Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

The Good News About Private Equity in eCommerce

By Quiet Light

If you want to sell an online business, there are three primary options for buyers: those with their own money, those getting a loan, and private equity firms. Positioning yourself for a large exit can be difficult, but pay big dividends in the end. In this post we’ll discuss the private equity process, and how you can sell your small business for big bucks.

PE firms come with an open mind and don’t have time to waste

What does that look like on the macro level?

What does that look like on the individual business level?

It’s reasonable to expect multiples to increase, thanks to private equity

You can probably have your cake and eat it too

PE firms aren’t looking to avoid risk

You’ve probably noticed that scams are trending lately.

Enterprising folks like Anna Delvey and Billy McFarland keep showing their hands, revealing an exhausting but existentially-interesting knack for generating capital out of thin air.

The world’s become fascinated by these modern-day Rumpelstiltskins who for a little while seem able to spin straw into gold.

Movies and podcasts have been made, and fraud merch is already in the works.

Grifters are nothing new, of course, and it always strikes me that they live lives of total paradox – working extremely hard in what seems like a relentless attempt to avoid hard work and circumvent the system.

Frank Abagnale, the famous security consultant whose resume includes pretending to be an airline pilot, escaping federal custody, and defrauding banks of millions of dollars as a teenager, once said, “Technology breeds crime.”

It certainly seems true lately, especially in the case of Theranos, a company valued at $9bn just a few years ago and built almost entirely on deception.

There’s one thing all the con-artists have always gotten right, though… If you have big goals and big ideas, you need big capital to make them happen.

In the legitimate business world, if you own a business that’s cruising along at a steady pace, but which you know has the potential to ramp up to next-level revenues, you’re probably going to need legitimate capital.

Luckily, our guest on the podcast last week brought good news from the world of Private Equity – there’s no shortage of capital. Not even the tiniest bit.

In fact, the sheer number of dollars boggles the mind.

If you sell an online business right now with revenue at a certain level, private equity will likely come up.

Brian Rassel is Vice President with the 20-year-old private equity firm, Huron Capital Partners.

His firm specializes in business services, consumer goods, and specialty manufacturing.

Listen to the Source of this Post:

This blog post is based on a podcast episode that we recently recorded. Listen to the full episode here:As Brian explains it, several things have happened to make the cups of private equity full-to-running-over right now, including:

- Hedge funds have declined in popularity.

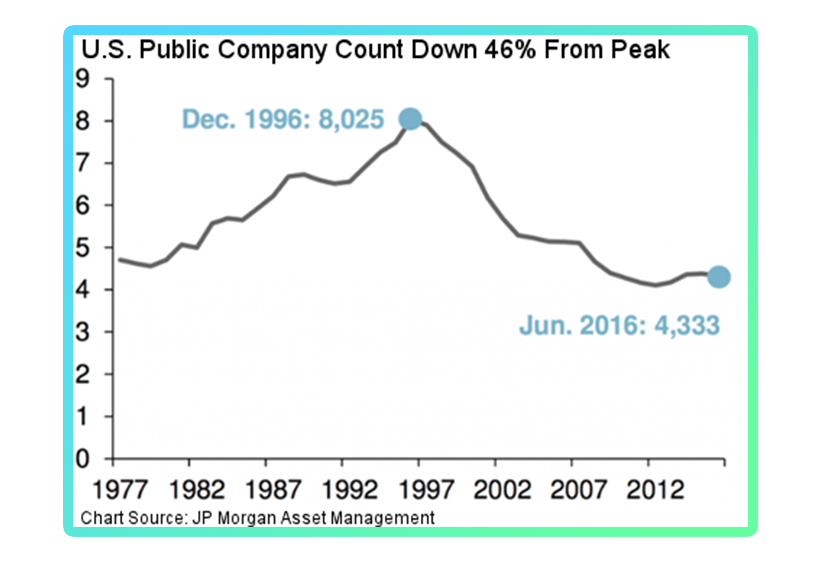

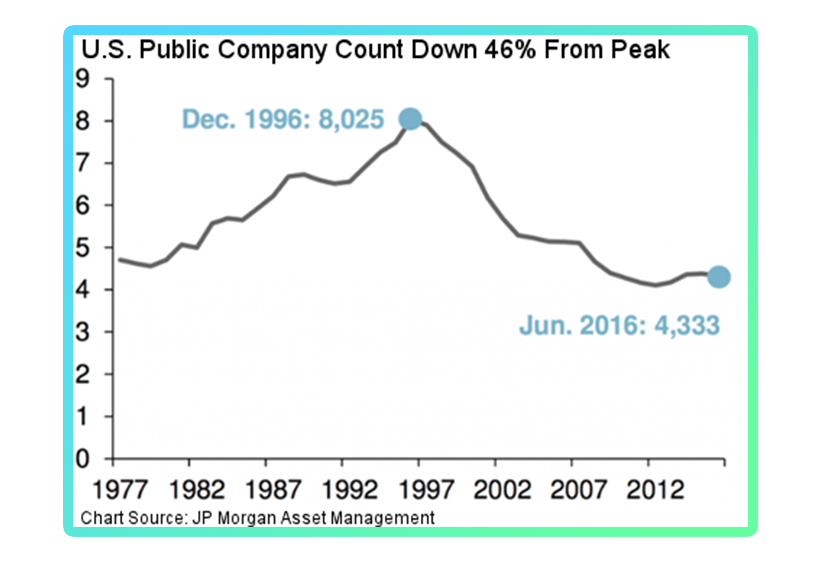

- There are now half as many publicly listed companies as there were in the mid 90’s.

Those two things, among others, make institutional investors more likely to seek access to private companies.

Enter private equity firms.

Basically, if you need capital to grow your business or have a decent-sized business to exit, they’re your ally.

A quick definition of private equity is, “pooled private capital going into private businesses.”

As forces in the ecommerce world now converge with forces in the private equity world, the two are quickly becoming a match made in heaven.

Why is that? Read on for the answer to that question, as well as an in-depth look at the good news Brian Rassel had to share with anyone looking to sell an online business.

The good news is:

There’s a whole lot of money

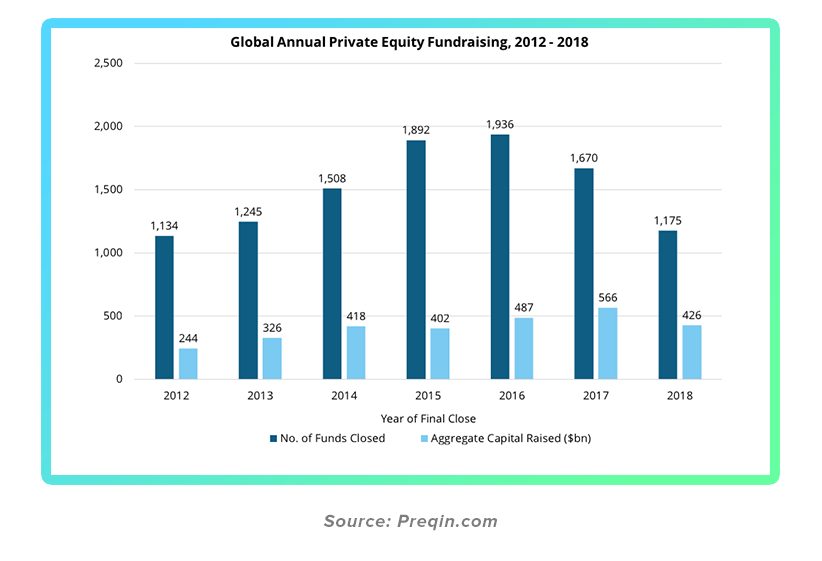

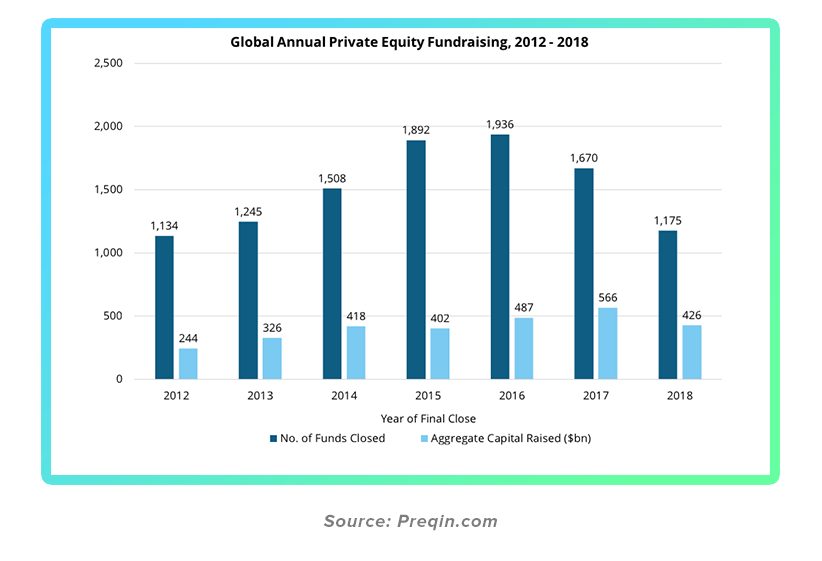

According to Preqin, the alternative assets database, 1,175 private equity funds raised $426bn in 2018 alone.

“Dry powder” (which as I understand it in the private equity world means cash on hand ready to invest) reached 1.2 trillion dollars at the end of last year.

Let’s all give that a moment to sink in.

$1.2tn ready to invest. As of three months ago.

To understand all that money, especially if you’re planning to sell an online business, it helps to understand where it comes from.

According to Brian, fund managers seek capital that’s institutionally managed, such as that of:

- Insurance companies

- Endowments

- Pensions funds

- Universities

- High-net-worth individuals and families

These fund managers generate theories about the best places to put that capital, then pitch their ideas, raise the money for their next fund, and deploy it over time. Huron, for instance, has raised 5 successive funds since 1999.

The funds in private equity are raised for every type of private-business investment across the gamut. (More on that below.)

And their sizes vary as follows:

- Small funds – from around $50MM

- Mid-sized funds – $300MM to $400MM is common

- Huge funds – the largest fund to close last year was an $18.5bn fund raised by the Carlyle Group

In order to have enough diversification, Brian explains, each fund needs around 10 investments.

Once they’ve raised the fund, a firm will deploy it over the next four years or so, putting around 20% of the money into new platform companies in the first year.

A platform is simply an industry or area of business that the fund isn’t already invested in and onto which they can add over the next several years by acquiring other companies in the same space.

If you plan to sell an online business in the near future, that add-on investment, especially, could be your company.

Normally, the fund aims to “harvest” the companies it acquires on a rolling basis after 3-5 years of growing each one.

And to invest around 20% of the fund each year, reserving the last 20% for contingencies.

The life of a fund is usually around 8-10 years total.

Again, keep in mind how much capital sits waiting in these funds to be deployed at the moment – well over a trillion dollars.

PE firms come with an open mind and don’t have time to waste

Also keep in mind that these funds need to find places where all this capital can be put to work efficiently.

They aren’t in the business of operating companies, Brian says, but investing in them and growing them.

If you sell an online business and they take an interest in your company, he assures, they aren’t looking to waste your time or theirs.

They want to find out quickly if it’s the right opportunity to put that capital to the best use.

How is it best used? By doing things like:

- Bringing the right resources.

- Providing capital solutions and availability.

- Setting strategies.

As Mark said on the podcast last week, a private equity fund acts as an accelerant to strategically, “pour gas on the fire that’s already existing.”

With all that said, a firm doesn’t have a specific business prototype in mind exactly. But they do go out looking for those fires to add fuel to, wherever they may be.

What does that look like on the macro level?

Brian explains that to find those fires and generate deal flow, firms primarily do three things:

- Evaluate deals that come to them.

When companies come to their attention through brokers or investment bankers, firms take a look and set out to prove the thesis that the business would be a good fit. Right off the bat, they look for companies that exhibit things like great cash flow, leadership in their space, and a counter-cyclical nature (meaning they do well in economic downturns). - Network with executives across a range of industries.

While meeting with and forming relationships with these executives, the firm keeps an eye out for change on the horizon in specific industries. “Change creates opportunities,” says Brian, “[it] creates winners on one side, losers on the other side, and…you need that kind of disruption to create any sort of interesting investment outcome.” The firm makes a practice of discovering that sort of change and then may build a case around it for investing in a certain industry. - Engage in “ExecFactor®” investment.

This is the most pro-active method. Huron’s ExecFactor® approach entails forming a strategic partnership with an executive or entrepreneur who has a winning idea and a vision for how to execute it. If they believe in that person’s vision, they happily go looking for a platform company to acquire for him or her. “We call that getting ‘Phil’ behind the wheel,” says Brian, “We need to find a car for Phil to drive. We believe he’s the best driver in that industry.”

What does that look like on the individual business level?

The process of evaluating a specific business once it grabs their attention can take anywhere from 30-90 days, Brian says.

That process entails:

- Preliminary study

The firm digests a vast amount of information about the target acquisition, including “anything the business can possibly produce about itself.” Brian says that at this stage, the more information made available (all under NDA) and the more organized you can be about it, the better. This step is necessary to get to LOI and can help save major time and effort later. - Due diligence

At this point, once under LOI, a firm engages a quality-of-earnings firm. They also hire out the legal research on the business and the work of creating the transaction documents.

Again, the process can take anywhere from 30-90 days and involve around 20 people.

4-8 of those people would be from the acquiring firm itself, depending on whether or not the acquisition is an add-on to an existing investment, and the rest would be advisors.

Brian points out that time is a private equity firm’s most valuable resource.

At Huron, they look at over a thousand deals each year and acquire around 20, so they’re committed to as efficient a process as possible.

If you sell an online business and attract the attention of a private equity firm, they’ll most likely have a very specific reason for thinking that you’re a good fit for them.

“We’re also looking for situations where the seller in some way is choosing us,” Brian says, “There has to be a great fit and a reason why we’re a better owner than someone else for that business.”

Once they commit to the process, he points out, they’re not looking for the deal to fall apart. That can happen, of course, when new information becomes available, but it’s certainly not the intention once they find an interesting investment.

Their job at that point is to validate everything they believe to be true or they’ve been told.

Firms benefit overall from having a broker involved on the seller side. At Huron, Brian says they call brokers “river guides,” due to the fact that their involvement makes the journey smoother and saves a ton of time overall.

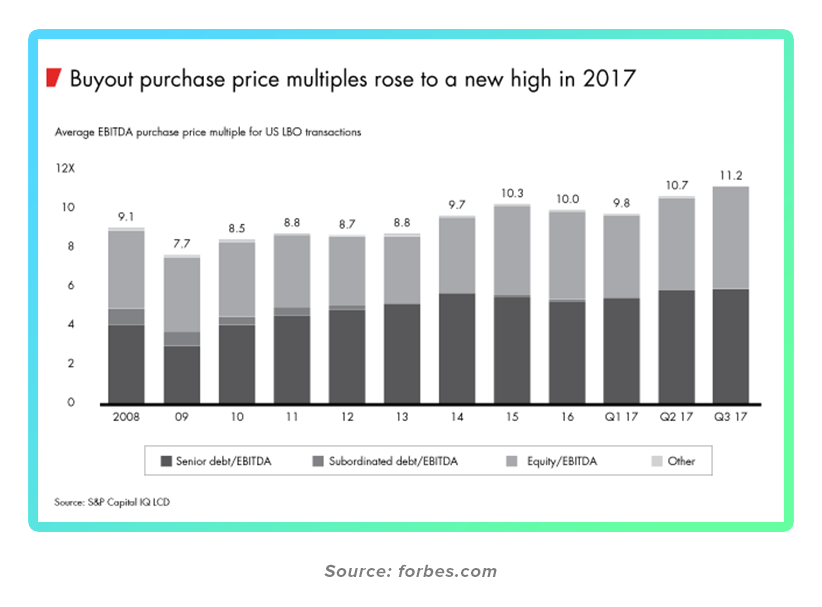

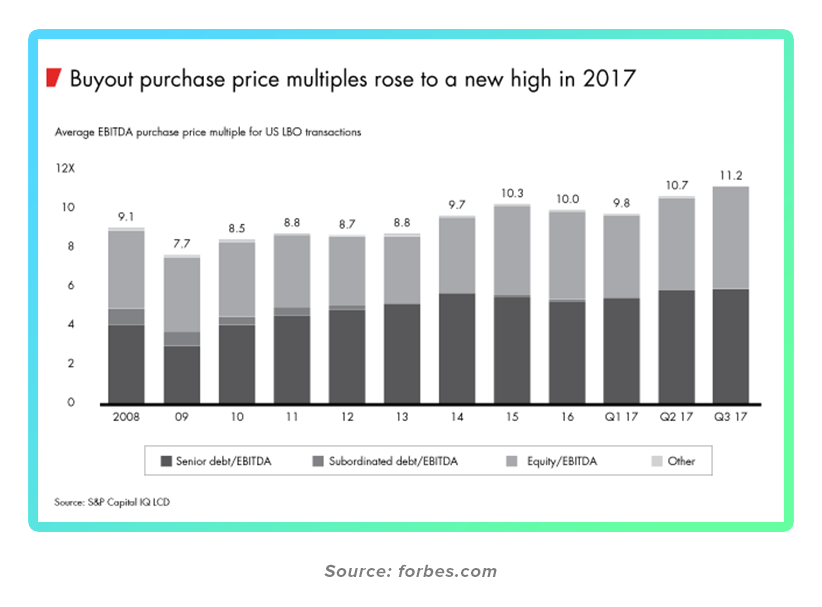

It’s reasonable to expect multiples to increase, thanks to private equity

Currently private equity firms tend to pay much higher multiples than those you commonly see in the online world.

As the two worlds, ecommerce on the one hand and private equity on the other, continue coming together more and more often, Brian expects deal values in the online space to climb.

More good news if you’re planning to sell an online business in the future.

The most valuable deals of all, he believes, will be hybrid companies that combine features of both online and traditional models.

These businesses will be highly under-writable because they’ll have relevance to the future while still existing in a less dynamic and more predictable space.

In a nutshell, Brian’s predictions for the next 3-5 years in ecommerce:

- Private equity becomes more comfortable with the standalone ecommerce business model.

- More traditional business models are drawn to the structure and growth possibilities of an ecommerce model.

- Multiples rise.

You can probably have your cake and eat it too

Generally, private equity firms prefer to have an owner stay on board as part of the management team post-acquisition.

“For your sellers who are looking to exit the business and hand it off to somebody else,” Brian explains, “private equity is not going to be the right solution.”

If you were to sell an online business to a private equity firm, they’d expect you to still keep some skin in the game.

The ideal deal structure from Brian’s perspective would include cash from the firm, debt which the business takes on, and equity rolled over from the you the seller.

Take as an example this $80MM transaction:

- $32MM equity in cash paid by the firm to the seller

- $40MM debt taken on by the new business and paid to the seller

- $8MM in equity rolled over back into the business by the seller

This type of deal structure shows the seller’s confidence in the business, but also allows the seller to participate in the future growth and take advantage of the opportunity to turn that $8MM into $16MM over the next few years.

The benefit for the investors is that management has that much more incentive to make their high-level growth goals and ROI happen.

“We believe in creating a broad base of ownership,” says Brian, “so that we’re all on the same page.”

Private equity represents a great opportunity, as Mark points out, when you’re “income-statement rich and cash poor.”

This type of deal offers you a chance to double-dip in a sense and take some money off the table, but then continue growing your business to its full potential thanks to the influx of cash.

PE firms aren’t looking to avoid risk

If you attract a private equity investor to your business, that spells opportunity all around.

Not only do they look to accelerate growth, but they can do so while taking on more risk than an individual investor likely would.

That’s due to the simple fact that a private equity fund, with a whole portfolio of investments, has less net worth tied up in a single business.

In some ways, they can afford to fail, at least in the short term. Importantly, they can take on the kind of trial and error failures that tend to lead to great successes.

They’ll be willing to try your ideas, Brian says, and more of them, than you as a single business owner can usually afford to try on your own.

As I mentioned, it can be a match made in heaven.

Imagine the possibilities if you had the capital to back your grandest vision.

If you could take more risks in your business, try out more of your craziest ideas, and add fuel to the fires that are already hot. What then? What might change?

It’s one of the reasons, surely, the con-men and -women of the world tend to capture the public imagination. Besides the thrill of the chase, we’re at awe at the sheer lengths they’re willing to go to, as risky as all get out, to bring about their own vision of the future.

Of course, those are short-term gains and the con always catches up to them.

Crime doesn’t pay.

But in the world of private equity, vision does pay, and risk.

And if you’ve built a profitable resilient business that you’re ready to take to the next level, your genuine hard work and ingenuity might just pay off handsomely.