Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

What Taxes Will You Pay When You Sell Your Internet-Based Business?

By Quiet Light

When preparing to sell, most owners love to focus on the purchase price of their business. After all, it is the number that sellers have the most control over, and it plays a significant role in determining their financial future.

While it can be easy to base your selling decision on a nice, round number that represents your business’s value, it’s important to dig a bit deeper in order to discover how much you’ll actually receive when the transaction is complete. Understanding the dollar value of your business is relatively easy, but having a clear idea of how much of it will stay in your bank account isn’t quite as straight forward.

As exciting as it is to complete a successful exit, every seller must quickly face the legal requirements that follow—paying taxes. IRS publication 544 on “Sales and Other Dispositions of Assets” contains 42 pages about this complicated subject. The purpose of this Quiet Light article isn’t to overwhelm you with every possible scenario. Rather, it is to provide you with a general idea about the tax consequences of most business sales.

Unfortunately, most tax situations are not 100% straightforward and predictable when selling a business. Since there are many factors that determine your post-sale tax burden, it’s a good idea to complete a projection of what your taxes will be before you sell your business. This ensures that you have a clear understanding of the full financial ramifications of the deal you’re considering.

To help answer the often-asked question “how much am I going to have to pay in taxes when I sell my business?”, we enlisted the help of Jeff Haywood. Although this information can be extremely valuable for helping you gain a better understanding of taxes for sellers, it should by no means be taken as advice.

Before selling your business, it’s important to speak with a tax professional who can answer questions specific to you and your situation.

Capital Gains Tax

In regards to taxes, most sellers start with one basic question: When I sell my business, what rate will the proceeds be taxed at?

There isn’t one, straightforward answer—it all depends on your ownership structure and the terms of the deal.

Taxes for sole proprietors, partners, and S-Corps

Sole proprietors, partners, and members or shareholders of an S Corporation are taxed according to their personal tax situation. Therefore, a seller whose business is organized under one of these structures will want to consider the overall tax consequences of the sale on their individual income tax.

The ordinary income recognized through the sale of a business can move the seller into other income tax brackets, based on U.S. tax code. This means that the impact on their taxes could be greater than just the tax on the sale. For example, if the income they receive through the sale of their business pushes their personal income into a higher tax bracket, it could increase the taxes on their other income as well.

When buyers and sellers enter into an asset purchase agreement, they typically must come to an agreement on how the various assets are classified in each of their tax reporting procedures. The document that establishes how assets are reporting is called the Asset Allocation Agreement.

Why is the Asset Allocation Agreement important?

The asset allocation agreement is extremely important when it comes to determining how the sale of your business will be taxed.

Depending on how the business’s assets are allocated, the proceeds from selling the business will be taxed as ordinary income, capital gains, or a combination of the two.

Since the capital gains tax rate is typically lower than the rate for personal income tax, it’s usually favorable to the seller to have as much of the purchase price as possible allocated to capital assets.

Therefore, the agreed allocation of the sales price to the various assets can have a significant effect on the after tax value of the sale for the seller.

In the event there isn’t an asset allocation agreement, the tax code stipulates that the sales price must be allocated to the assets sold based on their fair market value. If the buyer assumes a debt or takes the property subject to a debt, the fair market value of the asset must be reduced by the debt for this allocation.

Essentially, the asset allocation agreement is an important tool in the negotiations of a favorable purchase agreement since it takes into consideration the impact of taxes to be paid following the sale.

What are capital assets?

A capital asset is an asset that is expected to generate value to its owner over an extended period of time, usually more than a year. Capital assets can include real property or depreciable personal property used in trade or for business. Capital assets do not include property that is intended to be sold to customers.

Capital gains and losses

The gain or loss on the sale of capital assets is the difference between the amount you realize from a sale or exchange of property and your adjusted basis.

Your adjusted basis is your original cost or other basis plus certain additions, such as the cost of capitalized improvements, and less certain deductions, such as depreciation. Typically, your cost includes amounts that were capitalized rather than expensed.

To include another, more simplified explanation of capital gains or loss: it is the change in value of an asset over time. In the situation we’re discussing, the asset refers to your business. Of course, it’s not always simple to determine how much money was originally invested in the business, which is why there is a more complicated way to calculate capital gains and losses.

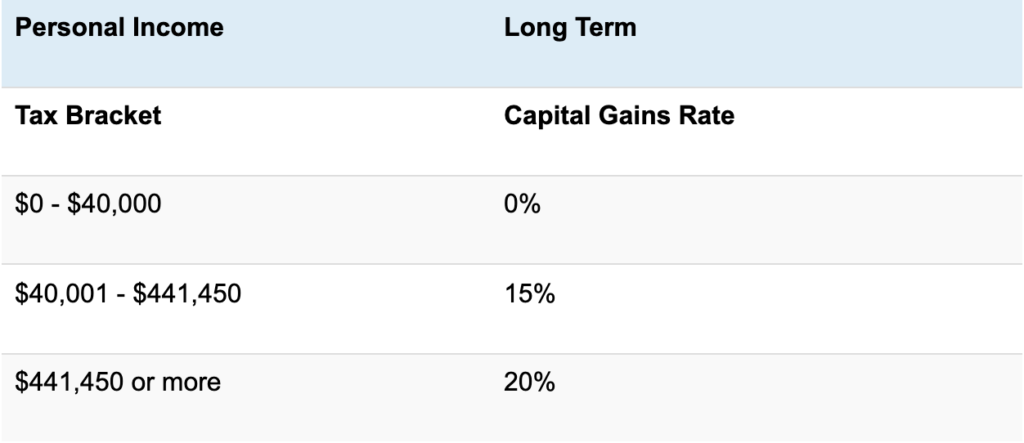

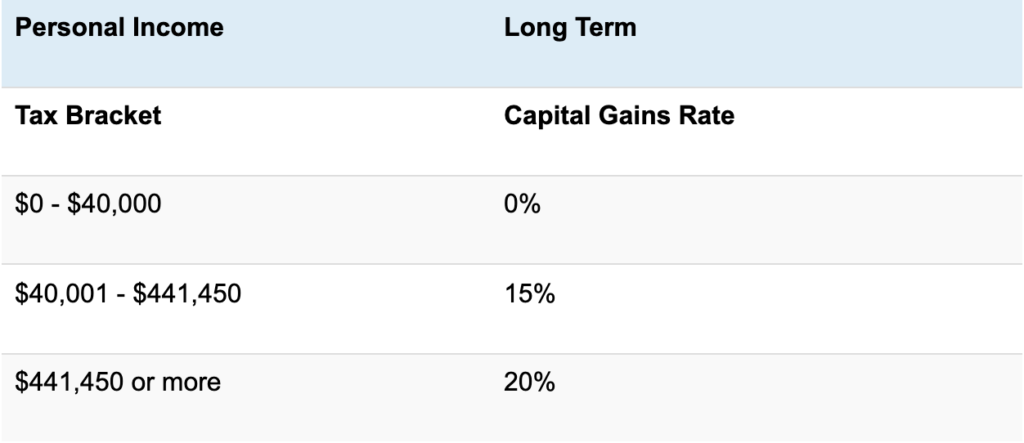

Capital gains tax rates for 2020

Long Term Capital Gains Tax Rates are determined by the individual’s personal income tax bracket. Below are the 2020 Capital Gains Tax Rates as they correspond to personal income tax rates.

Ordinary Income Taxes

Above, we discussed that it is generally advantageous for sellers to have as much of the sale price as possible allocated to the sale of capital assets, which are taxed at more favorable capital gains tax rates.

Unfortunately, certain assets do not qualify as capital assets. When non capital assets are sold, the proceeds from them are considered ordinary taxable income, which is taxed at rates that generally range from 10% to 37% depending on the seller’s tax bracket.

The profit on the amounts allocated to non-capital assets like inventory, copyrights and unrealized receivables are taxed as ordinary income and subject to your personal tax rate.

Some examples of property that are can not be classified as capital assets include:

- Personal property.

- Inventory.

- Receivables.

- Depreciable business property (furniture, vehicles, equipment).

- Copyrights.

There are also additional taxes including the Alternative Minimum Tax, the Net Investment Income Tax, the Additional Medicare Tax, and state and local taxes to consider. Finally, in some cases there may be a recapture of depreciation previously taken on assets which are taxed at ordinary income tax rates.

Taxes for C-Corporations

Unlike other business entities, sellers of C-Corporations are generally unable to benefit from the favorable capital gains tax rates that apply to other businesses, even if the sale includes capital assets. Instead, C-Corporations are usually required to pay both federal and state income taxes on the proceeds of the sale, which are typically higher than capital gains tax rates.

In addition, shareholders of C-Corporations will find themselves paying additional taxes when the proceeds are distributed among the company’s members, which obviously leads to double taxation.

The amount of taxes that shareholders pay depends on the method by which they are distributed, which can sometimes be a taxable dividend.

Since C-Corporations aren’t able to enjoy capital gains tax rates, the asset allocation agreement is usually far less important for sellers of C-Corps, although having one is still advisable.

Obviously, this is a pretty significant difference compared to what a seller of a sole proprietorship or partnership experiences. Taxes for C-Corporations are often significantly higher when it comes to selling, which prompts some entrepreneurs to reconsider what entity they want to choose during the initial formation process.

A corporate income tax accountant can answer more detailed questions about the tax implications of selling various business entities.

Broker Fees

Broker fees are typically tax deductible.

According to presiding tax rules, the seller is taxed on the sales price less the cost of the sale and less their adjusted basis in the assets sold. Since broker fees are part of the cost of the sale, they are usually deducted from the purchase price before it is taxed.

This often applies when dealing with brokerage fees for a rental broker, online broker, full service broker, or real estate broker. Although there are some differences, if you’re familiar with the real estate industry or have worked with a real estate agent or listing agent, there won’t be too many surprises when learning about business broker relationships.

What are the tax implications of allocating money to a non-compete agreement?

In business acquisitions, it’s common for the seller to sign a non-compete agreement as part of the deal. Therefore, it’s often necessary to allocate part of the purchase price to the non-compete agreement that is signed.

For the seller, the amount received for a non-compete agreement will typically be taxed at the less favorable ordinary income tax rates rather than at the favorable capital gains tax rates. Therefore, it is in the seller’s interest to negotiate more of the sales price to be allocated to assets that are subject to long-term capital gains rates.

Taxes on Seller Financing

Receiving payments on the sale of assets over a period of time can have very beneficial tax implications for the seller. Whether or not a qualified intermediary is involved, the seller will usually bear the tax burden at the time that payments are received. Therefore, if payments are spread out over a number of years, it can result in less taxes than if all of the proceeds are received in a single tax year.

This is because a seller financed sale of assets is treated as an installment sale, which means that the seller only pays taxes on the profit portion of the proceeds that are received in a given year. The seller will also have taxable interest received as part of the payments, which is determined by the interest rate agreed upon in the promissory note.

Since taxes rates increase based on a person’s annual earnings and capital gains, most sellers will pay more if all of their proceeds are lumped into a single tax year. By spacing the payment out over several years via seller financing, each year might be taxed at a lower rate, which effectively reduces the total amount of taxes paid on the sale of the business.

However, this only applies to money received through the sale of capital assets. For assets not qualifying as capital assets, the seller must pay taxes on them in the year of the sale regardless of when money is received.

Taxes on Performance-Based Financing

This type of earn-out clause is very complicated and subject to special tax rules. The IRS uses the term “Contingent Payment Sales” for transactions of this nature.

In some situations, the seller may recognize the entire gain or loss in the year that the business is sold. In such cases, the seller would likely be required to pay taxes on the total amount received for the sale of the business.

However, performance-based financing can also be viewed as an installment agreement, recognizing the gain or income as payments are received. Similar to seller financing, this could allow the seller to spread out their income or gain over multiple years, which could reduce their tax rate and overall tax burden.

Additionally, a seller may also be able to recognize the gain after the basis in the property sold is recovered. The terms of the agreement can affect the profit percentage used to determine the taxable portion of the payments received in a given year. Although this can be very complicated, it can also be an additional way for a seller to spread out their recognized income over several years and allow them avoid moving into higher tax brackets.

Typically, earn-outs are taxed at the rates that correspond to their asset allocation. In other words, if the earn-out payments are applied to capital assets, the profit portion of the payments can be subject to favorable capital gains rates based on the asset allocation agreement.

This can also be a very powerful way to structure a deal when the two parties do not agree on the value of the business.

The importance of personalized advice and guidance

Clearly, there are numerous variables that can affect a seller’s tax situation. Although we’ve covered many of the most common questions in this post, each seller’s situation is unique, so it’s important to speak with a qualified tax professional before selling your business.

You may have noticed that his article uses the terms “typically” and “usually” many times throughout the piece. This is because the application of the tax law is based on the specific facts and circumstances of the parties involved in the transaction.

To understand the true tax implications in a specific case, there are many factors that should be discussed with a CPA who has experience with these types of transactions.

A business sale is a life-changing transaction for sellers, so we strongly suggest that you seek the opinions of qualified experts who have completed the respective higher education requirements in their field. Sound legal council, expert tax advice, and a thorough analysis of your business can all help you to maximize the chances of a successful outcome.

To understand how your personal tax situation may be impacted by the sale of your business, it’s also a smart idea to have a CPA complete tax projections for the various scenarios you’re considering. This process can reveal opportunities, help you steer clear of pitfalls, and ultimately equip you with accurate expectations of what lies ahead.

If you’re exploring the possibility of selling your business, we’d love to speak with you. Not only will our team of qualified advisors provide you with a free valuation of your business, but we’ll also answer your questions and help you gain a clear perspective on the opportunities before you.