Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Sell Your Website For More Money – A Comprehensive, 4-Step Guide

By Quiet Light

You may already agree that having an exit strategy plan can add significant value to your business when it comes time to sell your website. You may also understand the basic concepts of what makes an online business valuable and what could potentially damage a web-based business’s value.

But how do you take this information and put it together in an actual plan for your business? How long should an exit strategy take?

Knowing the principles that make an online business valuable and knowing how to implement those principles into a plan are two entirely different concepts.

If you want to figure out how to develop a plan that will add significant value to your online business, follow the four steps below.

Step 1 – Identify Complete ‘Deal Breakers.’

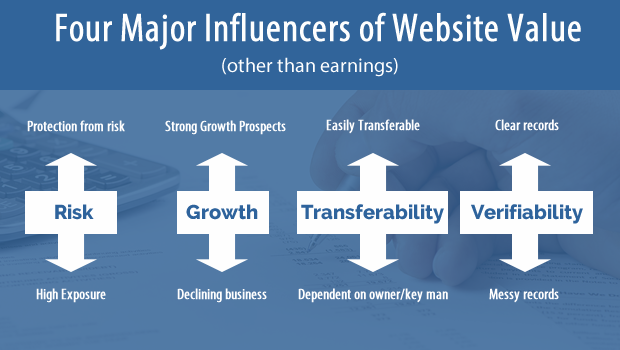

There are four essential pillars that make a website valuable (disclosure: in the past I identified only three pillars. I have since broken out ‘verifiability’ as an independent pillar):

- Risk Mitigation. High-risk businesses tend to receive lower valuations. On the other end of this spectrum, websites protected from risk receive a valuation boost.

- Growth prospects. There are few stronger influencing factors that a website’s growth trends. Showing real, tangible, and likely growth prospects adds significant value. On the other hand, businesses in decline are severely discounted.

- Transferability. To sell your online business, another owner must reasonably be able to run and grow the company. Websites that don’t work under new ownership are unsellable. The more work a transition requires the lower your valuation.

- Verifiability. Before a buyer spends significant money on your website, you need to prove its metrics with 3rd party statements such as tax returns, bank statements, and clean financials. Websites with easy to read reports and verified metrics receive higher valuations while businesses with confusing reports (or no reports) can be close to unsellable.

Each of these areas (or pillars) helps to determine just how valuable your business would be in the open marketplace. The better your website scores in each category, the more valuable it becomes. The opposite is true as well.

But there are some situations where a website may have an absolute ‘deal breaker’ that makes the sale of their website virtually impossible to imagine or complete.

As you develop your exit positioning strategy, take the time to analyze each of these pillars for any possible deal breakers within your business.

Here are some examples for each of the pillars.

Risk Mitigation

While exposure to risk or protection from risk is a powerful influencer of value, the closer risk moves to ‘certainty’, the closer you get to having an absolute deal breaker.

Keep in mind that your website’s exposure to risk tends to fall on a scale.

Also, be mindful that your online business may have multiple risks that you should measure each on their own scale. The more risks that fall closer to ‘near certainty’, the lower the value of your business.

What causes an absolute deal breaker is when risk moves too close to ‘near certainty’. For example:

- You are aware of pending legislation that will effectively shut down your industry (it can happen)

- You know that a key vendor will stop supplying product shortly

- You built your business in an illegal industry (illegal movie streaming, for example)

- You’ve built your business on natural Google rankings using blackhat SEO techniques

In some cases, you won’t be able to deal with any of these ‘deal breakers’. In other instances, you’ll have the time to pivot your business in such a way that those deal breakers are no longer a major threat.

Growth Prospects

How could the growth prospects of your business contain an element that makes your website unsellable?

When the only growth prospects of your business are negative growth prospects.

Obviously, any of the situations I listed in the risk mitigation section would cause negative growth prospects, but there are situations that make a business unsellable:

- An industry that is going the way of buggy whips

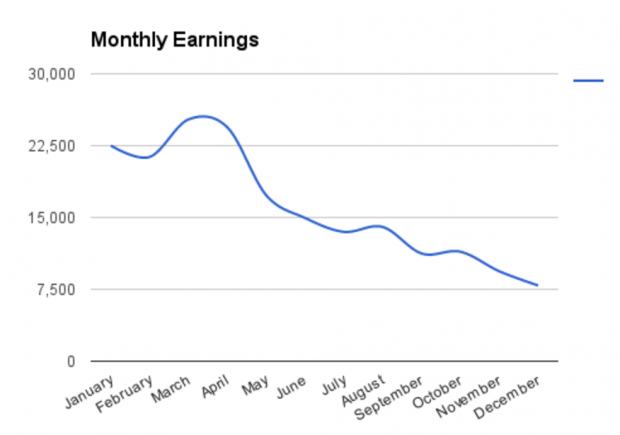

- A long (18+ months), steady history of decline combined with current low-income levels

It is vital when selling your business to demonstrate to buyers that they will see a positive return on their investment. This is either done by showing an ability for the business to grow, or by reducing the asking price of the business so much that a buyer is virtually guaranteed to see a return on their investment.

Transferability

If there is something that would prevent a new owner from effectively operating your business, then it will be impossible for you to sell the website.

This point may seem somewhat obvious, but the number of entrepreneurs who build transferability issues into their business is quite surprising.

All transferability issues will cause significant downward pressure on the value of your business, but there are some situations in which transitioning to a new owner simply isn’t possible or likely.

For example:

- Special personal licensing is required (while this wouldn’t prevent a sale to another licensed individual, it would prevent a sale to the vast majority of buyers)

- You are the business. For example, your business revolves around unique consulting services that only you can offer.

Major transferability issues need to be dealt with as early as possible in your exit strategy as they take the time to change and to prove that the change does not have a negative impact on the business.

Verifiability

One of the most frequently ignored aspects of exit preparation on the part of sellers is the ability to verify the metrics of their business, both financial and otherwise.

If a buyer is not able to quantify your website through various metrics – and if they are not able to verify those metrics – there is no reasonable way for them to determine if they will receive a positive ROI by acquiring your business.

Because of this, you should take a serious look at the reports for your business to ensure you have a sellable business.

Verifiability situations that can cause a business to become unsellable include:

- Multiple businesses that share a single bank account that make it impossible to distinguish which business is incurring which expenses

- A lack of any record keeping for the business

- No web analytics software installed

Like the other three pillars, any ‘deal breakers’ contained in verifiability should rise to the top of your exit strategy pan.

What to do If You Find a Deal Breaker

Most businesses will not have any deal breakers. However, if you do find a deal breaker in your business, put your plans to exit on hold and work to resolve that deal breaker.

Step 2 – Develop a List Of Optimizations

Assuming there are no big deal breakers that require your immediate attention, it is now time to prepare a list of optimizations to maximize the sellability and value of your online business.

To develop this list, go through each of the four pillars listed above. Identify any and all areas of your business that you could optimize and write them down. Don’t worry about how feasible every idea may be, and don’t concern yourself if an optimization feels too small. Just write them all down.

Here is a short (and incomplete!) list to get you started thinking in the right direction:

- Risk Mitigation

- Is my business reliant on any single vendor?

- Is my business reliant on a single client?

- Does any client or group of clients make up more than 20% of my website’s revenue?

- Do I have multiple sources of inbound traffic?

- Is my business’s revenue strongly concentrated on a third party network (e.g. Amazon, eBay, etc.)

- Do I have a developed and active email list?

- Do I have an established social media following?

- Are there any protections I can implement to prevent competition?

- Does my website’s traffic rely on natural Google search rankings?

- Growth prospects

- Is my business growing year over year?

- Is my business declining?

- Can my company expand into neighboring niches? What would it take to grow in this area

- Are there natural upsells my website could pursue

- Are there marketing channels not yet explored?

- What are the forecasts for my niche and industry?

- Transferability

- Do I have skillsets that are crucial to the success of my business?

- Do I have employees who perform key, irreplaceable work?

- Are there license requirements for what I do?

- Is my business built on my personal image and brand?

- Do I have personal relationships with vendors that resulted in better deals?

- Do I have personal relationships with clients that resulted in sales?

- How easily could I replace every person in an organization chart of my business?

- Verifiability

- Are my tax returns a close match to my profit and loss statements?

- Do I run multiple businesses through one tax ID?

- Do I run various businesses through the same bank account?

- Do I run personal expenses through my business account?

- Do I have multiple businesses that share resources?

- Do I have analytical software installed?

- Have I setup various reporting to track members?

- Can I recreate my financial profit and loss statements based on bank accounts and merchant statements?

As you make this list, you’ll be able to transition your list into a set of objectives or plans that should increase the value of your business. For example:

- Risk Mitigation

- Objective 1 – Develop a regular newsletter to test the responsiveness of our email list

- Objective 2 – Expand into Amazon FBA to broaden revenue channels

- Objective 3 – Reach out to potential backup vendors in the event our primary vendor fails

- Growth Prospects

- Objective 1 – Focus on trimming costs to keep earnings on a steady increase

- Objective 2 – Optimize Adwords spend to be more cost effective

- Objective 3 – Test a handful of upsells to demonstrate possibility of adding more regular upsells

- Transferability

- Objective 1 – Hire outside bloggers and reduce my blogging to 1 blog post per month

- Objective 2 – Put together a detailed training manual for my tasks

- Objective 3 – Remove my credentials as an M.D. from the website

- Verifiability

- Objective 1 – Hire a bookkeeper to clean up financials

- Objective 2 – Setup goals and tracking in Google Analytics

Once you have a list of possible optimizations, it’s on to step 3 where we’ll begin to decipher which opportunities you should pursue.

Step 3 – Identify Three Characteristics For Each Optimization

As you developed your list of possible optimizations, you probably found yourself wondering if some of those optimizations were worth the effort.

In this step, we’ll begin to score each possible optimization effort so you can identify the optimizations you want to pursue. To do this, you’ll score each optimization on three characteristics:

- Time to implement & prove

- Ease and cost of implementation

- Expected impact to value of company

Time to Implement & Prove

Not every optimization will take the same amount of time to implement, and some optimizations require that you run the business for a few months to show how the business functions after the change.

For example, let’s use Quiet Light Brokerage. I built my company on my reputation as someone who has been in this industry for a long time. If I were planning to exit this company, I’d want to show that the business can operate without my presence.

To do this, I’d probably hire someone to write for the blog. I’d reduce the number of conferences I attend, and I’d work to elevate members of my team into regular contributing roles for earned media opportunities.

Hiring people to take over some of my key roles would take a couple of months. After that, I’d need to show that the business can do just as well after I’ve made those changes, so I’d need to wait at least six months if not longer.

Ease and Cost of Implementation

The second score you want to apply to each optimization is the ease and cost of implementation. There are some optimizations that are simply unrealistic because they would be far too costly to implement. Other optimizations may be extremely easy and cost effective.

Let’s again use Quiet Light Brokerage as an example. In this example, I want to work myself out of the picture for the business.

Since I do most of the blogging for the business, I could open the blog up for guest blog posts. Alternatively, I could hire a writer to manage the blog (and possibly increase the content output).

For our earned media efforts, I’d have a few options. I could assume that a new owner can get the same earned media. I could hire a firm to do this for me (~$3,500/month). Or I could stop altogether, but that would come with a significant risk of hurting the revenue and earnings of the business.

For the sake of having a plan in place, I’ll set a cost of $3,000/month for this optimization.

Expected Impact on Valuation

This last score is very tricky to calculate. In our working example, I’ve identified that if I were to position Quiet Light Brokerage for an exit, I’d want to reduce my role in the company. This will take 6-12 months and could cost as much as $36,000/year.

There would be two main benefits from this change, however:

- My workload would reduce dramatically (I currently spend 25+ hours per week on content development)

- Revenues may increase with a professional team in place

It’s difficult to say just how much this would impact the value of my company, so I prefer to use a simple qualifier such as “moderate increase in value.”

Hiring a blogger would likely result in a modest rise in the value of Quiet Light.

Tying Everything Together

Apply these three characteristics to each of your Optimizations. Your list will look something like this:

- Transferability

- Objective 1 – Hire bloggers to replace my blogging activity.

1 month to hire, 5 months to prove

$400/month

Good improvement in value - Objective 2 – Hire marketing firm to get earned media

1 month to hire, 6 months to prove

$3,500/month

Good to Very strong improvement in value - etc…

- Objective 1 – Hire bloggers to replace my blogging activity.

Step 4 – Start With Low Hanging Fruit & Long Implementations

Now that you have a list of optimizations, estimates for the time and cost of implementations, and a score for just how strong of an impact it will have on the value of your company, you are ready to make a plan to optimize the value of your business.

Start With The Easiest Items

You’ll want to start with the easiest and least costly items on the list that offer moderate to very strong improvements in value.

It’s not uncommon to get burnt out when working an exit strategy. You may find several months into your exit strategy that you simply don’t have the energy or desire to optimize your business further. If this happens, you’ll have made some headway into improving the position of your business.

Identify Long-Implementation With Strong Upside

You should also identify any optimizations that have good to strong upsides, but long-implementations. Since these take a longer amount of time to implement, you’ll want to get started on these as soon as possible.

There is a Diminishing Rate Of Returns

You won’t want to implement every optimization that you’ve identified. Optimizing a business for sale comes with diminishing rates of return.

In other words, the more you optimize and maximize the value of your business, the less you’ll be able to improve the value of your business with further optimizations.

So start with the most impactful, but relatively easy implementations and work from there.

Balance Out Optimizations Across All Four Pillars

As you identify the optimizations you want to pursue and the timeline needed to make those optimizations, make sure that you do not leave any significant deficit in any of the four pillars of value.

In other words, don’t optimize the growth prospects of the business while ignoring a significant risk. Similarly, don’t spend all of your efforts reducing the risk of the business while ignoring the fact that it will be incredibly difficult to transition to a new owner.

Spread your optimizations out evenly so that your business scores well in each of those categories.

Finally, Use Common Sense

Creating an actionable, step-by-step exit strategy for your online business shouldn’t be incredibly complex. In the end, you want to make your business into a sellable product for potential buyers.

Buyers want a return on their investment. This normally comes in the form of a financial return on investment, but there can be many types of ROI. Your goal is to create a company that can provide that for potential acquirers.

So as you create a step-by-step exit strategy, keep common sense in mind and you’ll be well on your way to a profitable exit.

Comments are closed.

Thanks so much for this excellent overview. Really helpful, Mark!