Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

A SaaS Guru’s Guide to Saas Valuation

By Quiet Light

Few things seem as simple but turn out to be as complicated as churn and some of the other metrics used to evaluate a Saas business for sale. Luckily we have several powerful tools to make that easier and one of those is our own David Newell. After getting started in M&A with Citigroup, David moved into the online brokerage world where he oversaw more than 200 deals before joining us here at Quiet Light. With his expert guidance, we’re making sense of SaaS valuation and uncovering the opportunities often hidden within micro-SaaS companies.

- The Making of a SaaS Guru

- How to Spot a Diamond in the Rough

- 3 Key Valuation Factors to Get a Handle On

- Tools That Help You Evaluate a SaaS Business

“There’s something fishy about Google’s motto, ‘Don’t Be Evil’,” British comedian David Mitchell wrote around tax season several years ago.

“I’m not saying it’s controversial, but it makes you think, ‘Why bring that up? Why have you suddenly put the subject of being evil on the agenda?’”

“Amazon, in contrast, has never ruled out evil as part of its business plan,” he joked, “aspiring only to ‘Work hard. Have fun. Make history.’ It sounds like an Apprentice contestant’s Twitter profile.”

This comes from an article Mitchell wrote for the Guardian when folks were first up in arms over the relatively small amount of tax paid by Amazon in the UK.

I think we take Bezos’s world-domination plan largely for granted now, but 6 years ago around this time it was still shocking to many.

Listen to the Source of this Post:

This blog post is based on a podcast episode that we recently recorded. Listen to the full episode here:“Is there any point in my being angry about this?” Mitchell wrote, “Everyone else already is.”

“It feels like the interesting thing would be to come out in favour of it,” he quipped.

Pointing out that the company had vacuumed up more in government grants from the UK than it would pay out in tax that year:

What elevates Amazon’s activity is the fact that it applied for government grants. The elegance of that corporate choice is like the ambiguity of the Mona Lisa’s smile, the ruthlessness of Mike Tyson’s punch, and the adaptability of the malaria virus combined. There is no point in criticising anyone or anything that can do that. They can only be admired or destroyed.

Besides having taxes on the brain, I mention this because David Mitchell has long been one of my favorite Smart British Guys.

And now, as luck would have it, we have our own resident Smart British Guy here at Quiet Light.

Before becoming the expert at preparing a SaaS business for sale that he is, David Newell started his career in Mergers and Acquisitions at Citigroup in London.

After four years of working on “big tech media and telecoms M&A and capital raises,” he decided to look for greener pastures in the online space, and soon worked his way up to Head of Brokerage and Operations at another online firm.

There he oversaw expansion overseas plus more than 200 deals, many of them SaaS acquisitions.

“A lot of deals across a lot of business models and a lot of niches, and yeah it was a very exciting endeavor,” he says of that leg of his career.

The making of a SaaS guru

Last year David launched his own personal-development content platform, Inner Truth.

Billed as “the UK’s pioneering audio platform for self-discovery”, it’s grown massively in a short time.

David’s achieved bona fide SaaS-acquisition-guru status, all those hundreds of deals later, and hearing him discuss the path his brokerage career took to get there is an education in itself.

Meanwhile, he’s already made me a lot smarter.

After hearing David on the podcast last week, I just spent the last several days immersed in Baremetrics’ Open Project platform.

(i.e., “$57 paid by That Company 1 hour ago. That Person canceled monthly 3 hours ago. $57 payment failed by Another Guy 3 hours ago.”)

It’s a SaaS valuation playground.

I feel like I’ve died and gone to metrics heaven.

Trendlines, benchmarks, quick ratios, cohort analysis, it’s all there…

All highlighting the beauty of the SaaS business model without leaving out the sticky, tricky parts.

David began studying the model and the complexity of SaaS valuation in earnest around 2014 and wound up handling exits for Patrick McKenzie and Rob Walling, among others, just a couple years later.

What drew him to SaaS early on? The strength of the companies he was seeing, the valuable “IP mote” (Intellectual Property protection) each one had, and the enticing MRR for starters.

Much of the beauty I mentioned, of course, revolves around that MRR.

Nothing says “high multiples” like Monthly Recurring Revenue.

Buyers love it, investors crave it.

Although, along with that comes a whole host of other issues like the complexity of the metrics, the intricacy of the revenue profile, and the difficulty of churn.

With David’s help, this post will take a close look at those and other valuation factors, as well as the massive opportunity inherent in what he calls the micro-SaaS model.

How to Spot a Diamond in the Rough

What attracted David’s attention back in 2014 as Head of Brokerage and Operations was a somewhat overlooked model he now refers to as micro-SaaS.

VC-backed startups were grabbing all the attention.

But these were small often engineer-founded software companies under $1MM in value, which were “not really being thought about…and valued in a very sophisticated way” given their strengths.

What, according to David, constitutes a micro-SaaS?

A company that’s not VC-backed.

A company that’s not in fast-growth mode with investors pushing for a revenue-multiple exit.

A company that is for the most part bootstrapped and slower-growth oriented.

This type of company will often already have tons of time and effort poured into it on the technical side, with a solid architecture in place.

But you’ll find much less effort put into the sales and marketing side of the business.

Why? Because the software engineers who build such a company, says David, are happy to grow their businesses organically and slowly for the most part.

They tend to excel at finding and solving technical problems for customers but may lack the desire or skillset to excel at marketing.

Which means the value they create for someone who wants to take over and ramp up the marketing for a technically-sound, somewhat competition-proof company can be enormous.

The road has been paved for major growth mode; it just hasn’t been driven on yet.

A large amount of the value proposition of a micro-SaaS business, David says, comes from the fact that such a company has already gone through the daunting process of finding product-market fit.

While in a physical-products company that can happen quickly, not so with SaaS.

The process can take many months and tens of thousands of dollars, which explains in part the higher multiples for SaaS.

It’s a major key when it comes to valuing a SaaS business for sale and the higher multiples those companies can command.

3 Key Valuation Factors to Get a Handle On

What are the top 3 things buyers should look at to determine value, or sellers should focus on to increase value?

- 1. Churn

In David’s experience, given that SaaS is a subscription model, churn is the most important but least understood metric of them all.

It sounds simple enough…it’s the percentage of your customers who leave in any given time period.

It looks like this: customers who leave over a segment of time/total remaining customers.

In other words, churn represents lost revenue.

But upon closer examination, it’s not simple after all, and those waters can get very muddy. Especially when you’re comparing the metric across multiple companies.

According to ProfitWell, in fact, at last count there were 43 different formulas used by public SaaS companies to calculate churn.

The problem comes from the way you define the terms in the calculation…

- How do you define customers during the given time period? Do you include free-trial customers? Discounted customers?

- How do you define total customers over a given time period when new customers are being added daily? Total customers on the first day or the last day of that period? Or an average?

- How do you define the moment a customer leaves? When they cancel or when their subscription actually ends?

A clear and impactful churn metric will help you make effective decisions about value as a buyer or about next steps as a business owner.

ProfitWell advises that, for the metric to be useful, you should keep it simple and consistent. Define those terms in the most relevant way.

The simplest way to calculate churn is to divide the total number of churned customers during the period by the number of customers you had on the first day of the period.

No method is perfect, but they advise this method because:

- It’s not rocket science (and some methods seem to be)

- It’s a quick calculation

- It requires two easily accessible numbers

According to David, working with churn rate from a strictly revenue perspective can be more helpful than churn rate from a customer accounts perspective and is another way to keep things simpler.

Overall, the key with valuing any SaaS business for sale is to understand the formula being used.

And the goal, of course, the holy grail for any subscription business, is negative net churn.

That occurs when the gains in revenue from upgrades or new customers out-pace the losses.

David’s best advice for reducing churn…

Put resources into customer success with your product and improve your onboarding experience for new customers.

Customers often churn away who are only using a small portion of a product’s functionality, simply because they don’t know what’s possible.

Where customer education hasn’t been optimized yet, you’ll find another huge opportunity to boost the value of a SaaS company.

What’s a good churn rate?

David points out that depending on the type of customers you serve, median churn rates can vary greatly.

Enterprise customers, for example, predictably have a very low expected monthly churn.

A .5-1% per month churn rate is common.

It makes sense, as change comes slowly at that level with lots of stakeholders.

SMB (Small and Medium sized Business) customers, on the other hand, have a higher expected monthly churn rate at around 3-7%.

- 2. Revenue Profile

When it comes to the revenue profile of a SaaS company, the less risk it indicates for a buyer, the more valuable the company.

MRR is less risky than ARR (Annual Recurring Revenue), because it’s more predictable.

Especially given the fact that ARR is sometimes offered at a discount.

And also given the reality of debt financing often used to buy a business. Monthly revenue makes life easier.

David uses a “blended multiple” for that reason, and explains that the multiple applied to MRR should be higher than that applied to ARR.

If you’re a SaaS business owner with an eye on an exit, any attempts to artificially increase earnings should be avoided.

That usually includes discounting, pushing annual plans, or even offering lifetime plans.

All will affect the revenue profile of the business, and savvy buyers will spot those methods a mile away.

- 3. Acquisition Channels

A premium SaaS business for sale will have multiple customer acquisition channels to reduce concentration risk.

And also take care that, within those channels, the competition is relatively low.

A crowded VC-occupied field like project management, John points out, may not be where you want to be.

Because the cost to acquire a customer goes up in direct proportion to the amount of competition for that customer:

It’s the same rules in ecommerce but nuanced in SaaS, because you’ve put down a lot of capex up front to develop the product. So you have to be savvy when it comes to acquiring customers at a reasonable rate.

Overall when it comes to customer acquisition, remember two of the four pillars of business valuation – reduce risk and open up avenues for growth – and you’ll stay ahead of the curve.

Tools That Help You Evaluate a SaaS Business

Whatever you use to evaluate metrics, David advises, standardize. Otherwise the numbers are useless, and your time is wasted.

Stay consistent, choose what works for you, and stick with it. The most popular options for evaluating metrics:

- ChartMogul

- Baremetrics

- ProfitWell

Whether looking at a SaaS business for sale or growing one, the best tools for analyzing a company’s data are the ones that you find the easiest to use.

David likes ProfitWell for it’s simple and friendly dashboard.

Cohort analysis allows you to look at the behavior of groups of customers over time.

“Looking at their cohort analysis for churn,” David says of ProfitWell, “is an incredible way for seeing whether the business underlying is improving or getting worse as new customers are coming on board.”

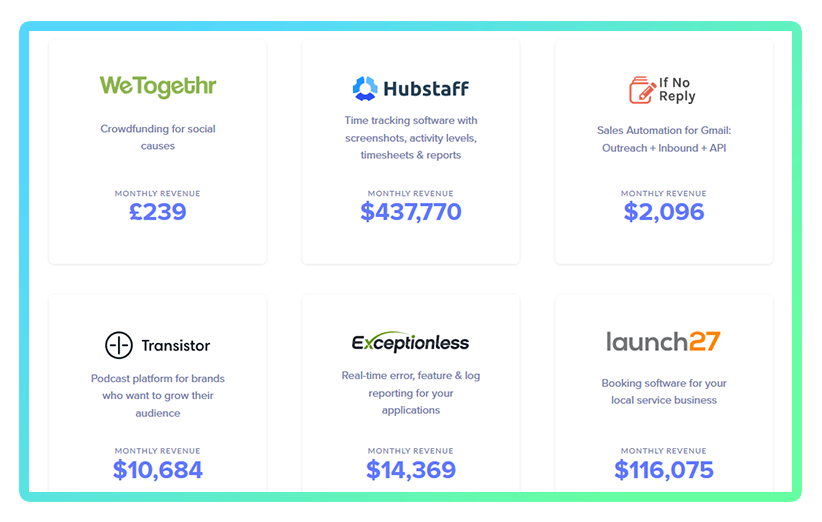

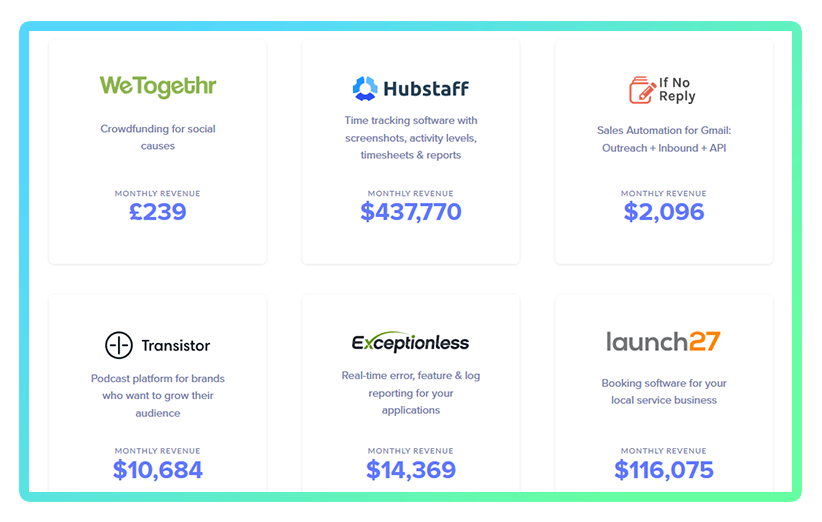

Baremetrics, as I mentioned, provides valuable benchmarks.

It’s an incredible tool for studying the data of open-source SaaS businesses.

Companies on the platform include:

- ConvertKit (MRR = $1,300,546)

- Buffer (MRR = $1,604,290)

- Baremetrics (MRR = $107,869)

- Hubstaff (MRR = $437,770)

Fair warning, if you have an addictive personality like I do, stay away.

We have so much information at our fingertips right now, it’s mind blowing.

The more I think about it, “Don’t be evil” just doesn’t cut it at all.

We’re a collection of intelligent people, us entrepreneurs, with access to a ton of amazing tools at this moment in time.

We can do better than that.

For me, I’d say the David Newells of the world are more inspiring than the Bezos of the world.

Be smart. Create value. Pay your taxes.

Find the business models, SaaS or otherwise, that most elegantly fit the way you’re designed.

Then play the game not of world-domination, but world-contribution.

It might not make the best Twitter profile or an edgy tech-giant motto, but I’ll stand by it.