low one will see an exponential improvement.

6. Adjust for Revenue Mix + Gross Margin

The next adjustment is the SaaS business’s mix of license-revenue (recurring software fees) to service-revenue (one-time onboarding, maintenance, upgrade revenue). SaaS models come in varying shapes for core, over-the-top services.

Since license revenue is recurring and higher margin, it’s much more valuable than one-time service revenues. Generally speaking, this is priced into the public market SaaS multiple with an assumed 80:20 mix of license fees to service revenues. If the business earns less than 70% of its revenue from license fees, it’s not considered as truly SaaS and will be discounted as such.

Where this predominantly factors in, though, is in the overall gross margin of the business. With an assumed 80:20 mix of license to service revenue, the average gross margin for a SaaS business is around 75% -80%. If the business earns below this, it’s usually because there is a higher mix of service revenue—or it is an irregularly expensive software to provide to end users.

Either way, this reduces the future cash flows of the business. That means there’s cause for discounting the valuation (or increasing it if there is a very high license fee mix / gross margin profile). Buyers look closely at gross margin because it determines how much cash can be reinvested back into sales, marketing, and product development. This is a barometer for the business’s overall generative capacity.

To calculate gross margin, we need to assign:

- Professional service costs

- Hosting and personnel costs

- Customer support

- Customer success

- Any other direct costs with delivering the services.

If we’re benchmarking for a 75% to 80% gross margin, we can see a premium to the multiple set in at the 85%+ level. A discount sets in anywhere below 75%.

7. Adjust for Profitability

The last factor to adjust for is business profitability While it’s expected that SaaS businesses will have a lower run-rate profit margin than other business models, buyers see more value in a consistently profitable and fast-growing SaaS business.

We see this largely coming into play with slower-growing SaaS businesses. If the company scales slower than its peers, it can offset slow growth with stronger profitability.

A common valuation rule of thumb in SaaS is “The Rule of 40,” which says that a SaaS company’s annual revenue growth rate + EBITDA margin should be equal to or greater than 40%. If you’re not profitable, you need to grow revenue at >40% a year. If you’re slower, then you need to be profitable. Of course, if you’re profitable and growing fast, you’re in excellent valuation territory.

The Rule of 40 helps us look at operating profit and revenue in context. That’s possible in two scenarios:

- If revenue grows >40% per year, any EBITDA margin >10% is a premium. There’s no major impact if the margin is between 0% to 10%.

- If revenue is <40% per year, any EBITDA margin >15% offsets low revenue growth.

Sell My SaaS Business: Overview of the Valuation Process

After these seven steps, you have a series of adjustments to place a SaaS business within a multiple bracket. This is accurate to a range of within 20% to 30%.

Remember, these are just seven major considerations. There are other nuances, such as:

- Overall company size (larger gets a premium)

- Geographic revenue diversity

- Age of the business (older gets a premium)

- Market position (leader, follower, or middle of the pack?)

- Uniqueness of IP

- Quality of the development team

- Product lifecycle (where in the cycle? New, old?)

- Customer payback period

- Conversion metrics in the funnel

- Revenue per employee

You must communicate your story in a captivating way to the market to successfully sell your SaaS business. There are more selling points to a SaaS business than its revenue growth and market size, but this guide is intended as a jumping-off point to get you started. Now you understand the valuation process and which factors influence your multiple, let’s look at how to scale your business. The key is to do this in a way that not only improves top- and bottom-line revenue, but that will increase your multiple more quickly. This is what I think of as “value-centric” scaling.

Increasing Value As You Scale Your SaaS Business

Whether you’re looking at a SaaS business on an SDE or Revenue multiple basis, increasing the top line and the bottom line will increase your overall valuation. But not all growth is equal for SaaS. Some strategies are more valuable to buyers than others because they strengthen your business profile.

For example, it’s beneficial to grow trial users and subscribers through an existing channel that is beneficial. But increasing these numbers simultaneously with a complementary channel, like paid ads, diversifies the business’s customer acquisition channels. This makes the business more valuable to buyers. While both options create the same top-line growth, they have a different effect on the multiple.

If a SaaS business earns anywhere from $0K to $10M in ARR, you can leverage a handful of strategies to potentially boost your multiple.

In this section, we will explore three high-leverage growth strategies for the lite-SaaS stage ($0 to $1M ARR) to increase your revenue and multiple. Then we will touch on scaling strategies for brands in the company-SaaS phase ($1M to $5M ARR), where businesses need to think out of the box to continue growing.

From $0 To $1M ARR: How To Increase the Value of Your SaaS Business

After assisting with 20+ SaaS exits, I believe that the three most powerful growth strategies you should explore as you go from “lite-SaaS” to “company-SaaS” are:

- Reducing Churn

- Outsourcing Development

- Going Multi-Channel

Each of these affects the Four Pillars of Value. Because of that, these three strategies also affect your valuation multiple as a “life-SaaS” business.

Specifically, each of these strategies influences the Growth, Transferability, and Risk growth pillars, respectively. Let’s dive into each.

Video: The Three Big SaaS Valuation Levers

In this video, Senior Quiet Light Business Advisor, David Newell goes into detail about key strategies to maximize the value of your SaaS business.

Reducing Churn in Your SaaS Company

Churn is a very important driver for company value. It affects other key factors that influence cash flow. But most importantly, it improves revenue predictability, reducing perceived risk in the eyes of a buyer.

It’s easier to reduce churn from 15% to 12% than it is from 5% to 2%. That means the benefits are exponential.

Churn is the bane of every SaaS business owner. It’s one of the hardest problems to solve because so many interrelated factors influence your churn rate. But that means it’s one of the most valuable problems SaaS business owners can solve.

In the lite-SaaS phase, a higher churn rate is expected. The business has fewer financial resources to reduce churn., In many cases, lite-SaaS businesses target an SME customer demographic, which churns more readily than large/enterprise-level customers.

You would expect to see a monthly churn of 3% to 7% for smaller B2B SaaS apps, and an equivalent churn of 1% for larger and enterprise-facing SaaS apps.

You want to be on the right side of the churn equation. This creates incredible long-term value for your business and pays off right away in the form of a better multiple. The question is: how do you overcome churn?

Based on your exit time horizon, you can implement short-, medium-, or long-term strategies to improve your churn rate.

Short-term strategies

In the near term (3 to 6 months), the most effective strategies are:

1. Optimize your failed payments and rebill churn using a tool like Profitwell’s Retain

The usefulness of this depends on your current level of delinquency churn. But, as a default, you should use a service like this to capture any lost revenue.

2. Remove self-serve cancellation

A lot of founders are put-off by the idea of making cancellation harder, but it’s something your customers might end up thanking you for. If you don’t know why customers cancel, how can you improve your product?

It may be the case that customers cancel because they don’t know what your product can do. In that case, a simple support conversation can rescue the customer and provide invaluable insight to front-end optimization. For a great case study, read about Josh Pigford’s experience at BareMetrics.

Medium-term strategies

In the medium term (6 to 12 months), consider adopting these two strategies:

1. Collect feedback from canceled customers to inform strategy

If you’re not collecting quality exit-survey data from churning customers, you’re losing valuable insights. These are essential to optimize your onboarding process (and, more often than not, it’s actually the root of most cancellations in the first place).

You need to have a dedicated onboarding/customer success infrastructure. This is the most effective way to reduce churn in the long-term. You may not have resources for customer success right now, but you should collect insights now to inform your strategy later. Software like LessChurn is effective for gathering these insights. It can even help you make the requisite changes to the product, onboarding, or customer success protocols you have in place.

2. Poll customers and ship requested features

Depending on the nature of your exit-poll feedback and your current support-ticket dialogue, it might make sense to explore a tactical shipment of high-requested features. It’s also useful for identifying missing or unrefined features that cause customers to churn.

This also pays dividends for your sales narrative when you go to market. Buyers are wary of founders who stop product development 12 to 18 months before going to market. That leaves buyers with an aging app and potentially a discontent customer base. This is one of the main reasons buyers ask for support ticket data: they want to see what customers are saying. Ship a few highly-requested features six to 12 months ahead of listing. This is often a major win for your investment story.

Long-term strategies

Over the longer term (12+ months), the most effective strategies are typically overhauling onboarding with step-by-step walkthroughs, video, follow-up sequences, and, wherever possible, improving customer success with the product with webinars, live chat, HelpDesks, and email education. Many of which you see are the day-to-day activities of larger SaaS businesses pursuing this form of customer retention through success.

How Do You Outsource Development for Your SaaS Business?

Many SaaS apps start with the founder as the main developer. When these apps find product-market fit early on, the owner still might be the main point of contact for development, even several years after founding.

This is fine during operation, but it creates a major problem when you want to sell. The key-man risk associated with the business is very high, presenting buyers with a major transferability issue (a key valuation pillar). This translates into a discounted multiple, an earnout offer structure (to de-risk the deal), or a very extended transition and training period. None of which is particularly ideal for the owner.

Instead, outsource development as fast as possible. A third party may seem like an additional expense, but the corresponding uplift in your multiple can be anywhere from 0.25X to 0.75X. Even with low earnings, the benefits of outsourcing stack up quickly.

But if your goal is to ultimately scale the business to a company-SaaS for exit, then this is a must. Investors in larger exits absolutely expect this to be the case.

Hiring platforms like TopTal or CodeMentor are good sources for development contractors. A smart, de-risked way to bring in a third-party developer (contractor or employee) is to have them learn the codebase and document it at the same time (code architecture map, annotations, etc). This not only establishes their understanding of the code but also improves the overall saleability of the business. Thanks to a fully-documented codebase, the buyer can review during due diligence.

Start this process at least six to nine months before coming to sale, at a minimum. However, you can see benefits as late as three months before a sale, as long as the developer is onboarded correctly. In a best-case scenario, you want to demonstrate to a buyer that the developer has worked for you for a long period of time and had experience shipping major developments with the software.

If you’re still the primary developer on your app, outsourcing yourself out of this part of the business is the most effective thing you can do to lift your multiple.

Going Multi-Channel in Your SaaS Business

It’s very common for early SaaS businesses to build a customer base from organic acquisition sources. Typically customers begin with friends and colleagues, a Product Hunt launch, guest blogging, top 10 lists, podcasts, etc. Usually, Google organic search is a main source of traffic for trials and subscriptions. That’s good, but it also means the business is 100% dependent on one source to acquire customers. A fall in the SERPs can have a big impact on traffic, trials, and customers, leaving the business vulnerable.

SaaS business owners are product people, not marketing people. The thought of diversifying into paid marketing, affiliate relationships, or cold outreach isn’t appealing. Even so, these strategies are valuable levers for the business. Investors are always thinking about risk and diversification, so a SaaS business with diverse customer acquisition channels is significantly more valuable than one with a single channel.

In addition to a revenue increase and earnings expansion, diversified businesses can see a multiple uplift anywhere from 0.25X to 1.00X. This depends on the percent of customers coming from other channels, as well as the business’s overall marketing mix.

These three value-centric scaling approaches will take your SaaS business from $0 to $1M in ARR. Once you’ve reached seven figures of ARR, the challenges change from early structural fixes to increasing customer volume for your customer acquisition funnels.

At this point, the right funnel optimization strategy depends on your business. This guide won’t dive deeply into these strategies, but in my experience, I recommend cold/outbound marketing strategies, integrations marketing, and pricing model updates.

Now that the business has grown enough for you to consider an exit, there’s one last step to take before you go to market. You need to evaluate the business’s “saleability.”

Sell My SaaS Business: How to Improve ‘Saleability’

A successful sale relies on more than just having a valuable business. You need to have a business that’s sellable to a buyer. In the world of business brokerage, we call this the business’s “saleability.”

The difference between value and saleability is that value is how much the business is theoretically worth, and saleability is whether it can realize that value in the market. For example, if a business has no accounts and poor internal documentation, it won’t be able to complete due diligence or justify its valuation in the market—no matter how good it appears to be.

The more valuable a business, the more intense buyers’ scrutiny. There is more value at risk here, so your business must have more saleability the larger the deal is.

The best way to improve your business’s saleability is to get its house-keeping in order, and way ahead of coming to market. One of the most common and costly mistakes founders make is wanting to come to market, but then realizing they don’t have enough information to make it through due diligence. This translates to a two to six month delay before you can come to market.

Saleability not only makes your business sellable, but it also increases your multiple.

Here are seven things you should have in place for your SaaS business before coming to market:

- Get Your Financials In Order

- Track Your SaaS Metrics

- Tax Returns & SBA

- Document Your Code Base

- Secure Your IP

- Ensure Security & Compliance is Faultless

- Establish A Product Roadmap

1. How to Sell My SaaS Business: Start Getting Your Financials In Order

You need at least three years’ worth of monthly profit and loss statements to value your business. Ideally, these should be prepared by a bookkeeper and housed in a standard accounting software like QuickBooks, Wave, or Xero.

Buyers will go through every line item for each month, so you need to accompany the P&L with:

- Monthly bank statements

- Merchant processor statements

- Credit card statements

- Monthly invoices

You would be surprised how many documents go missing in the course of running your business. Buyers intensely audit bank statements and credit card statements, and they need all line items reconciled.

This is why it’s a bad idea to mix personal expenses with your business accounts. It’s also the reason you shouldn’t mix business assets together, or share costs between them. It creates all sorts of assignment issues and ambiguity when you have to explain to your buyer.

Instead, set up one dedicated corporate entity to house your business financials. Keep personal expenses separate. Or, if you can’t keep them separate, make sure they’re low-cost and obvious (e.g., food, transportation, etc.).

If you want some more information on how to best set this up, check out our video and podcast here.

Track Your SaaS Business Metrics

SaaS businesses live and die by their customer metrics. The same is true when you’re selling a SaaS business. If you use a merchant processor like Stripe or BrainTree, then an over-the-top analytics software like BareMetrics, ProfitWell, and ChartMogul are key to quickly provide metrics to your buyers. Set up Google Analytics goals to show visitor-to-trial metrics. Link that to trial-to-conversion to give buyers a clear view of your funnel.

If you have a larger business, it might make sense to create a custom accounting dashboard to track your metrics. There are various SaaS CFO-type services that can set this up, like KPISense. This is beneficial because it adds third-party oversight, making it easier to prove your numbers quickly during due diligence.

Tax Returns & SBA for Your SaaS Business

Clean tax returns are necessary to improve your saleability and, in turn, your multiple. You need to have clean tax returns prepared for due diligence to make this happen.

Many buyers use a combination of cash and debt to finance the acquisition. Most of this debt comes from traditional banks, which require clean tax returns to permit financing. The most popular debt facility is an SBA loan. The SBA, or Small Business Administration, is a branch of the US government the supports small business activity. It underwrites loans to help buyers acquire businesses for up to $5M. This allows banks to offer very competitive, low-interest terms to buyers. To that end, the banks will only extend financing with clean tax returns. This is to prove the business is profitable and likely to repay the loan.

What does it mean to have “clean” tax returns? First of all, it must be for a US-based corporate entity. This entity can hold only one business (which means no mixing other business interests) and have relatively few personal expenses. The banks and SBA don’t participate in the adding back of expenses that we discussed in the SDE valuation section of this guide. Instead, they rely largely on the bottom-line net profit.

A word of caution: minimize personal expenses as much as possible. With too many personal expenses, you’ll reduce the business profit so much that the bank won’t be able to prove the business can cover its debts (also known as a debt cover ratio).

This is problematic for SaaS businesses. Personal expenses aside, operational expenses alone can run your profit down substantially, particularly as you scale. If you have a very profitable SaaS, you can optimize it for SBA eligibility by keeping it within its own corporate entity and avoiding large personal expenses.

You might wonder, “Is it worth the hassle or the higher tax payments on earnings?” For the most part, the answer is yes. SBA eligibility significantly increases buyer demand. That’s because they only need a 10% to 20% down payment on an SBA loan to buy a business. If you’re selling for $3M, for example, there are a lot more buyers with $300K in cash than there are with $3M in cash. Because there’s more demand, you can qualify for a higher multiple.

SBA loan deals do not come with any earnouts or holdbacks either. As the seller, that means you’ll receive between 90% to 100% of the deal value in cash at closing. That’s definitely a strong incentive!

In practice, it’s not common for SaaS businesses to become SBA eligible. This is because of the operational expenses associated with scaling run the profits down below an acceptable debt/cover ratio for banks. But if you have a maturing or particularly profitable SaaS business, SBA eligibility is a lucrative path. Remember, before coming to market, you need a minimum of two years of US tax returns to be SBA eligible.

If you want to learn more about the SBA loan process and eligibility, check out our podcast with one of the top lenders in the SBA space.

It’s generally good practice to have clean tax returns for your business, no matter your SBA eligibility. Clean documentation maximizes demand when you go to market and improve your chance of successful due diligence.

Why Is It Important to Document Your Codebase?

Most SaaS businesses begin by bootstrapping with code created by their founders. Unfortunately, as the business scales, code documentation is often an afterthought.

This is problematic when you want to exit because no one else can quickly understand your codebase. You end up in a situation where nobody knows the codebase better than you. That means a buyer can’t quickly understand the code architecture or map its progression. This puts a lot of buyers off entirely, slows due diligence, or requires a substantial transition period post-sale—none of which is great for you. The flip side is also true: a well-documented code base encourages buyers, rapidly speeds up the time to close, and significantly reduces the transition period.

Create detailed documentation for your codebase before you come to market. If you don’t want to do this yourself, hire a developer and have them learn the code while they document it. This removes you as a key-man risk to the business, reduces your workload, and outsources development, which increases your value.

So, how do you document your codebase? See here and here.

Secure Your Intellectual Property

Once a buyer is comfortable with the codebase, they’ll want to establish that your IP actually belongs to you. If you’ve had third-party or contracted developers working on the code, be sure to have IP assignments in place that assign ownership to you. This can be done retroactively, but it needs to happen before you go to market. If you have an in-house team, make sure their employment contracts stipulate this too, as the buyer will want to check them.

Aside from your codebase, registering trademarks, patents, and any other IP is an absolute must before going to market. Ensure nothing has expired or is currently in a contested situation (which will need to be disclosed).

Ensure Your Security and Compliance is Faultless

Once the buyer understands your code and verifies your IP, they want to ensure your business is safe and compliant. This is standard for things like encrypting user data and ensuring PCI compliance for credit card information. It also extends to any industry-specific regulations, like HIPAA for healthcare SaaS companies. If you fail in this area during due diligence, it’s often fatal to a deal. Ensure your security is faultless before you come to market.

Establish A Product Roadmap

You can also boost your saleability by providing a 12 to 18 month roadmap for your buyer. This might seem like an unusual level of foresight to give to a new owner, but remember that nobody knows your business better than you. Experienced buyers will appreciate your insight.

A product framework is a compelling way to paint a picture of future growth to your buyers. More often than not, this gives buyers greater confidence to execute on the business. That means many investors would be willing to pay a higher multiple. Conversely, if you have no ideas or input on how to grow the product, that leaves buyers confused and uncertain. That doesn’t give buyers the confidence they need to buy your business at a premium multiple.

Thanks to this guide, you should now have a highly valuable business that’s also highly sellable. It’s now time to go to market to get the best valuation. But how do you make that happen?

Why Hire an Advisor to Help Sell Your SaaS Business?

If you already know what SaaS buyers are out there, what they are looking for, and how to value your business, you might think, “Why should I hire an advisor to sell my business?”

This is a great question. And it’s one you should absolutely ask before appointing any advisor. There are many good reasons to consider professional representation for the sale of your business. Consider these nine benefits that an advisor brings to the table for your SaaS sale:

More Demand = Greater Value

Hiring an advisor means you get access to their list of vetted, pre-qualified buyers. These buyers trust that broker to bring good deals. That means you get priority attention over direct-sale opportunities. A well-established advisor should have good relationships with their buyers, know what each is looking for and how to position your business.

If you’re already at the table with a potential offer in the wings, working with an advisor will bring more demand to the table and get a better result. Advisor fees vary from 5% to 10% of the transaction value (sliding down as the business value goes upwards), and if they can’t get you a higher result to make up for their fee, then you shouldn’t hire them at all.

Sell Your Best Story

You need a good story to market your SaaS business. First, your story should give buyers confidence in your business’s strong track record. Second, your story should paint a picture of growth and the business’s potential success. Simply put, the better the story, the better the multiple.

Most founders are experts in growing their businesses, but not at marketing their story to others. When you spend 20 to 60 hours a week on your business, it can be difficult to have an objective, high-level understanding of its strengths and weaknesses through the eyes of a potential buyer.

Advisors create this picture for you, creating a compelling investment story that attracts a lot of buyers. A great business with a terribly written investment story will either fail to sell, or sell under market value. This is why you should always review the advisor’s sales and marketing materials before you hire them. Detailed, well-written, and compelling marketing materials make a huge difference to the sale process.

Increase Your Value Before You Go To Market

Every business is different. You’re going to have different opportunities and threats than the other SaaS businesses in your niche. The sellers that achieve the best exits are those that speak with advisors several months or even years before they sell. This gives your advisor time to give you plenty of exit-planning advice, ensuring you’re poised for a higher multiple once you do eventually exit. If you exit plan too late, it means you leave value on the table during your sale.

As we often say at Quiet Light, the right time to prepare to go to market is right now.

Negotiating The Best Terms

Negotiating the sale of a business is much like negotiating the sale of anything else: it works best if you’re prepared and if you don’t get emotionally invested. If you have two offers from private equity and two from strategics, how do you compare them? What constitutes a “good” offer? What terms are standard and what should you be wary of? What is the right mechanism for an earnout? A holdback? An equity rollover? How much cash is acceptable upfront?

Your advisor has gone through hundreds of deals before this. They will know what is and what isn’t acceptable, what’s standard, what is advantageous, and what could cause problems. Accepting a deal with a great headline multiple can turn into a real headache if the structure of the deal works against you.

On the topic of headaches, negotiation can be an emotional rollercoaster. Try to be as objective as you can. Negotiating the value of your hard work, and determining the future of your employees, is emotional. A neutral, independent advisor is helpful support that keeps you sane during this emotional time.

What Are You Actually Worth?

In the valuation section of this guide, we talked about the different valuation methodologies for SaaS and the drivers that move a business along each spectrum. Each driver, whether it’s growth, churn, channel diversity, or gross margins, was compared in its relative context to other businesses. That means you need to have data points for similar companies.

In short, you can’t value a business accurately in isolation. You can get in the vicinity, but “in the vicinity” could leave tens or hundreds of thousands of dollars on the table. Working with an advisor means your business is benchmarked against their previous sales data—which means your valuation is accurate and reliable.

For example, Quiet Light’s twelve-month average listing to sale price was 95%. That means the average business sold within 5% of its asking price. Then 33% of all businesses listed sold at their exact asking price. Partnering with an advisor assures you that your business isn’t undervalued.

Navigating Due Diligence

After receiving and accepting an offer on your business, you move onto due diligence. This process can last anywhere from 14 to 60 days, depending on the complexity of the transaction. Naturally, a lot of investigation and discovery takes place during this time. It’s not uncommon for the buyer to find unexpected things that cause them to doubt or discount the deal. Some buyers will overemphasize the importance of some findings to negotiate a discount on the deal. Private equity buyers, in particular, are prone to this.

The question then becomes, how do you determine if it’s an embellishment or a legitimate reason to discount? You need an advisor that’s been through dozens of due diligence processes to defend your interests, navigate issues, and ensure the deal closes successfully. This is a key differentiator between advisor-led and self-led deal processes. Not only is the success rate much higher for advisor-led deals, but the delta between offer terms to closing terms is substantially smaller. The majority of advisor-led deals have little to no changes in terms because of the quality of preparation beforehand, combined with the advisor’s expertise.

Information Containment

Once you decide to sell your business, the last people to know are usually a) your customers, b) your employees, and c) your competitors. Using an advisor means your sale process and confidential business information is safeguarded with non-disclosure agreements, pre-vetted buyers, and the controlled dissemination of information.

Another consideration here deciding what information to show and what not to show prospective buyers. This is always more of an art than a science because buyers need to know a certain amount of information to put together a compelling offer. But they often ask for more if they can get away with it. An experienced advisor safeguards the flow of information and defends you from leaking sensitive information into the wrong hands.

Avoid Emotional Fatigue (Partially)