Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

The Definition & Importance of Seller’s Discretionary Income

By Quiet Light

Correctly valuing an internet-based business requires careful analysis of several core components of its performance. By looking critically at the right numbers, savvy buyers can gain a deep understanding of the business’s story, as well as make informed predictions about its future potential.

In order to make sense of the numerous spreadsheets and reports that you’ll be presented with during the research process, it’s important to sharpen your business-buying vocabulary. When you’re reviewing marketing materials for available websites, you may notice terms such as “EBITDA,” “SDE”, and “ODI” floating throughout the text.

What do these terms mean, and why are they so critical in the valuation process? In this article, we’ll be explaining the vocabulary that accompanies the most important metrics when it comes to valuing internet-based businesses.

Earnings Before Interest, Taxes, Depreciation, & Amortization (EBITDA)

As its name implies, this value represents profits taken before any interest expense, taxes, depreciation, and amortization are accounted for. In other words, EBITDA is the profit for the business owner before non-cash expenses. Correctly calculating EBITDA is essential to avoid problems with your financial records and to prepare an accurate balance sheet.

In some cases, adjusted EBITDA can be applied to the multiple to determine the business valuation on its own. However, usually, it is added to the current owner’s salary and benefits to produce a value for SDE, which is then applied to the multiple.

Seller’s Discretionary Earnings (SDE)

Seller’s Discretionary Earnings (SDE) are the pre-tax and pre-interest profits before non-cash expenses, one owner’s benefits, one time investments, and any non-related income or discretionary expenses are accounted for. In addition, SDE may require that expenses be adjusted if a new owner will necessarily need to take on a new expense after the asset sale.

Let’s break this down into each of its parts:

- Pre-tax and pre-interest profits before non-cash expenses: As discussed in the previous section, this is EBITDA – the accounting terminology for earnings before interest, depreciation, taxes, and amortization.

- One owner’s benefit: Standard in the calculation of SDE is the “add-back” of one owner’s compensation. If there are multiple owners who actively participate in the operation of the business, part of the calculation of SDE requires that a projection be done to replace the other owner’s efforts and work (check out this article for an in-depth discussion about transition staff during a business acquisition).

- One-time expenses: This would include major website redesigns, purchasing specific licenses, one-time application fees, and any other one-time business expenses that could affect the net income and cash flow.

- None-related business expenses or income: Common scenarios would be taking consulting income and running that through an e-commerce business, taking extra time on a business trip for a personal vacation, charging your business “rent” for a home office, and running an automobile expense through your business when your business does not require an automobile. Essentially, any expense that is not actually necessary to run the business would fall into this category.

- Adjusted expenses: Sometimes, a new owner may encounter additional expenses that the previous owner didn’t need to account for. Consider a company that owns a large fulfillment center as well as a small website that uses the fulfillment center at no cost. Any company acquiring this small website will need to account for the expense of warehousing and filling orders. This expense will need to be injected into the overall earnings statement of the business.

The ultimate goal of identifying the seller’s discretionary earnings is to properly identify what a new owner can reasonably expect their annual earnings and discretionary cash flow to be. Of course, this determines the sale price and market value.

Oftentimes, this calculation reflects a combination of art and math. Therefore, it is not uncommon for a buyer and seller to disagree about what is being included – or not included – in their discretionary earnings number.

Thinking of Selling Your Business?

Get a free, individually-tailored valuation and business-readiness assessment. Sell when you're ready. Not a minute before.

Common Areas of Disagreement

As mentioned, disagreements between the buyer and seller about the discretionary earnings number are not unusual. Often, these disagreements arise due to the ambiguous nature of certain business metrics, particularly discretionary expenses. There are many instances in which a buyer and a seller may simply see an expense, earning, or replacement value in a different light. Common areas of disagreement between buyers and sellers include:

- Replacement owner’s benefit: In cases in which there are multiple owners who are actively working on a business, only one owner’s benefit can be added back into the earnings. For the other owners, their earnings need to be adjusted to represent reasonable market rates. For example, if there are two owners of a business and one does the marketing and customer service while the other handles all order fulfillment, and both are working full time, one of the owner’s benefits need to be added back into the earnings. Let’s suppose we add back the benefit of the owner who handles marketing and customer service. The owner who handles all order fulfillment needs to have his or her earnings adjusted to what it would cost to replace that owner with a full-time worker doing that same job. Buyers and seller’s can disagree over this as they may have different opinions about the actual scope of the work or what a reasonable rate is to pay someone to replace that owner.

- One-time expenses: Some one-time expenses are easy to justify such as a one-time application fee or licensing fee. Other one-time expenses can be disputed if the buyer and seller do not agree that it is indeed a one-time expense. For example, major website redesigns and upgrades are typically added back into earnings as they are not ongoing costs. However, it is also reasonable to suppose that a site will need to be periodically upgraded and redesigned. Since the choice to upgrade and redesign is typically done at the owner’s discretion, it is usually an added-back expense.

- Adjusted Expenses: In the section above, we used the example of a fulfillment center that utilizes some of its space and workforce for a small web business. In calculating the total seller’s benefit, a replacement cost will likely need to be injected into the earnings statement in order to properly represent potential earnings and cash flow. Buyers and sellers may disagree over the determination of that replacement cost. On the one hand, a seller may argue that injecting a replacement cost is not necessary. Using our example of a fulfillment center, if the amount of space and workforce necessary to fill orders could easily be run from a home office, then a seller may argue that a replacement cost is not necessary. Of course, a buyer may disagree with this claim.

- Owner’s Salary: The owner’s salary is typically the most disagreed upon add-back of them all. Buyers will sometimes complain that it’s not a legitimate add-back because they’ll need someone to run the day-to-day operation. However, sellers can argue that if a business earns $100,000 in EBITDA, the seller can choose to pay him or herself a salary of $1 per year or $100,000 per year. In the latter example, if he or she paid themself $100,000 per year, the business would have zero earnings and applying a multiple that would lead to a business value of zero. Right away, it’s easy to see that doesn’t make sense.

Owner’s Discretionary Income (ODI)

It’s important to note that SDE is sometimes referred to as Owner’s Discretionary Income (ODI). If you see this term when you’re doing your research on a business, don’t let it confuse you. ODI is the the same thing and SDE – both are the discretionary cash flow available for the owner. However you choose to call it, this number plays an important role in determining the value of your business.

Buy a Profitable Online Business

Outsmart the startup game and check out our listings. You can request a summary on any business without any further obligation.

Discretionary Earnings will Vary from Buyer to Buyer

The purpose of focusing on a seller’s discretionary earnings is to provide a consistent number that can be used as a baseline for a buyer to make their own calculations and estimates as to how much a business will earn for them. Each buyer will have their own set of circumstances and expenses which will adjust that final earnings number.

For example, some buyers intend to outsource 100% of the work in a business. As such, they will need to inject an expense for whatever work the seller is currently doing for the business. Other buyers may have no intention of ever housing inventory even though the current owner of the business is able to comfortably do so out of their home. That buyer will need to plan for an added warehousing expense.

Because a buyer’s situation will necessarily change from one buyer to the next, we focus on the seller’s income that they have at their discretion.

Establishing a Baseline (Business Valuation)

While it’s beneficial to business owners to reduce their taxable income by charging certain expenses to the company, doing so can distort the actual SDE of a business on the balance sheet. Normalizing the company’s income and expenses reduces confusion and can more clearly illustrate the earning power of a business for buyers.

We focus on SDE (and EBITDA) during the recasting or normalization process in order to get closer to a solid baseline valuation. The baseline value tells us how much a business is actually earning for the seller, as well as what it could potentially earn for the buyer once the transaction is complete.

To develop a clear SDE, we have to start with the EBITDA, which provides a firm foundation before any add-backs. Beginning with the EBITDA, we then add:

- The Owner’s (or Owners’) compensation, including benefits.

- Add-back values for personal items such as personal travel expenses or vehicles.

- Add-back values for one-time expenses (e.g. new computers, website redesign, etc.)

Each of these adjustments are made to provide a more accurate picture of the potential income available to the buyer. Whether you’re preparing to sell to a solopreneur or a large private equity firm, this is an essential step in the valuation process.

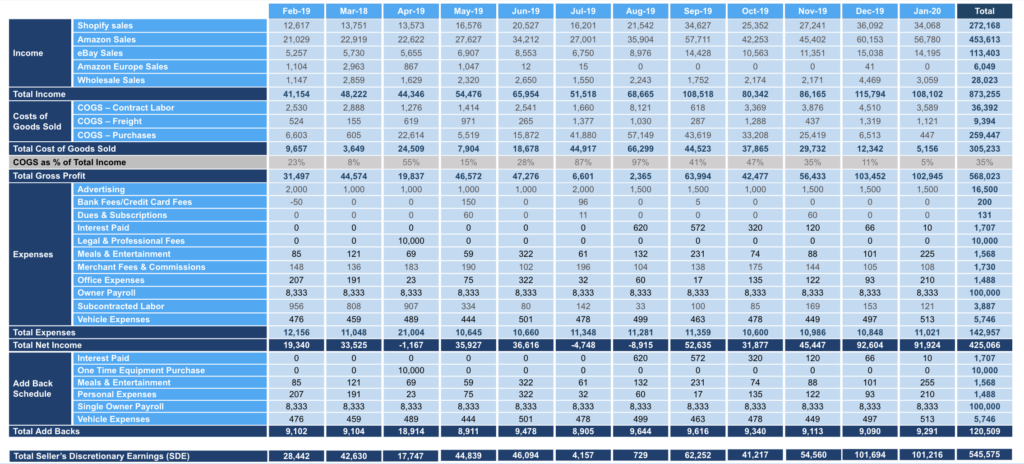

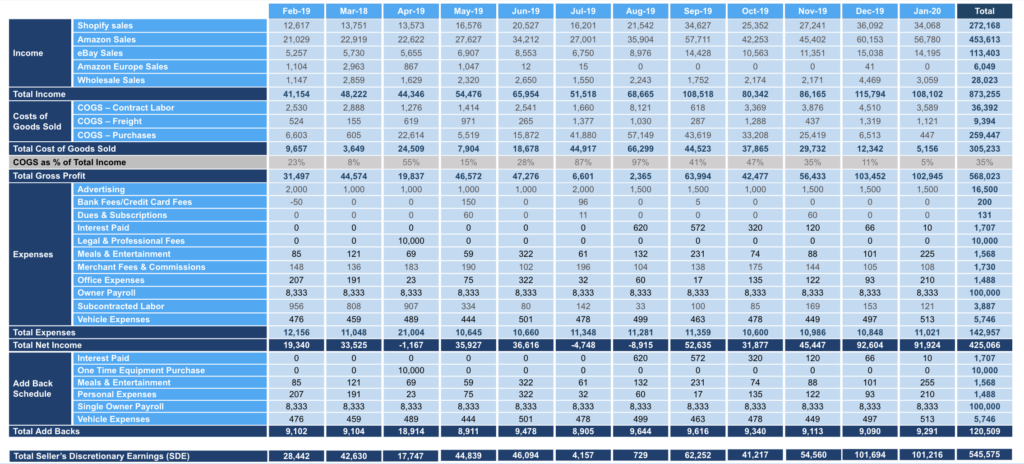

A Sample Income Statement

Applying The SDE To Your Calculations

When calculating SDE, remember that every buyer and business owner is unique. Each has their own set of circumstances, expectations, and goals that will impact their version of the final earnings value. For example, if someone plans to reduce staff by farming out certain roles (or even all of them), they’ll need to adjust the SDE to account for the cost of the contract services needed to replace the work currently done by staff or the owner.

Remember, the potential costs involved are already reflected in the multiples of SDE in the original asking price. For example, if a saas business needs a new website (or equipment, or licenses, etc.) in order to function, these items must be factored into the one-time expenses as well when determining the sale price.

It’s important to note that most internet-businesses are valued using an earnings-based multiplier, as compared to a revenue multiple.

Once the SDE is determined, it is multiplied by a number known as the multiple. There are a multitude of factors that determine this number, but all relate to the overall desirability of the business. Check out this article for a more in-depth discussion of the valuation method used for valuing web-based businesses.

Also, our qualified business brokers are always available to discuss your situation in greater detail. To learn more, schedule a free consultation today with one of our experienced entrepreneur advisors.

Comments are closed.