Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Guidelines On Effectively Hiring A Bookkeeper & Why You Should

By Quiet Light

https://www.youtube.com/watch?v=bn5utp4_oGk

If you are one of my subscribers, you may have downloaded and read one of my eBooks called “5 Common Problems That Destroy Website Value”. One of those common problems is not keeping clean financial records for any potential future owner to look over. Messy financials can cast you in a bad light, and make it look as if you have things to hide. One solution is hiring a bookkeeper.

But this is easier said than done. There are lots of bookkeepers out there advertising their services. There are almost 1.6 million bookkeepers in the US alone, with it projected to rise to 2 million by 2022.

So how do you separate the good honest ones from the bad ones that will hurt you more than help you?

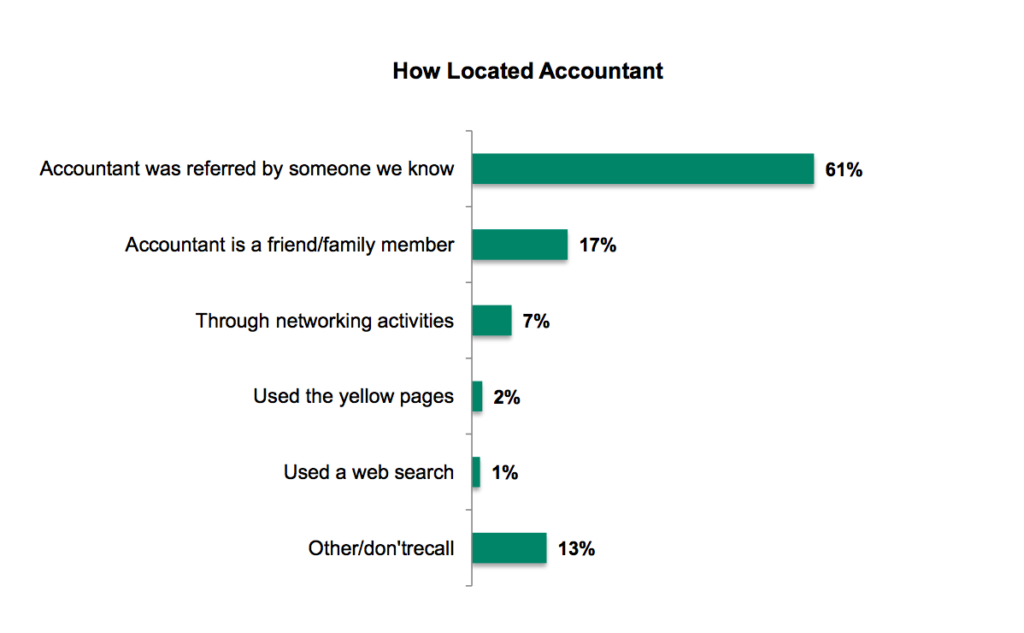

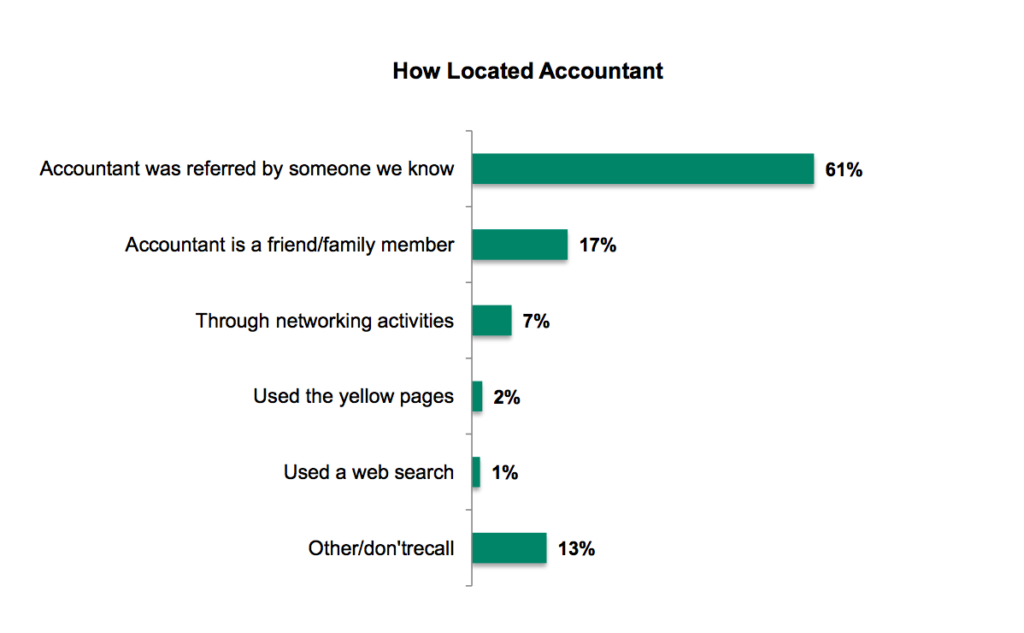

How Are Businesses Finding Bookkeepers?

That is the purpose of this article – to give you some guidelines on what to look out for, when searching for the dream bookkeeper, and the warning signs of a bad one. Business owners should interview no less than five bookkeepers when hiring someone. These are the questions you should be asking them to test their true worth to you.

“Have You Ever Managed The Books For An Online Business?”

This is, of course, the number one question, and a lot of bookkeepers probably haven’t dealt with an online business in their entire career. I mean, how many bookkeepers (especially of the older generation) can honestly say that they know how Paypal operates? Or how payments are taken through Stripe?

If they say they have managed the books for an online business, well then that would be an immediate gold star for them. But then you have to quiz them on the types of online businesses they have dealt with, as obviously there are countless types. Just because they’ve dealt with e-commerce businesses (for example), it doesn’t necessarily follow that they would immediately be comfortable understanding and doing the books for a dropshipping business, or a lead generation business.

If they have never dealt with an online business before, do they understand the following, about the vital differences between online and offline businesses?

- Internet businesses have less infrastructure. There is usually no storefront, no physical office for clients, and no significant support staff. In fact, it could very well be one person sitting at their desk at home with a laptop, and a Skype number to talk to customers.

- Internet businesses are usually closely held (meaning one owner, very little, if any, staff). If staff have been hired, it may only be one or two on a part-time basis to handle specific tasks.

- Internet business owners are more likely to hire contractors vs. in-house staff. Contractors are easy to let go if the need to hire them diminishes. Plus, contractors handle paying their own taxes and benefits, which is one less expense and hassle for the business owner.

- Internet business owners are more likely to mingle personal expenses or other business expenses with their business. If, for example, a personal bill needs to be urgently paid, the owner may decide to send it from the business bank account. A good bookkeeper needs to be able to keep effortlessly personal payments separate from business payments.

How Will I Be Able To Access My Books?

Even though the bookkeeper will be working on your books most of the time, it goes without saying that you, as the owner, should be able to view the books at any time, and have administrative control. So now you need to ask the potential candidate how you would be able to see your books if you decided to hand the reins to them.

- Which computer program will they use? The recommended product in this area is Quickbooks, so give points to the candidate if they immediately and confidently give that reply (most will).

- Will the accounts be kept online for easier viewing? Online accounting software has come a long way over the past several years and offers a great way for you to collaborate with your bookkeeper.

- How often will they be updated? Most bookkeepers will be able to manage the books on a monthly basis. You’ll want to have quick and easy access to your books so you can view the growth of your business.

- How will the books be backed up? Having backups is essential in case the main file (or whatever program they ask to use) becomes corrupted.

- And the question they will not like to hear at all – but still needs to be said – what would happen if you fired them and had to hire another bookkeeper? Would you still have administrative access to your books? Can they guarantee a seamless transition to their replacement?

How Would You Handle This Scenario?

Now it’s time to test their professional skills by giving them hypothetical scenarios, and asking them how they would deal with it.

Some possible scenarios you could put to them include:

- How different types of deposits would be entered in the books.

- How fraudulent orders would be recorded (if you have an e-commerce business).

- Which areas of your business can or should be treated as cost of goods sold (there are significant discrepancies among bookkeepers, even though the definition shouldn’t allow for discrepancies).

- What is better for your business, accrual or cash based accounting?

Can You Explain the Difference Between…

How well can your bookkeeper explain difficult concepts to you? Whenever you hire a professional, you should hire someone who will help you understand a unique area of your business.

An excellent way to find out how well your bookkeeper can explain foreign concepts is to ask candidates to explain the purpose of the balance sheet. Most business owners don’t have a firm grasp of a balance sheet, but your bookkeeper should. The balance sheet is often ignored, but it is an important document.

If your bookkeeper can explain it to you and how it would look for your business, then you know you have a good bookkeeper.

Have The Bookkeeper Inspect Your Current Books

The final test is to crack open the books and let the candidate inspect them. Ask them to point out actual and potential problems. When you are interviewing multiple bookkeepers, they will give a whole variety of answers and will help you to decide which one is the best fit for your business.

Your financial reports contain an absolute wealth of information and data about your business, but most business owners don’t have a solid set of financial records to reference. Therefore it pays to have the right bookkeeper who will do a first rate job from day one.

Then, when the day comes to sell the business, those first rate books will significantly help to ease in a smooth and effortless sale. 71% of US businesses employ an outside accountant – will yours be one of them?