Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

4 Tips To Manage Your Expectations When Selling Your Website

By Quiet Light

Why do deals fall apart? When a buyer makes an offer (and when the seller accepts an offer), the hope is to close the deal. So why do some deals fail?

The most obvious reason for a deal falling apart would be a material discovery that changes the deal. For example, the buyer may discover undisclosed expenses, a vendor who won’t transfer, or a key piece of operational information that changes the upside prospects. On the seller side, the buyer may try to renegotiate the price or structure of the offer in a way that makes the offer no longer desirable.

While material changes are the most obvious reason for a deal falling apart, mismanaged expectations are a more common cause of broken deals. Both the seller and the buyer walk into an offer with certain expectations as to what the business is, how they’ll proceed to get to a closing, and what information to exchange. If these expectations fall short, it can cause a ripple effect that eventually destroys the deal.

The Fog of the Deal

Selling a business is stressful. Buying a business is stressful. There is a lot of information to process, collect, organize, and interpret for both the buyer and the seller. There are complex negotiations, tax consequences, and value judgments. Sellers risk losing their businesses, and buyers risk losing significant investments.

While these stresses may be easy enough to manage in the early stages of a sale, as you get closer to the closing of your sale, it’s not uncommon for the stress to ramp up exponentially. This stress often colors your perceptions in other areas, especially when the deal isn’t going as you originally expected.

Suddenly, what would be a normally reasonable request from your buyer may seem like an untrustworthy power play. A buyer who requests more time to finish due diligence seems to be an indecisive individual who just can’t pull the trigger. Both the seller and buyer begin to over-react, negotiate unimportant details and get lost in the fog of the deal.

You can avoid this fog – or dissipate it – by properly managing your expectations as well as the buyer’s expectations. If you know what to expect, reasonable requests will remain reasonable while unreasonable requests will be easier to identify and diffuse. Here are four simple times to help you manage your expectation.

Put Your Price on Paper and Hide It

But this question is toxic to completing a sale. There will never be a final answer to “how much more could I get?” until the deal is lost. At that point, any previous offer they gave you is worthless.

Rather than let this question bother you through the negotiation process, decide for yourself before you put your business on the market what your desired price will be. Write this on a piece of paper, put it in an envelope, and put it in your desk drawer.

When negotiations ramp up and get intense, you can reference this piece of paper to bring your expectations back. You’ll be surprised at just how much your expectations change during a negotiation.

This is also extremely useful if you engage with a buyer who tries to renegotiate the price of the business after a previously accepted offer.

What Are Your Terms?

Selling a business is much more than just the price. You need to consider the structure of the deal, the tax consequences (and how the purchase price is allocated), how long you’ll be expected to stay on for training, and the amount of time and intensity that a buyer will need to finish their due diligence.

And that’s just a general list. Your business will have other concerns and terms that will be unique to it. As you talk to potential acquirers, maintain a running list of criteria that you’d like to see from your deal and determine what is most important to you.

Having a physical list of criteria can help you avoid the fog of negotiations and give you access to your thought process when you didn’t have the distractions of the current deal.

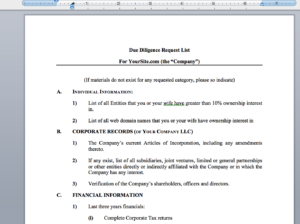

Use a Due Diligence Checklist to Manage Delays

Before a buyer hands over six or seven figures for your online business, they’ll do a thorough due diligence. Online businesses are extremely risky to acquire, and if your business fails under their ownership, they’ll have little recourse to recoup their investment.

Because of this, it’s not uncommon for a buyer to ask for more time than they anticipated when they made the initial offer for your business. From your perspective, this can appear as if the buyer isn’t serious, or appear that the buyer is simply stalling. Sometimes this is true, but it usually is not.

When a buyer asks you for more time to do due diligence, don’t panic. Rather, check their request for more time against the progress they have made up to that point. Ask the buyer to put together a due diligence checklist at the beginnin of the deal and identify what has been accomplished and what remains on their checklist.

Some buyers will object to this as checklists can “grow” as they discover more about your business, but this shouldn’t be an obstacle to starting and maintaining a checklist. Maintaining a checklist that both you and buyer can see will help both of you manage your expectations.

Don’t Let a Broken Deal Break You

Being a part of a broken deal is extremely frustrating. Losing a deal – especially when that deal is close to closing – is more than just a simple disappointment. It can feel like a violation of trust.

Unfortunately, broken deals happen, and sometimes there is nothing you can do to prevent it. Sometimes circumstances change, sometimes a buyer develops cold feet and walks, and other times a buyer has a legitimate cause that forces them to walk away. Until the final contract is signed, and money is in your account, you cannot count on a deal being certain.

That said, if you are part of a broken deal, don’t let that deal break you. Broken deals are not a sign that your business is unsellable. In fact, many times a broken deal can lead to a new offer from a new buyer that was better than the first.

Take advantage of a broken deal by analyzing where that first buyer ran into issues. What parts of due diligence were confusing and difficult? What seemed to make that buyer nervous? Gather this information and focus your efforts to smooth out that process so that the next buyer will avoid that difficult area.

Conclusion

A lot of the content we write on this blog focuses on how to maximize metrics to get the most value for your deal. But the process of selling an online business is as much about managing the ‘soft side’ of the deal as it is about gathering solid tangibles. At the top of this ‘soft side’ of the deal is managing expectations.

Go into your deal knowing that you’ll certainly experience the natural ‘fog’ that comes with a stressful transaction, and then take practical steps to setup sound footings throughout the deal.