Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Is Your Customer Acquisition Strategy Optimized?

By Quiet Light

Whether you’re growing a business or looking to acquire one, it’s not uncommon these days to have a well-spring of value sitting around untapped – customer data.

In this age of big-data, we have access to an incredible amount of information. And we know we should use it.

It’s like falling water. Unless you put some mechanics in place to capture and convert that energy, its power flows away unharnessed.

Sooner or later anyone in ecommerce faces the same questions around customer data…

How do we put it to best use? What exactly do we do with it?

Spend just a few minutes searching for the answers to those questions, and life gets instantly complicated.

I mean head-nodding, eyes-rolling-back complicated.

Listen to the Source of this Post:

This blog post is based on a podcast episode that we recently recorded. Listen to the full episode here:I’ve even come to the conclusion that some who explain customer metrics are purposely trying to piss you off. I’ll try not to do that.

Fortunately, Babak Azad is one man who seems to have a gift for cutting to the chase and making customer acquisition and the data that helps you analyze it look a lot simpler.

Azad was the Senior Vice President for Media and Acquisitions at Beach Body for 8 years. He’s now the founder of Round Two Partners, where he helps ecommerce companies hone in on their customer acquisition strategies.

When he arrived on the scene over at Beach Body they were already bringing in a hefty $100 million in revenue annually. By the time he left, that number had grown 10x to over $1 billion.

According to Babak, a critical thing to understand about customer acquisition is this: Customer acquisition directly relates to customer experience.

And your ability to optimize the customers’ experience with your brand depends on your ability to analyze your customer data.

Two big take-aways from Mark’s conversation with Babak this week:

- More than 4 acquisition channels may indicate that you’re wasting money.

- The simplest answer you’ll ever hear to the question of what to do with all that customer data: Just start doing something.

If you’re ready to get a better grip on customer acquisition here’s your chance.

We’ll take a look at Babak’s approach to customer analytics, and with his help break it down for you into a few doable and clear steps.

In this post:

First Look at Your Customer Data – Start Somewhere

Then Determine How Much to Spend on Acquisition

Refine and Get More Advanced as You Go

Accept That Attribution is the Bane of Your Existence

Focus On a Few Channels

See the Connection Between Customer Acquisition and Your Brand

First Look at Your Customer Data – Start Somewhere

Start somewhere sounds well and good. But where?

Start by asking the right questions of the data you have.

Let’s look at an overview of customer acquisition.

Your customer finds out about you from somewhere and embarks on a customer journey…

They see an ad, video, or post and click on one of your website pages, a landing page, or an opt-in where they enter their email address.

Maybe they google your brand later on and land on your website. Maybe they receive a series of automated emails from you. Ultimately, they convert to a sale.

Ideally, you look at the data from various ad platforms, your email platform, or your website, and can trace the exact steps they took on that journey.

You want to know how a customer found you and what prompted them to convert, so that you can go out and get more customers just like that one.

You want to know how much a customer is worth, so you can determine how much you can afford to spend to get new ones.

Best case scenario, a good data analysis with the help of marketing attribution tools such as Salesforce and Google Analytics shows you where to keep spending money and where to stop wasting money.

You execute marketing strategies, allocate ad spend, and communicate with current and potential customers based on your findings.

As you focus your efforts on what’s working, revenues and margins go up.

That’s customer acquisition in the broadest strokes. And it reveals a perfectly good place to start…

According to Azad, start with the conversion.

Let’s say you gather the customer data you have for 2017. He recommends segmenting your customers into cohorts based on the month they converted or made the first purchase.

Then take each group – January, February, March, etc. – and start with a basic analysis. How much revenue did it bring in? When were the sales, and where did they come from?

If you don’t sell a product or service with recurring revenue, monthly cohorts can still be beneficial. The most valuable cohorts can reveal which strategies are working well for retention and repeat sales.

Once you have an organized approach to looking at your customers and the revenue they bring, you’re in a better position to make these two important decisions:

- How much you want to spend to get more like them (next up).

- Where to best spend it.

Listening to Babak’s take on customer acquisition, someone who has experience growing revenue exponentially, made one thing very clear to me…the more you know about your customers, the stronger you are as a business.

Every additional piece of information makes you better.

Then Determine How Much to Spend on Acquisition

Determining ad spend on different platforms sounds a lot like CPA (Cost Per Acquisition), right?

It is that, but CPA alone means very little.

CPA means the amount you spend on a platform over a given time divided by the customers gained from the platform during that time.

Babak stresses that there’s no single optimal Cost Per Acquisition figure; it depends on your business.

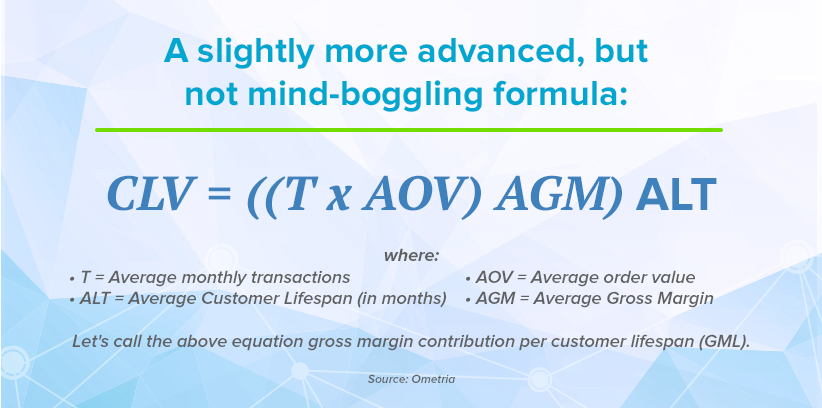

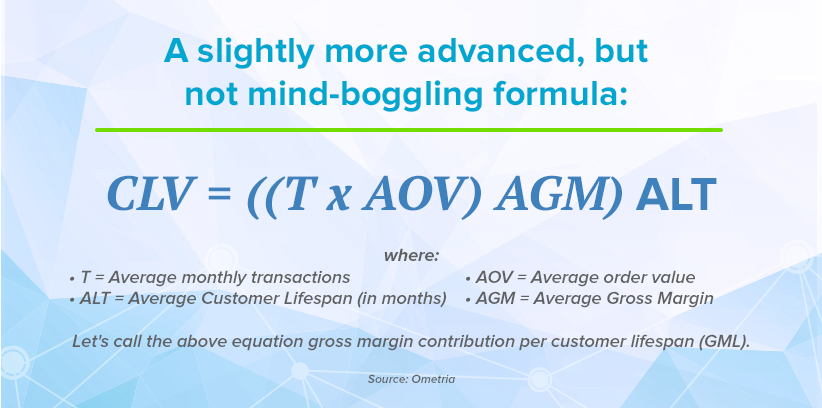

That’s where LTV (Customer Lifetime Value) comes in.

LTV is the gross profit you can expect from an average customer over the lifetime of your relationship with that customer.

In the simplest terms, one formula for LTV is this:

Average Purchase Price x Average Number of Repeat Purchases Over a Customer’s Lifespan x Gross Profit Margin

* Note that there are many more advanced methods to calculate LTV, this is just one, and perhaps the simplest. Here are more still.

While wild guesstimates aren’t helpful, predicting based on experience and the available data will be better than not analyzing at all. As Babak mentioned on the podcast, “Done is better than perfect.”

Regardless of the method you use, if you want to know what you can afford to spend on acquisition, you must first know what a customer is worth.

By breaking down LTV by channel, and CPA by channel, you can determine that channel’s Return on Investment (ROI) over time.

Refine and Get More Advanced as You Go

Once you’re comfortable with segmenting your customers into cohorts as mentioned above, you can get more advanced with cohort analysis.

The objective with cohort analysis is to find the highest performing cohort in a given time period and then ask questions of that group of customers.

What acquisition methods were used? What emails sequences were in place? What pricing strategies? Were discounts or price scarcity applied, for instance? Did anything change?

You can often learn as much from an underperforming cohort as you can from the high-performers by asking the same questions.

Once you determine the questions you want answered from a cohort, you must identify metrics needed to answer those questions.

Depending on what you’re digging for, you may look at summary metrics like total revenue and number of transactions or you may look at percentages, ratios like margins, or trends.

You, or someone you hire, can perform most cohort analysis in Excel using pivot tables or data visualization (charts and graphs).

Of course, cohorts don’t have to be formed based on the date of conversion alone. You can further segment groups based on acquisition channel, for example – looking at not just when they signed up, but also how they signed up.

Cohort analysis allows you to test strategies across your funnel, as well.

Basically, you can get as simple or as advanced as you want. And as Babak advises, start simple and add complexity to your analysis as you build knowledge and skills through practice.

The two basic tools you’ll need to begin?

- Excel

- Person from Upwork or local college who loves Excel

And, the basic data sources to begin with?

- Google Analytics

- Ecomm platform such as Shopify

- Email platform such as Hubspot

Accept That Attribution is the Bane of Your Existence

I’ve tried to simplify and look for the path of least resistance in this post – until now.

Looking at customer data invariably means looking at conversions.

As anyone who’s done it knows, tracking conversions gets highly complicated.

More than one person has said that if you don’t fully understand conversion, you’re probably wasting money.

But again, remember Babak’s philosophy: Done is better than perfect.

The complication arises because attribution is a bitch, plus these two factors:

- Platforms assign a conversion based on a window of time and it’s often not accurate.

- Customers often don’t behave according to the way conversions are tracked.

For example, Facebook may attribute a view-through conversion to a customer who watches a video ad one day and the next day searches his inbox for an old email with a coupon and then clicks on the link in the email and makes the purchase. But the email platform may show the conversion as well.

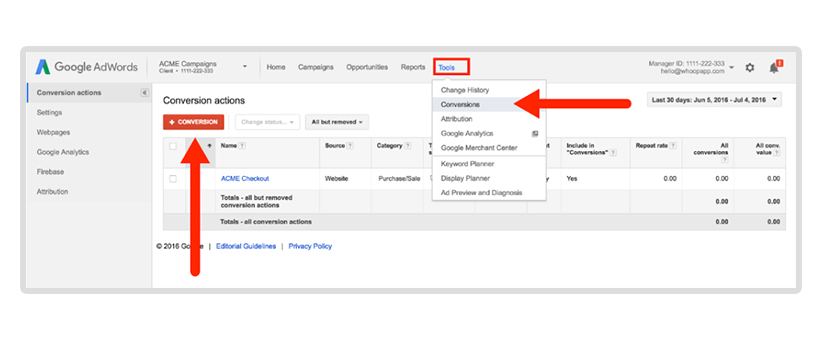

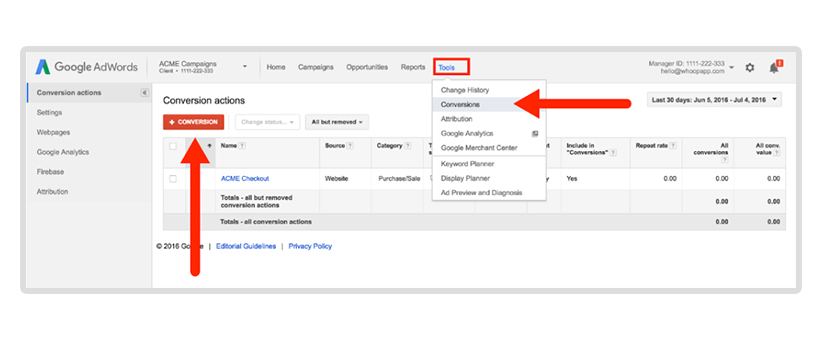

To analyze your data most effectively, it’s good to know how conversions are tracked.

Here is the most thorough explanation I’ve found about what can and does go wrong when it comes to attribution, written by one of those people who says that you’re probably wasting money.

In a nutshell, a lot depends on the conversion/attribution window you’re using. In Facebook, there are two variables when it comes to attribution windows:

- Time lapse (1 day, 7 day, 28 day, etc.)

- Action taken (click on link, view video, etc.)

Facebook explains its attribution window settings here. And they explain that, to them, attribution window and conversion window are different things here.

Like I said, it’s impossible to keep it simple with attribution. However, you can add to your understanding one platform at a time and learn as you go.

And remember that your data doesn’t have to be perfect to be useful.

Focus On a Few Channels

As the above topic shows, while diversifying is important from a risk perspective, too many channels can overcomplicate things.

And that can make you less effective at customer acquisition in the long run.

In Babak’s words, “Most businesses that have scaled substantively [have] gone deep and hard in a couple of channels… it means they’re focused, and it means they’re exploiting where things are working.”

He even goes so far as to recommend focusing on two channels.

And he’s seen lots of businesses grown into 9 figures focused on just these four:

- Google (+ Bing)

- Facebook (+ Instagram)

- Affiliates

Again, some basic customer analysis (see LTV and ROI above) will let you know what’s working and where to focus your resources and attention going forward.

See the Connection Between Customer Acquisition and Your Brand

Babak points out that customer experience should be the lynchpin of your acquisition strategy.

Coming from someone who’s increased revenues tenfold to over $1 billion, it’s an important point.

To him, building a brand is critical in today’s hyper-competitive landscape, and he equates that with a solid focus on customer experience and the long-term sustainability of your company.

Basically, by brand-building he means treating your customers extremely well and investing in the quality of your products so that you deliver what they really want.

That’s how you acquire customers and then keep them around long enough to stay in business.

To stay with my theme of keeping things simple, let’s see if I can sum up customer acquisition in just a couple of sentences…

Use your customer data to get to know your customers, how they respond, and how much they’re worth. Then treat them the way you’d want to be treated while spending money only where your money is most effectively spent.

Meanwhile, when cohort analysis and calculating LTV gets complicated and your brain starts to hurt…shut your computer and go do something nice for one of your customers. You won’t go wrong.