Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

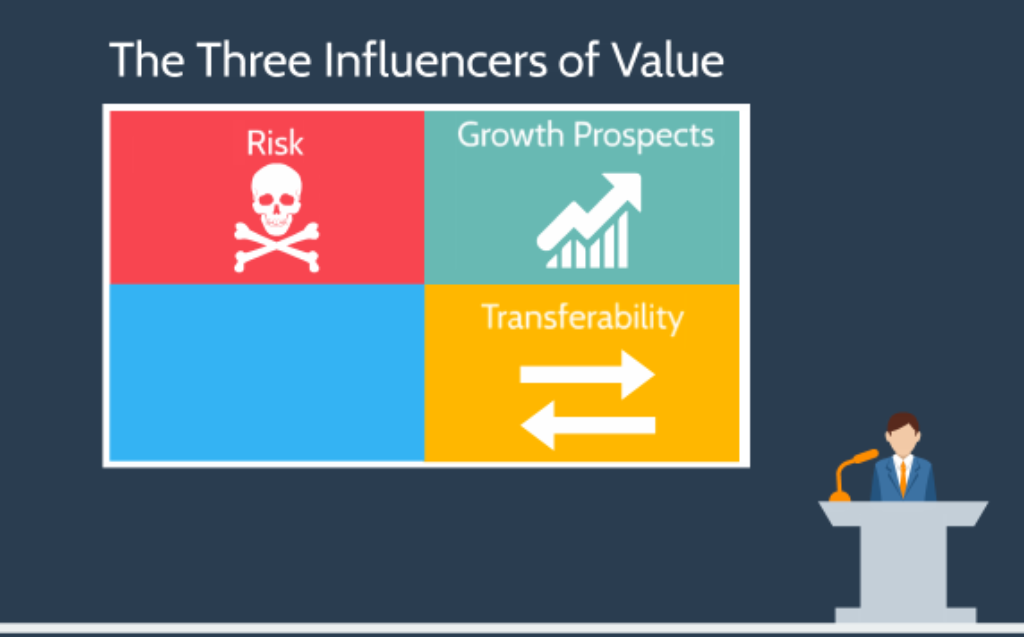

The Three Biggest Influencers When Calculating Website Value

By Quiet Light

When we consider what makes a website valuable, there are many factor which come into play. While we can create a list of the dozens of factors that influence website value, since no two businesses are the same, there is no single template as to which factors you should pay most attention to. Each website is judged on its own merits.

Rather than wade into countless factors which influences the final value to rise or fall, I’d like to take a different approach and look at the “big” influencers of website value. It turns out that any of the individual factors that influence value can actually be listed under one of three broad categories: risk, growth prospects, and transferability.

First Major Influencer: Risk

This is because buyers have so much to lose if the business fails. If your business fails under your ownership, you lose the value of the business as well as its income (this would certainly be a very bad thing).

However, if a buyer acquires your website, and the business quickly fails after they buy it, not only do they lose the value of the business plus the income, but they also lose the amount of money they initially invested in the business.

This is because most buyers will acquire your website at a multiple of its annual earnings.

How Long Does It Take To Get Paid Back?

This is why a buyer is so sensitive to risk. With such a large amount of capital invested upfront, a buyer will look at every aspect of your website to ensure that they generate a positive return while protecting that initial investment as much as possible. So when they come across risk that they perceive to be clear and present to your website, this will place heavy downward pressure on your valuation.

Second Major Influencer – Growth Prospects

Generally speaking, a buyer acquires a website primarily because they are seeking a return on their investment. And a website that has strong growth prospects appeals to buyers more strongly for that very reason.

In the section on risk, I used the example of a buyer who acquired a website for $300,000. In that example, we assumed the website generated $100,000/year in earnings and made the point that if all things remain equal, the buyer will have to wait 3 years to earn back their original investment.

Let’s assume for a moment that all things don’t remain equal, and that the new owner quickly grows earnings to $150,000/year. Now, instead of waiting three years to earn back their original investment, the buyer only needs to wait two years. Plus, the value of the business has increased significantly.

Of course, one could argue that just about every business has some potential for growth, so it is important that we make a distinction as to what adds value to your business and what doesn’t.

In the past I’ve made the argument for a distinction between “growth prospects” and “potential”. In this distinction, potential simply amounts to speculation without any basis for that speculation while growth prospects is speculation with some facts and evidence for that speculation.

For example, a business that has grown 10-15% year over year for the past 5 years has genuine growth prospects based on its history. On the other hand, projecting that a buyer could grow the business 150% “if someone simply invests in some marketing” falls into that non-specific, purely speculative category of “potential”.

Growth prospects aren’t just limited to a history of growth, however. Clearly untapped revenue sources, obvious revenue upgrades, and other areas can be genuine growth prospects. Generally speaking, the more clearly you can demonstrate how a buyer will experience growth, the more your valuation will be influenced positively.

Third Major Influencer – Transferability

Buyers ask themselves several questions as they evaluation any website acquisition:

- “Can I run this business efficiently?”

- “How long is it going to take for me to learn this business?”

- “Will the customers remain loyal to a new owner?”

- “Will the vendors give me the same terms?”

- “Am I qualified to run this business?”

- and so on.

What Drives The Business?

We evaluated a grant proposal writing service years ago. Although the business itself had great numbers, low risk, and high potential, all the skill was in the owner who wrote the proposals. Any buyer who evaluated that business would quickly realize that the talent that made the business run would not transfer over to their ownership.

This is an area where many website owners fall into a trap: they become the heart and soul of the business. They become the face of the business, and the engine which makes it run. When a potential acquirer tries to envision the business without the current owner, it becomes clear that the business relies heavily on the contributions of the current owner.

In addition to questioning whether they are personally up to the challenge of owning your business, there can be additional hurdles which make transitioning the business difficult: special licensing fees, expensive software licenses, unique vendor requirements (such as requiring a physical storefront to carry a product line), and other obstacles can torpedo your website’s value.

Apply These To Your Own Website

As you think about your website value and how you can make it into a more valuable asset, take a step away and look at the bigger picture. Will a buyer see your website as potentially risky? Can they seem themselves running the day to day operations? Will they get a sufficient return on their investment?

What about growth? Can they count on building the business beyond what it is now, or is it just a solid income producer?

As you evaluate these three broad influencers, risk, growth prospects, and transferability, you’ll likely find dozens of more specific elements of your business that influence its value. These will quickly become the pressure points you’ll target to maximize the value of your website.