Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

The Ultimate Guide to Buying, Valuing and Selling Amazon Businesses

If you are reading this, it likely means you have successfully started an Amazon business and want to know what it takes to sell it. Or you are in the process of launching and want to know if it’s a sellable asset. On average, 50% of the value Amazon sellers will ever get from their business comes at exit.

Creating a successful business on Amazon isn’t easy. If you’re an entrepreneur who has chosen to blaze your own path, you should be very proud of the hard work, dedication, and skill that has gone into the asset you’ve created. Regardless of its size, there’s something very powerful about launching and selling your own business.

On the other hand, maybe you’re considering buying a profitable Amazon business. After all, the Amazon marketplace is booming, with the company’s revenue topping $280 billion in 2019. Purchasing the right online business can be a great way to substantially increase your income and generate a high ROI.

In either case, there’s a multitude of questions that inevitably pop up along the road to buying or selling. In order to help you make the most informed decisions, we’ve drawn from our years of industry experience to create this ultimate guide for navigating the exciting marketplace for Amazon businesses.

We’ve broken this subject up into the most important topics that our clients consistently ask us about. Through this guide, we’ve sought to provide a thorough and detailed outline of the possibilities that lay before you.

Who Buys Amazon Businesses?

As Amazon continues to grow, entrepreneurs and investors have realized just how lucrative the marketplace really is.

Starting a new business from scratch is difficult, risky, time-consuming, and has no guarantee of success. Therefore, there are always businesspeople actively seeking to buy established Amazon businesses. In fact, there are generally more buyers than sellers in the market at any given time.

If you’re planning to sell your Amazon FBA business, you might be wondering what kind of buyer might be interested in your specific business. Of course, each business is unique and offers a different set of challenges and benefits. Additionally, as a seller, it’s important to consider what type of buyer you want to sell to since different buyers lead to different selling experiences and outcomes. Your own personal goals will largely determine what kind of buyer is best for you and your business

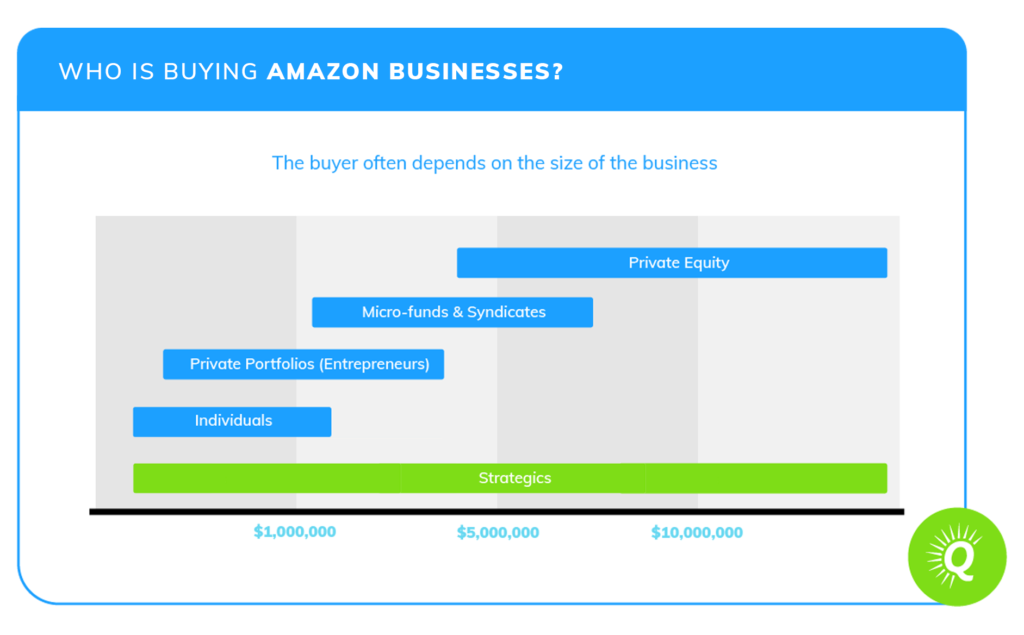

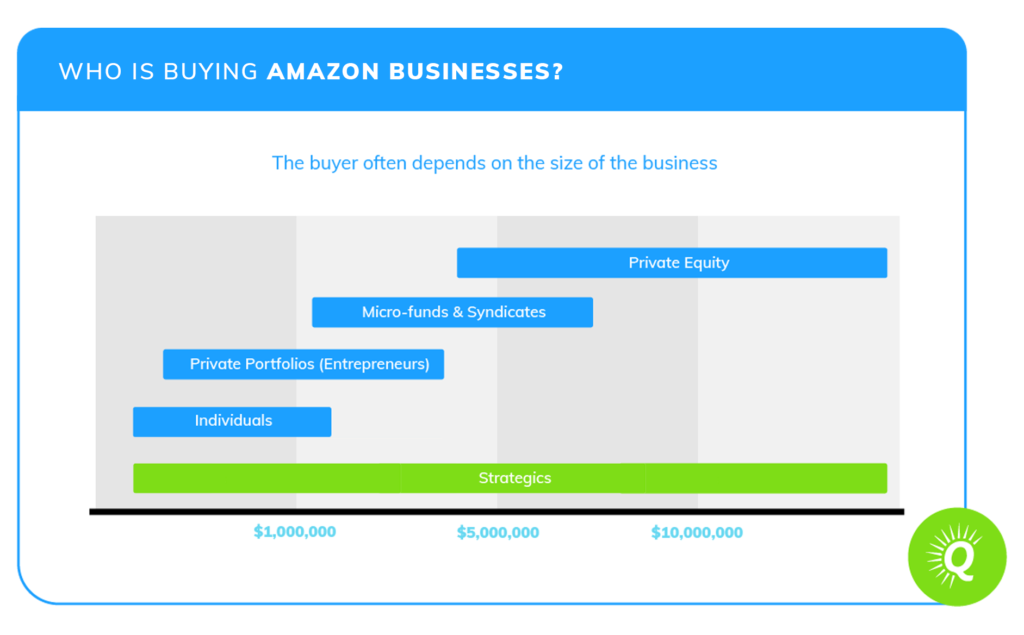

In general, most buyers can be broken down into four categories:

- Private Equity

- Microfunds and Syndicates

- Private Portfolios

- Individuals

- Strategic and Investment Buyers

Also, any of these buyers can fall into the categories of strategic or investment buyers. Below, we’ll describe each of these in detail.

Private Equity

Private equity generally refers to investment funds dedicated to buying, growing, and selling private companies. They’re usually set up as limited partnerships and focus on “flipping” the businesses they buy.

Private equity deals generally share a few characteristics:

- The deal size is usually more than $10 million, but can sometimes be in the $2.5 million range.

- Their goal is typically to buy, grow, and sell privately held businesses.

- The seller generally maintains some equity in the business after the sale.

- The seller usually still has responsibilities in the business after the sale.

Since the seller maintains some equity, it’s important that they have confidence in the private equity firm’s ability to successfully grow the business.

Your business’s value is the first indicator of whether or not a private equity firm will be interested in buying it. If your business’s worth is less than $2.5 million, it’s unlikely that you’ll be dealing with a private equity buyer.

If your business is worth several million dollars, then you may have the opportunity to sell your business while still experiencing the benefits of its future growth potential.

Often, when a private equity firm buys your business, they’ll want you to stay on as a partner to help manage its continued growth. This means that your deal structure will allow you to maintain some equity in your business at closing.

While some sellers prefer to receive all of their funds upfront, maintaining equity in your business allows you to enjoy a second payday (double dip) when the private equity firm sells off the business.

While there are some great benefits of selling to a private equity firm, there is also a risk. What if your business declines under their new ownership? If that happens, you’re likely going to take a loss, since you’re still a shareholder. Therefore, if you receive an offer from a private equity firm, be sure to do your research before deciding that they can be trusted to successfully grow your business.

Microfunds and Syndicates

Microfunds and syndicates can be thought of as mini private equity funds. While there are some similarities, there are also some key differences.

- Deal size is typically lower, usually occurring in the $1 million to $5 million range.

- Clear transactions (seller receives most of their value at closing).

Microfunds and syndicates generally have the same goal as private equity firms—to buy, grow, and then sell privately held businesses. However, they’re generally not as well capitalized as private equity firms. Therefore, they’re usually shopping for businesses that fall below $5 million.

Additionally, unlike deals involving private equity firms, sellers typically receive most or all of their value at closing. This means the seller doesn’t need to risk losing out if the business declines. However, it also means that the seller doesn’t have the possibility to “double-dip” if the new owner successfully multiplies and sells the business.

Private Portfolios (entrepreneurs)

There are a number of common characteristics of private portfolios and the deals they participate in:

- Private portfolios are generally owned by individuals.

- Deal sizes can vary, but they’re typically around $1 million or less.

- Often, private portfolio buyers use an SBA loan.

- Deals usually close relatively quickly.

- The seller usually gets most of their value at closing.

Private portfolios typically refer to individuals who own multiple businesses. Unlike most of the buyers we talked about above, deals with private portfolios often involve SBA financing.

While there are some great benefits for both the buyer and seller in SBA deals, there are also some guidelines that deals must adhere to. For an in-depth discussion of SBA financing, be sure to check out our podcast episode Using SBA Loans to Buy and Sell Ecommerce Businesses with Stephen Speer.

Because private portfolios involve fewer people, transactions generally happen relatively quickly. Also, entrepreneurs who create portfolios of businesses typically shop in the $1 million price range, although there can certainly be substantial variance.

Lastly, when selling to a private portfolio, the seller is often able to receive most of their value at closing. Obviously, this is very appealing to most sellers.

Individuals

There are many individuals interested in buying online businesses. Some common characteristics of deals with individuals include:

Unlike private portfolios, these individuals are only seeking to purchase one business.

Often, individual buyers are C-Level executives who want more flexibility in their work-life.

These deals can be up to $5 million but generally fall below $2.5 million.

There are plenty of successful individuals interested in purchasing online businesses for the same reason you may have started yours—freedom, flexibility, and the opportunity to try something new. Even without prior online business experience, many buyers are able to succeed by finding the right business.

The main difference between private portfolios and individuals is the number of companies they’re seeking to acquire. While private portfolios buy multiple businesses (by definition), individuals are generally in the market for a single business.

There is certainly a range of price points for individual buyers, but most of these deals occur below the $5 million mark, and many are under $2.5 million. Like with private portfolios, transactions involving individuals typically happen pretty quickly and often involve SBA financing.

Strategic and Investment Buyers

Most buyers can be classified as either a strategic or investment buyer.

Strategic buyers are those for whom the business will help to achieve a specific strategy. For example, if you’re selling a pet supplies business and the buyer owns a pet food company, then they might be able to use each business to grow the other by leveraging resources and cross-selling to each business’s existing customers.

Because strategic buyers can generally experience rapid growth after acquiring a new business, sellers can sometimes land very lucrative deals with these buyers.

While many sellers seem to have the notion that strategic acquisitions are commonplace, they actually make up a small minority of all business acquisition transactions.

Investment buyers typically buy businesses independent of other businesses. In other words, they buy businesses ‘as-is’ and don’t have a strategy to leverage another business’s assets to help it grow.

Because investment buyers don’t have a unique advantage for growing the business, they generally pay close attention to its current performance and trends.

Below, we’ve included a visual diagram to show the range of deal sizes that each kind of buyer engages in.

What Kind Of Buyer Is Right For You?

Finding the right buyer all starts with gaining clarity on what your goals are.

Do you want to make a “clean break” from your business or are you interested in being involved in its management and growth? Do you want the vast majority of capital upfront, or do you want to continue being a shareholder in the hopes of profiting from its future growth?

The attractiveness of each buyer and offer is unique to what you’re seeking to accomplish. Therefore, choosing the right buyer is as much of a personal decision as it is a business decision.

Now that we’ve discussed the buyer landscape, it’s time to turn out attention to the first step in the selling process — valuing your business.

How to Value an Amazon Business

Like all internet-based businesses, there are many factors that impact the value of an Amazon business. However, the most crucial variable is the trailing 12 months of Seller’s Discretionary Earnings (SDE), since Amazon businesses are valued using an earnings-based multiplier rather than a revenue-based multiplier. In short, SDE is the money that is left for the owner after all core business expenses have been paid.

Getting the SDE number right is critical to the entire process of selling your Amazon business.

If you (we) report an inaccurate SDE number, your business may be listed at a price that doesn’t reflect its true value. This means that you will either undervalue your business and leave money on the table, or overcharge your buyer. If the latter occurs, the error will likely be discovered in Due Diligence and the deal will be renegotiated or fall apart altogether.

While the SDE is a concrete number derived from your financial statements, the multiple is determined by a variety of factors, some of which are more qualitative. Each of these affects one of the Four Pillars of Value (more on this below).

After you establish the correct SDE and the multiple, you multiply the two numbers together to determine the value of the business.

Factors that Impact the Multiple

There are a wide variety of factors that could impact your multiple, including:

- Niche

- Age of the business

- Total revenue and SDE trends

- Growth opportunities inside and outside of Amazon

- Barriers to entry

- Competition

- Margins

- Account ratings and reviews

- Owner’s workload

- Transferability

- Number of staff or contractors needed

- Brand ownership

- Trademarks and patents

- Economic conditions

- Marketplace value trends

While these are some of the more common variables to consider, this is by no means a complete list of all the elements that may impact the value of your business. If you would like to review a deeper, in-depth analysis of determining the value range of a web-based business, consider reading The Ultimate Guide to Website Value by Mark Daoust here at Quiet Light.

The Four Pillars of Online Business Value

The Four Pillars of Value represent the four primary areas that determine the value of your business. During the valuation process, we’re going to look closely at each of these variables within your business:

- Growth

- Risk

- Transferability

- Documentation

Below, we’re going to explore each of these in more detail. For an infographic post dedicated to this topic, check out The Four Pillars of Value That Make Up A Valuable Website. Or, read this comprehensive guide to valuing websites, which includes a thorough discussion of The Four Pillars.

Growth

The most promising way to generate a high ROI on a new acquisition is through growth. Therefore, buyers will look closely at the current trends within your business as well as the opportunities it faces. If there’s a clear roadmap leading to increased earnings, buyers will be willing to pay more.

In general, the fastest ways to grow an eCommerce or Amazon business are:

- Add more products.

- Launch on more platforms (Walmart, Etsy, Ebay, etc.).

- Increase Advertising traffic.

- SEO investment with keywords, search terms, and A+ content.

Improving your existing business practices to increase efficiency is also an important consideration.

For many buyers, growth potential is the most important quality to look for when considering a business acquisition. Simply put, when someone is looking for an FBA business to purchase, they’re usually doing so with the intention of building it far beyond its current position in the market.

As an Amazon seller, there are many ways to position your business for significant growth (more on this below), and it all comes down to identifying untapped opportunities.

Some opportunities are those that exist within the operational framework of the business. Mismanaged advertising budgets and supply chain inefficiencies are just two examples of weaknesses that can be positioned as opportunities. In general, we recommend that Amazon sellers spend 10% of their gross revenue on ads for growth.

Amazon ads have changed more in 2020 than they did in every year preceding combined. There are more advertising techniques like bid up/down, real estate such as display and video ads and custom brand image sponsored brands. When you look at buying a business, if one of these areas is under tapped it’s a huge opportunity for growth.

As a seller, if you can identify a way to lower the shipping cost by 30%, that offers the new owner an easy way to grow the business. Of course, this results in a higher multiple.

Expanding to new channels or adding SKUs is another great opportunity for growth. If you’re only selling on the Amazon platform, be sure to point out the potential of selling through Shopify, social media, or other channels that you’re not yet utilizing. Often, it can be very easy to take an existing Amazon listing and re-create it on your own website.

The hottest channel to grow on in 2020 was Etsy. No one saw it coming. Some members of our team predict that Walmart will be 2021’s.

Additionally, consider doing some product research to identify growth opportunities with new product lines. More than likely, a new owner will want to understand what new products represent untapped potential. The magnitude of growth potential will significantly impact the value of your business.

Another important element to consider are the tools being used by your business.

Are the right tools in place in the business? Keyword and product research tools such as Helium 10 can change how growth is found. Do you know what your competitor sales are and what your market share is? Do you know how many keywords you index for in SEO? Do you have a tool to measure profit down to the sku level?

Risk

While buyers gravitate towards growth, they shy away from risk. Although smart buyers understand that every business carries a degree of risk, there is a wide range of riskiness that different businesses experience on the Amazon platform. Common risks include:

- Any single point of failure.

- Channel risk.

- Barriers to entry.

- Competition.

- Market and product stability.

Whenever there’s a single point of failure within your business, it will likely be considered relatively risky. For example, having just one Amazon listing is a recipe for quick decline — any negative changes in its ranking or the market spells trouble.

Another common area of risk is channel risk. If your business is dependent on Facebook ads for a majority of its sales, potential buyers will view it as less stable, since no-one really knows when Facebook is going to change its algorithm and render your campaigns ineffective.

Unsurprisingly, most buyers will look closely at your market to understand what competitors represent the greatest threat to your business. If you’re selling a generic, private label product and a multitude of other Amazon FBA seller accounts are popping up every other day with the same product, that might pose a risk to your business.

To a large extent, the competition in your market is closely related to the barriers to entry that exist. If you’re selling unique products that are difficult for another Amazon vendor to source or better yet, you have a trademark or patent, you’re in a defensible position with lower market risk.

Just as the potential for growth increases will increase the value of your Amazon FBA business, a high level of risk will lower its worth.

Transferability

Maybe, your Amazon business runs smoothly under your leadership. How easy would it be for another person to manage the beast you’ve built?

Transferability refers to the level of ease a new owner would experience running your business. Would a new owner be able to step into your shoes and be successful with about forty hours of training over the next thirty days? Or, would it be an endless headache for someone else taking over the helm.

There are a number of questions that will help you to determine how transferable your business is:

- Is your name or reputation attached to the business?

- Does the owner require a specialized skill or credential?

- What is the owner’s workload?

- Do you have well-trained staff who can run most or all aspects of the business?

- Do you have clear standard procedures that explain the operational processes within your business?

- Will your vendors and partners work with a new owner?

If your name or reputation is an important part of the business’s success, then you may have an issue when it comes to selling. For example, let’s say that you’re a physical therapist selling physical therapy equipment that is branded with your name and image.

Unless you can remove your personal identity from your business and have it still run successfully, a new owner will be very wary of buying it from you.

Additionally, if the owner of your business needs to have a specialized skill or credential, there are going to be significantly fewer buyers qualified to purchase from you. Even if someone loves your physical therapy products company, they may not be able to purchase it if they’re required to hold a physical therapy license to run it.

One of the great benefits of owning an Amazon FBA business is the potential for automation. If your business is highly systematized and requires very little time to manage, it’s likely that many buyers will be attracted to purchasing from you.

Instead of spending their time putting out fires and managing the daily operations, they’ll be able to focus on what entrepreneurs love most: growth!

Connected to the previous point, potential buyers are going to look at the team in place to handle the operations of your business. Without reliable staff who are well equipped to handle the responsibilities of your company, a new owner will likely be unable or uninterested in running the business.

For a smaller Amazon vendor that doesn’t have full-time staff, they may need to show that they have a reliable network of contractors able to fulfill the business’s operational practices.

Since each Amazon FBA business is unique, most buyers will want to have clear instructions about how the business is run. Therefore, it’s important to have clear standard operating procedures written down and easily accessible. Not only does this make it easier for a buyer to understand how to lead their new entity, but it also makes it much more simple to replace staff since the job roles are clearly defined.

Lastly, it’s important that your vendors and partners will be willing to work with the new owner. Since Amazon FBA businesses rely heavily on vendors to produce their products, this is essential. Obtaining your suppliers’ confirmation on this matter will instill confidence and increase the value of your business.

Documentation

Documentation is what allows potential buyers to really understand the asset they’re considering purchasing. Without organized and accurate documentation, you won’t be able to clearly communicate the state of your business or how to run it.

A few key questions to ask about the documentation within your business include:

- Are your financial statements clear and accurate?

- Can you produce accrual financial statements?

- Do you have clear standard operating procedures?

Your financial statements are what really tell the story of your business. Revenue trends, advertising costs, seasonality, and fluctuations in Costs of Goods Sold are just a few examples of the core metrics that ultimately determine the value of your business. Of course, knowing these numbers relies entirely on obtaining clear and accurate financial statements.

In addition to having full and complete financial statements, it’s important that you can produce accrual financial statements. Not only does accrual accounting provide more accurate information regarding your SDE, but it also allows you to identify key trends within your business.

We’re going to go into a lot more detail about preparing your accurate financial statements and accrual accounting in the following section. For now, let’s just say that this is a significant element in the valuation process.

Above, we talked about the importance of providing clear standard operating procedures that outline the roles and practices within your business. This falls under the pillar of documentation.

Even if an Amazon FBA business has low risks and high potential, its value will be decreased if it doesn’t have clear and reliable management procedures in place. You can think of your standard operating procedures as a blueprint for running your business. You probably wouldn’t try to build a house without a plan, and most owners will be wary of buying a business that doesn’t have effective documentation in place.

Not only does documentation provide clarity and guidance for a new owner, but it also instills confidence that the previous owner has been responsible and diligent.

No Two Amazon Businesses Are Alike

Although we apply the same valuation process on each business we look at, it is critically important to understand that no two Amazon businesses are alike when it comes to conducting a valuation.

A personal approach must be taken with each valuation. Together, the business owners and brokers have to work together to determine the value range of the Seller Account and overall business. This should never be a one-sided process. The value range has to work for the seller, the broker, and an eventual buyer. Otherwise, you are just listing your business for sale and not actually selling it.

Personal circumstances can also cause sellers to offer lower prices for the business. A divorce, new business opportunity, or purchasing a house can all create pressure to come up with quick cash. We’ve seen all sorts of reasons for varying multiples. Each valuation must be looked at individually based on all relevant factors to arrive at a valuation that lands in an acceptable range for potential buyers.

Now that we’ve discussed what determines your business’s value, let’s talk about what you can do to increase it…

How to Increase the Value of Your Amazon Business

Understanding how to increase each of the Four Pillars of Value is essential for helping you get maximum value when it’s time to sell. This blog post offers a detailed overview of the information discussed here.

Below, we’re going to discuss ways to increase the value of your Amazon FBA business.

Clean Up Your Financials

When it comes to increasing the value of your Amazon business, cleaning up your financials is one of the highest leverage tasks you can do.

Establishing clean and accurate financial statements is necessary for every other step along the path to selling, including the valuation. So, naturally, this is the first task in the process.

“Clean financials” may sound ominous, and they can be. For many entrepreneurs, the task of setting up an organized financial record-keeping system seems unnecessary in the beginning stages of their businesses.

More often than not, designing logos, products, and supply chains take front stage in the founder’s mind. There’s some rationale for this order of priorities, as financial management isn’t too relevant until there’s money to manage.

However, once your Amazon FBA business is up and running, recordkeeping has immense value. This is especially true when it comes time to sell.

A familiar conversation sometimes pops up when we start working with Amazon business owners.

Can I use only the Amazon reports as proof of income when selling my Amazon Business? Possibly.

Will it be more difficult? Yes.

Will I get maximum value? No. In many cases, not having proper financial records can make it impossible to sell.

For Amazon business owners that use QuickBooks, Xero, or another accounting software, congratulations. Your workload just got lighter. But for those who need to develop their P&L and other financial statements, don’t worry. We can help with that.

To be clear, when we say “clean financials,” this does not mean avoiding the write-offs that many self-employed individuals enjoy. Instead, it means being able to clearly identify total revenues, trends, gross profits, expenses, and ultimately the Seller’s Discretionary Earnings (SDE). As discussed above, SDE is a major determining factor of value when selling your Amazon FBA business.

What About My Salary and Other Personal Benefits?

In order to get maximum value when selling your Amazon business, you will want to show strong profits. However, expenses such as your salary, travel, amortization, and depreciation can substantially reduce the profit reported on your P&L statements.

To address this concern, your broker will develop an “Add Back Schedule” to show the true earnings for your Amazon Business after these expenses are “added back” to your business.

Basically, anything included on the Add Back Schedule doesn’t reduce your profit. The earnings you experience after accounting for add-backs is called Seller’s Discretionary Earnings (SDE).

Add-back examples include:

- Owner’s salary

- Personal meals and entertainment

- Travel

- Mobile phones

- Services you no longer use (and have not for 6+ months) that have had no impact on sales

- One-time expenses

- Auto expenses

- Charitable contributions

Add-backs are generally any expenses that don’t not carry forward to a new owner in the process of the sale. The best method for understanding what clean financials look like is to see an actual P&L in the proper format with an add-back schedule.

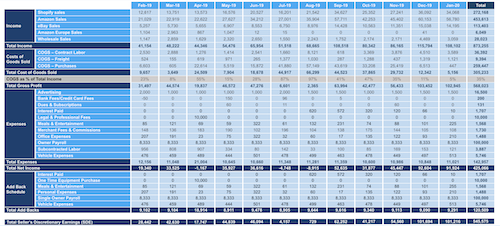

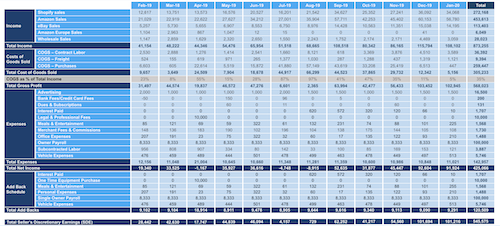

Here’s a glimpse of what a Quiet Light-presented P&L for an Amazon business looks like in full detail:

Notice that at the bottom of each column add-backs are added to the Net Income to determine the Total Seller Discretionary Earnings.

For example, in the column on the far right, you’ll see that the Net Income for the year is $245,829 and the Total Add Backs are $71,312. The Total Add Backs are added to the Net Income to arrive at an SDE of $317,141.

In the previous section, we discussed how a multiple is applied to the SDE to determine the value of the business. As mentioned, the multiple is based on a variety of factors including the business’s growth, risks, transferability, and documentation.

Let’s say that based on these variables we determine that your business is valued at a 2.5 to 3X multiple. This means that your business is worth 2.5 to 3 X the SDE.

In this example, we would multiply 2.5 X $317,141 to calculate the lower range of $792,852, and we would multiply 3 X $317,141 to calculate the upper range of $951,423.

So far, the value of your business is between $792,852 and $951,423.

In some cases, we add the cost inventory to this number to arrive at the list price. In other cases, this number is the list price, and the cost of inventory is added to it at the time of the sale.

Why It’s Important To Collect Sales Tax

The decision to collect and pay sales tax has the potential to help you access more buyers and increase the value of your business.

The question may come up from potential buyers, “are you collecting sales taxes and paying them?”

While collecting and paying sales tax may seem like a low-priority task in the beginning, it’s importance shouldn’t be overlooked. Not only does failing to adhere to tax laws create legal liability, but it can also lead to some serious challenges when it comes time to sell your business.

Failing to collect sales tax can:

- Distort your margins.

- Undermine your integrity as a seller.

- Create the perception of liability for a new owner.

All of these elements can cause potential buyers to be wary of your business, and can even lead to deals falling apart in the due diligence process. For a case study, read How Failing to Collect Sales Taxes Nearly Killed a Million Dollar Deal.

Luckily, there are some easy ways for Amazon sellers to create simple systems for collecting and paying sales taxes. TaxJar is one software that many sellers use.

Try to Sell During a Growth Period

In the previous section, we talked about the importance of growth during the valuation process. All else being equal, businesses that are experiencing rapid growth are significantly more valuable than those that are stagnant or declining.

If possible, it is best to sell your business during a period of growth.

During growth periods, buyers will be willing to pay a higher multiple because of the potential for the business to earn a higher SDE in the future than it is at the present time.

Of course, it’s not always easy to get the timing right. However, if you think ahead, you might be able to establish some growth strategies before it’s time to list your business.

Leave Some Low Hanging Fruit for the New Owner

Connected to the previous point, it’s always helpful if you can point out some easy ways for the new owner to grow the business.

For example, if you’re selling only on Amazon, perhaps consider holding off on implementing a Shopify strategy so there are some clear opportunities for potential buyers.

Of course, since SDE is a significant determining factor of the value of your business, it’s always a balance between maximizing your profit and leaving the untapped potential for the new owner.

Essentially, improving your SDE or any of the Four Pillars discussed above will help you to increase the value of your business. Each business is unique, so it’s important to evaluate what ‘value-adding’ steps are most appropriate for your specific Amazon business.

The Selling Process

Let’s start with one of the first questions that some Amazon sellers ask…

Is Selling Your Amazon Business Even Possible?

In most cases, the answer is yes.

Although the myth that Amazon accounts are “unsellable” has largely been dispelled, many owners have wondered about this over the years. The answer is yes, selling your Amazon Business is an acceptable and realistic option. We’ve seen it done many times over the years without any loss of reviews or ratings.

We contacted Amazon to specifically ask about transferring seller accounts and if it could be done. In reply, we got a resounding “yes”, along with instructions on how to do so.

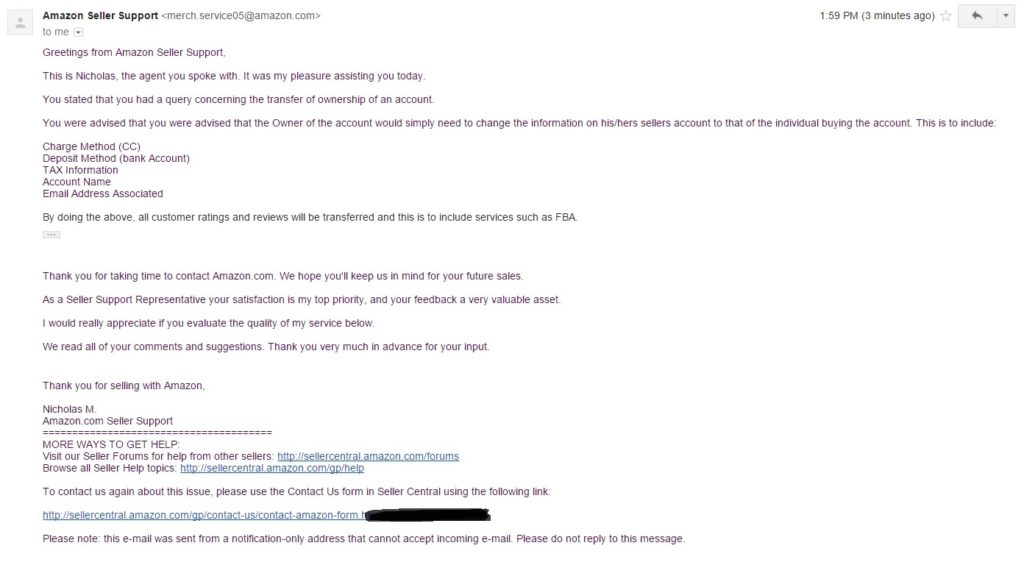

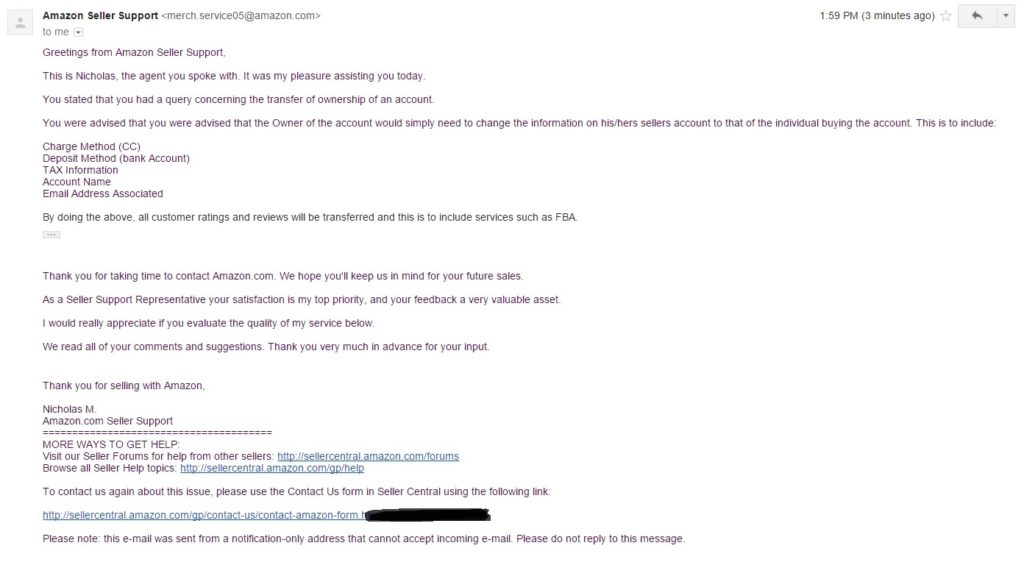

The letter you see below took four phone calls to receive. We now request that every Amazon business owner get the same letter from Seller Support. This letter instills confidence in buyers who have heard rumors that an account cannot be transferred without losing rankings and ratings.

In addition, getting the “all-clear” from Amazon when selling your Amazon business keeps the entire transaction transparent. This helps protect both the buyer as well as the seller. In a transaction of this nature, transparency is an absolute necessity.

If you’re the owner of an Amazon business, you already know that different Seller Support representatives will give you different answers to the same questions. Therefore, don’t be too surprised if the first representative you talk to tells you that selling your business isn’t possible. The fact is,

Amazon does support transfers of accounts, but many support representatives don’t know this. However, if you’re persistent, you’ll find someone who will give you the relevant instructions.

Letter Instructing Amazon Business Owner On How To Transfer a Seller Account

In addition to offering clear instructions on how to transfer the account, the email also states “By doing this, all customer reviews and ratings will be transferred…”

According to Seller Support, they can only send it to the email address associated with the account.

To date, calling Seller Support and asking for this letter has had no negative impact on any of our clients’ accounts. When you look at it logically, it makes sense for Amazon to allow the transfer of Seller Accounts. Their objective is to make money for their shareholders, allowing account transfers helps to achieve this goal.

When a new owner takes over a Seller Account, their goal is presumably to grow the business. Of course, when this happens, Amazon profits.

We have been told by former Amazon executives that the only reason Amazon hints at not allowing the transfer of Seller Accounts is to prohibit those who have already been banned for poor practices from purchasing accounts, as well as those who haven’t followed the proper transfer guidelines.

They seem to want to reserve the right to say “no” to these individuals, which is completely understandable. From our experience, owners of properly-run Amazon Seller Accounts who go through the proper channels should not encounter difficulty with the transfer process.

Having said all this, a letter from Seller Support stating that you can transfer your account is a “must-have” in the minds of buyers prior to selling.

Unlinking Accounts

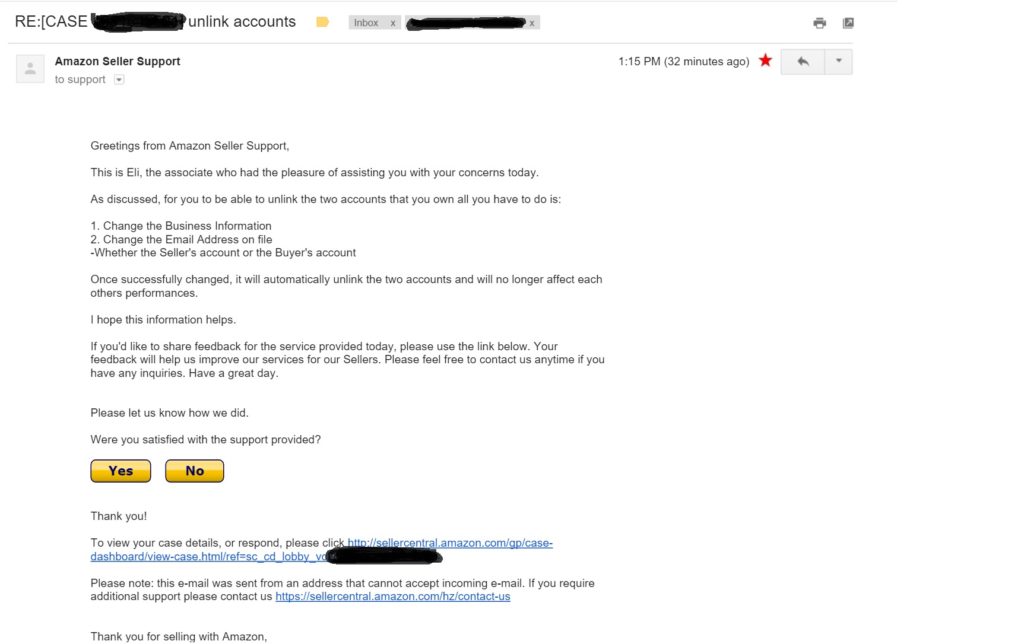

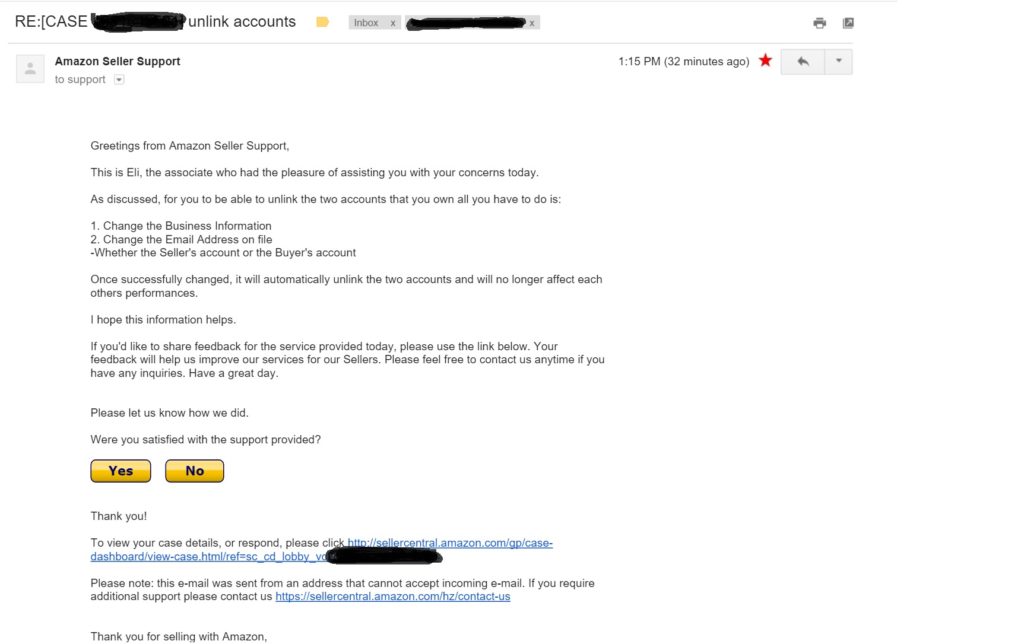

While we’re at it, we thought we’d share one more myth-busting letter from Seller Support. There’s a lot of talk about the difficulty of “unlinking” seller accounts, but we can show you how simple this process is when selling your Amazon Business.

Under certain circumstances, you can in fact own more than one Amazon Store Account.

The following letter is in reference to a sale in which the business seller had two Amazon business accounts. This seller sold completely different types of products from the two accounts, but the deposits all went to the same bank account. We were engaged to assist with the sale of both Amazon businesses.

In the process of those sales, the seller, buyers, and Quiet Light wanted to ensure that the accounts were unlinked and completely separated from each other with no future recourse from Amazon.

The owner of the accounts reached out to Amazon and after several calls was able to get the following email with instructions on how to unlink the accounts.

In summary, selling your Amazon Business and having all of the reviews and ratings transferred can be done. So, rest easy if you’re worried about your ability to transfer an account.

How Old Should My Amazon Business Be Before I Sell?

Prior to the birth of the Amazon business as a viable online business model, the minimum age for businesses we would take on was 24 months.

While there are exceptions to every rule, we have found that buyers generally prefer to acquire businesses that have reached the two-year mark.

Any online business less than two years old is generally significantly devalued due to the risks associated with a young business, even if it has somehow catapulted to the top of Google’s rankings. Even if a new business is doing well, we have always advised our sellers to hold off on selling until it is at least 24 months old in order to get maximum value.

Although we recently sold an Amazon business that was just 18 months old, most buyers prefer to buy businesses that are at least two years old. We certainly believe that older businesses have a lower risk profile for potential buyers.

If this business owner had waited another six to 12 months before selling and the growth trajectory continued, they certainly would have sold for a higher multiple.

When working with sellers, we always suggest looking at the situation from the buyer’s perspective. Buyers like opportunities with low risk and a lot of room for growth. The younger a business is, the more perceived risk there is associated with it. Yes, there can also be significant growth potential, but “business age” versus “growth opportunities” is a delicate balance that can only be looked at on an individual basis.

Examining the Cost-Benefit of Selling Your Amazon Business

When you investigate the value of your Amazon business and believe it is time to sell, you should without a doubt know all of the financial factors involved. Part of this involves understanding all of the costs and benefits of selling, as well as having a clear plan for yourself for after the sale.

It’s worth pointing out that we never encourage sellers to decide to sell their business. Rather, we encourage them to plan to sell. When you plan to sell, the process is far more manageable and within your control than if you arbitrarily decide you’re ready to let your business go.

Financial Factors: What Is Left Over After The Sale?

Although each business is unique, most owners encounter three fees that must be paid throughout the selling process:

- Broker Commission

- Legal and Accounting Fees

- Taxes

The Broker’s Commission

At Quiet Light, we are “success-based business brokers.” This means we only get paid if we are successful in helping you sell your business. If the assets of your business are not transferred to a new owner and funds do not wind up in your bank account, we did not succeed at our job and therefore we do not get paid.

Legal Fees

While it’s important to have sound legal advice and documentation throughout the selling process, the associated fees aren’t as high as you might expect. In fact, it’s rare to see a seller spend more than $3,000 to $5,000 on legal fees during a six or seven-figure transaction. In some cases, the costs are much less.

Some of the standard legal documents include a Letter of Intent (LOI) and Asset Purchase Agreement (APA). We can help by providing templates, but we always advise our sellers to have their own attorneys review the documents.

Taxes

Estimating your correct tax expenses is a critical step in determining how much you will have left after the sale of your business.

The money you earn from selling your business is generally taxed at the capital gains tax rate, although it depends on the allocation. In addition to federal capital gains taxes, it’s important to inquire about any taxes you’ll owe to the state you live in. Since tax rates vary based on a number of factors, it’s not possible to provide an exact estimate of what you can expect to pay. Plan on speaking to your accountant to get a clear idea of how the proceeds from the sale of your business will be taxed.

Also, check out our podcast episode with Shanyn Stewart about saving money on your tax bill.

Consider Your Personal Tax Situation

One other financial consideration when selling is the possible impact on the rest of your tax situation. Ask your accountant if selling your business will bump you into a different tax bracket or make you ineligible for certain deductions?

Having a discussion with your accountant about these implications is a critical step in the process.

It is best to have that talk after you understand the potential value of your business. Doing so will allow your accountant to help you make the most informed decision. If the numbers and math matter as much to you as they do to most Amazon business owners, you may want to read Should you Sell or Hold your Business: A Data- Driven Answer by Mark Daoust .

While many business owners may feel the “Owner after Tax Proceeds” may seem low, to others it is a financial windfall, especially since in many Amazon businesses the profits are needed/used as working capital and continually re-invested into the ever-growing need for more inventories. This scenario results in a business being worth much more than the seller sees in their bank account based on the annual operations of the business.

Once you’ve done the math and understand the value of your business and what will be left over after all expenses and taxes, you can determine if or when to sell. Note that the majority of our valuation calls result in the buyer deciding to hold off on selling their Amazon business until they reach their target value or goal that they have set.

If you’re a seller without a financial exit goal, we strongly recommend that you establish one. Write it down and keep up with a monthly review of the P&Ls until the value grows to the point at which you can achieve your exit goal. We’re happy to help with a follow-up review anytime.

The Engagement Letter

Once you have decided to sell your Amazon business, it’s time to review and sign an Engagement Letter with the brokerage firm you choose to work with. This is and should be, uncomplicated. Typically, Engagement Letters specify things like:

- Exclusivity Periods

- Non-Exclusive Arrangements

- The Engagement Letter Details

Below, we’ll explain each of these.

Exclusivity Periods

An exclusivity period is the amount of time that a seller dedicates to working with a single brokerage firm.

Ultimately the relationship between the business owner and broker must be strong and mutually respectful. The broker cannot sell the business without the help of the owner, and vice versa.

At Quiet Light, our exclusive periods last for just 90 days. This is because the listings we take on are normally under LOI or sold within that time period. If the 90 day period passes and the business is still not sold, the Engagement Letter should allow for a continued relationship in the same manner as the exclusive. In other words, the seller and broker can both voluntarily agree to stay within the agreement set forth by the Engagement Letter after the 90 day period ends.

Non-Exclusive Arrangements

Some brokers may try to win your business by offering non-exclusive relationships or multiple exceptions to their exclusivity. This allows a seller to work with multiple brokers simultaneously. In our experience, this often creates a lot of confusion and the possibility of brokers fighting over who gets paid a commission (with you in the middle). A short exclusive relationship is your friend.

The Engagement Letter Details

The finer details of the Engagement Letter are in place for the mutual benefit and protection of the seller and brokerage firm. It’s important to read the details carefully, ask questions if necessary, and follow the guidelines within the Engagement Letter during and after the business sale.

The Marketing Package

A Marketing Package is what your broker puts together to present to potential buyers. It should be an in-depth overview of your Amazon business.

The marketing package includes details such as the origin of the business, how it operates, what the workload entails, and where the strongest growth opportunities lie.

Basically, the Marketing Package gives buyers all of the information they need to make an informed decision about your business. One crucial element within the Marketing Package is the Client Interview.

We’ll get into this more below, but everything stated in the Marketing Package will be verified during the Due Diligence process. Due Diligence is the time period after signing a Letter of Intent when a buyer investigates and reviews third-party verification of your financials, digs deeper into the threats and growth opportunities of the business, and gets to know you better as a person.

The Client Interview

As a seller, this is your opportunity to communicate the strengths and opportunities within your business, as well as address the challenges that the new owner may experience.

An in-depth Client Interview that is written specifically for your business can provide a detailed overview of what it’s like to be in the driver’s seat.

In the Client Interview, our job is to ask every question we think potential buyers will want to know about your business and document your answers in writing. This will not only save you an immense amount of time in the process of marketing your Amazon Business, but it also helps create excitement and a vision for the new owner.

This step takes a lot of work. Qualified brokers understand that it’s essential to represent your business as detailed and accurately as possible. This keeps everything on track when you get to Due Diligence and helps prevent surprises from arising.

Confidentiality is Key

Before being shown the marketing package, potential buyers are required to sign a Non-Disclosure Agreement (NDA).

If you look at the listings for sale on our website, you’ll notice that we give no details that enable buyers to determine the exact business that is for sale. The Client Interview, Profit and Loss Statement, traffic trend graphs, images, and other important documents are only shown to interested buyers who have signed the NDA.

If you would like to view a full Marketing Package, please visit our site and click on any of our listings to request more details. If you do not have an NDA on file, that will be the first step. Once that is complete, you’ll have the opportunity to see how our Marketing Packages are put together.

Buyer Conference Calls

It’s essential that buyers and sellers speak directly before signing a Letter of Intent (LOI).

Without this step, both the buyer and seller are doing a significant business transaction with a complete stranger. Of course, there’s still a limit to how well you can get to know someone from a couple of phone calls, but this step will certainly give you a much better idea of who the potential buyer is and if you feel confident in them taking over your business.

The conference call is generally the last step before the LOI. Up to that point, the buyer is focussed on reviewing the financials and interview, and most communication occurs via email.

Often, a buyer will ask the seller questions they have already asked the broker. This gives them a chance to hear answers directly from you. On the conference call, your broker should make introductions, ask the buyer to give a sixty-second background of themself, and then step back and let the buyer ask their questions.

The broker should be in the background (often on mute) listening to how the call progresses. If available, a LinkedIn profile of the buyer should be shared with the seller in advance.

The objective of the conference call should be clear: To help the buyer and seller get to know one another and understand any questions that haven’t yet been answered. No successful deal is one-sided, and the conference call is a great opportunity for both parties to learn and make informed decisions.

After the conference calls, the buyer should know whether or not they want to put forward an offer.

As a seller, even though there are only two other people on these conference calls, they can sometimes be a source of stress or anxiety. Here are some guiding principles to help you make a positive impression.

How to Handle Conference Calls

- Be Yourself – Let your personality shine through. Also, don’t be afraid to show the joy and enthusiasm you have for the business. Passion sells!

- Be Honest – In addition to being unethical, lies and exaggerations will be discovered during due diligence, can derail deals, and create legal liability. If there is something uncomfortable about the business, it is best to present it openly, honestly, and with a suggestion of how a new owner can address the situation.

- Don’t Take It Personally – If a buyer comes off as obnoxious, rude, or uninformed, avoid taking it personally. Listen to their opinions, and if they’re wrong, politely explain that you understand their position, but respectfully disagree. Then, explain why.

- Keep it Simple – Most potential buyers will not be familiar with your particular industry. Avoid jargon and buzzwords. Explain the business as you would to your grandmother. If the buyer shows any particular knowledge, you can get more technical, but let the buyer take the lead on how technical the conversation becomes. The worst case is to have a buyer pretend to understand a conversation and then fail to put in an offer because they were actually confused the entire time.

- Listen – Answer questions openly and concisely and then turn the conversation back to the buyer with a question such as “Did that answer what you were asking?” Then, listen actively to what they are saying.

- Remember the Point – Although buyers will hurl numerous questions at you, they often do not remember many of the answers. The point of the call is, in large part, to determine if you are trustworthy and will follow through on the commitments you make such as training the new owner. Remember to stay calm, relaxed, and friendly. Demonstrate how you will help the buyer succeed.

- Build Goodwill – Offer to do more than what is contractually required. You may need a reservoir of goodwill during Due Diligence. So be sure to let the buyer know you care about the business and will help with its success throughout the selling process.

- Avoid Being Baited – If a buyer asks what is the least you will accept, defer to your broker. It’s the broker’s job to be the negotiator and, if necessary, the “bad guy.” It’s your job to be helpful. You will have a relationship with the buyer after the sale, so keep it on a high level.

The Letter of Intent

The Letter of Intent (LOI) is a written statement from a potential buyer that establishes their intention to purchase a business.

It should lay out the basic terms of the offer and deal. Although it’s exciting to receive an LOI, it is not a rock-solid guarantee that you have “sold” your business. Just like selling a house, you have to have the business “inspected” first.

In the vast majority of transactions, the LOI is not reviewed by an attorney. The language is simple and clear. A good LOI acts as a framework for the final and binding purchase agreement that will come towards the end of your deal. It should contain the major pieces that need to be negotiated.

The Letter of Intent, by its very nature, is a non-binding agreement that should be fully contingent on the buyer’s satisfaction with due diligence.

Due Diligence

Due Diligence is the process in which the buyer verifies that the information provided by the seller is true and correct. Basically, this is the time for the buyer to have all of their questions answered about the nitty-gritty details of the business.

Due Diligence occurs after the Letter of Intent has been signed and requires the seller’s cooperation and engagement. The Due Diligence process goes much deeper than the Marketing Package, conference calls, and online research.

While the Marketing Package provides information about the business’s performance, in Due Diligence the seller must prove that the revenues, expenses, and other metrics are correct. Because this occurs within the Exclusive Period, the buyer can review all aspects of the business without being concerned that another buyer will buy the business.

The Exclusive Period is generally for two to three2-3 weeks but can then be extended through to closing once the Asset Purchase Agreement drafting and editing process has begun.

Due Diligence Goal

The general goal of due diligence is to verify that the information provided by the seller is true and correct. The most common areas that buyers look at include:

- Financials: The seller is usually required to provide enough financial information for the buyer to be able to rebuild the profit and loss statements for at least the previous 12 months. The financial information should come entirely from third-party sources such as Amazon statements, bank statements, vendor invoices, merchant charge statements, and in some cases, tax returns. Using these documents, the buyer should be able to verify the monthly P&Ls.

- Vendors and Contractors: Vendor and contractor relationships are important assets that must be transferable to the new owner. Some vendors try to negotiate more favorable terms (which may be less favorable for your buyer) when they learn that a client’s business is being sold. Obviously, your buyer will want to ensure that they receive the same discounts, terms, and deals that you’ve experienced with your vendors.

- Documentation: Buyers will want to make sure your business is properly registered and doesn’t have outstanding litigation or actions taken against it. In rare cases, these issues can transfer over to a new owner. Be prepared to dig out your old incorporation papers and other documentation.

- Key Reports: Most businesses have various Key Performance Indicators (KPIs) which owners track and manage. You may have reported these KPIs in your marketing package — now is the time to prove their accuracy using third-party documentation.

If you are a buyer reviewing this article and want some help with due diligence, consider reaching out to the folks at Centurica. Their team will help you save time and avoid headaches by reviewing your deal, assessing risk, doing financial verifications, and more. We’ve worked with them in many transactions, and they are thorough and professional.

Staying Organized Through Due Diligence

As a seller, one of your goals during Due Diligence is to provide enough information for a buyer to rebuild the P&Ls for at least the previous 12 months. P&Ls are created by the seller with information pulled from various sources.

As mentioned above, Due Diligence requires that all financial information is verified by third-party sources. Crucial financial information generally includes any income or expenses within the business.

Buyers will also make sure that the business’s vendor and contractor relationships will transfer to the new owner.

Sellers should put together the following documents and save them as PDF files in preparation for Due Diligence. Since some of these documents are years old and may be difficult to locate (depending on how organized you’ve been), it’s generally a good idea to complete this step sooner rather than later. Doing so will allow you to cram less work into the short window of time you have when selling your business.

One helpful tip is to name and save third-party documents so they can be easily sorted by date (i.e., 1.2018 Amazon Statement, 2.2019 Amazon Statement, etc.). Your broker will create a Dropbox folder (or something similar) and send an email to the buyer and seller inviting them to join the folder once all of the documents are in place.

Due Diligence Request List

Buyers generally prepare a Due Diligence Request List with the help of the broker, their accountant, or other professional.

If notes need to be added to the Due Diligence Request List, then a word document is generally created so all questions and answers can be easily located in one place.

Being well organized is the key to a successful Due Diligence process. A massive data dump of files and emails will only make things more difficult for your buyer, adding time and headache to the entire process. The following items may be requested by the buyer, but the full Due Diligence Request List will likely be much longer.

- Amazon statements for the last 24 months.

- Bank statements for the last 24 months.

- Merchant statements for the last 24 months (if the product is sold through a website as well).

- Vendor invoices or proof of Cost of Goods Sold (COGs) for the last 24 months.

- A complete list of vendors with pertinent contact information. This may be withheld until the APA process has begun and trust has been further established.

You should expect due diligence to be invasive, detailed, and potentially exhausting if numbers are not your strong suit. Throughout the entire process, your broker should facilitate all communication and be there to support you.

Dealing With Errors & Discrepancies

If the Due Diligence process turns up a $10,000 error on your part that effectively reduces your income from $100,000 to $90,000 you can expect one of two things to happen.

- Your buyer walks because his minimum SDE threshold has been reached and the business does not produce enough income.

- Your sale price is reduced by $10,000 x the multiple that the business was valued at. If your sale price was determined using a 3X multiple (covered earlier in this guide) then you would drop your price by $30,000. Of course, this change would be reflected in the APA.

If an honest error does occur, we suggest that you accept a reduced price based on the corrected numbers. However, you do always have the option of refusing to lower the price, but doing so may cause the buyer to walk away.

Of course, getting the numbers right the first time is the key to avoiding renegotiation once your purchase price has been established.

If the buyer is satisfied with the due diligence process, the deal is further detailed in the Asset Purchase Agreement.

Asset Purchase Agreement

An Asset Purchase Agreement (APA) is an agreement between a buyer and a seller that establishes the terms and conditions of the deal.

If the buyer is satisfied with the due diligence process, the deal is further detailed in the Asset Purchase Agreement. A typical time period from the LOI to signing the Asset Purchase Agreement (APA) and closing is 30 to 40 days. We generally allocate about two weeks of that for due diligence and a week to ten days for drafting the APA, editing, and signing.

Just like with the Letter of Intent, we can provide an asset purchase agreement (APA) draft customized for your transaction. Our APA template starts out as a 13-page document and is modified and added to based on the specifics of each deal. We often suggest that you have your attorney use it as a starting point for a more detailed agreement.

The APA is the most important document that you’ll sign throughout the selling process. It’s important to note that an APA differs from a Stock Purchase Agreement (SPA) in which company shares, titles to assets, and titles to liabilities are also sold. In an asset sale, the assets are itemized in a schedule on the APA.

Transferring Assets

Typical assets that are transferred with the business include:

- All website domains and URLs

- All third-party Seller Accounts (Amazon, eBay, Etsy, etc.)

- All hosting accounts

- All domain name accounts

- All e-commerce platform accounts

- All website content and files

- All customer lists

- All marketing materials

- All vendor contacts

- All social media accounts

- All policy and procedure documents/files

- All toll-free numbers associated with websites

- All email addresses associated with websites

- All registered or unregistered trademarks

- All contracts (written or verbal) with customers and suppliers

- All inventory on hand or on order at the time of closing

Excluded Assets

In an APA transaction, it is not necessary for the buyer to purchase all of the business’s assets. In fact, it’s common for a buyer to exclude certain assets in an APA.

One Amazon business that we listed had a class B motor-home listed as an asset on its balance sheet. The seller had purchased the motor-home to travel the country, connect with business partners, and boost her B2B revenues. She even had the business’s logo added to the motor-home to make it official.

The buyer had no interest in the motor-home. Since it was an asset on the balance sheet, it didn’t impact on the trailing 12twelve months of SDE. Therefore, when the purchase price for the business was negotiated, we made sure to exclude the motor-home as an asset so the seller could keep and enjoy it after the sale.

Other Often-Excluded Assets

Other often excluded assets include:

- Vehicles

- Furniture

- Fixtures

- Equipment

- Computers

- Leases

- Cash-on-hand, on deposit, or in financial institutions (unless funds are a deposit or prepayment for undelivered goods or services of the business)

- Accounts receivable

- Security deposits of any kind

- Prepaid taxes that pertain to any period after the closing

- Tax refunds or rebates

- Insurance premium refunds

- Mobile phones

- Personal property

Once an APA has been agreed upon and executed, the two parties move to the next stages of closing, transition, and training.

Closing, Transition, and Training

You have listed your Amazon business for sale, negotiated the price, and completed due diligence. The APA has been signed and the seller has funded the escrow account. Now, it is becoming VERY real that you are in fact selling your business.

When selling an online business, closing is almost always done remotely and happens solely between the buyer and seller. Your broker can do little to nothing to help expedite this process and steps aside to let this happen between the buyer and seller.

Defining “Closing” When Selling The Assets Of An Online Business

In regard to selling an online business, “closing” means transferring control of all of the assets listed in an exhibit in the APA over to the buyer and receiving payment. This generally takes place within a day or two of signing the APA.

To close a deal, the buyer funds the purchase by wiring money to an escrow account held by an attorney or another third-party escrow service such as Escrow.com. Once the wire transfer goes through, the seller transfers the assets to the buyer. At that point, the deal is considered to be closed.

To transfer the Amazon Seller account, the seller typically logs into their Seller Account and completes the following steps:

- Changes the admin username and password

- Changes the credit card on file for Amazon charges

- Changes the bank account on file for deposits

- Changes the tax information (Employer Identification Number (EIN), also known as a Federal Tax Identification Number)

- Changes the email address associated with the account.

According to the Amazon Seller Support letter we discussed above, “all customer ratings and reviews will be transferred.” Since most Amazon Seller account holders also have websites and vendor relationships, control of these assets is also transferred to the new owner.

The closing process for a typical Amazon business only takes a few hours. Once the buyer has control of the assets, the escrow account holder is notified by both parties and the funds are released to the seller. If closing starts in the morning, we generally see funds released and the wire transfer delivered to the seller’s bank account during the same day.

We prefer to close on any weekday other than Friday. We avoid Fridays if possible in case there are any delays and the transfer requires another day. If two parties decide to close on Friday and the wire transfer isn’t completed on that day, it usually gets delayed until Monday. As you might imagine, this can make for a very long weekend!

Training & Transition

Once the business transaction has closed, the training and transition period begins. In the Quiet Light APA, the transition and training period is generally “up to 40 hours over the first 90 days”.

Since some businesses are more complex than others, the training and transition period can vary greatly.

The goal of each party in this phase should be to ensure a smooth and successful transition of the day-to-day operations and to pass along an understanding of where the growth opportunities lie within the business.

Usually, training and transition happens via the following methods and should always be scheduled:

- Telephone

- Screenshare

- Face to face (rare)

It is highly recommended that buyers and sellers both keep a journal of the time spent on the transition and training period to avoid potential disputes. Some well-organized sellers keep this journal on a Google Drive document that is shared with the buyer.

In most cases, the 40 hours of agreed consulting time is not fully used by the buyer. This is due to the fact that running an Amazon business isn’t usually a complicated process. It’s more common for a buyer to reach out to the seller after the first 90 days with a quick question or seek the opinion from the seller.

As a seller, It is always advisable to do everything possible to respond to the buyer’s questions in a helpful and timely manner. You want the new owner to be successful!

Summary: Selling an Amazon Business

At one point, starting and selling an Amazon business wasn’t possible. Today, we are working with multiple six and seven-figure Amazon businesses at any given time. Our buyer database seems to clearly understand the value of Amazon businesses and the benefits (and risks) associated with them.

As always, regardless of whether you plan to sell your Amazon business today, next year, or just want to explore your options, we are happy to help. Our valuation process involves absolutely no pressure to list your business. In fact, we end up encouraging the vast majority of our clients to wait.

One former client had this to say about their experience with us:

“Joe Valley and the team at Quiet Light are the exception to the higher pressure tactic rule. I chatted with Joe for over a year before listing my business. He was patient, knowledgeable and understanding of my anxiety, based on his own experience of selling his eCommerce business. I can’t imagine doing the deal without Joe. He is truly the best and I now count him as a friend, mentor and confidant” ~Craig A.

Our goal is to understand your business and provide personalized guidance based on our vast experience and expertise so you can make the best possible decisions for you and your business. Each of us at Quiet Light has built, bought, and sold our own web-based businesses, so we truly understand the position you might be in.

Next Steps

If you’re interested in learning more, the next step is to give us a call to receive a free valuation and see what areas of your business are strong, and which could use some attention. In this review we will:

- Provide an estimate of its current market value.

- Identify any elements that may be reducing its current value.

- Help identify ‘low-hanging fruit’ which could increase the value of the business.

Visit our sell page to sign up for your free consultation today.

If you’re interested in exploring businesses to buy, be sure to check out our online businesses to buy.